EUR/USD stalls while GBP/USD and USD/JPY push higher

Outlook on EUR/USD, GBP/USD and USD/JPY amid recovering US yields.

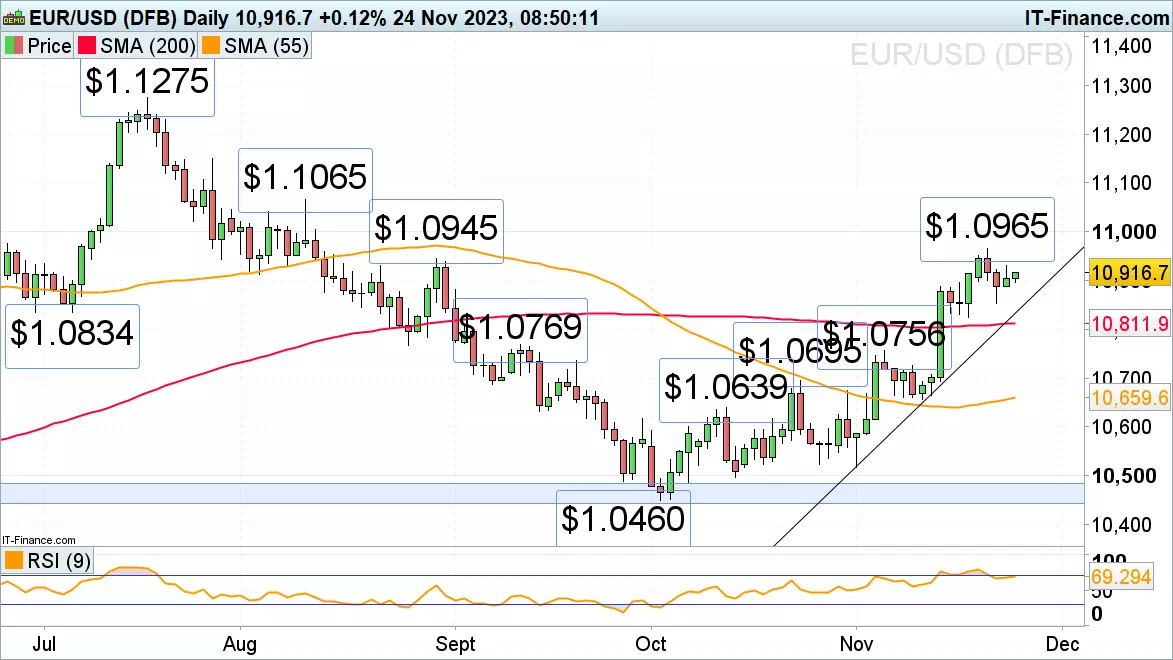

EUR/USD range bound below its four-month high

EUR/USD continues to trade in low volatility and volume as US market participants are mainly absent due to the prolonged Thanksgiving holiday.

The cross still has the $1.0945 late August high in its sights, a rise above which would open the way for its four-month high at $1.0965 to be reached. Further up lie the late June high at $1.1012 and the August peak at $1.1065.

A bullish run will remain the most likely scenario as long as Wednesday’s low at $1.0853 underpins. Minor support below that low comes in around the $1.0834 July low and the 200-day simple moving average (SMA) at $1.0812.

GBP/USD rises on improving UK consumer confidence

GBP/USD is closing in on this week’s high at $1.257 as GfK consumer confidence for November comes in better-than-expected at -24 versus -30 in October. A rise above $1.257 will likely target the mid-August low at $1.2617.

The current upside momentum should prevail while Wednesday’s low and the 200-day SMA at $1.2455 to $1.245 underpin. Only a currently unexpected drop through this support zone would engage the early November high at $1.2428.

USD/JPY recovery is ongoing

USD/JPY’s swift descent from marginally below its October 2022 peak at ¥151.95 to this week’s ¥147.16 low has been followed by a bounce back to Wednesday’s ¥149.75 high which remains in sight.

With Japan’s October month-on-month (MoM) inflation seeing its highest jump in a decade by 0.7% and year-on-year (YoY) inflation rising to 3.3% while US yields are bouncing back, USD/JPY is likely to head back up again.

A rise above ¥149.75 would eye the early October peak at ¥150.16. Further potential minor resistance can be spotted at the 26 October high at ¥150.78. Minor support below the 55-day SMA at ¥149.37 can be found at the late October low at ¥148.81.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices