What is an exchange traded fund (ETF)?

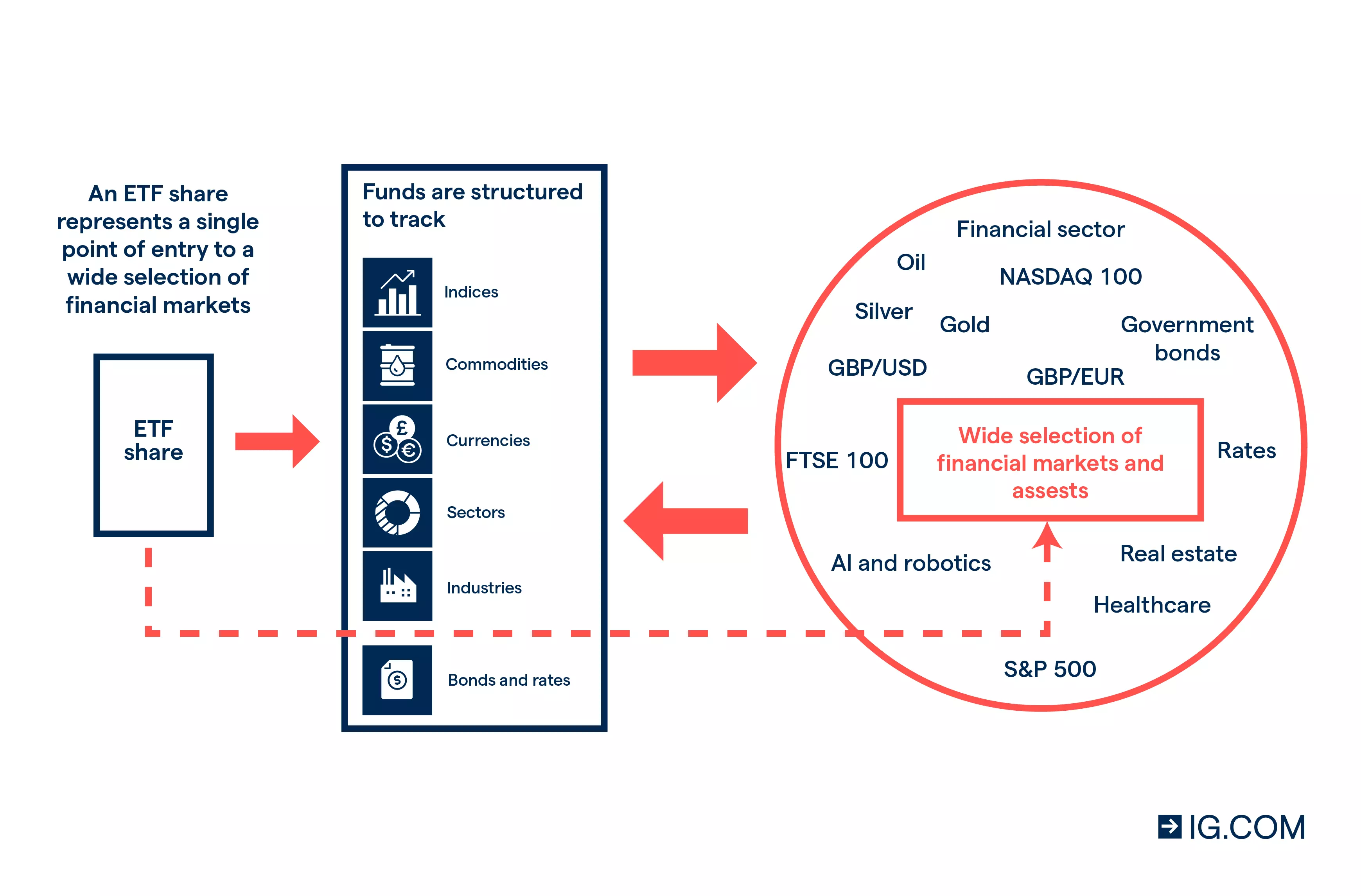

An exchange traded fund (ETF) is an investment instrument that tracks the performance of an existing market or group of markets. The fund will either physically buy the assets it is tracking or use more complicated investments to mimic the movement of the underlying market.

ETFs are bought and sold on a stock exchange – in much the same way as stocks. They perform a similar function to indices, investment trusts and other exchange traded products. You can buy an ETF to track a sector, an index, stocks from a specific country, a commodity, a currency or fixed income markets.

Many ETFs are designed to track the underlying assets, but some funds hand pick the assets they track. You can choose to trade ETFs via CFDs, or invest via our share trading platform.

Popular ETFs to watch

- The iShares Core S&P 500 ETF tracks the S&P 500 index, which measures the performance of large-cap US stocks

- The Vanguard Total International Stock ETF, which invests in global stocks, excluding US, listed on the FTSE Global All Cap Index

- The iShares Core MSCI Total International Stock ETF tracks the results of large-, mid- and small-cap non-US equities

- The Vanguard FTSE 100 UCTIS ETF tracks the performance of the FTSE 100 stock index, which is comprised of the UK’s top 100 companies by market capitalisation

- The Global X Cannabis ETF tracks the cannabis index, which provides exposure to companies that are active in the cannabis industry

- The WisdomTree WTI Crude Oil gives indirect exposure to crude oil prices by tracking the Bloomberg crude oil subindex

- The iShares US Energy ETF tracks the results of the Dow Jones US oil and gas index, which measures the performance of companies in the US oil and gas sector

How to pick the right ETF for you

With so many ETFs to choose from, it’s important that you pick the right ETF for you and your trading goals. There are three main things to consider when choosing your ETF:

The type of ETF

There are so many different ETFs available, not just in terms of the underlying assets you can track – stocks, currencies, commodities and so on – but whether your exposure is long or short, and leveraged or non-leveraged.

Take a look at the different types of ETF below.

The ETF’s size

Assets under management (AUM) is the total value of investments held within an ETF. Larger funds often have better liquidity than smaller ones, which means they have lower spreads – saving you money in the long run as you can open your position for less.

The structure of ETFs

There are two main types of ETF available. Physical ETFs, which use assets to track the underlying market, and synthetic ETFs which use derivatives. Both have advantages and limitations which you should consider before taking a position.

For example, physical replication makes it easier to see what you are invested in and is generally considered less risky than synthetic replication. However, there are some markets where physical replication is impossible or hugely inefficient. In which cases, synthetic replication provides exposure to markets that would be otherwise unavailable.

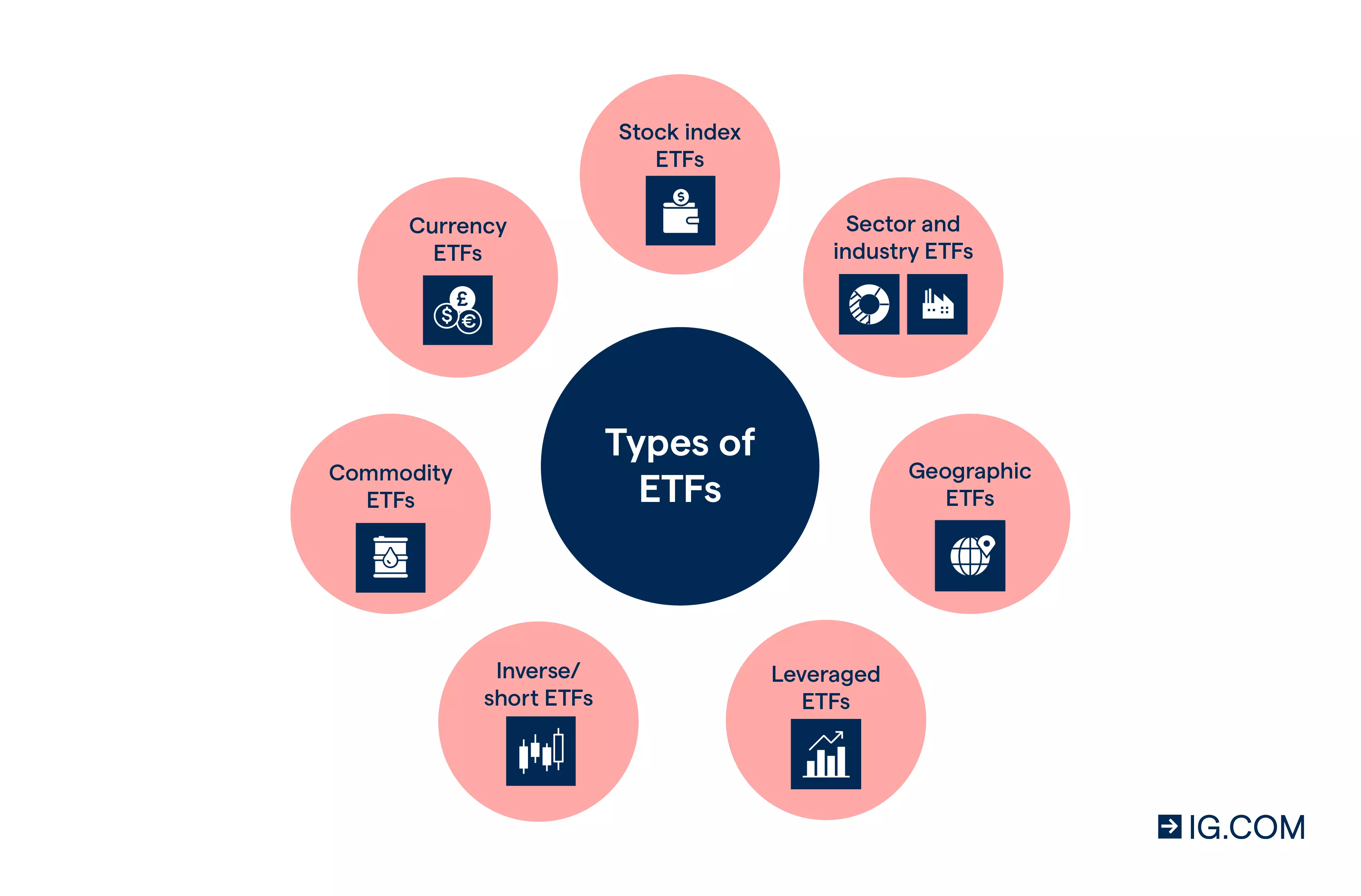

Types of ETFs

Stock index ETFs

Stock index ETFs are funds that track the performance of a given index. As stock indices are nothing more than a number representing a group of shares, traders and investors have to find ways to trade on their price.

ETFs enable you to gain exposure to an entire index from a single position. For example, an ASX 200 ETF would track the performance of the ASX 200 (known as the Australia 200 on our platform), and would either hold physical shares of the index’s constituents, or products that mimic its price movements.

Currency ETFs

Currency ETFs enable you to gain exposure to the forex market, without having to buy or sell the underlying currencies. In some cases, these ETFs will only track a single currency, but for the most part they track baskets of currencies.

You can use currency ETF to trade the economic health of regions – such as the EU – or emerging market economies. They can also be used as hedge against inflation and foreign asset risk.

Sector and industry ETFs

A sector or industry ETF tracks an index of companies operating within the same industry. For example, the AI and robotics sector has the Robo-Stox Global Robotics & Automation Index ETF, which tracks stocks related to autonomous transportation, robotics and automation, and more.

Like currency ETFs, sector ETFs can be used to take advantage of changes in an economy’s health and as a hedge against any existing positions. If you have significant risk in a particular sector, you might choose to mitigate this risk by shorting a sector ETF.

Commodity ETFs

Commodity ETFs usually take their price from futures contracts, rather than containing the physical commodity.

It’s important to note that there is a difference between commodity ETFs and commodity-linked ETFs, such as the sector ETFs described above. Commodity ETFs emulate the price of the underlying commodity, whereas commodity-linked assets track companies within the industry.

Geographic ETFs

Geographic ETFs enable you to track assets in a specific region. For example, you can buy a US ETF that grants you exposure across all the US indices, a North American ETF that includes Canadian companies, or an international ETF if you’re looking to diversify your portfolio.

Inverse or short ETFs

Inverse ETFs move in the opposite direction to the underlying asset. They can be found in any of the above categories of ETF.

You’d use an inverse ETF as a means of opening short positions on the market. They can be useful hedges for existing long positions, or as a way of speculating on falling markets.

Leveraged ETFs

Leveraged ETFs are designed to mirror an underlying asset but use financial derivatives to amplify investors’ exposure. For example, a leveraged 2x ETF would maintain a $2 exposure to the underlying asset for every $1 of investor capital. When using a leveraged instrument, losses can also be magnified. This is because losses (and profits) are calculated based on the full $ exposure, so losses or profits can far outweigh your initial capital.

How to take a position on ETFs

Buying an ETF

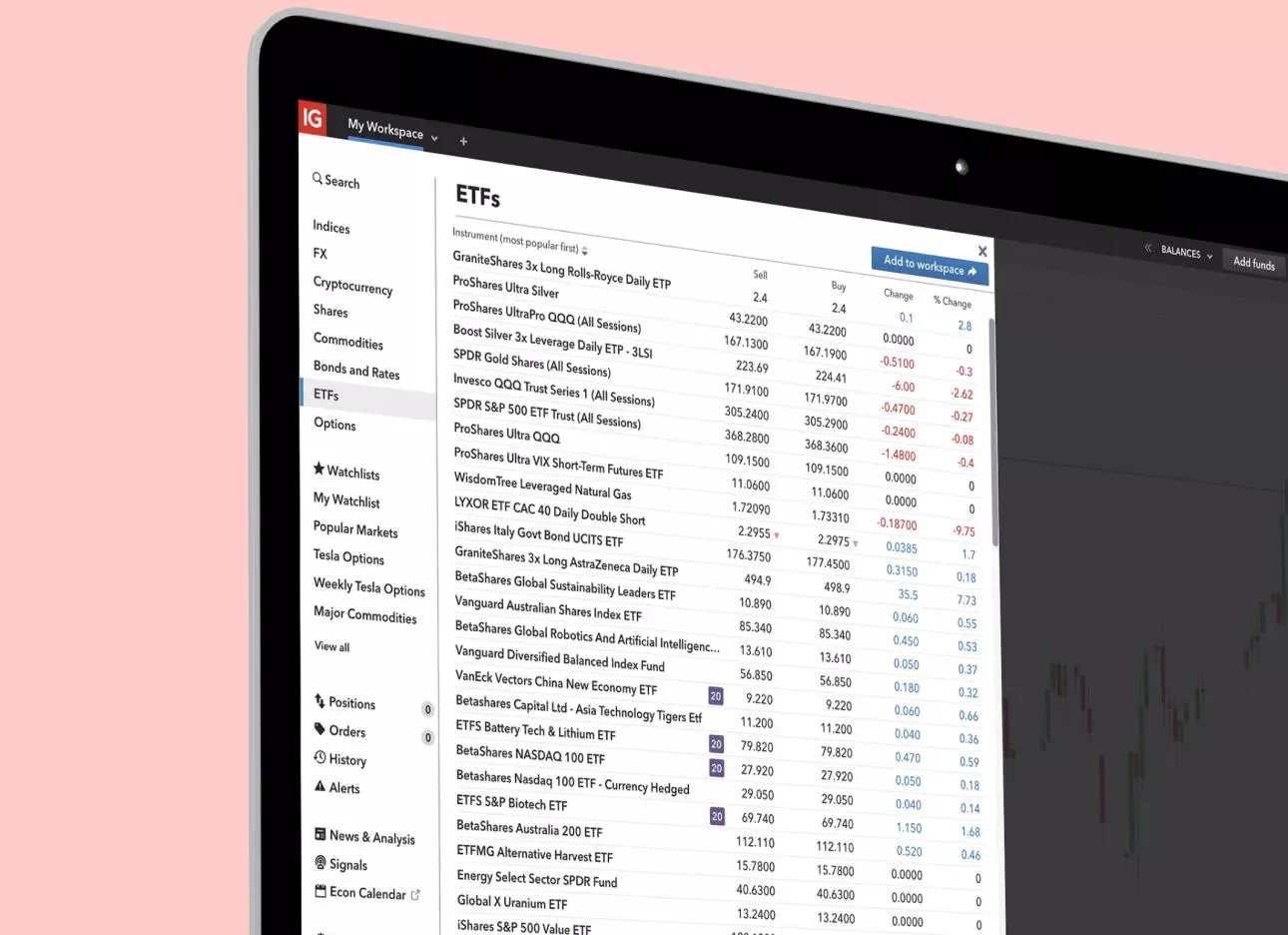

ETFs can offer broad market exposure from just a single position. You can buy and sell ETFs on sectors, indices, bonds, commodities and more by ETFs can offer broad market exposure from just a single position. You can buy and sell ETFs on sectors, indices, bonds, commodities and more by opening a share trading account with us.

We have over 3480 global ETFs to choose from, and you can keep your costs down with commission from zero on International ETFs when you trade with instant conversion (0.7% FX fee applies).1 If Australian-listed, there is a standard rate of A$5 per trade or 0.05% for trades above A$10,000.

First, you would need to decide what proportion of your capital you want to invest in each different asset class or region. Then you can choose whether you want to take a passive approach or use an actively managed fund.

Research has shown that it is difficult to find a fund manager who consistently beats the market after fees,2 which is why ETFs have become a common way of accessing a higher rate of return.

ETFs are low cost and share the best qualities of both closed and open-ended funds.

Trading an ETF with derivatives

Trading ETFs is a great way to get exposure to shorter-term price movements within certain sectors. When you trade ETFs with CFDs, you can use leverage to get amplified exposure to the ETF of your choice.

As a result, CFDs enable you to open a position for just a fraction of the cost of traditional investing. This means that, while leverage can magnify your profits, it can also magnify your losses. This is because loss is calculated based on the full size of the position rather than the cost of opening that position and can far outweigh any initial deposit, so it is important to create a risk management strategy before you trade.

Learn everything you need to know about trading and investing in ETFs

FAQs

Are ETFs a good investment?

ETFs are a good investment tool for building your portfolio. As well as generally being cheaper than actively managed funds, they share similar features to closed-end funds (those sold to investors by investment companies) as they can be traded throughout the day.

They also share similarities with open-ended funds (open-ended investment companies and unit trusts) as they are scalable – this means the price of an ETF is kept in line with its net asset value (NAV).

How does an ETF work?

ETFs work in much the same way as stocks. A fund manager will design an ETF to track the performance of an asset or group of assets, and then sell shares in that fund to investors.

These investors then own a portion of an ETF, but do not have any rights to the underlying assets in the fund. Instead, ETFs track the value of the underlying, and provide investors with near-identical returns.

What is the difference between ETFs and shares?

A share is a portion of a company that can be bought or sold after it has listed on a stock exchange via an initial public offering (IPO). When you own a stock, you own a portion of that company – this means you could receive dividends if they are paid and will gain voting rights.

ETFs are traded in a similar way to stocks, but they track an underlying asset or basket of assets. They can track a range of markets, including company stocks, indices and commodities, but would not entitle the holder to own those underlying assets.

Discover IPO trading and the upcoming IPOs to watch.

How is an ETF price determined?

An ETF’s price is determined by the value of the fund’s underlying assets, known as the net asset value (NAV), and not by the fund’s market price. NAV is calculated as the ETF asset value minus the ETF liability value, divided by the number of shares in circulation. So, if just one of these values change, the NAV will also change. This is why supply and demand for an asset or market, for example the FSTE 100, can also play a part in pricing.

The percentage change in the ETFs price is what matters, not the actual price. So, whether you buy 100, 60 or 15 shares of a FTSE 100 ETF for $1,000 – if the value of the ETF goes up 10%, the value of your investment will be worth $1,100.

How do ETFs make money?

There are two parts to this question: how traders or investors make money from ETFs, and how ETF providers make money. Traders and investors can make money from an ETF by selling it at a higher price than what they bought it for. Investors could also receive dividends if they own an ETF that tracks dividend stocks.

ETF providers make money mainly from the expense ratio of the funds they manage, as well as through transaction costs. An expense ratio is the amount you pay to hold an ETF – it normally comes out of the funds performance and is not charged to traders and investors separately.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

You might be interested in…

Start trading over 140+ US markets with our exclusive out of hours offering

Discover upcoming IPOs and how to trade grey markets with us

Discover how to buy and trade shares with us

1 Note for multi-currency accounts: These figures apply to clients who opt for the default setting of 'instant currency conversion'. Clients who choose to convert currencies manually will pay commission of 2 cents per share with a minimum charge of $10 on US stocks and, for European markets, we charge £10 / €10 per trade or 0.1%, whichever is higher.

2 S&P Global, 2017.