Stock indices 101: empowering beginners with confidence

As a new trader, understanding stock indices can feel overwhelming. Here’s a clear, step-by-step guide to help you trade them confidently.

This article was produced by IG's editorial team using AI-enhanced research

Did you know?

Throughout this guide, we use IG's index names alongside the global index names they represent.

Your guide to market benchmarks

You've likely heard of stock indices like the FTSE 100, the Dow Jones or the Nikkei 225. These numbers are often quoted in the news, reflecting how much they've moved up or down. But what exactly are stock indices and what do they represent?

A stock index measures the value of a specific section of the stock market.

Let’s break down stock indices into five simple steps.

Step 1: What are stock indices? 📈

A stock index measures how a group of shares is performing collectively.

These groups can be selected by:

- Country: Australia 200 (ASX 200), Wall Street (Dow Jones), US 500 (S&P 500)

- Sector: Technology, healthcare, financial

- Market size: Large, medium or small companies

For example, the Australia 200 (ASX 200) tracks the largest 200 companies in Australia. If the share prices of these companies rise, the Australia 200 also rises.

New to stock indices?

Step 2: Why do stock indices matter? 🌍

Indices offer a quick snapshot of how a market or economy is doing.

They're crucial indicators for:

- Economic health: A rising index suggests economic strength, while a falling one may signal weakening conditions.

- Investor sentiment: Indices reflect optimism or pessimism about market conditions.

For instance, if the Australia 200 (ASX 200) rises, investors might view Australia's economic outlook positively.

Step 3: How are stock indices calculated? 🧮

Stock indices are calculated in two primary ways:

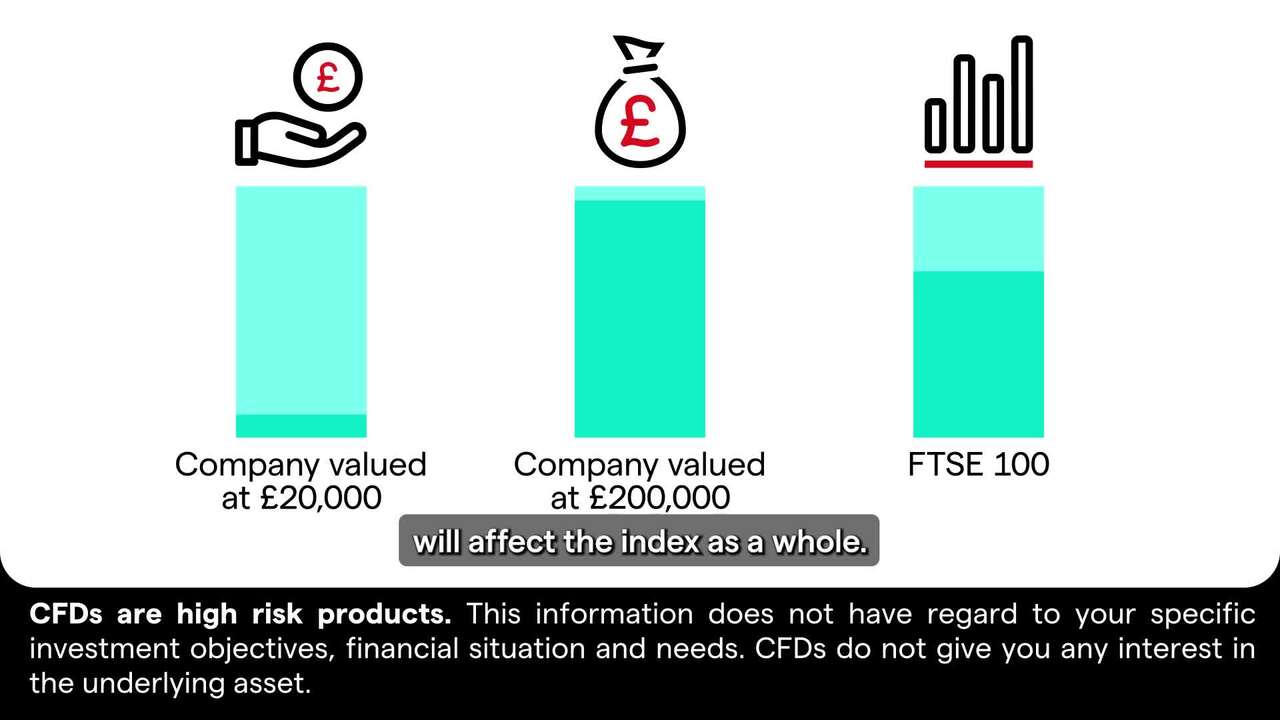

Capitalisation-weighted: Companies with larger market values have more influence. For instance, the Australia 200 (ASX 200), US 500 (S&P 500), and FTSE 100.

Price-weighted: Stocks with higher prices have greater influence. Wall Street (Dow Jones) uses this method.

Example: If BHP has double the market value of Coles, a 1% change in BHP’s share price impacts the Australia 200 more significantly than the same change in Coles.

Find the right index for your strategy

Step 4: What are the world’s major stock indices? 🌐

Every major market has at least one key index.

Country |

IG index name |

Global index name |

Australia |

ASX 200 |

|

United States |

Dow Jones Industrial Average |

|

United States |

S&P 500 |

|

United States |

NASDAQ 100 |

|

Germany |

DAX |

|

France |

CAC 40 |

|

Japan |

Nikkei 225 |

|

Hong Kong |

Hang Seng Index |

|

United Kingdom |

FTSE 100 |

- The US has several major indices representing different segments: Wall Street (Dow Jones), US 500 (S&P 500) and US Tech 100 (NASDAQ 100).

Step 5: How can beginners trade stock indices? 📊

Indices aren't traded directly because they're numerical benchmarks, not physical assets. Instead, you trade financial products that replicate their performance:

- Exchange-traded funds (ETFs): Funds that mirror an index's performance

- Index funds: Managed funds that track indices

- Derivatives: Products such as contracts for difference (CFDs), futures, and options

Example: If you believe the Australia 200 will rise, you could buy an ETF or open a CFD position, profiting from the upward movement without owning the actual shares.

So what's next?

Important to know

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.