Why use our trading alerts?

Know exactly when to expect economic events and what their outcomes are

Find out the second that your target level or price change is hit

Save time – we monitor the markets for you

React instantly to email, SMS or push notifications on the move

What are trading alerts?

Trading alerts are free, automatic and customisable notifications you’ll get whenever your specifications are triggered – when prices move, events happen and technical conditions change. So you can get on with your day, with us monitoring the markets for you, and take advantage of opportunity when it arises.

Types of trading alert

Price alerts

- Be notified when your market moves by a certain percentage or amount in points with price change alerts – you’ll only find these with us

- Know when your market hits support, resistance or breakout by creating price level alerts

- Get these free trade notifications immediately sent by email, SMS or push notification

- Use as part of your risk management strategy – price alerts keep your positions open, so you can decide when to take action

Economic event alerts

- Set alerts for macro events like central bank announcements, and see how the market reacts

- Receive macroeconomic figures as soon as they are released

- Set reminders to notify you 5-60 minutes before events

- Get alerts by push notification on your mobile, in the platform or by email

- Just tick the box next to your event in our economic calendar to set an alert

Technical indicator alerts

- Create buy and sell alerts using popular indicators: Moving Average, Exponential Moving Average, MACD, RSI, Standard Deviation, Stochastic, Bollinger Bands and Price (share CFDs only)

- Build and set indicator alerts quickly and easily through our free charts

- Get full control over your alert, combining up to four different indicators

Open an account to start setting alerts

*Demo accounts are only available for spread betting and CFD trading.

Open an account to start setting alerts

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account to start setting alerts

Open an account to start setting alerts

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

How to use trading alerts

- Create a trading account with us

- Log in and open the trading platform

- Find the ‘alert’ tab in your market’s deal ticket

- Choose between price and indicator alerts

- Enter your conditions

- Edit existing alerts from the left-hand flyout

- Or, set event alerts for straight from our economic calendar

- Manage your trade notifications in the ‘settings’ tab of My IG

What markets can I get trading alerts for?

Forex alerts

Set alerts on any currency pair we offer – including EUR/USD, GBP/USD and USD/JPY.

Stock alerts

Get share price movement alerts on any of the 11,000+ stocks available.

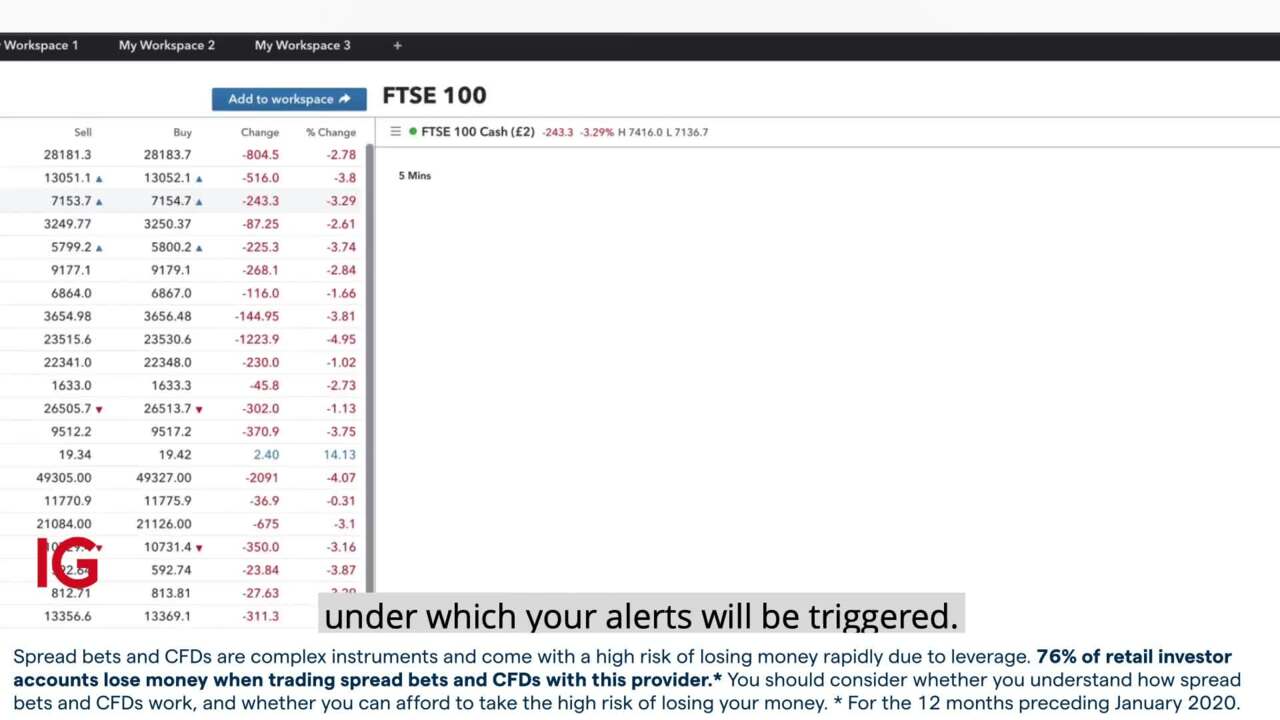

Index alerts

Keep an eye on global stock indices like hte FTSE 100 and Germany 40.

Commodity alerts

Know as soon as gold, silver, oil, or any other commodity we offer moves in the way you choose.

FAQs

You can get trading alerts for economic results, price movements – whether a level is hit, or a price changes by your chosen amount – and technical conditions.

You can receive trading alerts by SMS and push notification on your mobile, in the platform, or by email.

You’d set a trading alerts can be created to notify you of economic releases, price changes and when your technical conditions are met. Trading signals inform you of significant trends or patterns in the markets that could lead to a trading opportunity.

Try these next

Turn opportunities into trades on fast, intuitive technology.

Trade wherever you are, whenever you want with our award-winning apps.1

Advanced trader? Plug your own algorithms into our new web API or MT4.

1 Awarded ‘best finance app’ and ‘best multi-platform provider’ at the ADVFN International Financial Awards 2024.