How to manage your trading risk

Spread betting and CFD trading both come with a unique set of risks. That’s why we’ve compiled a guide with risk management tips, tools and techniques. Find out how to manage your trading risk when using leveraged derivatives, and access our free educational resources.

How can I manage my risk when trading?

Choose your trades’ exit points

Manage unfavourable market movements by using stop-losses and guaranteed stops1

Execute trades at favourable levels

Set limit orders to automatically buy or sell when the market level is more favourable

Use our online learning portal

Become better at combating risk by using free educational materials, like IG Academy

Stay on top of market movements

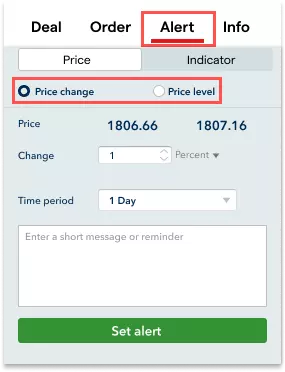

Set alerts and we’ll notify you when a market reaches your specified level

Know your profit and loss

Get a balance snapshot on our platform to easily view your gains and losses

Get negative balance protection

Never go below zero with FCA-regulated negative balance protection2

What is meant by ‘risk’ in trading?

In trading, ‘risk’ refers to the possibility of your choices not resulting in the outcome that you expected. Trading risk comes in a range of forms. The most prominent risks you’ll face when trading spread bets and CFDs are:

- Market risk: the general risk that your trades might not perform as you thought it would, due to unfavourable price movements. The market can be affected by a range of external factors like recessions, political unrest, etc.

- Impact of leverage: trading on leverage – ie using margin – amplifies profits and losses, as your risk isn’t limited to your initial outlay. Your gains and losses will be based on the full trade value, and you could lose more than your deposit

- Lack of knowledge: failure to study the markets and doing thorough analysis can be detrimental. You should learn as much as you can about trading and the asset you’re looking to buy or sell before opening any positions

- Emotional trading: it’s not always easy to control your emotions when trading. Impulsivity, fear and greed – to name a few – can take over, and you might end up making poor trading decisions

What are the risks of trading?

There are various risks involved in trading, and different reasons to why they might happen. The most important thing to remember is that you should take steps to mitigate these risks.

The risk |

Why it happens |

Ways we help |

| Losing more than your deposit on a trade | Spread bets and CFDs are leveraged, so you only need to put up a fraction of your position’s value to open it but your profit or loss could be much more than your initial deposit | You can set an automatic stop or limit, to define the level you'd like your trade executed at |

| Having your positions closed unexpectedly | You need a certain amount of money in your account to keep your trades open. This is called margin, and if your account balance doesn’t cover our margin requirements, we may close your positions | Keep an eye on your always-visible running balances in our platform or app, and add more funds if they’re needed |

| Losing more than the money in your account | Sometimes your positions may be closed out automatically, leaving you with a negative account balance | UK regulation safeguards you with negative balance protection, and we bring negative accounts back to zero at no cost to you.1 |

| Sudden or larger-than-expected losses | Markets can be volatile, moving very quickly and unexpectedly in reaction to announcements, events or trader behaviour. This could have significant bearing on your open positions | As well as setting stops, you can also be notified of significant movement by setting a price or distance alert, giving you the choice of whether or not to react |

| Having an order filled at a different level to the one you requested | When a market moves a long way in an instant – or ‘gaps’ – any orders you have placed may be filled at a worse (or better) level than the one you requested. This is called slippage | Use guaranteed stops for protection against slippage on orders to close. They're free to place, with a small premium payable only if your stop is triggered |

Trader’s Guide

- We reveal the top potential pitfall and how to avoid it

- Learn from data gleaned from over 100,000 IG accounts

- Discover how to stick to your plan and increase chances of success

Protect yourself with our risk management tools

We have a range of risk management tools available. Plus, you’re protected by law through negative balance protection.2

- Stop-losses

- Guaranteed stops

- Limit orders

- Negative balance protection

- Built-in risk protection

- Price alerts

Set a stop-loss to close your position automatically if the market moves against you.

There’s no trigger charge, but no guarantee of protection against slippage – so your position could be closed out at a worse level if the market gaps.

Attach a guaranteed stop to your position, and it’ll always be closed out at exactly the price you specified.

You’ll only pay for your stop if it’s triggered. If this happens, our guaranteed stop premiums still offer the best value in the market for most major indices and FX pairs.1

Set a limit order and we’ll execute your trade at a predetermined level that is more favourable to you than the current market price.

You can set a limit entry order to open a new position or a limit closing order to terminate an existing position.

Your account will never go below zero – even if the market gaps – thanks to negative balance protection.2

This is not a product of ours – it’s your right as a trader. Because we’re FCA-regulated, we have to apply negative balance protection to all retail clients’ accounts.

To help protect you from excessive losses, we’ll sometimes close your positions if you’re on margin call.

However, we can’t always apply this protection and it’s sensible to maintain adequate funds in your trading account to avoid potentially being closed out.

Get notified when your market moves by a certain percentage or amount in points with customisable price alerts.

You’ll get free email, SMS or push notification. Our award-winning app makes it even easier to react to these alerts.3

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

We help you choose the right leverage for your trades

We make it our priority to support you in making trading decisions that are right for you. One of the ways we do this is by helping you navigate the world of leverage.

We believe that allowing excessively high levels of leverage is not in your best interest. That’s why we work hard to limit our maximum leverage, to protect you from distorted win or loss probabilities on your trades. We also try to minimise transaction costs by keeping our charges and overnight funding fees at a very competitive level.

We help you to plan and manage your trading decisions

Before you open your first trading position, you’ll need to do a lot of research about financial markets and the different ways to get access to them. The good news is that our educational materials are here to help you grow as a trader and manage your risks.

Join IG Academy

Explore a range of free beginner, intermediate and expert courses

Get analyst insights

Read articles on trading strategy, economic news, and trade ideas

Watch free webinars

Watch live or pre-recorded webinars hosted by our experts

FAQs

How do I calculate risk when trading?

To calculate risk when trading, you can use two techniques: risk per trade and risk-reward ratio. Deciding how much to risk depends on your personal preference and circumstances.

Some traders would suggest not risking more than 1% of your capital per trade, while others go up to 10%. Keep in mind that, if you’re on a big losing streak, the amount you’re risking per trade will have a huge effect on your capital and the ability to claw back losses.

We explain the other technique – the risk-reward ratio – below.

What’s risk-reward ratio in trading?

The risk-reward ratio in trading is the money you’re risking compared to your possible gain. To calculate the ratio on a particular trade, take the capital you’re laying out (your risk) and compare it to the profit you could make (your reward).

For example, if the max loss on a position is £200 based on where you place stops and the max profit is £800 based on where you place limits, the risk-reward ratio is 1:4.

Many traders prefer a risk-reward ratio of 1:3 or higher (so, 1:3, 1:4, 1:5, etc.). However, the higher the ratio, the greater the chance that the market will hit your max loss before your max gain.

What’s leverage?

Leverage is a trading concept that enables you to open a position using a deposit (called margin), while getting exposure to the full value of the trade. Your profit and losses will also be based on the full position size – so they’ll be magnified when compared to your margin. This is why it’s extremely important to take steps to manage your risk when trading on leverage.

What is the difference between a stop order and a limit order?

A stop order is a tool that you can use if you want us to execute your trade at a particular price that is less favourable than the current market price. They’re the opposite of limit orders, which instruct us to execute your trade at a price that’s more favourable than the current price.

Learn more about stop orders and limit orders

Try these next

Learn how to create a plan that will help you achieve your trading goals.

There are a number of reasons why spread betting is so popular. We explain some of the benefits.

Protect your capital when trading on our range of powerful platforms and apps.

1 You’ll pay a small premium only if your guaranteed stop is triggered.

2 Negative balance protection is a regulatory requirement of all providers in the UK, which ensures you can never lose more than is in your account. Negative balance protection applies to trading-related debt only, and is not available to professional traders.

3 Best trading platform as awarded at the ADVFN International Financial Awards 2021and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2021.