Ahead of the game: 19 April 2024

Your weekly financial calendar for market insights and key economic indicators.

US equity markets dropped for a third straight week, with the Nasdaq leading the decline, plunging over 4%. This drop was triggered by ASML, a Dutch tech giant that supplies chips to the semiconductor industry, reporting earnings below expectations, alongside rising geopolitical tensions and fading hopes for Fed rate cuts in 2024.

The ASX 200 also suffered, dropping almost 4% this week. This downturn wiped out nearly all its first-quarter gains, as negative sentiment from Wall Street heavily impacted the Australian market.

- In the US, Powell says interest rates need to stay up until inflation's on target

- China's Q1 GDP outperforms, hits 5.3%YoY versus the 5.0% forecast

- UK's March inflation hotter than expected at 3.2% YoY, core rate at 4.2%. Unemployment ticked up to 4.2%

- US retail sales beat expectations in March, jumping 0.7% MoM. Retail sales control group, key for GDP, up 1.1%

- In the UK, the unemployment rate for February increased to 4.2%, exceeding expectations of 4%

- VIX index up for a third week, hitting 18. Wall Street's fear gauge ticks higher

- Crude dropped 5% to $81.50 on US inventory build and Middle East tensions

- Australian job market dips, shedding 6.6k jobs in March, unemployment at 3.8%

- Gold up 1.70% to $2385, still shy of last week's $2431 peak.

- AU: Q1 Inflation rate (Wednesday, 24 April at 11:30am AEDT)

- JP: BoJ interest rate decision (Friday, 26 April at 2:00pm AEDT)

- US: S&P Flash PMIs (Tuesday, 23 April at 11:45pm AEDT)

- US: Durable Goods orders (Wednesday, 24 April at 10:30pm AEDT)

- US: Core PCE Price Index (Friday, 26 April at 10:30pm AEDT)

- GE: HCOB Flash PMIs (Tuesday, 23 April at 5:30pm AEDT)

- EA: HCOB Flash PMIs (Tuesday, 23 April at 6:00pm AEDT)

- UK: HCOB Flash PMI (Tuesday, 23 April at 6:30pm AEDT)

- GE: IFO Business Climate (Wednesday, 24 April at 6:00pm AEDT)

- GE: GFK Consumer Confidence (Thursday, 25 April at 4:00pm AEDT)

- UK: GFK Consumer Confidence (Friday, 26 April at 4:00pm AEDT)

-

US

S&P Global flash Purchasing Managers' Index (PMI)

Date: Tuesday, 23 April 2024 11.45pm

The recent run in stronger-than-expected US economic conditions has called for a delay in Fed’s rate cuts, with markets now looking for a September move instead of the initial June timeline. The scale of rate cuts through 2024 has also been revised down to two 25 basis point (bp) cuts from the previous three.

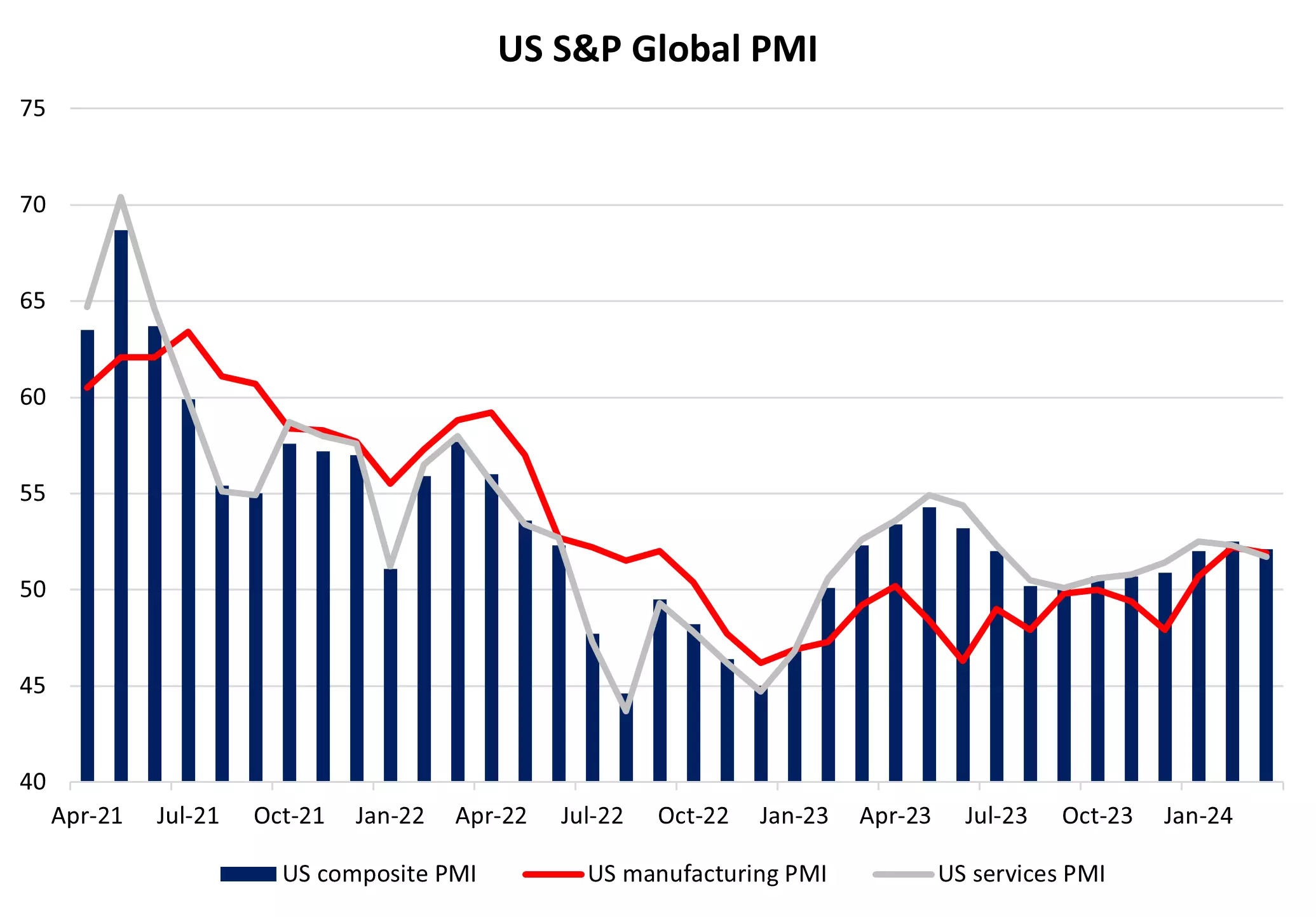

Further resilience in US economic conditions may validate this timeline and reinforce the growing chorus among Fed members for more patience in policy easing. In March, US flash PMI numbers have indicated steady growth, with manufacturing PMI coming in at 51.9, while services activities eased slightly to 51.7 from previous 52.3. The lukewarm expansion in economic conditions is expected to continue, which should keep soft-landing hopes in place.

US S&P Global PMI

-

AU

Q1 2024 Inflation rate

Date: Wednesday, 24 April at 11.30am

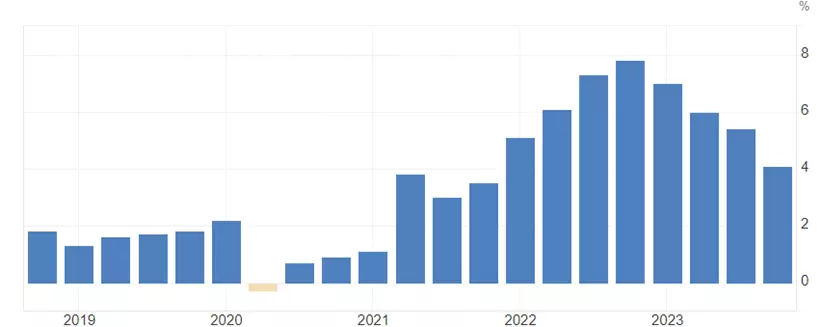

In the December 2023 quarter (Q4), inflation rose by 0.6% for an annual rate of 4.1% YoY, below the 4.3% expected and well below the 5.4% print of the September quarter.

The RBA's preferred measure of inflation, trimmed mean inflation, rose by 0.8% QoQ, which saw the annual measure of trimmed mean ease to 4.2% YoY, a significant drop down from 5.2% in the September quarter and below the RBA's forecast of 4.5%.

Michelle Marquardt, ABS head of prices statistics, said, "The CPI rose 0.6 per cent in the December quarter, lower than the 1.2 per cent rise in the September 2023 quarter. This was the smallest quarterly rise since the March 2021 quarter".

The March 2024 quarter (Q1) is expected to show headline inflation increased by 0.9% over the quarter for an annual rate of 3.5%. The Trimmed mean is expected to rise by 0.9% QoQ, allowing the annual trimmed mean to ease to 3.9% YoY.

Headline annual inflation

-

JP

BoJ interest rate decision

Date: Friday, 26 April at 2pm

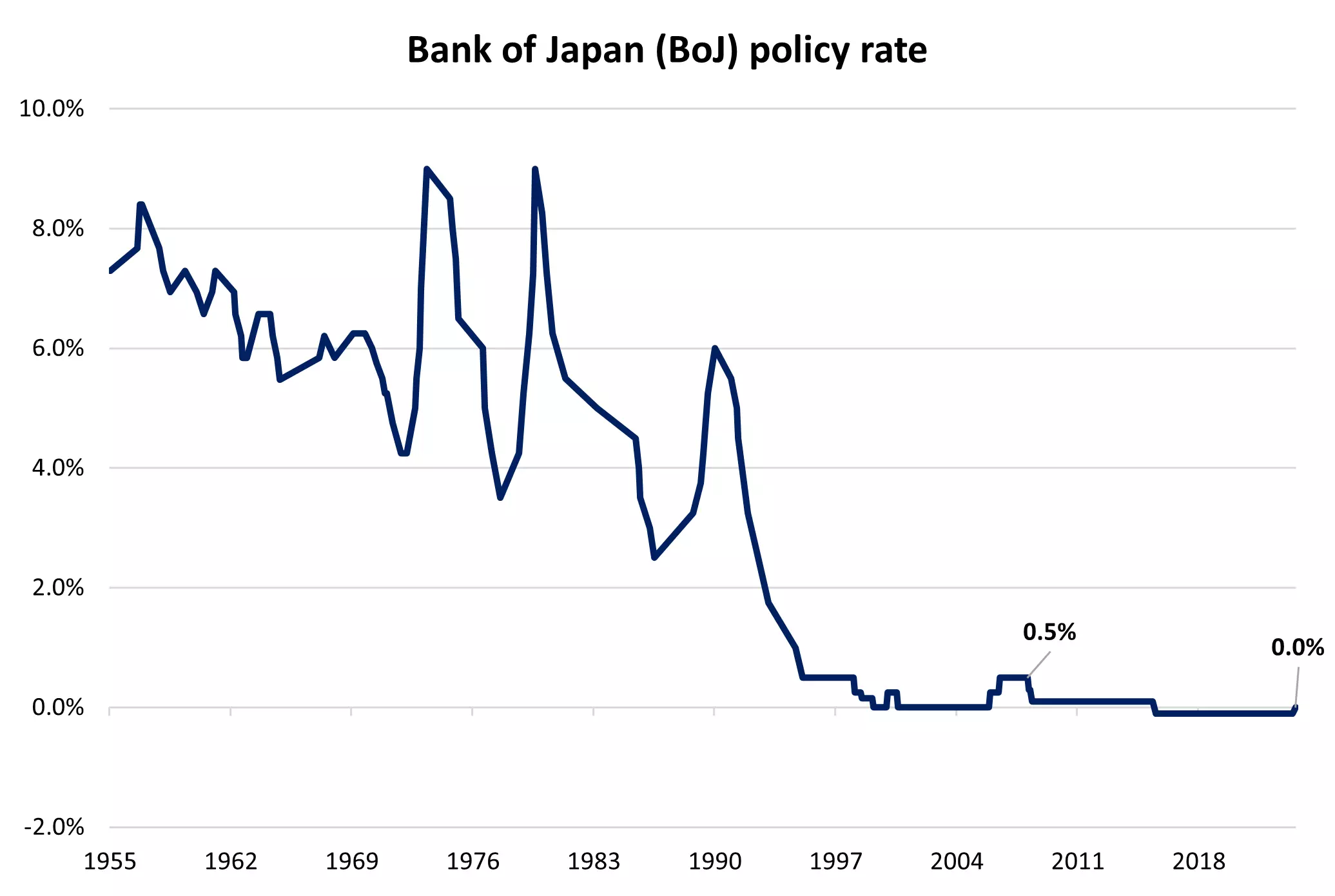

At the previous meeting, the BoJ raised its key short-term interest rate from -0.1% to a range of 0%-0.1% for the first time in 17 years, riding on the hopes that a virtuous wage-price spiral could bring its ‘sustainable and stable 2% inflation’ target in sight. The central bank has also abandoned its yield curve control (YCC) policy.

At the upcoming meeting, the central bank is expected to keep policy settings on hold, having previously indicated patience in its future policy assessments. Rate expectations are priced for the BoJ to potentially hike rates further only in the July or September meeting.

Focus for the upcoming meeting will be on the BoJ’s quarterly outlook report, with eyes on how the weaker yen and surging oil prices in recent months will raise the bar on its inflation outlook, which will set expectations for the central bank’s next rate move.

Bank of Japan policy rate

-

US

Core PCE inflation

Date: Friday, 26 April at 2pm

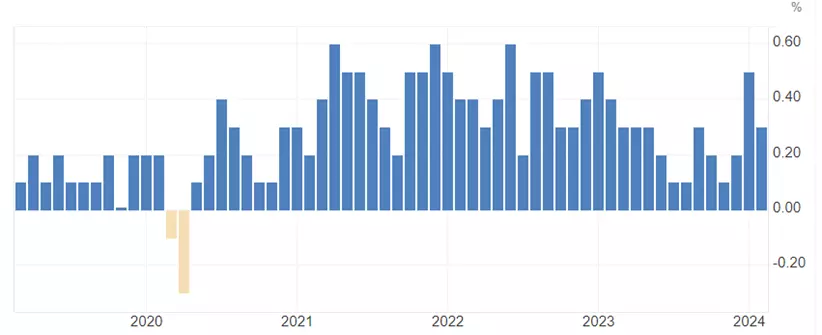

Both headline and core PCE price inflation have trended lower since September 2022. However, in February, headline inflation increased to 2.5% from 2.4%, while Core inflation remained stable at 2.8%.

Headline PCE for March is expected to increase by 0.3% month-on-month, which would raise the headline rate to 2.5%. The Core PCE price index is also expected to rise by 0.3% month-on-month, leaving the annual core rate of inflation at 2.8%.

After a third consecutive sizzling CPI report, the Fed chair this week was forced to acknowledge that rates would need to stay higher for longer until greater confidence emerged that inflation is returning to target. After pricing 170 bp of rate cuts at the start of the year, there are now just 42 bp of rate cuts priced for 2024, with a first-rate expected in September.

Core PCE Price Index MoM

This information has been prepared by IG, a trading name of IG Australia Pty Ltd. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices