Market update: Brent, WTI oil prices await OPEC supply cut quotas for 2024

Delayed OPEC+ meeting to take place on Thursday at 13:00 GMT – individual quotas and supply cuts remain central to the meeting and brent crude prices head lower after notable rejection at the intersection of the crucial $82 level.

Delayed OPEC meeting set for Thursday as quota agreement nears

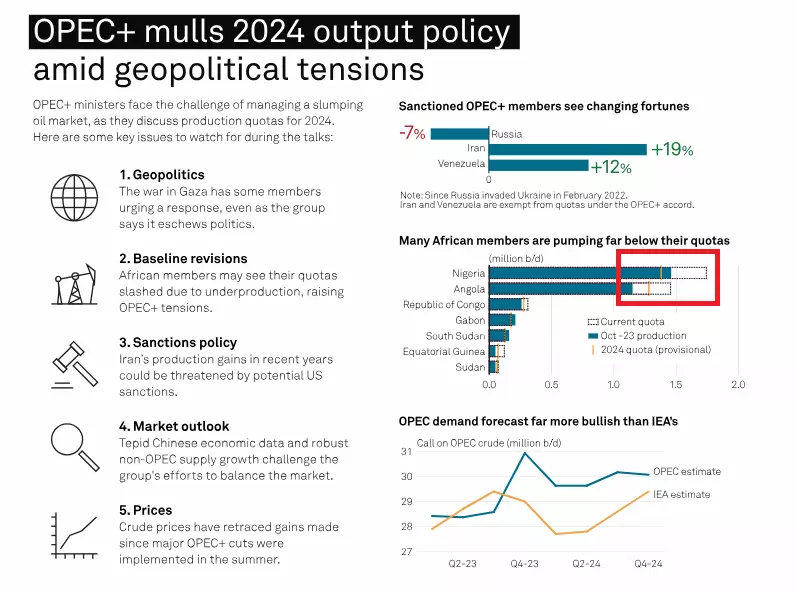

Last Wednesday, Brent crude oil was particularly volatile after news of OPEC’s decision to delay their meeting to Thursday this week hit the news wires. Since then, sources have pointed to a difference of opinion in the output levels being discussed for countries that have frequently fallen short of existing output quotas, namely Angola, Nigeria.

The graphic below highlights the difficulty faced by African countries in reaching its output targets due to a lack of infrastructure investment and capacity challenges. OPEC + will begin their meeting at 13:00 GMT on Thursday and the cabal is currently weighing up the option to extend supply cuts into 2024 and reports are even suggesting more aggressive supply cuts given weaker oil prices. OPEC has to navigate the negative effect of the global growth slowdown, mainly expectations of lower future demand and increasing non-OPEC supply (US) weighing on oil prices.

The 4-day ceasefire between Israel and Hamas has been mostly positive and talks about an extended truce continue subject to the release of more hostages. OPEC denied requests from Iran to issue an oil embargo on Israel and the war appears to have had minimal impact on recent oil prices.

Brent crude technical analysis

Brent crude oil tested the zone of resistance around the significant $82 level after Wednesday’s increased volatility after the announcement to postpone the November OPEC meeting. The zone comprised of the $82 level which has proved to be a pivot point numerous times in the past and the 200 day simple moving average (SMA).

Should bearish momentum pick up from here, there is little to get in the way of the decline, technically. Of course, should OPEC ramp up its supply cuts, this could jolt oil markets higher as markets adjust to a world of lower oil supply.

Resistance remains at $82 with a light level of support at the 50% Fibonacci retracement at $77 – the 50% retracement is generally less significant. Thereafter, support appears all the way at $71.50.

Brent crude daily chart

WTI technical analysis

WTI observed a similar path for price action – rejecting a move above the 200 SMA and trading lower ahead of the OPEC meeting. Before the intra-day bullish reversal on Wednesday, the commodity was on track to produce an ‘evening star’ – typically a bearish pattern.

Price action continues to head lower, after trading below the 200 SMA and the significant level of 77.40. Support appears at $72.50.

WTI daily chart

- This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Discover how to trade the markets

Learn how indices work – and discover a wide range of markets – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on the FTSE 100

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices