Forex 101: building confidence in currency markets

Discover how Aussies can access the 24-hour currency market. Learn how forex works, how to read currency pairs like AUD/USD and how to trade with confidence in a market that never sleeps.

This article was produced by IG's editorial team using AI-enhanced research

Why forex matters to Aussie traders 🌏

If you’ve ever converted Australian dollars for a Bali holiday, you’ve taken part in the foreign exchange market, also known as forex or FX.

But behind the travel desk lies a massive global engine:

✅ The most liquid market in the world

✅ Trades over $5 trillion a day

✅ Open 24 hours, five days a week

✅ Powered by banks, businesses and individual traders

Whether you’re in Sydney, Melbourne or Perth, forex gives Australian traders access to global currency movements, with opportunities to trade round the clock.

Step 1: Understand currency pairs 💱

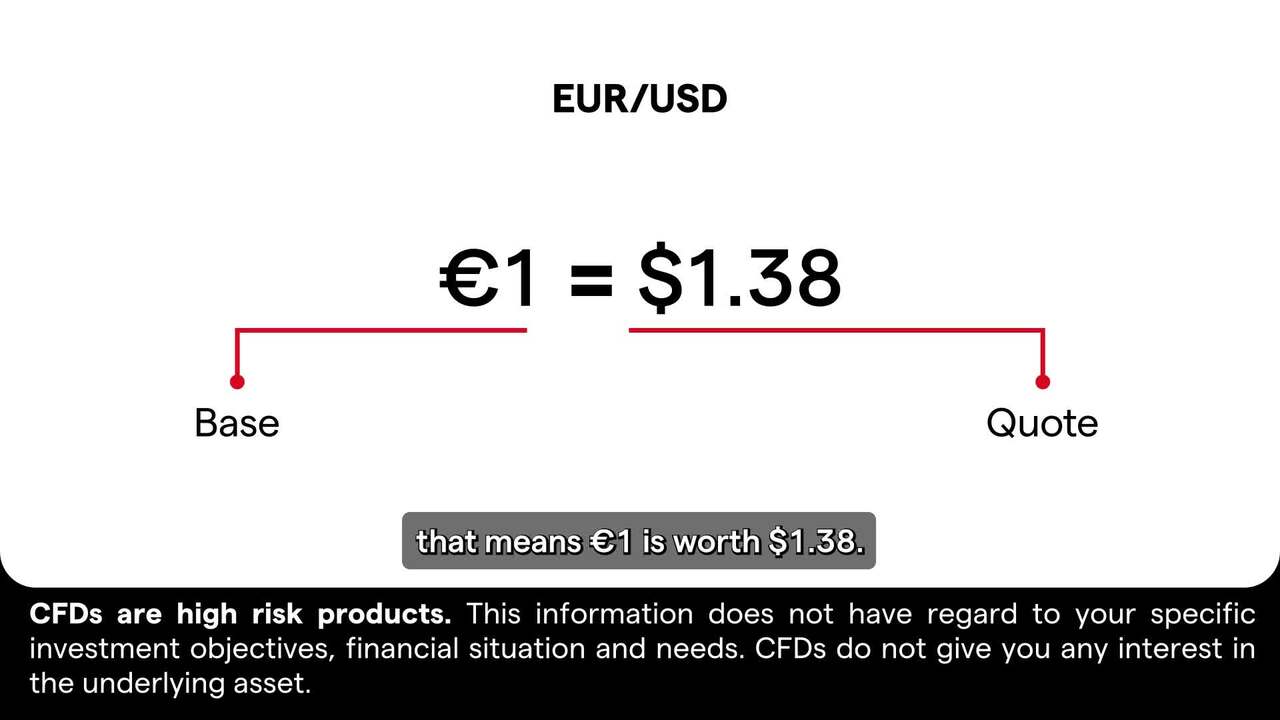

In forex, currencies are always quoted in pairs : one currency versus another.

For example:

- AUD/USD = Aussie dollar vs US dollar

- EUR/GBP = Euro vs British pound

The first currency is the base, the second is the quote. If AUD/USD = 0.6700, it means 1 AUD is worth 67 US cents.

🔁 Going long? You’re buying the base (AUD) and selling the quote (USD).

🔁 Going short? You’re doing the reverse by selling AUD to buy USD.

It’s a tug-of-war between economies and you’re backing one to outperform the other.

What is a 'lot'?

Step 2: Know your majors, minors and exotics 🧭

Most Aussie traders stick with major pairs as they’re liquid, lower cost and widely followed.

Pair type |

Description |

Example |

Major |

High volume, includes USD |

AUD/USD, EUR/USD |

Minor |

No USD, less traded |

AUD/NZD, EUR/JPY |

Exotic |

Emerging market currency pairs |

AUD/SGD, GBP/ZAR |

✅ Tip: If you're starting out, majors like AUD/USD or GBP/USD offer tighter spreads and plenty of daily news to track.

Step 3: Trade when the market moves 🕒

Forex is a 24-hour market and ideal for Australians who want flexibility.

The four major trading sessions are:

- Sydney

- Tokyo

- London

- New York

💡 Best time for Aussie traders?

Midday to late evening AEST, when the London and New York sessions overlap. This window sees the most liquidity and volatility which is ideal for spotting price action setups.

Why do USD pairs rule the roost?

Step 4: Get to know pips and lots 📊

Price moves in forex are measured in pips which is usually the fourth decimal point.

So if EUR/USD moves from 1.1050 to 1.1055, that’s a 5 pip increase.

To benefit from these small moves, trades are placed in lots:

Lot type |

Units |

Standard |

100,000 |

Mini |

10,000 |

Micro |

1000 |

You don’t need to fund the whole amount up front – thanks to leverage, you can open larger positions with a smaller deposit. Just remember: gains and losses are magnified, so risk management is key.

Step 5: What moves forex markets? 📈

Currencies rise or fall based on how investors feel about a country’s economy.

For the Aussie dollar, keep an eye on:

- RBA decisions on interest rates 🏦

- Iron ore and commodity prices ⛏️

- China’s economic health as our largest trading partner 🇨🇳

- Unemployment and inflation data from the ABS 📊

- Risk sentiment globally as the AUD is a “risk-on” currency, meaning it tends to rise when markets are feeling confident.

💡 Tip: Economic calendars are your friend. Plan around major data releases and central bank announcements to avoid surprises.

So what's next?

Important to know

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.