How to trade or invest in bonds

Take a position on one of the world’s most popular financial assets – bonds. Learn more about how you can trade or invest in the bond market with us, Australia's No.1 online trading provider.1

If you’re ready to open a position in the bond market, follow these three steps:

1. Decide to trade or invest

Speculate with derivatives when trading; or take direct ownership of shares in a bond ETF when investing.

2. Select your opportunity

Choose from our offering of government bond futures and bond ETFs.

3. Take your position

Create an account with us

to open your trade or investment.

For more info about how to trade or invest in the bond market, discover everything you need to know in this guide.

What is bond trading?

Bond trading is one way of making profit from fluctuations in the value of corporate or government bonds. Many view it as an essential part of a diversified trading portfolio, alongside stocks and cash.

A bond is a financial instrument that works by allowing individuals to loan cash to institutions such as governments or companies. The institution will pay a defined interest rate on the investment for the duration of the bond, and then give the original sum back at the end of the loan's term.

Learn why bond investing is popular

As noted, a bond is a type of loan in which the bond issuer owes the bondholder a repayment of the initial loan amount, plus a series of interest payments called coupons. These are frequently paid on an annual or bi-annual basis. The initial loan amount – or principal – is then repaid last, when the bond reaches its maturity.

As bonds are ‘negotiable securities’, they can be bought and sold in the secondary market. This means that investors can earn a profit if the asset appreciates in value, or cut a loss if a bond they sell has depreciated. Because a bond is a debt instrument, its price is highly dependent on interest rates.

Investors look to bonds for three primary reasons:

- To diversify an existing portfolio of stock holdings

- To earn an income from interest payments

- To trade as a financial asset, with the aim of earning a profit

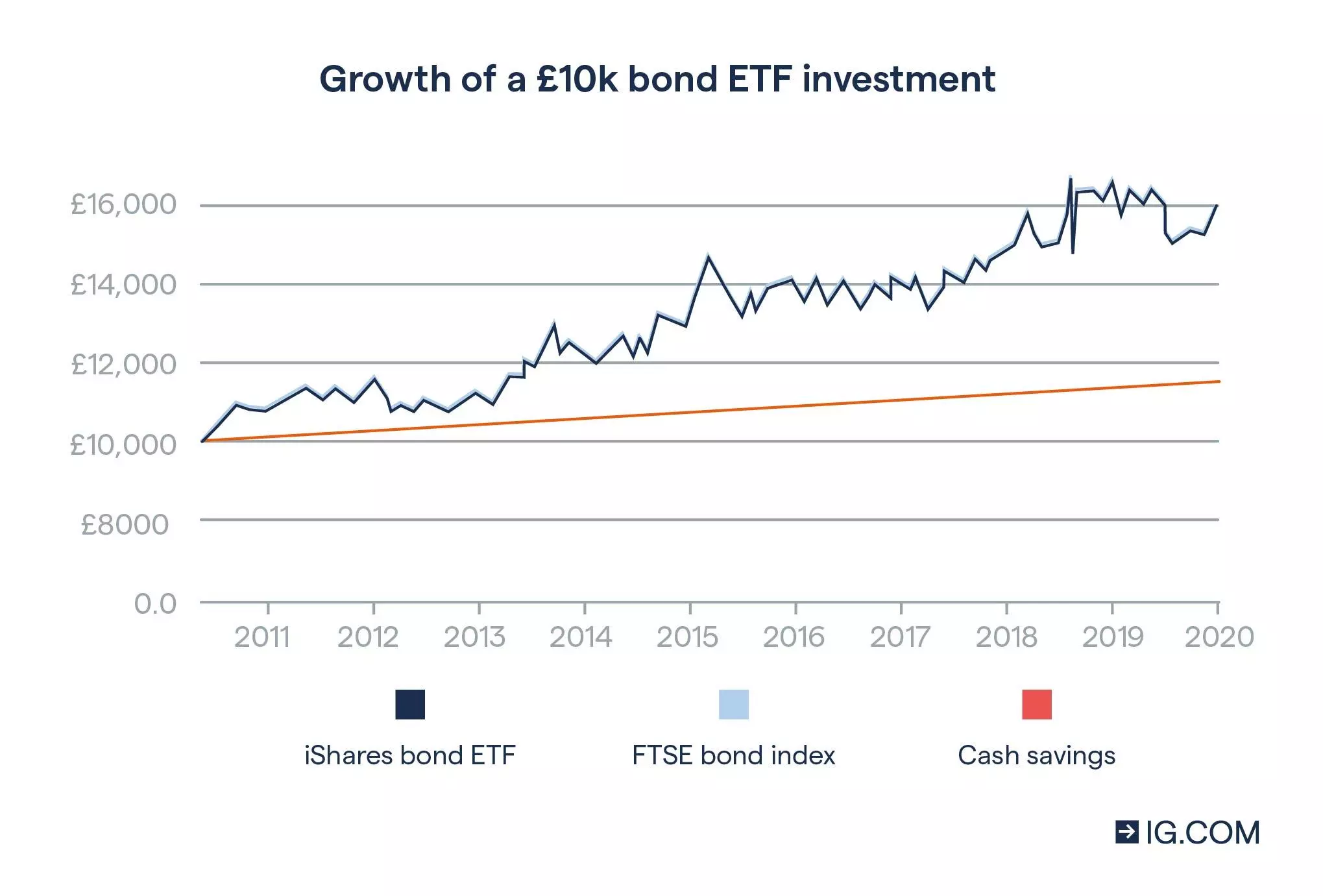

The above graph plots the returns on an initial £10,000 investment into the iShares Core UK Gilts UCITS ETF against its benchmark and a cash savings account earning 1.5% interest per annum.

Whereas the data show a higher return on the UK government gilt index and the gilt ETF, it’s important to remember that cash savings don’t incur the same risks associated with investing – risks which are only amplified when trading with leveraged derivatives like CFDs.

Types of bonds

Broadly speaking, bonds are issued by governments and corporations.

Government bonds

While all investment incurs risk, sovereign bonds from stable economies are regarded as being among the lowest risk investments available. In the US, government-issued bonds are known Treasuries. In the UK, they’re called gilts.

Corporate bonds

Although high-quality bonds from well-established companies are seen as a conservative investment, they still incur more risk than government bonds, and pay higher interest as a result. The credit risk of corporate bonds is evaluated by ratings agencies like Standard & Poor’s, Moody’s and Fitch Ratings.

Pick your bond trading or investing strategy

Income investing

Income investing is a strategy designed to earn regular, predictable and reliable revenues from assets. Building an income portfolio involves buying instruments like coupon-paying bonds and dividend-paying shares from companies, investment trusts, ETFs and mutual funds.

In the case of bonds, you can either buy them outright, or purchase shares in a fund – like a bond ETF. Buying corporate bonds from issuers is prohibitively expensive for many investors, but UK government gilts are highly accessible. Instead of paying coupons, bond ETF shares pay dividends from coupon and principal repayments made by their bond holdings.

Portfolio diversification

Portfolio diversification is a way to spread investment risk across many uncorrelated assets. Whereas including numerous different stocks, from several independent industries, in your portfolio minimises the risk associated with each, you’ll still be exposed to market risk.

Diversifying across asset classes – into bonds, for example – is a way to further mitigate possible losses in the event of a market downturn. The exact constitution of your portfolio will depend on your appetite for risk and desired returns, but allocations of ‘60/40’ (60% stocks, 40% bonds) and ‘50/50’ (50% each) are common.

To diversify your portfolio with bonds, you don’t have to hold actual bonds. You can achieve the same result by purchasing shares in a bond ETF.

Bond ladder

A bond ladder involves buying bonds – or other fixed-income securities – that mature at equal intervals. For example, you could start by purchasing three bonds: one with a one-year maturity, one with a two-year maturity, and one with a three-year maturity.

When each bond expires, you’d then buy a new bond with a three-year maturity, repeating the process for as long as you plan to invest. In this way, you’ll have a three-year bond maturing each year.

Bond ladders allow you to invest in longer-term bonds while securing a degree of liquidity (because they mature at regular and predictable intervals). The main advantage to this is that longer-term bonds usually have higher yields over their lifespans, meaning that they’re more profitable.

The downside, however, is that you may reinvest the maturing principal at a lower interest rate, thereby earning a comparatively lower coupon payment from the newer bond.

Hedging

When implemented correctly, hedging can be seen as a way to mitigate your losses should the market turn against an investment you’ve made. It’s achieved by strategically placing trades so that a gain or loss in one position is offset by changes to the value of the other.

Any strategy adopted when hedging is primarily defensive in nature – meaning that it’s designed to minimise loss rather than to maximise profit. But hedging should be approached with caution. To hedge an existing position in the bond market, you could use CFDs to short-sell the bond futures market, or you could invest in an inverse bond ETF.

It’s important to note that derivatives like CFDs are leveraged, which means you stand to lose more than the margin amount you deposited to open a position. Short-selling is also a high-risk trading method as your losses could, theoretically, be unlimited.

Speculating on interest rate changes

Owing to the inverse relationship between bond prices and interest rates – ie as interest rates rise, so bond prices typically fall, and vice-versa – bonds enable you to speculate on interest rate movements. With us, you can do this by taking a position in the government bonds futures market using CFDs.

If, for example, you think interest are set to rise, you could adopt a short position by selling the market. Conversely, if you think rates will decrease, you could go long and buy the market.

As above, please note that CFDs are leveraged, which means that you stand to lose more than your initial deposit.

A popular strategy to consider when trading government bond futures is the Five Against Bonds Spread (FAB). Here, you would adopt two opposing positions in bonds with differing maturities to profit from the relative mis-pricings in their spread (you would short-sell the maturity you believe to be overpriced and buy the maturity you believe to be under-priced).

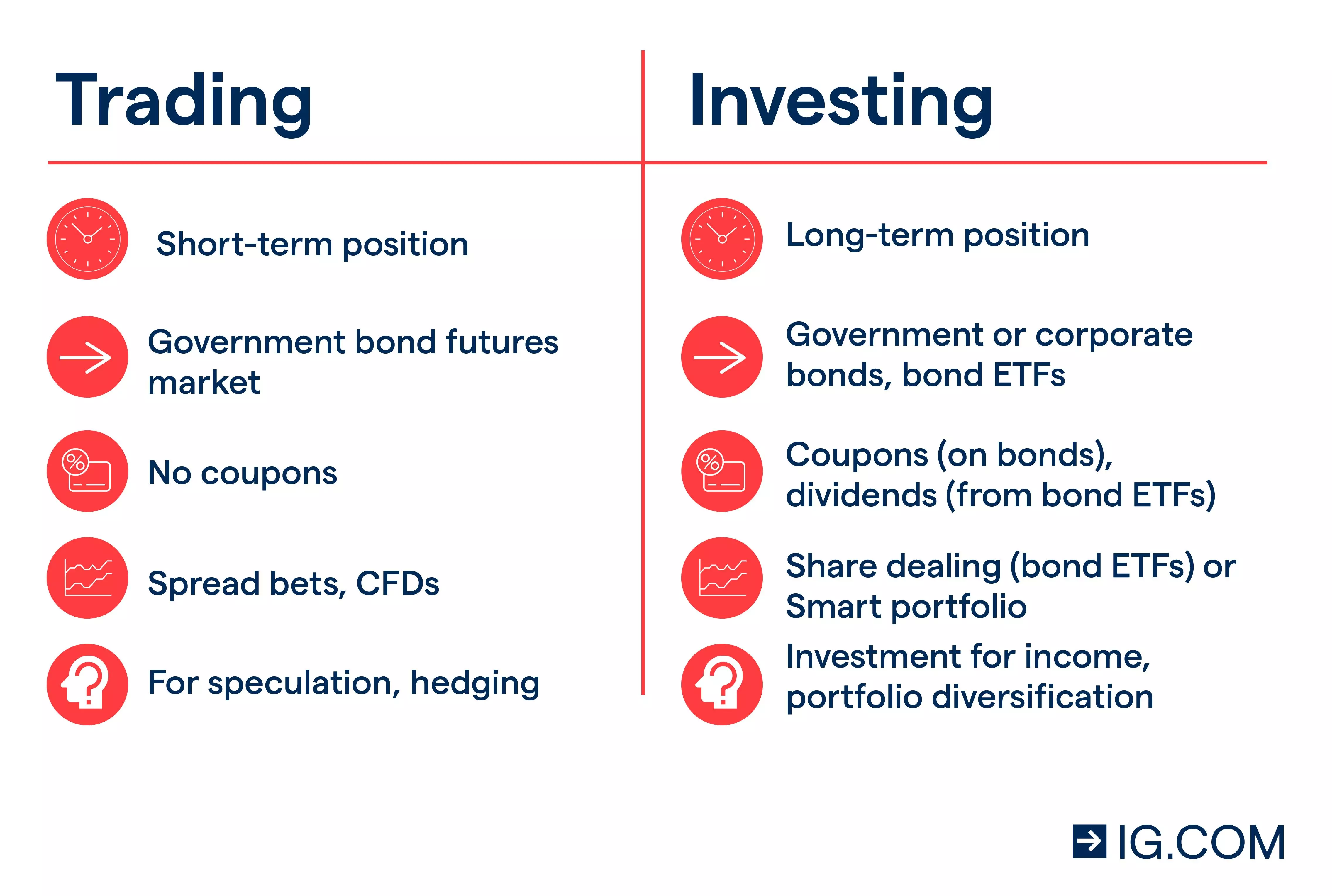

Choose your bond asset and decide to trade or invest

Which bond asset you decide to use depends on your investment goals, timelines and available capital. If you’d prefer to take short-term positions to either hedge or speculate on interest rate movements, you could do so via a CFD. Alternatively, if you want to earn an income, diversify your stock portfolio and have a long-term view, you could decide to buy bonds or shares in a bond fund, like a bond ETF.

To take a position in the bond market with our bonds platform, you can choose to trade or invest:

Trading

When trading, you do so using leveraged derivatives like a CFD. These let you speculate on the price movements of underlying assets – such as bonds – without ever owning the asset itself.

Our current offering includes the world’s leading government bond futures markets. Because our CFDs are issued off-exchange, you can deal in fractions of contracts.

Investing

When investing, you will buy shares in bond ETFs through our share trading account.

| How to take a position | Bonds you can take a position on | Way to trade or invest |

| Trading bond futures | Government only | Trade through an IG CFD account |

| Invest in bond ETFs or funds yourself | Government or corporate | Invest through an IG share trading account |

| Invest in bonds directly | Government or corporate | An investor can:

As an individual retail investor, investing in a bond directly can be difficult to access. Strategies including trading in bond futures, or investing in bond ETFs are more readily accessible as set out above. |

Bonds vs bond ETFs: what's the difference?

Bond ETFs use the power of pooled funds to buy a selection of bonds. They are complex investment vehicles because the bonds they hold may have different maturities, coupon rates and coupon dates.

Before buying shares in a bond ETF, it’s important to understand what assets it holds and what the fund’s particular characteristics are. It’s also important to note that unlike bonds, bond ETF shares never mature or repay a principal amount on the value of your share purchase.

With that said, bond ETFs can confer several benefits to shareholders:

- ETFs are often passively managed, and therefore have relatively low fees when compared to actively managed investment funds

- Bond ETFs frequently track a bond index, giving you wide exposure to several bond variations from a single position

- Like holding actual bonds directly, bond ETFs can act to diversify a stock portfolio, thereby mitigating risk

- Bond ETFs are mostly dividend paying, meaning that the coupons the fund receives from the bonds it holds are distributed to shareholders on a regular basis. However, these may not be a fixed amount as coupons may differ as to payment dates. Principal repayments from the held bonds may also cause these to fluctuate – if principals are paid instead of being re-invested

- Corporate bonds are often traded in lots with high values, for example, A$100,000. This is unaffordable for many investors. By purchasing shares in a corporate bond ETF, investors with less capital available can still access the corporate bond market

Pick your bonds platform and open an account

Once you’ve chosen which bond asset you’d like to take a position on, you’ll know which of our accounts to open.

- To trade government bond futures markets, open a CFD trading account

- To invest in bond ETFs yourself, open a share trading account

Our cutting-edge platforms have been recognised as Australia's best.2 Built around your needs, our web and mobile platforms are a faster, clearer and smarter way to trade.

Alternatively, use our demo account to develop your trading skills and master our award-winning platform for free. Because the demo simulates the live environment, you’ll be familiar with the platform when you create your live account.

Note that while we don’t offer a practice account for share trading, your live account can be opened for no minimum deposit.

Take your bond trading or investing position

How to trade government bonds futures

- Create an account or log in

- Pick a government bond futures contract from within our trading platform

- Select ‘buy’ to go long, or ‘sell’ to go short. Set your position size and take steps to manage your risk

- Open and monitor your position

How to invest in a bond ETF

To invest in bond ETFs yourself, follow these steps:

- Create an account or log in and go to your share trading account

- Familiarise yourself with our offering of bond ETFs

- Select your opportunity

- Determine the size of your investment and order type

- Open and monitor your position

Tips for investing in bonds

- 1. Look at the credit rating

- 2. Consider a bond or bond ETFs interest rate risk

- 3. Know the maturity date of the bond or bonds held by an ETF

- 4. Factor in the coupon or dividend payment

- 5. Understand your own tolerance for risk

Bond coupon rates should provide a return in proportion to the risk you take when buying the bond. Rating agencies like Standard & Poor’s, Moody’s, and Fitch Ratings assess the credit risk associated with both bonds and bond issuers.

The ratings they give bonds can be used to determine whether the yields offered by each are competitive. Bonds with low ratings should offer higher coupon rates. Bond ETFs also look to credit ratings to determine their risk and expected returns.

For example, whereas high yield (or ‘junk bonds’) pay higher coupon rates, they also incur considerable default risk (ie that the issuer will not be able to meet debt obligations).

Interest rate risk is the potential that rising interest rates will cause the value of bonds and bond ETFs to fall. That is, when rates are high, investors could get a better return elsewhere and demand for bonds declines. A measure of the percentage change in price due to a movement in interest rates is called a bond’s ‘modified duration’.

Bonds with longer terms to maturity are generally more sensitive to interest rate fluctuations, and therefore have a higher level of interest rate risk.

Because market interest rates include the inflation rate as part of their total value, inflation-protected bonds are less exposed to interest rate risk as they adjust coupon rates and principal amounts to meet inflation. In the UK, government Index-linked gilts vary rates in line with inflation, while the US equivalents are Treasury Inflation-Protected Securities (TIPS).

The maturities of bonds are extremely important. Bonds with longer maturities are typically issued with higher coupon rates – and higher yields to maturity – than shorter term bonds. This is because they’re more susceptible to the various types of risk incurred by bonds, including: interest rate risk, inflation risk, credit risk and liquidity risk.

Bond ETFs may specialise in bonds with set maturations, eg ten-year US Treasury bills (T-bills). The value – and share prices – of a long-term ETF may be more volatile than bond ETFs focused on shorter term securities. This potential volatility should form part of your investment strategy.

A primary reason for looking to bonds or bond ETFs as investments is the opportunity to earn a reliable income. This makes the coupon rate on the bond, or the dividends in the case of an ETF, a central consideration in your planning.

The determination of coupon rates is complex, and depends to a large extent on a bond’s credit rating, the prevailing interest rates for comparative levels of risk, and the bond’s term to maturity. Whereas bonds with lower credit ratings and longer terms have higher yields, they are more exposed to risk.

All interest or profit earned on investment is a reward for assuming risk. Understanding risk, and your own appetite for it, is fundamental to establishing sound trading and investment strategies that balance the potential for loss against the potential for reward.

Traditionally, bonds are looked to as investment vehicles that can diversify portfolios – and mitigate some of the risks associated with stock markets. But, they are not riskless, and should never be seen as a guaranteed – if low return – stream of revenue or profit.

Your particular preference for bonds should be put into the larger context of your overall investment strategy and risk tolerances.

Techniques for trading bond futures

- Going 'long' on lower interest rates

- Going 'short' on higher interest rates

- Hedging against inflation

- Hedging against interest rate risk

When interest rates drop, bonds become more desirable, and their prices rise. If you believe this will be the case, you’d adopt a ‘long’ position on your chosen government bond futures market. When going long, you elect to ‘buy’ a derivative to open your trade.

To close your trade, you’d then ‘sell’ the derivative. Should the price of the government bonds futures contract increase, you’ll earn a profit. Conversely, should the price decrease, you would cut a loss.

Before trading with leveraged derivative like CFDs, remember that they’re complex instruments and that losses can accrue rapidly.

When interest rates rise, bonds become less desirable, and their prices drop. If you think this is set to happen, you’d adopt a ‘short’ position on one of our government bonds futures.

When going short, you elect to ‘sell’ a derivative to open your trade. To close your trade, you’d ‘buy’ the derivative back. You’d earn a profit if you sold for a higher amount than you bought at, and cut a loss if the reverse were true.

However, please note that short selling is a high risk trading method because bond prices can keep rising – theoretically without limit. This means that when taking a short position, you stand to incur unlimited losses. You can attach stops to your positions to protect yourself by capping your loss.

Taking a short position on a government bond can be a way to hedge against possible downturns in the real income earned from shares and bonds you already own.

Inflation is an increase in the aggregate price level as measured by changes to a price index, like the CPI. When inflation is high, the dividends paid by shares and the fixed coupons paid by bonds both lose value in real terms – ie they have lower purchasing power.

This, in turn, negatively affects each asset’s market demand and price. By shorting the bond market and potentially profiting from the decrease in bond prices, you could lessen some of your real income losses.

But, hedging incurs significant risk. This risk is only amplified when trading with leveraged derivatives like CFDs as you stand to lose more than the margin amount you deposited to open a position. Additionally, when short-selling, your losses could be unlimited if the market moves against you and bond prices keep rising.

Interest rate risk is the possibility of rising interest rates causing the value of an investment to fall. Fixed-income assets like bonds are exposed to this type of risk. If you hold bonds or shares in a bond ETF and expect to cut a loss owing to a hike in interest rates, you could hedge by going short on the government bonds futures market.

For example, if you think the Bank of England (BoE) is going to increase interest rates, you could open a position on the UK government gilts futures market by electing to ‘sell’ a derivative like a CFD. If your prediction is correct and bond prices fall, your profit on the trade would mitigate the loss to your other investments.

FAQs

Are bonds a good investment?

This depends on your investment goals, timelines and desired risk-to-return ratios. Bonds are traditionally looked to as a means by which to diversify a stock portfolio and earn a fixed income. They can lessen an equity portfolio’s exposure to market risk as a sudden stock market downturn may not see a depreciation in bond prices. However, bonds still incur several notable risks, including interest rate and credit risk.

Are bonds less risky than stocks?

Bonds carry a different set of risks than those associated with stocks. With this said, bondholders are company creditors in the event of insolvency, so their debt is senior to shareholder claims on equity. This means that bondholders receive payments on their bonds before shareholders are entitled to any monies based on their part ownership of the company.

‘Guaranteed bonds’ are bonds whose terms have been guaranteed by a third party like an insurer or parent corporation, which may lessen the chances of default. Government bonds issued by stable, established and secure economies are regarded as being amongst the lowest risk investments available.

How can you take a position on bonds?

With us, you can speculate on the price of government bonds futures, or bond market EFTs using CFDs or invest in bond ETFs via a share trading account.

To buy corporate bonds, you need to approach an authorised dealer-broker.

What accounts can I trade or invest in bonds with?

- To trade government bond futures markets, open a CFD trading account

- To invest in bond ETFs yourself, open a share trading account

1 Number 1 in Australia by primary relationships, CFDs & FX, Investment Trends November 2024 Leveraged Trading Report.

2 Best finance app as awarded at the ADVFN International Financial Awards 2022.