Market update: AUD/USD price forecast-bullish momentum sustained with channel breakout

AUD/USD maintains elevated levels amidst retracement possibility: RBA and Fed positions point towards potential bullish continuation.

Australian dollar fundamental backdrop

The Australian dollar has held onto its gains from the past couple of weeks despite a slight recovery from the US dollar index at the back end of last week. The Australian dollar has been on a steady move higher since the RBA raised rates at the November meeting.

The Australian dollar has since been on an uptrend as this coincided with the US dollar weakness, and the Federal Reserve meeting last week. The Australian economy has been showing signs of a slowdown, with both services and composite metrics in contractionary territory.

If this is the peak rate for the RBA, it still puts the Australian dollar in the driving seat given the comments by Fed Chair Powell. The Fed are expecting 75bps of cuts in 2024, while the RBA are yet to strike such a dovish tone. The RBA could remain hawkish for a bit longer before we see some dovish repricing which could halt the Australian dollar rally. It will be an interesting end to the year and even more interesting in 2024, as we see how central banks navigate their way toward potential rate cuts.

The week ahead

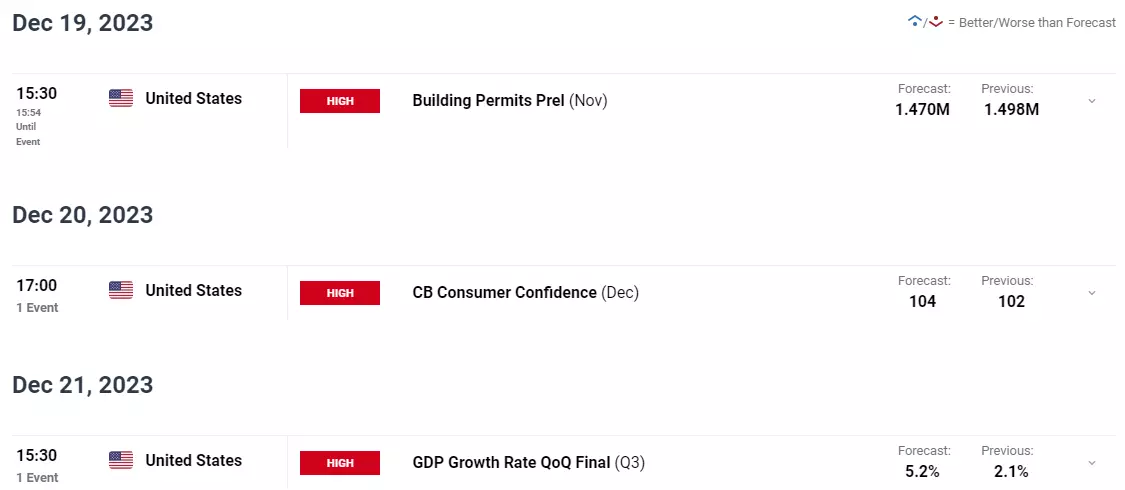

The rest of the week still brings in a lot of data releases from the US in particular. These releases could see small alterations in the Fed Funds rate expectations for the Federal Reserve. This is likely to persist heading into 2024, as data continues to be released.

Right now, however, any data releases are unlikely to have any lasting impact and is likely to only result in short term changes.

Earlier this evening we also heard comments from Fed policymaker, Mary Daly who confirmed that three rate cuts would likely be needed to avoid overtightening. Daly also said that this would likely depend on inflation, another sign that it is not a given. The recent rise in tensions in the Middle East has the potential to prop inflation up once more and lead to a global economic slowdown as well. Interesting times ahead indeed.

Economic calendar

AUD/USD technical analysis

AUD/USD had finally broken out of the channel which had been in play since March 2023. The breakout occurred last week Thursday and had since stalled. Looking at general structure we have just printed a fresh higher high which usually occurs before a pullback. The dollars resurgence on Friday failed to push AUD/USD lower and thus I am skeptical that the retracement I am looking for will come to fruition.

If it does however, I will be paying close attention to the ascending trendline, which could come into play, but before that there is support at the 0.6690 and 0.6590 handle which could prove to be stubborn. Alternatively, should AUD/USD continue its move higher from here then immediate resistance rests at 0.6790 and 0.6890 respectively.

Key levels to keep an eye on:

Support levels:

- 0.6690

- 0.6590

- 0.6500

Resistance levels:

- 0.6790

- 0.6890

- 0.7000 (psychological level)

AUD/USD daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Live prices on most popular markets

- Forex

- Shares

- Indices