Tesla stock drops 16% from its peak, time to buy the dip?

As we witness this week's disappointing Q3 delivery figures pushing the stock prices even lower, the question arises: Is it time to stay cautiously around the EV titan, or buy the dip?

Tesla's share prices have taken a steep dive by over 16% from their peak in July. As we witness this week's disappointing Q3 delivery figures pushing the stock price even lower, the question arises: Is it time for investors to stay cautiously around the EV titan, or could this tumultuous period present a dip-buying opportunity?

Tesla’s challenges

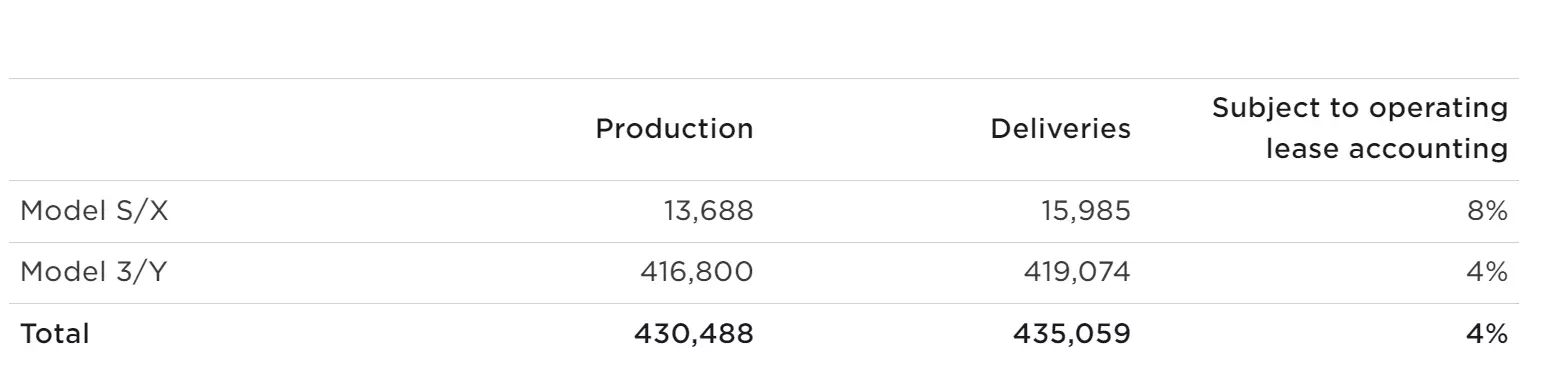

As a vital indicator for its to-be-reported earnings for the third quarter, Tesla's vehicle deliveries fell short of Wall Street predictions with a nearly 7% decline from the prior quarter, totaling 435,059 vehicles.

Tesla attributed the lower production and delivery figures to scheduled downtime at its factories and stressed that: “our 2023 volume target of around 1.8 million vehicles remains unchanged.”

Still, the disappointment on the Q3 data, which came after a record second-quarter deliveries, causing its share prices to fall by 2% immediately.

Why are investors so concerned about Tesla's sales and deliveries?

Beyond the economic headwinds that no business can escape, Tesla faces its own set of hurdles. As the electric vehicle market expands, competition also grows fiercer. China's BYD is now on track to beat Tesla as the world's largest electric vehicle seller, thanks to its aggressive global sales expansion footprint and cheaper price tag.

BYD reported sales of 431,603 fully-electric vehicles in the three months ending on September 30, indicating a 23% increase from the second quarter. During the same period, Tesla shipped 435,059 cars worldwide. Not only is Tesla's growth rate noticeably slowing, but what's even more noteworthy is that the gap between the two EV producers is now less than 4,000 vehicles, the closest ever.

While Tesla's shortfall in Q3 deliveries may be seen as a short-term issue, given that its factories are currently occupied with the production of a refreshed Model 3 and the new Cybertruck, it raises a disquieting question: Is Tesla capable of defending its kingdom against a well-equipped competitor? Furthermore, will the intensifying competition erode Tesla's once-proud profit margins?

Tesla technical analysis

On the daily chart, the current prices are trading within the lower region of a symmetric triangle pattern, with the lower trendline having provided strong support over the past week. Notably, the price has made multiple attempts to breach the 50-day moving average (MA) without success, establishing the level of $250-$255 as immediate resistance.

Conversely, a breakout below the 100-day MA would significantly increase the likelihood of a drop below $240 and potentially breach the months-long trendline dating back to May. Such a scenario is likely to trigger substantial selling pressure.

From a sentiment perspective, the Relative Strength Index (RSI) remains close to the neutral level, suggesting a cautious approach is warranted for both buyers and sellers for now.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get commission from just 0.08% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices