$0 on US and UK shares

Buy and sell US and UK shares with no commission with an IG share trading account1 (0.7% FX fee applies)

Pay $0 commission on Aussie shares

$0 commission per trade on all domestic shares and ETFs on an IG share trading account

Award-winning provider

Established internationally and locally, we have won Canstar's 5-Star Rating for both the trader and active trader categories in 20243

Mobile app

Trade on the move with our user-friendly, award winning mobile trading platform2. Available on both iOS and Android

Extended hours

Trade 700 US shares 24/54.

US shares

Directly invest in thousands of US shares, such as Apple, Tesla, Facebook and more.

Australian shares

Access all the local favourites from Afterpay and CBA to Qantas, Fortescue Metals and thousands more.

International shares

Choose from thousands of UK, German and Irish shares – from Vodafone and HSBC to Volkswagen and Siemens.

ETFs

Invest in a basket of shares or an entire index from just one position.

You can trade thousands of shares and ETFs from the following countries: Australia, UK, US, Germany and Ireland.

Find the complete list on our share trading product list (PDF). If there is a specific share that you can’t find on our platform, please call us on 1800 601 799 to discuss your individual requirements.

What do I pay?

Commission fees

Buy and sell Aussie, US and other international shares at $0 commission (0.7% FX fee applies to US and other international trades)

Foreign exchange fees

For relevant transactions, we will convert currencies at the time of execution based on the best available bid / offer exchange rates, plus an admin fee of just 0.7%.

For the full list of fees and charge, please refer to our share trading charges webpage

Ways to trade shares online

There are two ways to buy and sell stocks online with us. You can speculate on share prices using our leveraged trading product, or invest in stocks directly via our share trading services.

Share trading

Our share trading service enables you to invest in company shares with a view to selling them for a profit at a later date.

You can also earn an income from any dividend payments, and gain shareholder rights.

Share CFDs

Gain full exposure to a share’s price movement while only putting down a small deposit (margin).

You won’t take ownership of any shares, but you can take advantage of falling share prices as well as rising.

Variation margin applies and losses can exceed deposits.

What is share trading?

As a company’s market value goes up and down, so does the price of its shares. Share trading means buying and taking ownership of a company’s shares, so you can sell them on to make a profit if their value rises.

How to buy and sell shares

The most common way to buy and sell shares is by using a stockbroker or share trading service. To trade shares with IG you’ll need to open an account and decide whether you want to trade shares, or speculate on their price via CFDs.

ETF trading

Gain exposure to a group of assets – whether it’s shares, sectors or commodities – from just one position, with our range of exchange traded funds (ETFs).

Trade anytime, anywhere

- Web-based platform

- Mobile trading app

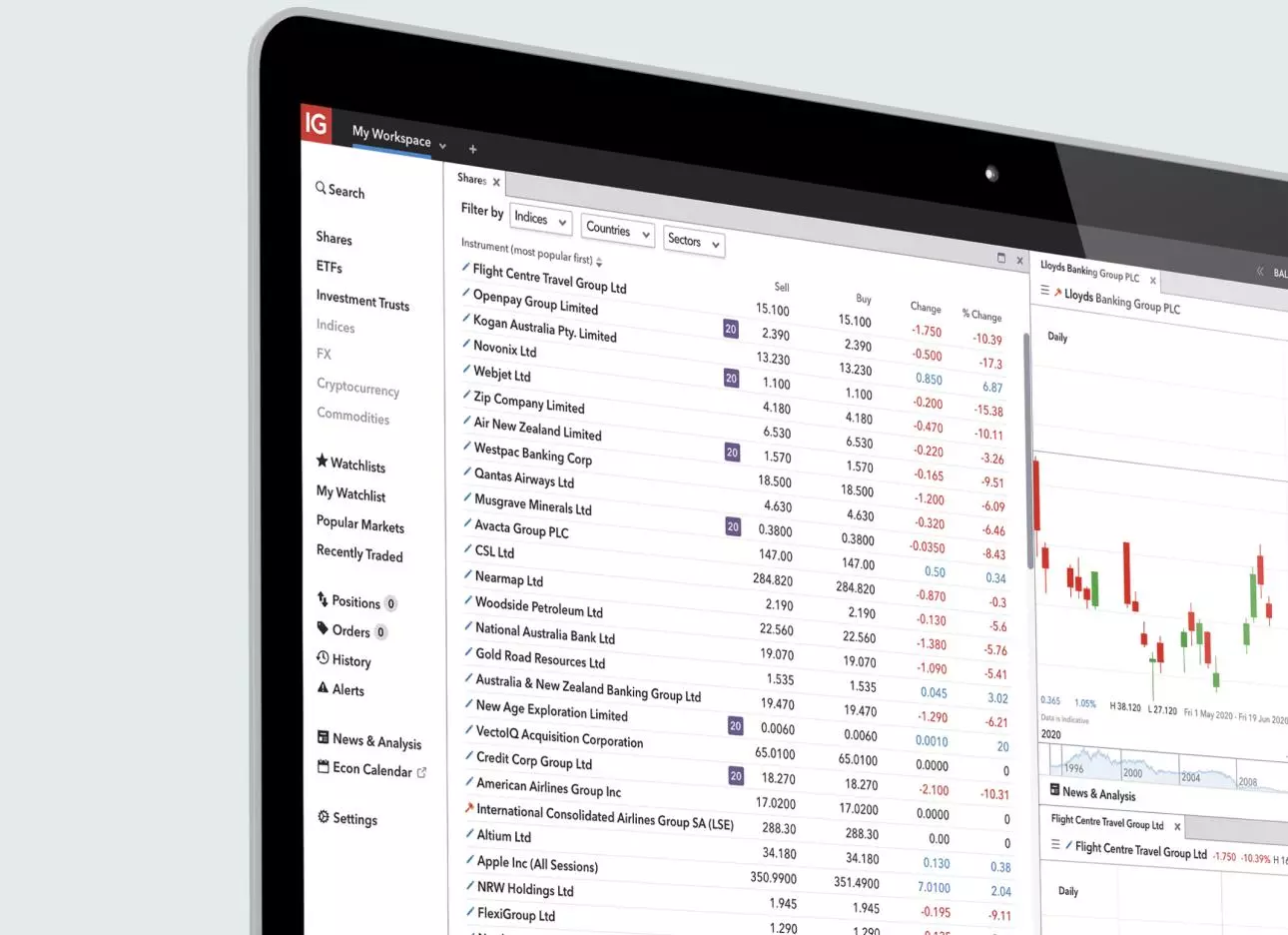

Our web-based platform

Take full control over your trading with our award-winning online platform.2

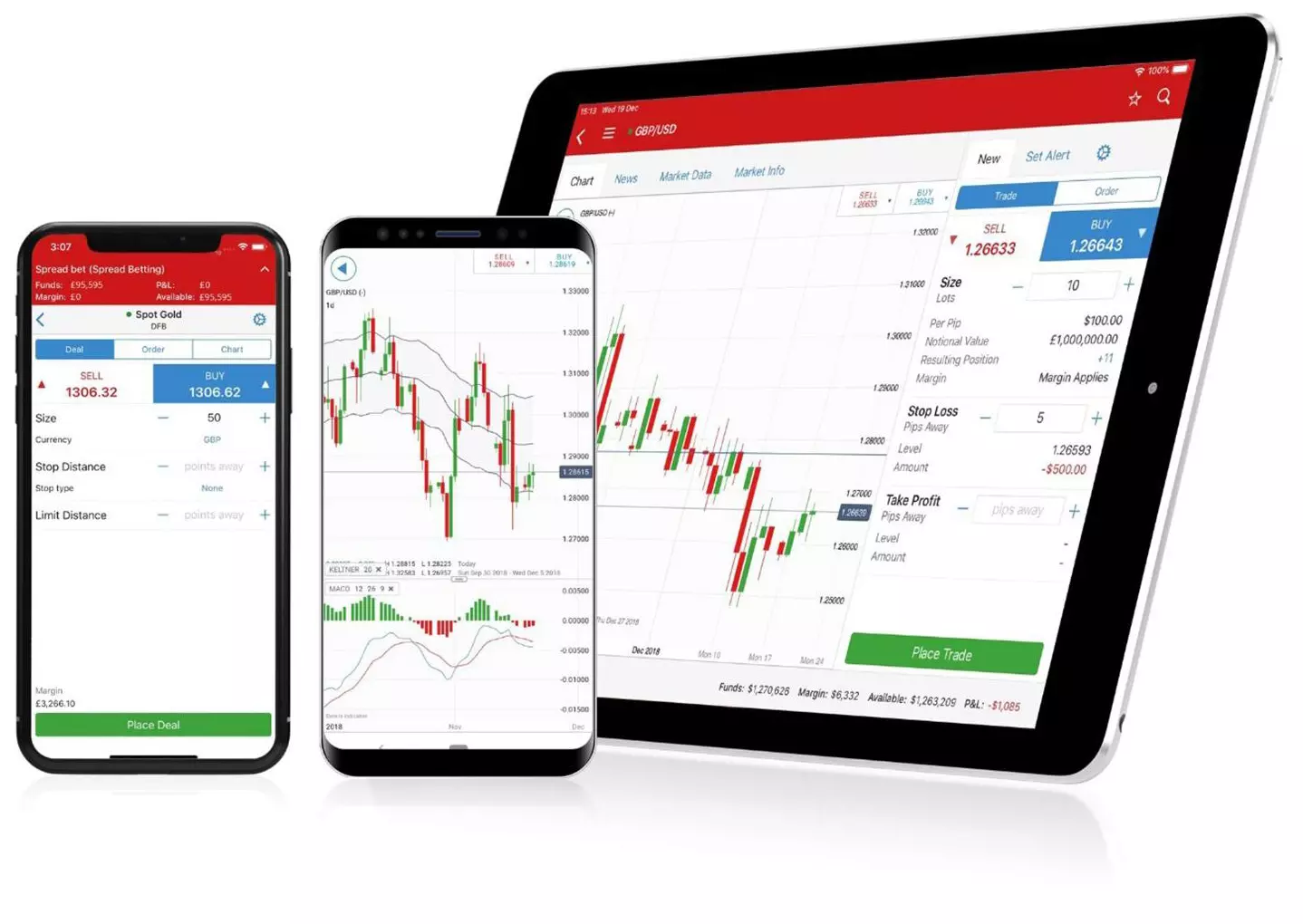

Mobile trading apps

Buy and sell shares on the go with our tablet and mobile platform.

Get the latest shares news

-

Alphabet earnings preview: will cloud and AI justify the $4 trillion valuation?

2026-02-03T05:21:30+0000 -

Amazon Q4 2025 earnings preview: AWS growth and cash flow concerns under spotlight

2026-01-29T02:44:44+0000

Open a share trading account

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

Open a share trading account

It's free to open an account, takes less than five minutes, and there's no obligation to fund or trade.

FAQs

What’s the difference between buying shares and trading share CFDs?

There are two main differences between buying shares and trading contracts for difference on a share.

First, when you buy a share, you’ll be taking ownership of a portion of a company – this will give you certain benefits, such as voting rights and dividend payments. However, when you trade on shares with CFDs, you won’t ever take ownership of the underlying shares – you’re just speculating on the future market price. One implication of this is that you can take advantage of leverage when trading CFDs; meaning you'll only need to put up a fraction of the full value of the trade - the 'margin' - to gain full exposure. This means both profits and losses are magnified, and that losses can exceed deposits.

Second, when you buy a share you will only profit when the underlying market price rises. When you trade CFDs, you can go both long and short – meaning you’ll have the opportunity to profit whether the market rises or falls.

Discover the differences between CFD trading and share trading

Can I transfer existing stockholdings to IG?

Yes, simply open an IG account and transfer your stock holdings by downloading the relevant form from our help and support hub. The form you’ll need to fill out will depend on whether you are transferring shares from a broker or from a registrar.

There are no charges for transferring shares, and the process should take less than three weeks.

How are dividends paid to my account?

Once we receive a dividend payment on any of the shares you own, we will credit your account. It will appear as additional cash and you can choose whether to either reinvest it or withdraw it.

How long does it take to withdraw funds once I have sold shares?

There’s a two or three-day settlement period once you’ve sold your shares until your funds are available to withdraw. In the meantime, the funds will appear as credit and can be used to trade.

How does IG hold my shares?

IG ensures our clients, and your investments are protected via a custodian, where financial assets are held on your behalf for safekeeping.

How does custody work?

A custodian is a regulated financial institution authorised to hold financial assets on behalf of clients for safekeeping purposes. Custodians operate under stringent regulatory frameworks with substantial fiduciary responsibilities and compliance obligations. This regulatory oversight provides legal protections and accountability measures that ensure appropriate care and handling of client financial assets.

Custodians must have a licence that requires them to hold significant amounts of regulatory capital before they can provide those services. The intention of holding regulatory capital is to protect investors by ensuring a custodian is shielded should it fall into financial stress.

IG has appointed a sub-custodian to hold shares on behalf of our customers for safekeeping. Your shares are held by Citi Group, IG’s market, clearing and settlement participant.

As a regulated entity, Citi Group holds the legal title as a separate entity from IG (so there’s a clear separation between our operating business and your shares). This means that your shares are not in any way linked to IG’s financial viability because Citi Group holds your shares.

Having a custodian ensures that the beneficial owner (that’s you) is the only one who can give instructions on what to do with your shares: be it buy more, sell some or transfer them to another broker. That is also true for creditors, who have no legal right to access your assets if IG were to no longer operate.

You might be interested in…

Discover the key differences between CFD trading and investing in shares

Go long or short on thousands of global shares with CFDs

Find all the important documents you need to start share trading with IG

1 $0 commission applies to clients who trade on the IG share trading account and opt for the default setting of ‘instant currency conversion’. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher. Other fees and charges may apply, please see our share trading cost and charges page.

2 Best Finance App, Best Multi-Platform Provider, Best Platform for the Active Trader and Best Online Stockbroker as awarded at the ADVFN International Financial Awards 2025.

3 As awarded by CANSTAR 2024 – Outstanding Value – Online Share Trading for both Active Investors and Traders.

4 Trading hours run from Monday 10am to Saturday 7am (AEST). During daylight savings, hours shift to Monday 9am to Saturday 6am (AEDT).