Futures and forwards: what are they and how do they compare?

You can trade over-the-counter (OTC) futures and forwards with us. Discover how futures and forwards compare, what the differences are between listed and OTC products, and more.

Futures vs forwards: what’s the difference?

Futures and forwards are financial instruments that can cater to different needs and market conditions. With us, you can trade over-the-counter futures or forwards using spread bets and CFDs.

While similar, a futures contract shouldn’t be confused with a forward contract. Both agreements give you the obligation to buy or sell an asset at a set price in the future, but there are a few differences between them. Futures are standardised, non-negotiable contracts traded on exchange, and forwards contracts are non-standardised, negotiable contracts traded over the counter.

Below are some features for OTC futures and forwards

| OTC futures and forwards | |

|---|---|

| Trading venue | Futures: on exchange and over the counter Forwards: over the counter Both usually traded through a broker |

| Standardisation | Futures: standardised Forwards: customisable * |

| Regulation | Subject to less stringent regulatory requirements |

| Counterparty risk** | Futures: mitigated by an exchange’s clearinghouse Forwards: higher default risk from both parties |

| Liquidity | Depends on contract specifics |

* We generally offer potential expiration dates that you can choose from when trading forwards with us.

** When trading with us, counterparty risk is limited based on the terms and agreements that govern our relationship with you.

Our futures and forwards offerings

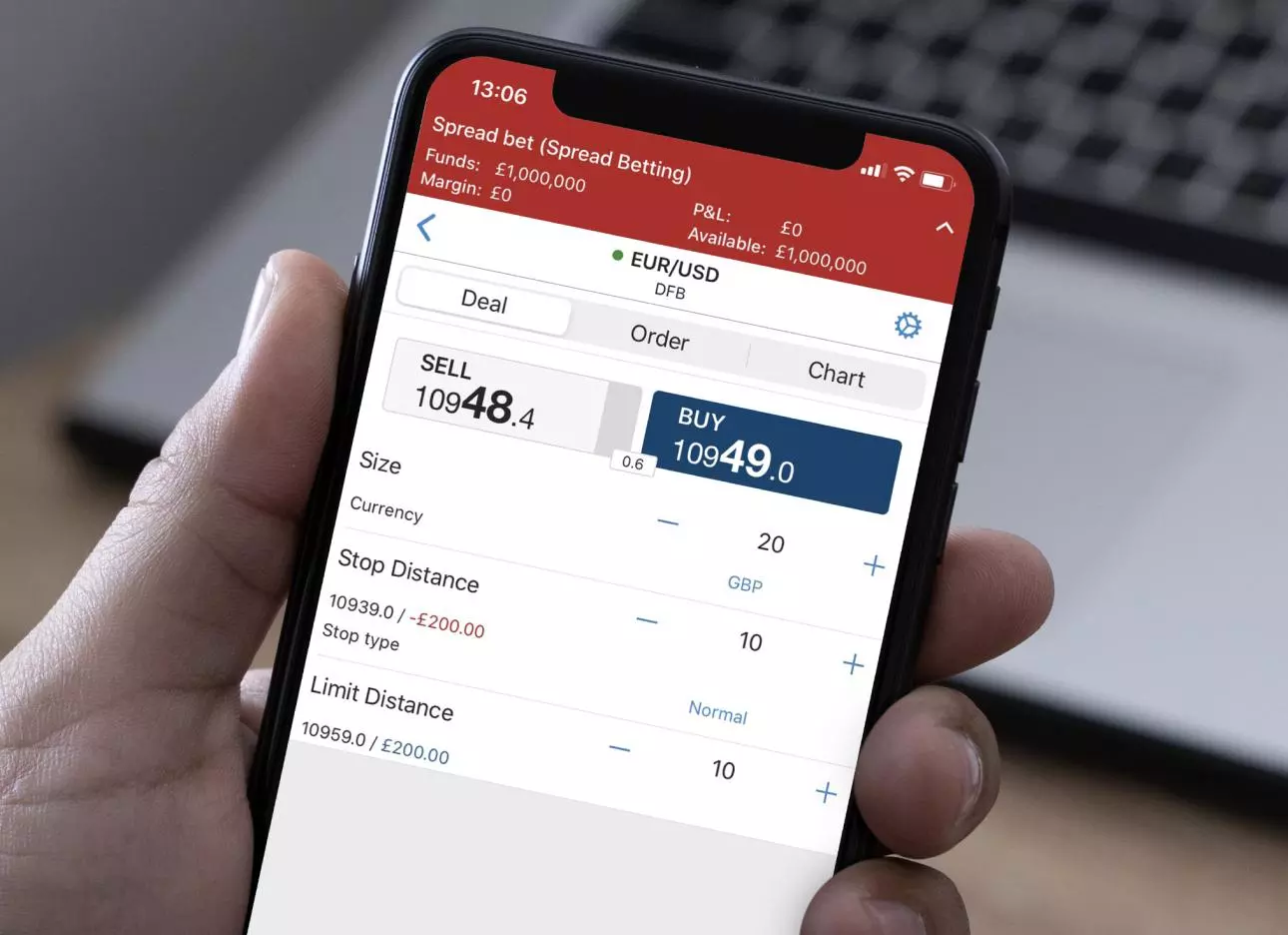

You can also trade a futures or forward contract as the underlying of a spread bet, or a futures contract as the underlying of a contract for difference (CFD) with us. Spread bets and CFDs are financial derivatives that enable you to trade using leverage.1

Trading futures with leverage

When you choose to trade futures and forwards over the counter, you’ll pay only a deposit (called margin or buying power) to open a position and get full exposure. The use of leverage comes with increased risk and complexity as both potential profits and possible losses are magnified to the full value of the trade. It’s important to manage your risk as you could lose money quickly – you could even lose more than the deposit you paid to open the position.1

Futures settlement

OTC futures and forwards are generally cash settled. Some forwards, like FX, can be physically settled. This means you’ll get the physical currency when trading using spread bets.

Futures and forwards: definitions

OTC futures and forwards can be described as follows:

| OTC future |

|---|

| OTC futures and forwards are contracts that aren’t traded on an asset exchange and can be tailored to the needs of the contracting parties in terms of the asset, quantity and |

Futures and forwards prices vs spot prices

Compared to trading a futures or forward contract, trading the spot market – which generally has tighter spreads – is typically preferred by short-term traders (eg day traders). However, some equity index futures also have narrow spreads. A spread is the difference between the bid and ask prices that varies depending on market conditions.

You can use our OTC products to trade a wide range of spot (or ‘cash’) markets. Spot prices enable you take a position on the current market price of an underlying asset like shares, exchange traded funds (ETFs), indices and forex. With spot trading, you’ll pay overnight funding charges if you keep your position open from one trading session into the next – to avoid these fees, you can open and close your positions within the same trading day.

With futures and forwards trading – which is generally more suitable for longer term trading – you won’t pay overnight charges as this cost is already accounted for in pricing for the duration of your contract; but the spread is typically wider (compared to spot trading).

Learn more about the differences between futures prices and spot prices

OTC futures and forwards markets vs spot markets

You can get exposure to a wide range of OTC futures, forwards, and spot markets as the underlying instrument of a spread bet or CFD on our platform. Whichever you choose, you can go long or short based on your market assumption.

Below are the spread bet markets you can take a position on via spot trading, and our OTC futures or forwards offerings.

| Spread bet market | OTC futures or forwards | Spot |

|---|---|---|

| Shares | Yes | Yes |

| ETFs | Yes | Yes |

| Indices | Yes | Yes |

| Forex | Yes | Yes |

| Commodities | Yes | Yes* |

| Bonds and rates | Yes | No |

* Below are the CFD markets you can get exposure to through our spot and OTC futures offerings.

| CFD market | OTC futures | Spot |

|---|---|---|

| Shares | No | Yes |

| ETFs | No | Yes |

| Indices | Yes | Yes |

| Forex | No | Yes |

| Commodities | Yes | Yes* |

| Bonds and rates | Yes | No |

* Commodity prices on our platform are undated, derived using the two most liquid futures contracts.

Futures vs forwards examples

The below are examples of trading OTC futures and forwards. Whether you trade over the counter or in the underlying, futures and forwards can be used for speculation or hedging.

OTC futures example in commodity trading: oil

A trader buys an oil CFD futures contracts that’s expiring in 6 months at a price of $50 per barrel. At the expiration date, the price of oil is $60. 1 standard contract = $10 per point

P/L in a CFD account = (number of contracts x value per contract) x (closing price - opening price)

That means the trader in this example would make a profit of:

(1 x $10) x ($60 - $50) = $100

Had the price fallen instead, you would’ve incurred a loss (of the same amount) because the market would’ve moved against the position.

If you chose to trade in a spread betting account instead, the P/L would be calculated as follows:

Bet size per point x (closing price - opening price)

Forward contract example in commodity trading: oil

A manufacturing company wants hedge the risk of rising oil prices between now and a specific date in 3 months. As the date is different to the fixed futures expiry, the company choses to trade a forward, which enables customisation (in the underlying). This way, it can choose an expiry to match the date it wants to buy the oil on.

The company pays $50 per barrel for the forward contract, and the price of oil rises to $60 at expiry. The higher cost will be offset by the hedge on the forward contract.

The payoff of a forward contract long position (in the underlying) = spot price at expiry - the agreed-upon delivery price

The payoff of a forward contract short position (in the underlying) = agreed-upon delivery price - spot price at expiry

That means the trader in this example would make a profit of:

$60 - $50 = $10 per barrel

Had the price fallen instead, the company would’ve incurred a loss (of the same amount) on the trade as they would’ve had to pay more than the spot price at expiry.

If the company chose the futures contract (in the underlying) with the fixed expiry instead, the profit or loss would’ve been depended on the spot price at contract expiration.

Is trading OTC futures or forwards better for me?

When engaging in any trading activity, it’s important to consider your unique trading needs, objectives, and risk tolerance.

Here’s how OTC futures and forwards may be of interest:

Price

The value of an OTC futures contract is based on the listed asset’s price on the underlying exchange. For forwards, we create prices synthetically, considering the asset being traded, the contract’s time to expiry, and prevailing interest rates. You’ll pay no commission when trading these with us, just our spread.

Listed futures are priced according to the spot value of their underlying market – forces of supply and demand are the main driver of these price moves. We charge a commission to execute a listed futures trade. Listed futures trades will also incur a per-contract exchange, clearing and regulatory fee.

Find out more about our charges

Counterparty risk

OTC products inherently carry higher counterparty risk as there’s no centralised exchange to guarantee the trade. The contract might not be honoured by the counterparty (your broker), despite the obligation to fulfil their end of the agreement. When trading on our platform, this risk is limited based on the terms and agreements that underpin the contracts and transactions that you enter into with us.

Regardless of the kind of product or financial instrument you choose, these terms and agreements are supported by applicable regulations as well as our policies and procedures that cover aspects such as protecting and segregating client funds and assets.

FAQs

What is a futures contract?

A futures contract is a standardised agreement between two parties to buy or sell an asset at a predetermined price by a certain expiry date. On our platform, you can trade a futures contract as the underlying of a financial derivative: either a spread bet or a CFD.

What is a forward contract?

A forward contract is an agreement between two parties to buy or sell an asset at a predetermined price by a certain expiry date. These contracts are traded over the counter and aren’t standardised – the asset, quantity to be ttingraded, and delivery date can be negotiated. With us, you can trade a forward contract using a spread betting account.

What are the pros and cons of futures and forwards?

OTC futures and forwards: flexibility through customisation, but liquidity is usually lower and counterparty risk is typically higher.*

* With us, counterparty risk is limited based on the terms and agreements that relate to your contracts and transactions on our platform.

What’s the difference between futures and forward prices?

We base our OTC futures contract’s value on the listed asset’s price on the underlying exchange, and our spread. We synthetically create prices for forwards, considering the asset being traded, the contract’s time to expiry, and prevailing interest rates, plus our spread. The funds required to keep your OTC futures position open until the contract’s expiry are included in our spread, as opposed daily settlement of funds.

Try these next

Explore our product offerings and choose the best one for you.

Discover how you can find the best platform for intraday trading.

Learn about amplified exposure, including the benefits and risks.

1 Leveraged products such as spread bets, CFDs and US-listed futures are complex financial instruments, with which an upfront deposit – called margin or buying power – is used to open a larger trade. Your margin will only be worth a certain percentage of your trade, but potential profits and losses will be calculated based on the total position size, not your margin. This makes leveraged trading inherently risky and should never be approached without a trading strategy and adequate risk management in place. Listed options are non-marginable (ie you can’t borrow cash to establish positions) in a cash account. In a margin account, listed options aren’t fully cash-secured (eg you aren’t necessarily required to put up the buying power in full upfront).

2 Best platform for options trading – ADVFN International Finance Awards 2024.