Zero commission investing.

No commission.1 No account fees. Over 12,000 stocks and ETFs to explore.

Plus earn 3.75% AER variable on your uninvested cash.2

Accounts

Smarter investing starts here.

- ISA

- GIA

- JISA

- SIPP

For the tax-efficient investor that demands more.

No commission.1 No account fees.

Earn 3.75% AER variable on uninvested cash.2

Invest £20k tax-free a year.3

Free to open, with flexible withdrawals.

For the opportunity-driven investor growing their portfolio.

Over 12,000 stocks and ETFs.

Earn 3.75% AER variable on uninvested cash.2

No commission.1 No account fees.

For the forward-thinking investor building their child’s future.

Invest up to £9,000 a year, tax-free.3

No commission.1 No account fees.

Over 12,000 stocks and ETFs.

For the future-focussed investor building for retirement.

Up to 45% tax relief on up to £60,000 a year.3

Earn 3.75% AER variable on uninvested cash.2

Over 12,000 stocks and ETFs.

Join IG. Get rewarded.

Code: INTEREST7

Get 7%

AER Variable

on your uninvested cash.

Your capital is at risk. New customers only. Offer valid until 13/03/2026 on ISA, GIA or SIPP accounts. Cannot be used in conjunction with other offers. T&Cs apply.

Code: CASHBACK200

Get up to

£200

Invest at least £100 and earn 5% cashback on all your investments with IG.

Your capital is at risk. New customers only. Offer valid until 13/03/2026 on ISA, GIA or SIPP accounts. 5% Cashback on up to £4k invested. T&Cs apply.

Code: NEWJISA

Your child's future deserves a

£50 boost

Invest £50 in stocks or ETFs and the first 200 will get £250.

Your capital is at risk. New customers only. ISA tax benefits depend on personal circumstances. Offer valid until 05/04/2026 on JISA accounts. T&C's apply.

Code: TRANS3K

Get up to

£3,000

when you transfer your investments.

Your capital is at risk. New customers only. Offer valid until 05/04/2026 on ISA, GIA or SIPP accounts. Cannot be used in conjunction with other offers. T&Cs apply.

Fair pricing

Pay less to invest.

Keep more of what’s yours, with IG’s competitive costs. Find out how your current provider compares to IG here.

(tiered)

ISA cap: £42

SIPP cap: £120

Cap £45/yr shares

(tiered)

(tiered)

(tiered)

(tiered)

(tiered)

(tiered)

Figures correct as of 16/02/2026.

Transfer your ISA, GIA or SIPP to IG before 5 April 2026, and get up to £3,000.4

Invest your way

Over 12,000 ways to build your portfolio.

The world’s most important markets, covered. Invest in 12,000+ stocks and ETFs across the UK, US, Australia and Europe from £10. Plus, invest 24 hours a day on 600 of the US top stocks. Wherever the opportunity is, you’re already there with IG.

Starting out or want a hands-off approach? Let us do the heavy lifting. Explore our ready-made and smart portfolios.

How to invest with IG.

Getting started is straightforward:

- Open an account

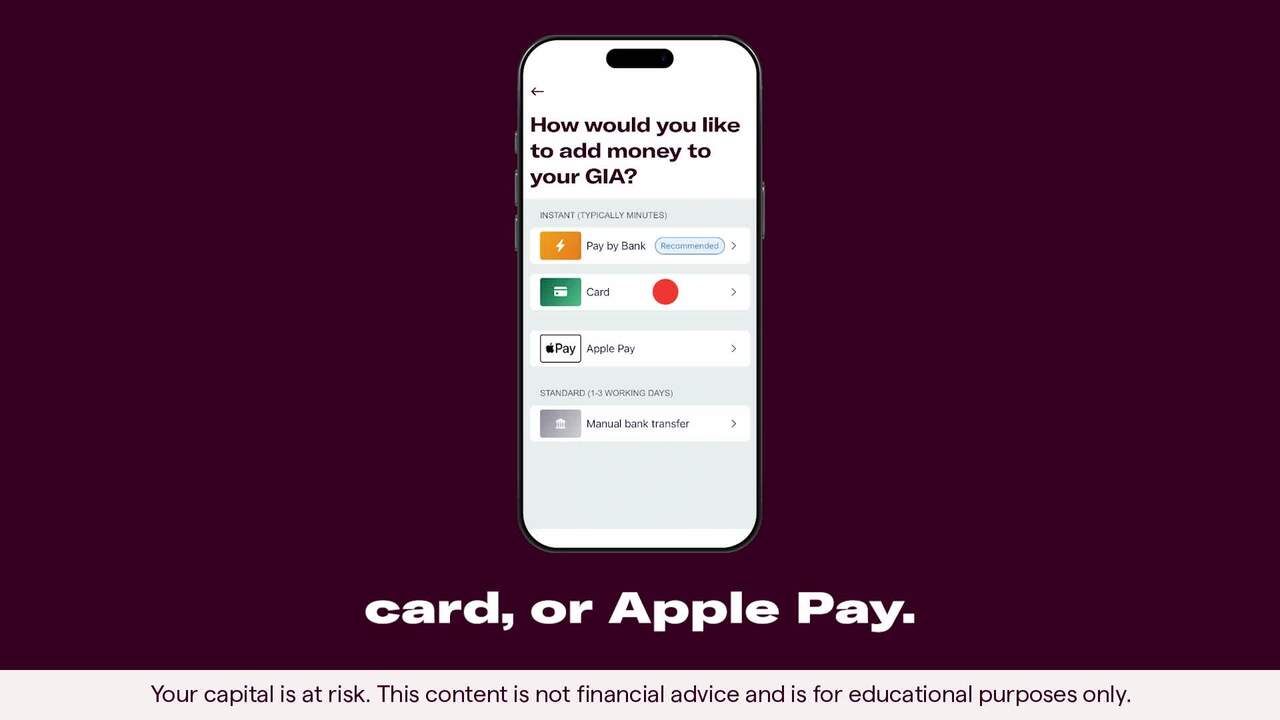

- Add funds

- Choose your stocks or ETFs and take control of your portfolio

Why choose IG?

50 years of trading experience.

Over 2 million active accounts globally.

An award-winning platform.

2026

Best For Share Traders

Boring Money

2026

Best Low Cost ISA

Boring Money

2025

Consumer Rated Value For Money

Boring Money

2025

Best Investing Education

Good Money Guide

Security and protection

Protecting your investments.

Securely held.

Your funds and assets are held in account completely separate from IG at regulated banks. They are kept away from our own funds and so even if IG were to go bankrupt, your cash and investments are safe and can’t be used by us or anyone else.

FSCS protected.

Your money is held in segregated accounts, separate from ours, and protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. Personal circumstances and type of service, may change how this protection applies.

Trusted by investors, like you.

FAQs

Still deciding?

We can help.

What investment accounts does IG offer?

We offer a range of account types, designed to suit your investing goals. Choose from tax-efficient ISAs, general investing accounts (GIA), and SIPPs for retirement planning.

Can I transfer my investments to IG?

Yes. Manage all your investments in one place with IG. You can transfer your existing investments in to or out of IG, with no fees and no fuss.5

Does IG offer flexible ISAs?

Our ISA account is flexible, meaning you can invest tax-efficiently and still withdraw funds without losing your annual allowance.

How much does it cost to invest with IG?

Investing with IG is simple, and cost-efficient. There are no commissions on your trades and no account fees, so every pound goes into your portfolio. The only charge is a 0.7% FX fee on currency conversions.

Is there a minimum deposit amount with IG?

You can start investing with IG from as little as £1, meaning you can start building a portfolio with whatever amount suits you.

1 Commission free on all stocks and ETFs traded within a UK GBP GIA, ISA and SIPP account. Other fees may apply.

2 3.75% AER variable interest on GBP cash balances in GIA, ISA and SIPP accounts. Interest will be paid on balances up to £100k per client. To earn interest in a calendar month, you must either hold an open position or have traded. Full T&Cs available here

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4

Your capital is at risk. New customers only. Offer valid until 05/04/2026 on ISA, GIA or SIPP accounts. Cannot be used in conjunction with other offers. T&Cs apply.

5 Physical share dematerialisation fee is £100 (inclusive of VAT) per certificate. Electronic shares are transferred free of charge. IG SIPPs are administered by Options Pensions, who charge a £210 annual fee and may charge for transferring investments not currently held in a SIPP. You may be out of the market for a period while your transfer takes place.