Gearing ratio definition

What is a gearing ratio?

A gearing ratio is a measure used by investors to establish a company’s financial leverage. In this context, leverage is the amount of funds acquired through creditor loans – or debt – compared to the funds acquired through equity capital.

Learn how to trade stocks

Find out more about share trading, including how to build a trading plan and open a position.

Gearing ratio formula

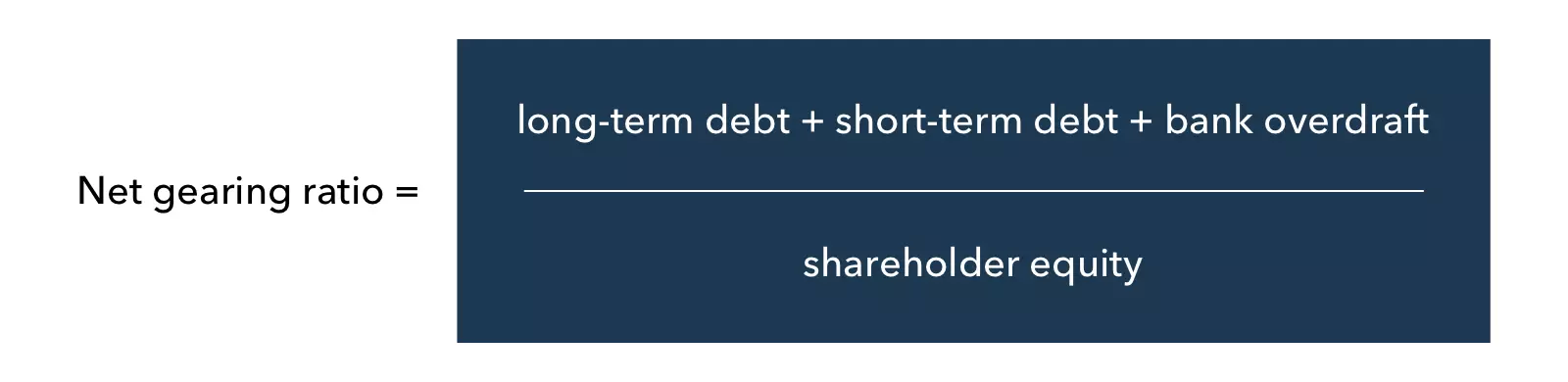

The most common way to calculate gearing ratio is by using the debt-to-equity ratio, which is a company’s debt divided by its shareholders’ equity – which is calculated by subtracting a company’s total liabilities from its total assets.

The gearing ratio formula is as follows:

This ratio is expressed as a percentage, which reflects how much of a company’s existing equity would be required to pay off its debt.

Example of calculating gearing ratio

Let’s say a company is in debt by a total of $2 billion and currently hold $1 billion in shareholder equity – the gearing ratio is 2, or 200%. This means that for every $1 in shareholder equity, the company has $2 in debt. This would be considered an extremely high gearing ratio.

What is a good or bad gearing ratio?

A good or bad gearing ratio is completely relative, as it is a comparison between an individual company and other companies in the same industry. However, there are some basic guidelines that can be used to identify desirable and undesirable ratios:

- A high gearing ratio is anything above 50%

- A low gearing ratio is anything below 25%

- An optimal gearing ratio is anything between 25% and 50%

A company with a high gearing ratio will tend to use loans to pay for operational costs, which means that it could be exposed to increased risk during economic downturns or interest rate increases. This could lead to financial difficulties, and even bankruptcy.

A company with a low gearing ratio will generally have more conservative spending habits or operate in a cyclical industry – one that is more sensitive to economic ups and downs – so it tries to keep its debts down. Companies with low gearing ratios maintain this by using shareholders’ equity to pay for major costs.

How can companies reduce their gearing?

Companies can reduce their gearing ratio by paying off their debts. There are multiple ways to do this, including:

- Selling shares. Releasing more shares to the public to increase shareholder equity, which can be used to pay the company’s debt

- Converting loans. Companies can negotiate with their lenders to swap their existing debts for shares in the company

- Reducing operational costs. By reducing the amount of outgoing money, by identifying inefficiencies and areas of improvement, a company can use the cash to pay its debts

- Increase profits. Creating a strategy that will help to increase profits can generate more cash with which a company can pay its debts

Pros and cons of gearing ratios

Pros of gearing ratios

A gearing ratio is a useful measure for the financial institutions that issue loans, because it can be used as a guideline for risk. When an organisation has more debt, there is a higher risk of financial troubles and even bankruptcy.

Gearing ratios are also a convenient way for the company itself to manage its debt levels, predict future cash flow and monitor its leverage.

Cons of gearing ratios

Using a company’s gearing ratio to gauge its financial structure does have its limitations. This is because the gearing ratio could reflect a risky financial structure, but not necessarily a poor financial state. While the figure gives some insight into the company’s financials, it should always be compared against historical company ratios and competitors’ ratios.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.