Low cost

Our transparent fees are lower than traditional wealth managers, starting from just 0.50% and capped at £250 per year, per account type.

Simple, online process

Create your account in minutes. Simply answer a few questions to help us determine the best portfolio for you.

Managed by experts

Choose from a range of wealth portfolios, expertly managed by IG and designed by BlackRock – the world’s largest asset manager.

Tailored to you

Your investment is spread across shares, bonds and commodities to suit your needs and risk profile.

A smarter way to invest

IG Smart Portfolios are expertly managed, broadly diversified portfolios with exposure to many global markets, such as fixed income and equity, along with alternative investments like gold and property. At a fraction of the cost of traditional wealth managers, our portfolios are designed to help you reach your financial goals sooner.

Your portfolio will be built to suit your risk appetite – we’ll just ask you to answer a few questions about your needs.

How we diversify your exposure

IG Smart Portfolios are built exclusively with BlackRock’s iShares ETFs, which we believe are the perfect asset if you’re seeking long-term growth. Not only do ETFs have low fund charges, meaning you can keep more of your returns, but they also provide diverse market exposure to help minimise your investment risk.

Your portfolio will include ETFs that cover a range of asset classes and geographies, including:

- Government and investment-grade bonds

- Developed and emerging market equities

- Non-traditional assets such as gold and property

A globally diversified portfolio tailored to your investment goals. Actively managed and rebalanced by our expert investment team, in partnership with BlackRock, to keep performance in line with your goals.

A fraction of the cost

IG Smart Portfolios offer you an affordable and innovative way to invest. All the costs involved in our low fee structure are fully transparent, and our commitment to clarity on charges means you’ll know the total cost of ownership (TCO) before you invest.

We offer this information upfront because we understand the difficulty in comparing costs between providers. Some simply offer a different type of service, while others don’t allow you to view your total costs unless you become a customer.

You can see a complete breakdown of costs for an IG Smart Portfolio in the table below. Discover how our total annual cost, on a £40,000 investment, compares with providers offering a similar type of discretionary investment management service.

|

Management fee |

Fund costs2 |

Transaction costs3 |

Est. total annual cost (%) |

Est. total annual cost (£) |

| IG Smart Portfolio | 0.50% | 0.13% | 0.09% | 0.72% | £288 |

| Wealthify | 0.60% | 0.16% | 0.00% | 0.76% | £328 |

| Moneyfarm | 0.75%* | 0.20% | 0.09% | 1.04% | £371 |

| Nutmeg | 0.75% | 0.19% | 0.07% | 1.01% | £400 |

This table contains latest available data from the websites of each provider. Data accurate as of May 2024.

* For the first £10,000. Tiered distribution after

Your IG Smart Portfolio will be managed free of charge if it exceeds £50,000, effectively capping your management fee at £250 a year. This means that as your investments grow, the average cost for your portfolio falls.

Online wealth management expertise

We created IG Smart Portfolios using iShares ETFs from BlackRock – the world’s largest asset manager, with over $6 trillion under management. We’ve tailored each of our offerings according to a defined level of risk – enabling you to choose from a range of expertly designed portfolios to suit your needs and risk appetite.

Using BlackRock’s cutting-edge investment research, we regularly rebalance our portfolios as market conditions change. This ensures that you have the optimal asset allocation for your risk profile.

Our relationship with BlackRock

We are responsible for constructing and managing your IG Smart Portfolio. Our decisions are based on asset allocation insights from BlackRock, which enable us to provide institutional-quality portfolios that cater to five distinct risk profiles.

The asset allocation insights from BlackRock are supported by Aladdin, BlackRock’s proprietary portfolio risk management platform. Aladdin is licensed by more than 200 external organisations, including some of the world’s largest financial institutions, and is used to analyse over $21.6 trillion of assets (as of February 2020).

By combining BlackRock’s asset allocation insights with our cutting-edge technology and expert customer service, IG Smart Portfolios can provide a better investment solution.

Performance

We believe that the combination of BlackRock’s investment management services, our technology and low costs puts us in a strong position to deliver impressive investment results.

We now have six years of performance data and the chart below shows average annual returns for each Smart Portfolio since these were launched in February 2017.

Remember, the value of investments can fall as well as rise, and you may get back less than you invested. Past performance is no guarantee of future results.

A full performance breakdown for each portfolio and its benchmark can be seen below.

- Aggressive

- Growth

- Balanced

- Moderate

- Conservative

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Last 12 Months |

Last 5 Years |

All Time* |

Annualised |

| Aggressive | 8.5% | -6.5% | 19.4% | 10.9% | 18.2% | -12.2% | 12.5% | 14.0% | 12.3% | 59.1% | 81.8% | 7.8% |

| Benchmark | 7.9% | -6.5% | 18.0% | 5.8% | 12.3% | -11.4% | 8.3% | 9.3% | 9.0% | 36.6% | 51.2% | 5.3% |

| Difference | 0.5% | 0.0% | 1.3% | 5.1% | 5.9% | -0.8% | 4.2% | 4.7% | 3.4% | 22.4% | 30.6% | 2.5% |

*Part year. The Aggressive Smart Portfolio has performance data from 28 Feb 2017.

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Last 12 Months |

Last 5 Years |

All Time* |

Annualised |

| Growth | 10.7% | -5.6% | 17.0% | 11.4% | 13.5% | -11.9% | 10.8% | 11.3% | 11.0% | 45.8% | 115.8% | 7.5% |

| Benchmark | 9.4% | -5.6% | 15.0% | 4.6% | 10.2% | -10.2% | 7.2% | 7.9% | 8.4% | 29.4% | 70.4% | 5.2% |

| Difference | 1.3% | 0.0% | 2.0% | 6.9% | 3.2% | -1.7% | 3.6% | 3.5% | 2.6% | 16.5% | 45.4% | 2.4% |

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Last 12 Months |

Last 5 Years |

All Time* |

Annualised |

| Balanced | 8.1% | -4.6% | 14.1% | 9.2% | 8.8% | -11.4% | 8.9% | 8.7% | 9.5% | 30.3% | 82.5% | 5.9% |

| Benchmark | 6.7% | -5.1% | 11.7% | 4.3% | 7.6% | -9.1% | 5.8% | 6.4% | 7.6% | 22.0% | 50.4% | 3.9% |

| Difference | 1.4% | 0.5% | 2.3% | 4.8% | 1.1% | -2.3% | 3.2% | 2.3% | 1.9% | 8.3% | 32.1% | 1.9% |

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Last 12 Months |

Last 5 Years |

All Time* |

Annualised |

| Moderate | 4.5% | -3.6% | 10.0% | 7.4% | 3.4% | -9.4% | 6.0% | 5.0% | 7.1% | 14.5% | 49.3% | 3.9% |

| Benchmark | 4.5% | -3.6% | 8.1% | 4.2% | 4.2% | -7.6% | 3.7% | 4.6% | 6.1% | 12.8% | 31.4% | 2.6% |

| Difference | 0.0% | 0.0% | 1.9% | 3.2% | -0.8% | -1.8% | 2.3% | 0.4% | 1.0% | 1.7% | 17.9% | 1.2% |

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

Last 12 Months |

Last 5 Years |

All Time* |

Annualised |

| Conservative | 0.3% | -0.9% | 3.6% | 2.0% | -0.4% | -5.6% | 4.3% | 3.6% | 5.2% | 4.3% | 19.1% | 1.7% |

| Benchmark | 1.3% | 1.6% | 1.7% | 1.1% | 1.1% | 2.2% | 5.6% | 6.1% | 6.0% | 17.9% | 27.9% | 2.3% |

| Difference | -1.0% | -2.5% | 1.9% | 0.9% | -1.4% | -7.8% | -1.3% | -2.5% | -0.8% | -13.6% | -8.7% | -0.7% |

Choose the best account for you

We offer three types of IG Smart Portfolio. You can have as many portfolios as you like, or any combination of each, which means you get complete flexibility over how you organise your investments.

General investment

A standard investment account, where gains and dividends are taxable.

This account type is useful if you’ve already filled your stocks and shares ISA.

ISA

Use your £20,000 ISA allowance so that your investment gains and the dividends you receive are all tax-free.

Your ISA allowance resets at the start of the tax year.

How it works

We ask about you

Whether you’re saving for retirement, school fees or just simply looking for a better return on your savings, we’ll tailor your portfolio to you. Just answer a few simple questions about your investment goals, and we’ll get you up and running.

We build your portfolio

After we’ve learnt about your investing goals, we’ll show you the portfolio with the best mix of investments to meet your targets.

See how we expect each portfolio to perform over time, and you can easily change which one to invest in.

Deposit your funds

Whether you’re saving for retirement, school fees or just simply looking for a better return on your savings, we’ll tailor your portfolio to you. Just answer a few simple questions about your investment goals, and we’ll get you up and running.

Top up at any time

Add funds to your investment whenever you like – you can even set up a standing order to do it automatically. Meanwhile, we’ll rebalance your portfolio as needed, so you don’t have to.

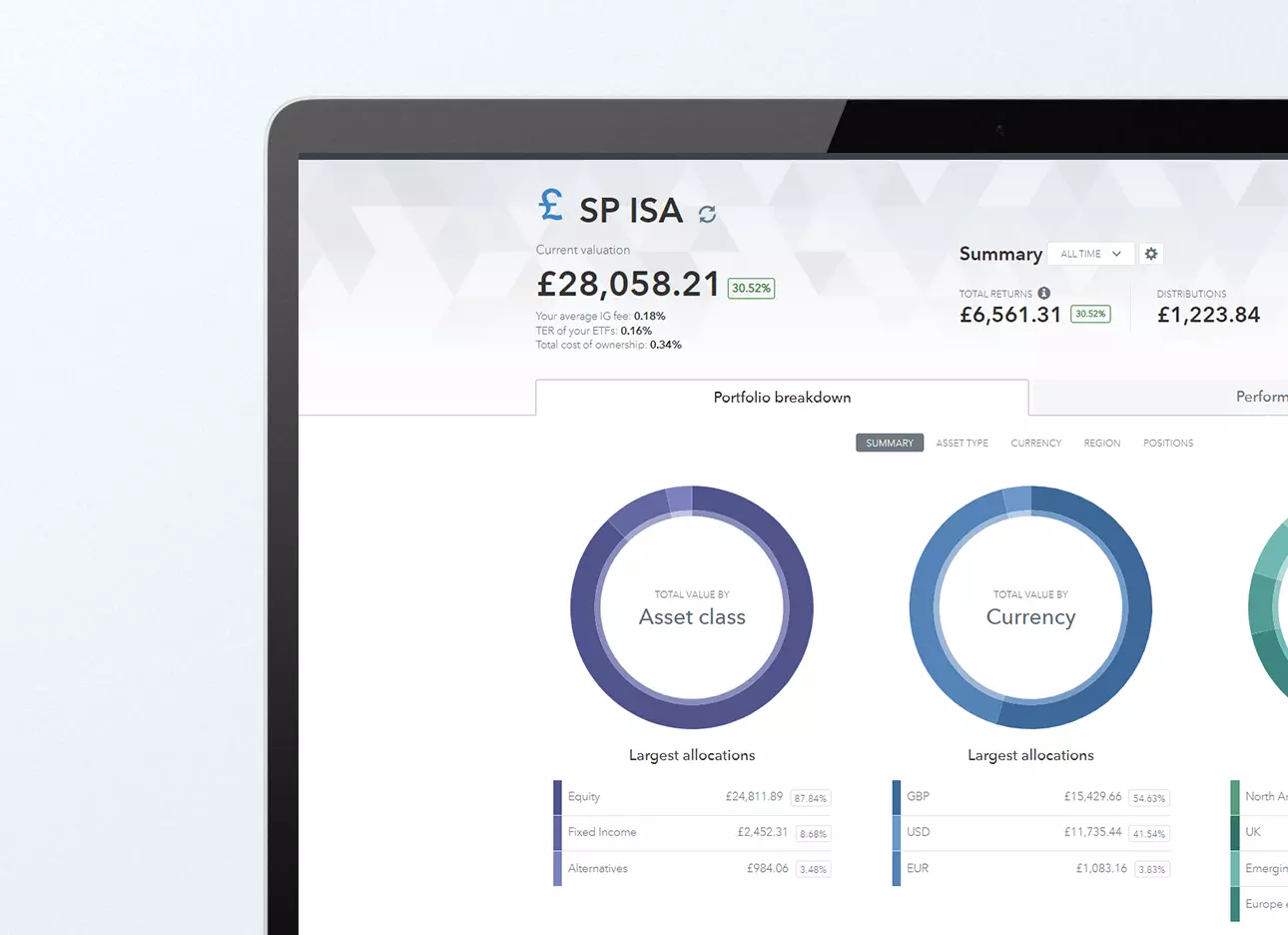

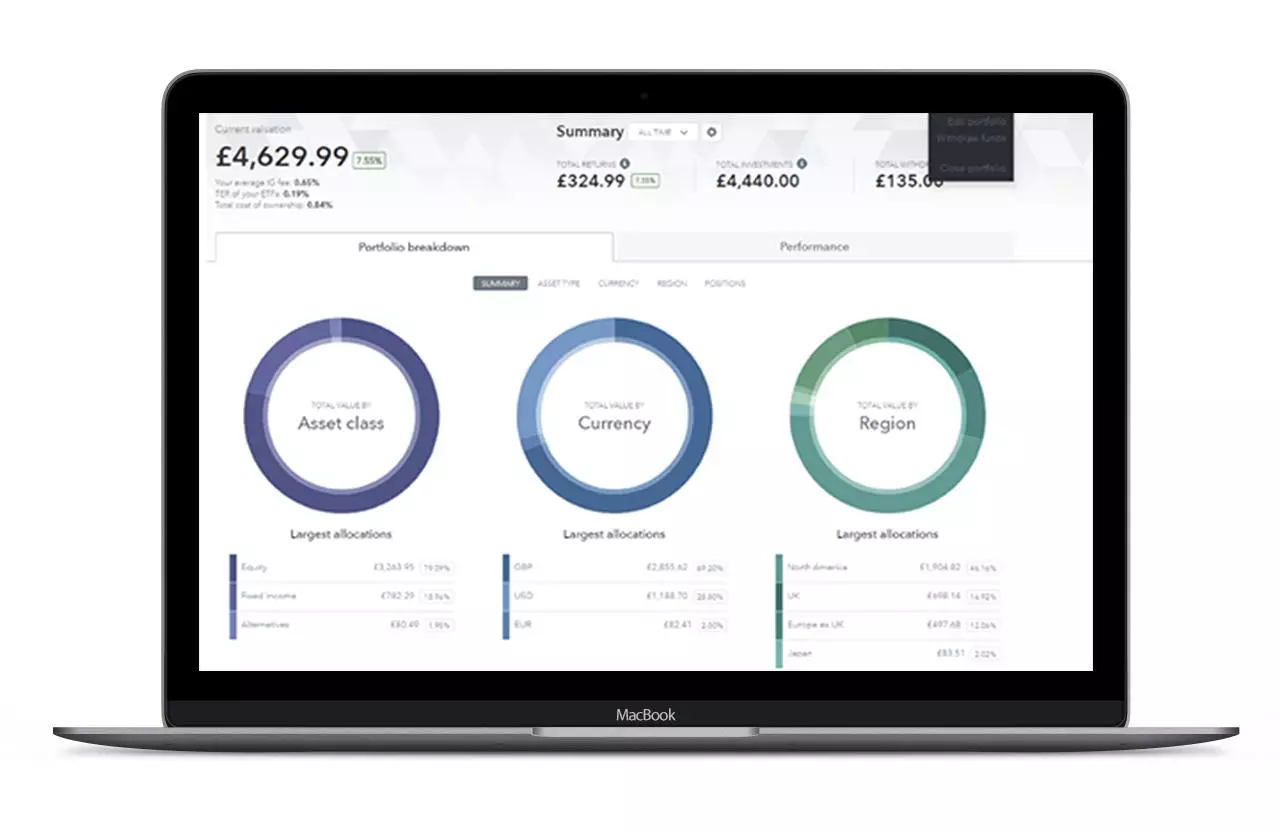

Check up on your portfolio

See how your portfolio is performing at any time on our intuitive online platform or mobile app. You can also switch between portfolios or withdraw your money without charge. Simple.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Get your free beginner's guide to investing

- Discover the benefits of investing your money

- Learn about the different investment options available and how to get started

- Understand how to build a diversified portfolio and manage your risk

FAQs

Who chooses what goes into my portfolios?

All five portfolios are based on models that are managed by BlackRock. BlackRock assets under management now $10 trillion. We created our partnership to give everyday investors the opportunity to invest in their expertly managed portfolios.

We power the technology behind your investments. From our platform, which lets you monitor your investments at all times, to our state-of-the-art dealing technology, which makes sure your cash is invested up to the nearest pound, we’re continuously looking for ways to improve your experience. Plus, our customer service team is on hand to help with any questions you have, 24 hours a day.

Can I have an IG Smart Portfolio ISA as well as an IG share dealing ISA?

Yes, our ISA account is designed to be flexible, so you can invest some of your ISA allowance in a Smart Portfolio and some in a share dealing account. You can move cash freely between each account type. If you withdraw funds, you have until the end of the tax year to add the cash back in, or you’ll risk losing out on your annual ISA allowance.

Can I withdraw my money at any time, at no cost?

Yes, and yes. While many wealth management companies will only allow you to buy or sell your investments at one point in the day, we have the technology to let you buy, sell or switch portfolio immediately, at any time. We don’t charge transaction fees for buying or selling, and we’ll never charge you for withdrawing your cash.

Do you offer junior ISAs?

Yes, IG offers a Junior ISA which allows you to invest up to £9,000 per year tax-free for your children. You can find out more about our Junior ISAs here.

2 The Total Expense Ratio (TER) for the ETFs in an IG Smart Portfolio is subject to your portfolio allocation and is currently between 0.11% and 0.14%. Correct as at 6 May 2021.

3 Source: www.theinvestmentassociation.org