How to trade shares

Discover how to trade or invest in shares with our market-leading offering – and take your position today.

Written by Anzél Killian, Senior Financial Writer. Reviewed by Axel Rudolph, Senior Market Analyst

If you’re ready to open a position on a share, here are three steps to follow:

1. Decide whether to trade or invest

Trading lets you speculate with derivatives; investing lets you take direct ownership of the shares.

2. Select your opportunity

Choose from an offering of over 15,000 international shares and ETFs.

3. Take your position

Create an account with us to open your share trade or investment.

For more info about how to trade or invest in shares, you can discover everything you need to know in this guide.

How to trade or invest in stocks in the UK

- Find out what shares are

- Learn why people invest in or trade shares in the UK

- Choose how you want to buy stocks: investing or trading

- Understand the risks and charges

- Open a UK share trading account

- Discover what moves the price of shares

- Pick a stock or ETF

- Choose your timeframe and open your position

You can choose to invest in the shares directly, or you can speculate on the price of shares rising or falling with derivatives like spread bets and CFDs. Both of these have their own unique pros and cons, which we explain later in this guide.

Learn why people invest in or trade shares in the UK

People invest in or trade shares because, just like other financial markets, they can be an opportunity to make money. At a basic level, you can take a position on shares to get exposure to economic growth – and if the health of an economy grows, you might find that companies that are based in that economy also grow.

Company growth is correlated with share price increases, which is what people are hoping for when they buy or invest in shares. Over the past 100 years, UK stocks have generated average returns of around 5% a year over and above inflation, meaning that the real value of an investment would have doubled around every 14 and a half years.

Generally speaking, investors will buy shares to:

- Make a profit from share prices rising

- Receive an income from dividends if the company pays them

- Benefit from the effects of compounding

This last point requires that a share investment be held for a long period of time, and it’s why you’ll sometimes hear the phrase ‘time in the markets is better than timing the markets’ when talking about share investments.

As an example, we can see from the graphic below that the maximum and the minimum annualised returns on the FTSE 100 consolidated around the average returns over time – smoothing out the market volatility to settle at just below 10% per year.

Learn more about investing in shares with our complete guide

Traders on the other hand, might be seeking to capitalise on short-term share price gains. Rather than investing in the shares, traders speculate on the share’s value. They can speculate on it rising by going long, as well as falling by going short.

This is made possible by trading with derivatives like spread bets and CFDs. That said, there’s no reason why you couldn’t invest in shares over the short-term – you'd just miss out on certain tax benefits that would otherwise be available to you through spread bets and CFDs.

Leverage is available when you use these products, which gives you full market exposure for an initial deposit – known as margin – to open your position. But, bear in mind that leverage can increase both your profits and your losses as they’ll be based on the full exposure of the trade, not just the margin requirement needed to open it. This means that losses as well as profits could far exceed your margin.

Choose how you want to buy stocks: investing or trading

Investing and trading are similar terms that some people will sometimes use interchangeably – but there are important differences for you to be aware of. We’ll go through what each of these terms means in this section.

Investing in stocks

Investing in stocks means that you’re taking direct ownership of a company’s shares. This will make you a shareholder, making you eligible to receive voting rights and dividend payments if the company grants them. Investing is how most people will get exposure to shares.

With us, you’ll be able to invest in companies for zero commission for US and UK shares*

To invest in a company, you’ll need to commit the full value of the shares upfront because leverage isn’t available. This is why some people will refer to share investments as non-leveraged; or a collection of share investments as a non-leveraged portfolio. Find out more about how to buy shares.

While this means that you might need more initial capital to get started when compared to trading, your losses are capped at this initial outlay. That said, you should be aware that you might receive back less than you initially invested.

When you create a share dealing account with us, you’ll be able to:

- Invest in over 11,000 individual companies from around the world

- Invest in an ETF or fund to give you exposure to a basket of different shares from an entire country, index or sector

- Invest in one of our Smart Portfolios – professionally managed ETF portfolios that our in-house experts build and monitor for you

Trading stocks

Trading stocks means that you’re speculating on a share’s price movements with derivatives like spread bets and CFDs – without taking direct ownership. Spread bets and CFDs are leveraged products, which means that you won’t need to commit the full value of the position. But, bear in mind that leverage can increase both your profits and your losses.

With spread bets and CFDs, you can ‘buy’ (go long) the shares if you think the stock’s price will rise, or you can ‘sell’ (go short) if you think the stock’s price will fall. Shorting with derivatives can be an effective way to hedge against downward price movements in your non-leveraged investment portfolio, or it can be a way to generate profits outright from shares that are falling in value.

But, when you go short your potential losses are theoretically uncapped because there’s no limit on how high something’s price can rise. Learn more about how to spread bet on shares or how to trade share CFDs.

When you create a trading account with us, you’ll be able to:

- ‘Buy’ (go long) or ‘sell’ (go short) 12,000 international shares to speculate on their price rising or falling

- Take a position on our range of ETFs to get exposure to a basket of shares from an entire country, index or sector that could be rising or falling in price

- Trade a host of global indices – including the FTSE 100, the Dow Jones Industrial Average (Wall Street) and the DAX (Germany 40) – to go long or short on the performance of an entire economy with a single trade

Understand the risks and charges

The risks and charges vary depending on whether you trade or invest. Trading can be seen as more risky than investing, mainly due to the use of leverage. But, investing also carries risk – and there’s no guarantee that your investments will increase in value, so you could receive back less than you initially invested.

Before trading or investing in shares, you should take steps to manage your risk. We’ve got courses at IG Academy that take you through risk management and how to mitigate your exposure to risk in the financial markets.

Investing costs

Our costs and charges for investing vary depending on how you’d like to take a position.

- Investing in shares

- Investing in ETFs

- Investing in a Smart Portfolio

| About | Risk and reward | Costs | With us |

Investing in an individual company’s shares. You might do this to benefit from long-term upward price movements, or to receive dividends and compound returns. |

Investing in shares carries its own risk because you’re betting on one company rather than diversifying your exposure through an ETF or other fund.2 |

Buy US and UK shares at zero commission*. Leverage isn’t available for share dealing, so you’ll have to pay the full value of shares upfront. |

You’ll be able to invest in over 12,000 shares, funds and investment trusts. Create a share dealing account |

| About | Risk and reward | Costs | With us |

Investing in an ETF that tracks a group of companies.

You might do this to benefit from the overall growth of an index or sector. |

Investing in an ETF is enables you to diversify your exposure across a range of different assets and companies.2 |

Keep your costs low with commission from only £3 per ETF position and a currency conversion fee of just 0.5%. |

You’ll be able to invest in a range of leading ETFs to get exposure to different sectors, assets or industries with a single position.

|

| About | Risk and reward | Costs | With us |

Investing in a portfolio of ETFs that is built, managed and monitored for you by our in-house experts.

You might do this to get access to a diversified portfolio of different ETFs. |

Investing in our Smart Portfolios gives you exposure to many different sectors with a single position.2 |

The total annual cost of owning an IG Smart Portfolio is around 0.71%, and even less if your portfolio exceeds £50,000 – at which point it will be managed free of charge.

|

You’ll be able to invest in our expertly managed Smart Portfolios and ISAs.

Create a Smart Portfolio account

|

Trading costs

Our costs and charges for trading vary depending on the product that you use to take a position.

- Trading shares

- Trading ETFs

- Trading indices

| About | Risk and reward | Costs | With us |

Speculating on the price movements of individual shares.

You can go long or short with leveraged derivatives like spread bets and CFDs. |

Your risks when trading are higher than share dealing due to the use of leverage – which can increase your losses as well as your profits.

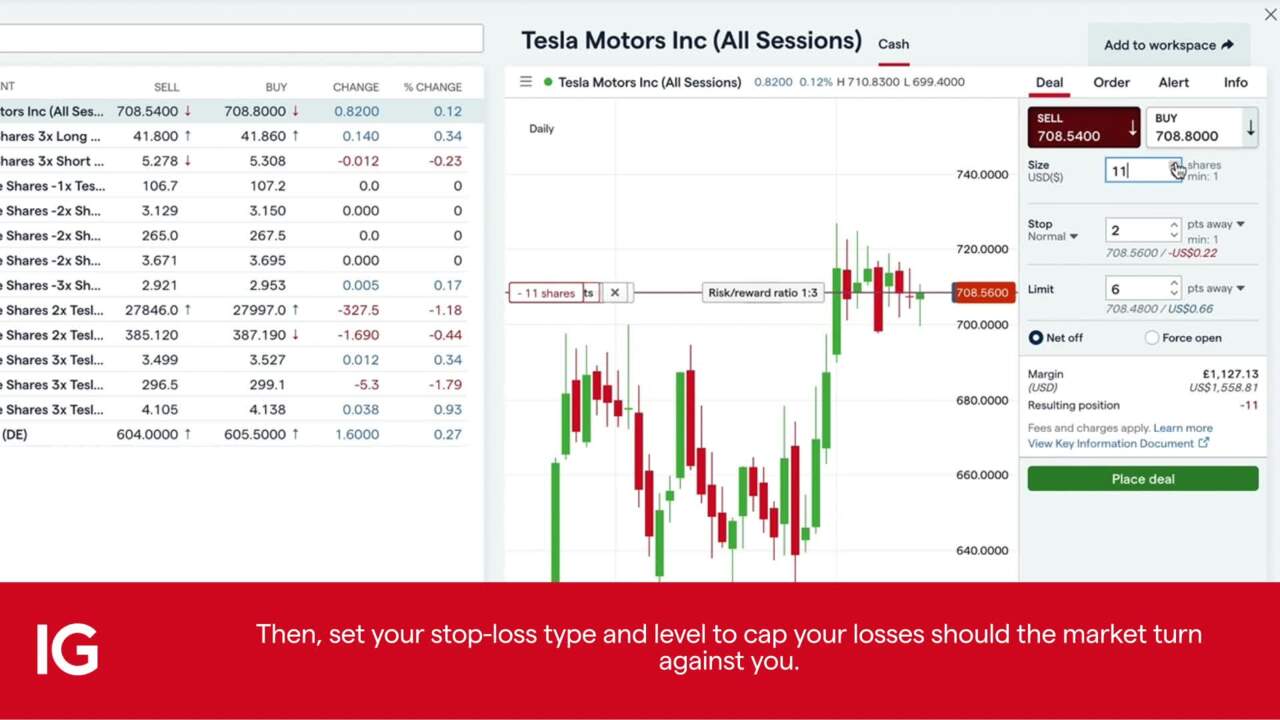

Attaching stops to your positions can help to mitigate your exposure to risk. |

Spread bets have minimum spread charges of 0.10% with us.

CFDs have a minimum 0.10% commission fee when you open and close a position.

Spot trading has overnight fees, while forwards do not. |

You’ll be able to trade over 12,000 international shares with spread bets and CFDs.

|

| About | Risk and reward | Costs | With us |

Speculating on the price movements of an ETF.

You can go long or short with leveraged derivatives like spread bets and CFDs. |

Your risks when trading are higher than share dealing due to the use of leverage – which can increase your losses as well as your profits.

Attaching stops to your positions can help to mitigate your exposure to risk. |

Spread bets have minimum spread charges of 0.10% with us.

CFDs have a minimum 0.10% commission fee when you open and close a position.

Spot trading has overnight fees, while forwards do not. |

You’ll be able to trade over 6000 ETFs including different indices, sectors, currencies and commodities with spread bets and CFDs.

|

| About | Risk and reward | Costs | With us |

Speculating on the price movements of an index – which is a collection of many different companies’ shares, giving you exposure to an entire sector or economy at once.

You can go long or short with leveraged derivatives like spread bets and CFDs. |

Your risks when trading are higher than share dealing due to the use of leverage – which can increase your losses as well as your profits.

Attaching stops to your positions can help to mitigate your exposure to risk. |

Spread betting and CFD spreads start from 1 on the FTSE 100, 1.2 on the Germany 40 and 2.4 on Wall Street. |

You’ll be able to trade a range of global indices like the Dow Jones Industrial Average (Wall Street), the FTSE 100, and the DAX (Germany 40) with spread bets and CFDs.

|

Open a UK share trading account

We’ve got a truly market-leading shares offering for traders and investors alike – with over 15,000 international shares and ETFs, a host of global indices, and portfolios that are managed by our in-house experts.

With us, you’ll also benefit from our out-of-hours All Session stocks offering. This lets you take a position on over 70 leading US shares when you otherwise wouldn’t be able to.

So, if you want to take a position on shares, you’ve come to the right place. We invented spread betting in 1974, and today we offer spread bets, CFDs and share dealing to retail traders who are looking to seize their next opportunity.

Discover what moves the price of shares

Before it goes public through an IPO, a company’s shares will have a set price range – often determined by the underwriter of the IPO (normally a large bank). This range will be set according to the anticipated interest in the listing, as well as the company’s fundamentals – including its revenues, its products, and its existing popularity.

Once the IPO has completed, fluctuations in the share price are caused by changes in the supply of and demand for the stock. If supply is higher than demand, the share price could fall; if demand is higher than supply, the share price could rise.

In the long-term, there are a range of reasons that the demand for a share can fluctuate over time. These reasons include:

- Earnings reports: companies usually release interim reports on their financial performance once every quarter and a full report once a year. These reports can influence a company’s share price as traders and investors use figures including revenue, profit, and earnings per share (EPS) as part of their fundamental analysis

- Macroeconomic data: the state of the economy a company operates in will affect its growth. Data releases such as gross domestic product (GDP) and retail sales can have a significant influence on company share prices – strong data can cause them to rise, while weak data can cause them to fall

- Market sentiment: share price movements aren’t always based on fundamental analysis. The view that the public, as well as market participants, have on a particular stock can cause demand to fluctuate. This is how some speculative bubbles are formed

- Interest rates: if interest rates are low, the stock market might see increased activity – despite the previous factors mentioned here. That’s because more people could turn to stocks and shares to achieve greater returns than they might otherwise be able to if they saved their money in a bank account

Pick a stock or ETF

We’ve got over 15,000+ international stocks and ETFs for you to choose from – as well as our own Smart Portfolios, which are managed by our in-house professionals. If you’re looking for inspiration for a stock to take a position on, consider using our stocks screener tool.

When you’re choosing a stock, it’s important that you carry out your own due diligence on a company. You should use both fundamental and technical analysis when assessing a company’s financials and potential future share price performance.

- Technical analysis is concerned with chart patterns, technical indicators and historical price action

- Fundamental analysis is based on a company’s financial metrics, including its net revenue, earnings calls, or profit and loss statements

Choose your timeframe and open your position

Timeframes are important considerations when you’re deciding how to take a position on stocks. Here are the differences between investing and trading:

- Trading tends to focus on the on the short- to medium-term, with traders taking positions over a number of hours, days or weeks – although it can be longer in some cases

- Investing focuses on the long-term, with investors buying and holding stocks for a number of weeks, months or years

The different timeframes that traders and investors favour are a result of the inherent nature of trading or investing.

When you trade with spread bets and CFDs at spot prices (‘cash’ in our platform), you’ll find that the spreads are tighter, but you’ll incur overnight funding charges. We also offer trading on futures or forwards for shares, ETFs and indices. With futures or forwards prices, you’ll find that the spreads are wider, but you won’t incur overnight funding charges.3

Investing doesn’t have any overnight funding charges, because you’re taking direct ownership of the shares – making them yours to hold for as long as you want. That’s why investing is favoured by people looking to spend time in the market, and trading is favoured by people who’re looking to attempt to time the market. But, that’s not always the case – and some people might choose to invest over the short-term, while others might choose to trade over the long-term.

How to make a shares investment

Investing in shares means you’ll be taking direct ownership – becoming a shareholder in the process, eligible to receive dividends and voting rights if the company grants them. You’ll profit if the share price rises above the price at which you initially invested.

To invest in shares, follow these steps:

- Create or log in to your share dealing account

- Familiarise yourself with our offering, including shares, ETFs and Smart Portfolios

- Select your opportunity

- Determine the size of your investment and order type

- Open and monitor your position

How to make a shares trade

Trading shares means you’ll be speculating on prices rising or falling with derivatives like spread bets and CFDs. You can do this from within our award-winning trading platform4 – which has in-built charting tools, technical indicators and in-platform news and analysis from our expert team.

To trade shares, follow these steps:

- Create an account or log in

- Decide whether you want to trade spread bets or CFDs

- Pick a company from within our trading platform

- Assess whether you want to go long or short and take steps to manage your risk

- Open and monitor your position

Stock market trading: the other things to know

Here are some other things to know about stock market trading, before you get started.

How does the stock market work?

The stock market works by facilitating the buying and selling of different companies’ shares between institutional and retail investors. Companies are in control of the number of shares that they’d like to be released – and the level of interest that a company’s shares draws in has a large impact on the share price.

How and why do companies go public?

The ‘traditional’ way to go public is through an IPO, in which an underwriter will sponsor a company’s public listing, setting a target share price. In this IPO process, a company’s financials will be heavily scrutinised before the listing, which helps to eliminate certain risks for institutional and retail investors because they’re able to make a more-informed decision.

Other ways that companies can go public include direct listings and SPACs. Direct listings enable a company to go public directly through a stock exchange. The company’s current employees and stakeholders will be able to convert their equity in the company into tradeable shares, which can then be issued through a stock exchange to the general public.

SPACs (special purpose acquisition companies) – sometimes known as reverse takeovers – are a more unorthodox way to go public, but there have been some high-profile examples in recent years. In basic terms, a SPAC is a shell company that’s set up with the sole purpose of carrying out an IPO, and then merging with a private company – taking the private company public in the process. Virgin Galactic is perhaps the most well-known company to have gone public through a SPAC.

As for why companies go public, there are several reasons. Most importantly – it’s a way to raise capital, which can help to fund expansion and further growth. Going public also carries a certain amount of prestige, especially if the company becomes a ‘blue chip’ – generally seen as the most stable companies in their sector.

Stability brings increased shareholder confidence, which will help to increase the company’s share price and subsequent market capitalisation. Eventually, a publicly listed company may start to look at acquiring other companies in its sector, and this can help to boost its own talent base – facilitating still further expansion.

How to choose between trading and investing in shares

Choosing between trading and investing is a decision for you as an individual – depending on your unique style and what you’re looking to get out of the markets. If it’s the possibility of slow and steady returns with lower risk, then investing might be preferable. If it’s the possibility of quick gains with higher risk, then you might prefer trading.

How do I find a share opportunity?

Every trader or investor will have a different preference for the share opportunities they choose. For example, some people prefer the low risk and potentially high reward opportunities that blue-chip stocks bring, or the additional income and compound returns of dividend stocks. Others might prefer the volatility of penny stocks.

You should carry out analysis – both technical and fundamental – when you’re trying to find a company to take a position on.

How to trade or invest in stocks out of hours

We’ve got a market-leading out-of-hours trading offering. You’ll be able to speculate on the price movements of over 70 key US shares when you might not otherwise be able to. Volatility doesn’t wait for the main market session – so we’ve made it so you can trade the pre-market open and post-market close.

How to trade shares with DMA and data from L2 Dealer

DMA is direct market access, and it’s available with CFD trading or share dealing. DMA lets you open a position directly through the order book of an exchange, giving you deep liquidity, full market visibility and advanced execution.

Our DMA platform is called L2 Dealer, and it enables you to trade share and forex CFDs, or invest in shares directly, with DMA. You’ll get access to Level 1 and Level 2 pricing data. Level 1 data will give you the pricing direct from an exchange, while Level 2 will also show the exchange’s order book.

What is liquidity and why does it matter in share trading?

Liquidity determines how easily something can be bought and sold. High liquidity makes it easier to quickly buy or sell, low liquidity makes buying and selling quickly more difficult. In share trading, you might want to pick shares with high liquidity if you’re planning on opening and closing a lot of positions in a short period of time.

In a market with high liquidity, you might find that bid-ask spreads are tighter – which would help to bring your total costs down when trading. On the other hand, in a market with low liquidity, spreads could widen and increase the cost of your trade.

What is execution and why does it matter when trading stocks?

Execution is the ease with which your trades are placed and filled. Our execution has been built to ensure that your trades are filled how you want, when you want – every time.

What is compound interest?

Compound interest is the interest that you earn on your interest. When investing, compounding lets you generate returns from reinvested earnings – things like dividends. To take advantage of compound interest, an investor must reinvest any interest earnings from their investments – which increases their total investment pot – and they must leave this pot to earn further returns over time.

As an example of compound interest, let’s say you save or invest £1000 and you achieve a return of 5% a year. In year one, your £1000 earns £50. You keep that in your savings or investment pot. In year two, your pot of £1050 earns £52.50.

Again, you leave the interest in your pot. In year three, your pot is now £1102.50 and it earns an interest of £55.13. By the end of year five, your pot is worth £1276.29 and you have earned £276.29 in interest.

By leaving the interest payments on investment earnings in your pot, it is generating more interest itself. Over time, this effect can be amplified because you’ll be reinvesting more earnings from your interest into your total investment pot.

Free share trading and investing tools and resources

Before you start trading or investing in shares, you should consider using the educational resources we offer like IG Academy or a demo trading account. IG Academy has lots of courses for you to choose from, and they all tackle a different financial concept or process – like the basics of analyses – to help you to become a better trader or make better-informed investment decisions.

Our demo account is a great place for you to learn more about leveraged trading, and you’ll be able to get an intimate understanding of how spread bets or CFDs work – as well as what it’s like to trade with leverage – before risking real capital. For this reason, a demo account with us is a great tool for investors who are looking to make a transition to leveraged trading.

Try these next

Start trading over 70 US markets out of hours with IG

Take a position on over 15,000+ shares and ETFs with IG

Learn how to make the most of IPOs and grey markets with IG

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 As with any investment, you could get back less than you invested.

3 Share and ETF forwards are not available on a CFD trading account.

4 Awarded ‘UK’s best trading platform’ at the ADVFN International Financial Awards 2020 and Professional Trader Awards 2019.

*Other fees may apply