Market update: Euro latest, Germany likely contracted in Q3, PMI and ECB meeting next

Bundesbank hints that German economy likely shrunk in Q3; EUR/USD slide finds support despite a lack of clear bullish drivers and EUR/GBP encounters resistance after bullish breakout

Bundesbank hints that German economy likely shrunk in Q3

Germany’s Bundesbank produced a monthly report pointing towards the likelihood of another quarterly contraction, as industrial production and weakening consumption plagues Europe’s largest economy. The report comes ahead of fresh German and EU PMI data for October, which is expected to show very little progress, remaining at suppressed levels. The German manufacturing PMI data set – a sector that normally produces strong results - has led the rest of Europe lower.

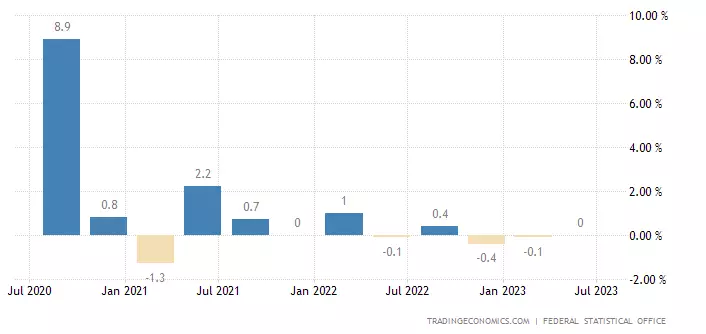

Should a contraction be confirmed, it would result in fourth straight non-positive quarter. Negative GDP growth during Q4 2022 and Q1 2023 placed Germany into a technical recession, followed by a flat GDP growth in Q2.

German GDP growth (QoQ)

EUR/USD slide finds support despite a lack of clear bullish drivers

The weekly EUR/USD chart reveals four prior weeks of consolidation, after the impressive selloff that preceded it. The US dollar, despite seeing an uptick in fundamental data, is struggling to reignite prior momentum. US GDP is likely to show a stellar 4.1% expansion according to markets and recent data has shown a tendency to surprise to the upside (FNP, CPI, US retail sales).

In addition, US Treasury yields maintain elevated despite easing in recent sessions. This is in contrast with the EU where fundamental data continues to suffer. Nevertheless, EUR/USD appears to be experiencing a reprieve. The lack of clear bullish catalysts suggest that any advance may be short-lived, creating the potential for a return to range bound conditions, although, the range appears much tighter than before (1.0640 – 1.0520).

EUR/USD weekly chart

The daily EUR/USD chart shows the period of consolidation in more granular detail. Current resistance appears via the May low of 1.0635, followed by 1.0700. The pair also trades well beneath the 200 simple moving average, but the MACD indicator favors the recent bullish momentum.

EUR/USD daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices