EUR/USD, GBP/USD and USD/JPY try to level out ahead of the weekend

Outlook on EUR/USD, GBP/USD and USD/JPY amid strong US growth and high US yields.

EUR/USD levels out despite heightened Middle East tensions

Despite heightened Middle East tensions and stronger-than-expected US growth, EUR/USD managed to bounce off its breached downtrend channel resistance line, now because of inverse polarity a support line, at $1.0522 on Thursday.

While this level holds, the mid-October high at $1.0639 may be revisited. For a medium-term bullish reversal to take shape, a rise and daily chart close above this week’s high at $1.0695 would need to be seen, though.

Below this week’s low at $1.0522 lies the mid-October low at $1.0496 and below it key support at $1.0484 to $1.0444, made up of the mid-November high, 7 December and 6 January lows. It needs to hold for EUR/USD to be able to bottom out.

GBP/USD hovers above its $1.2038 early October low

GBP/USD's slide towards its early-October seven-month low at $1.2038 is showing minor signs of slowing down while Thursday’s low at $1.207 underpins and as profit taking in US dollar longs ahead of the weekend gains traction.

A fall through $1.2038 would put the psychological $1.20 mark on the map, however.

Minor resistance above the mid-October $1.2123 low comes in around the $1.2216 to $1.2225 region which capped the cross a couple of weeks ago. While trading below this resistance area, downside pressure should remain dominant.

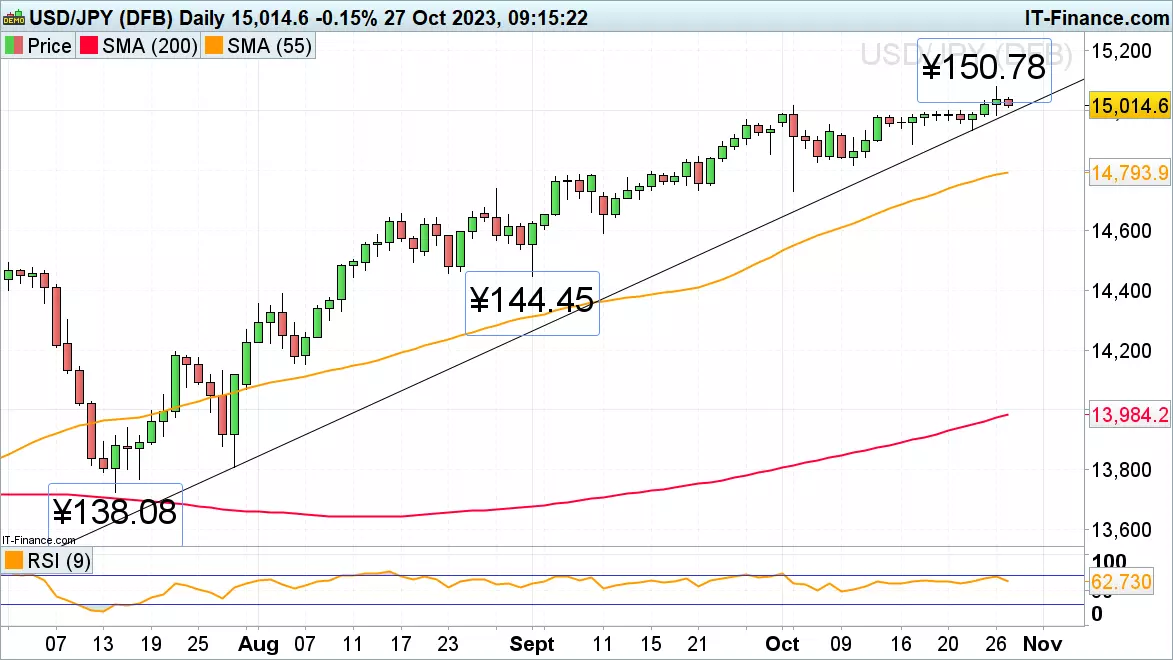

USD/JPY cautiously trades above the psychological ¥150.00 mark

Over the past couple of days USD/JPY has been cautiously trading above the psychological ¥150.00 mark, so far without the Bank of Japan (BoJ) intervening despite the early-October high at ¥150.16 having been overcome and a new one-year high being made at ¥150.78.

It lies close to the October 2022 peak at ¥150.94 around which the central bank might well intervene, though.

If so, the July-to-October tentative uptrend line at ¥149.86 would likely give way with this week’s low at ¥149.33 and the next lower 17 October low at ¥148.85 being expected to then be hit.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices