ROCE definition

What is return on capital employed (ROCE)?

Return on capital employed, or ROCE, is a long-term profitability ratio that measures how effectively a company uses its capital. The metric tells you the profit generated by each dollar (or other unit of currency) employed.

How to calculate ROCE

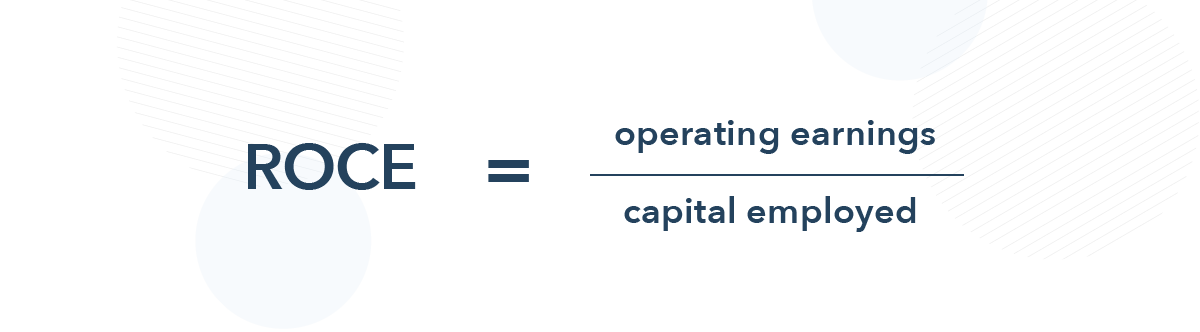

ROCE is calculated by dividing a company’s earnings before interest and tax (EBIT) by its capital employed. In a ROCE calculation, capital employed means the total assets of the company with all liabilities removed.

You would use the following formula when calculating ROCE:

Example of return on capital employed

Let’s say company ABC has net operating earnings of $300,000 – with $200,000 in assets and $50,000 in liabilities. To calculate ABC’s ROCE, you’d divide its net income ($300,000) by its assets minus its liabilities ($200,000 - $50,000 = $150,000). This would give you $2 – so, for every $1 invested in capital employed, ABC earns $2.

What does ROCE tell traders?

ROCE tell traders how efficiently a company is using its capital. Two companies with similar earnings and profit margins may have very different returns on their capital employed. While they may look similar on the surface, they would have significantly different attitudes toward spending capital. Traders can use ROCE as part of their fundamental analysis to establish whether a company is utilising its capital well (high ROCE) or not (low ROCE).

Analysts also use ROCE as a means of performance trend analysis for a company. In the majority of cases, an increasing ROCE ratio implies strengthening long-term profitability.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.