Gold prices gain as USD falls

Gold prices aimed higher on Tuesday as the US dollar fell; Bearish Engulfing follow-through remains a risk for gold and IGCS shows traders increased upside bets.

Gold prices gained slightly over the past 24 hours after the worst two-day loss since early February. The anti-fiat yellow metal benefited from a cautiously weaker US dollar as traders continued to fine-tune their expectations of where the Federal Reserve might take interest rates later this year.

During Tuesday’s Wall Street trading session, Atlanta Fed President Raphael Bostic spoke and noted that he favors one rate hike before “going on hold”. He added that a recession is not in his baseline outlook and that the central bank “will do what it takes” to bring down inflation to 2%.

This commentary might have kept the US dollar restrained and thus offered XAU/USD some lift. Focusing on Wednesday’s Asia-Pacific trading session, the economic docket is lacking notable economic event risk. That may keep traders focused on general risk appetite, which is fairly quiet for the time being.

XAU/USD technical analysis

On the daily chart, gold continues to face the downside risk of the aftermath of a Bearish Engulfing. Downside follow-through has been lacking, with prices being supported by the 20-day Simple Moving Average. Positive RSI divergence was present before the Bearish Engulfing formed, hinting that upside momentum was fading.

For the time being, watch the moving average for key support. In the event of a turn higher, the 2022 high at 2070.42 remains a key level to watch.

XAU/USD daily chart

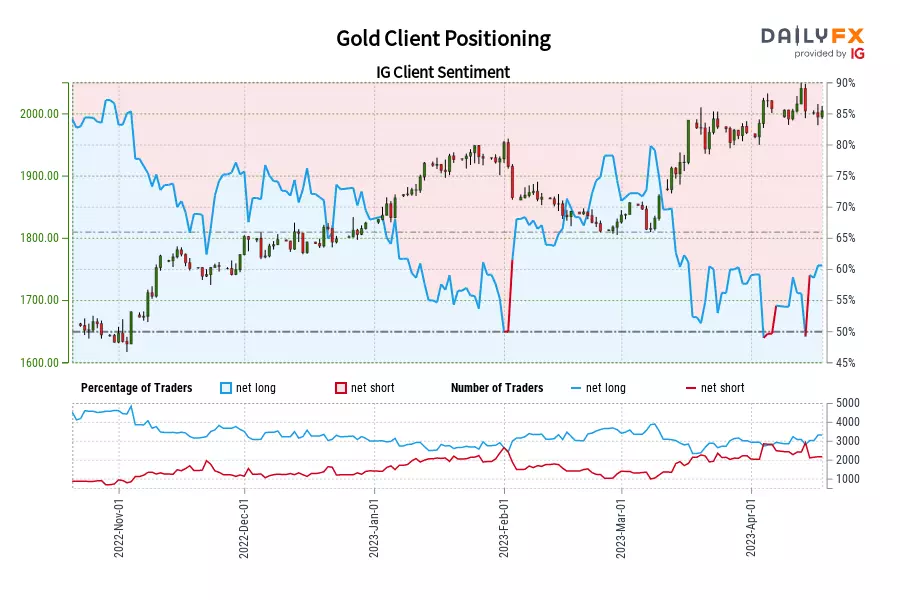

Gold sentiment analysis - bullish

According to IG Client Sentiment (IGCS), about 58% of retail traders are net-long gold. IGCS tends to function as a contrarian indicator. Since most traders are net-long, this hints prices may fall. But, upside exposure has decreased by 5.14% and 5.45% compared to yesterday and last week, respectively.

With that in mind, recent changes in exposure warn that prices may soon reverse higher once more.

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Speculate on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

Put learning into action

Try out what you’ve learned in this commodities strategy article in your demo account.

Ready to trade commodities?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Deal on our wide range of major and niche commodities

- Protect your capital with risk management tools

- Get some of the best spreads on the market – trade Spot Gold from 0.3 points

Inspired to trade?

Put what you’ve learned in this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices