What is slippage and how do you avoid it in trading?

Slippage can be either an unexpected bonus or an unwelcome surprise – depending on which way it goes. Find out more about slippage, and some steps you can take to reduce your exposure to it during your time on the markets.

What is slippage in trading?

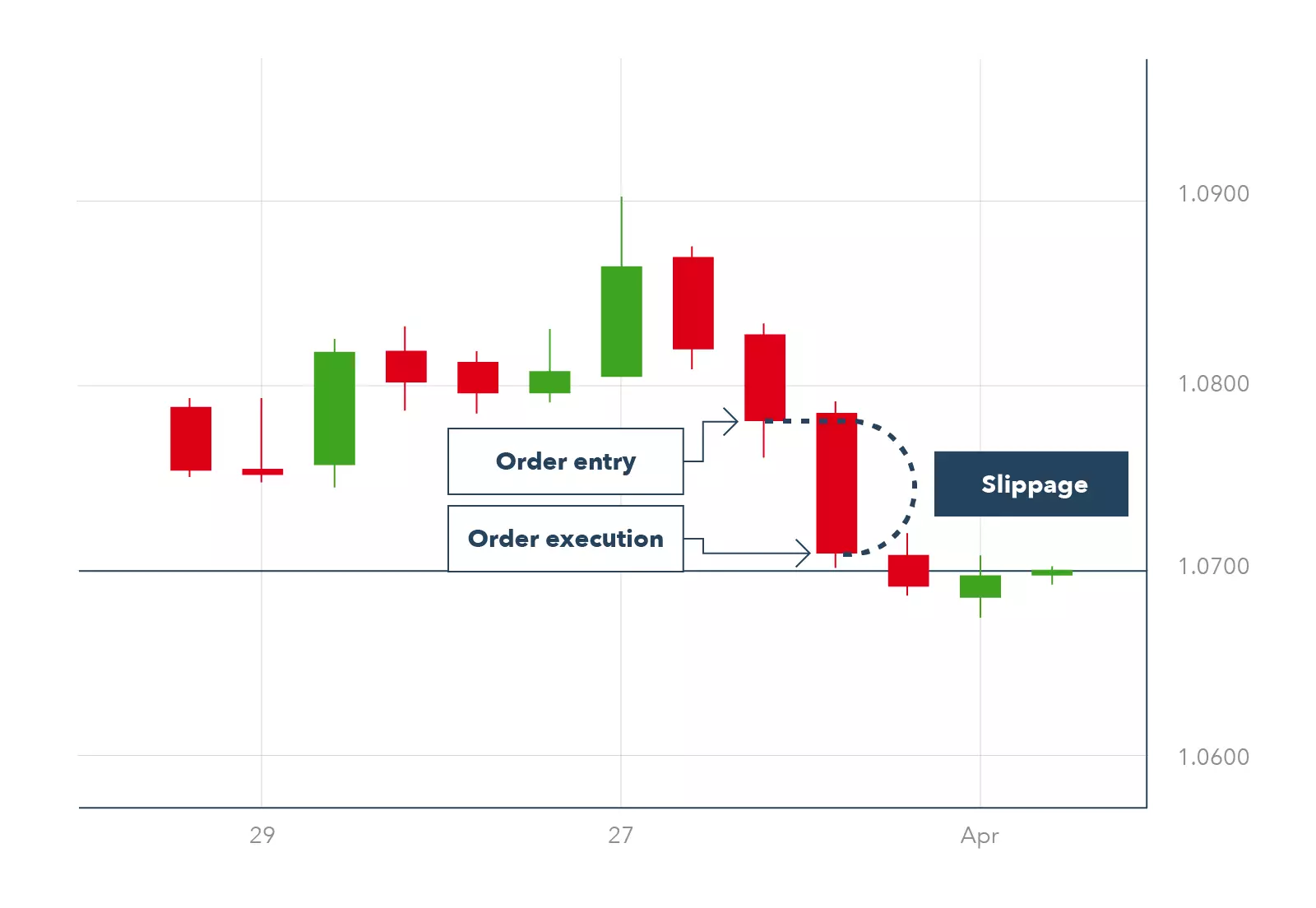

Slippage is when the price at which your order is executed does not match the price at which it was requested. This most generally happens in fast moving, highly volatile markets which are susceptible to quick and unexpected turns in a specific trend.

The price difference can be either positive or negative depending on the direction of the price movement, if you are going long or short, and whether you are opening or closing a position.

If slippage were to affect your positions, some brokers would still fill your orders at the worse price. IG’s best execution practices ensure that if the price moves outside of our tolerance level between the time when you placed the order and when it is executed, the order will be rejected. This protects you to some extent against the negative effects of slippage when opening or closing a position. However, if the price were to move to a better position for you, IG would fill the order at that more favourable price.

Aside from this, there are other ways to protect yourself against slippage such as using limits or guaranteed stops on your active positions. Limits can help you to avoid slippage when entering or closing a position, as a limit order will only fill at the price that you have requested, while a guaranteed stop will close out your trade once the asset’s price hits the exact level you specify. A premium is payable should the latter be triggered.

Find out how to avoid slippage

How does slippage occur?

Slippage generally occurs when there is low market liquidity or high volatility. This is because in low liquidity markets, there are fewer market participants to take the other side of a trade, and so more time is required between placing the order and the order being executed after a buyer or seller has been found. With this delay, an asset's price may change, meaning that you have experienced slippage. In volatile markets, price movements can happen quickly – even in the few seconds that it takes to fill an order.

Slippage in forex trading

Slippage in forex trading most commonly occurs when market volatility is high, and liquidity is low. However, this typically happens on the less popular currency pairs, as popular pairs like EUR/GBP, GBP/USD and USD/JPY generally have high liquidity and low volatility.

As an example, let’s say you decide to open a long position on the AUD/USD currency pair – which can be highly volatile – after it was quoted at $0.7026. However, in the time between submitting the order and the order being executed, the price might have increased to $0.7028. In this instance, you would have just experienced slippage, because you would be buying at a higher level than you had expected.

With IG, however, so long as the difference in price is within our tolerance level, your order will be filled at the original price requested. If it falls outside this tolerance level, it will be rejected so you can decide if you want to resubmit your order at the new price.

Slippage in stock trading

A typical example of slippage in stock trading would be if Microsoft stock had a bid-ask spread of $109.05 to $109.25. You might place a spread bet or open a CFD with a deal size of five contracts, and you might go short because you think that the price of Microsoft stock was going to fall.

However, slippage would occur if, in the second or two that it took for your order to be processed, the stock’s bid price changed and suddenly increased to $111.05. With some brokers, you might be subject to slippage on this order and get a worse price for your short position than you had expected.

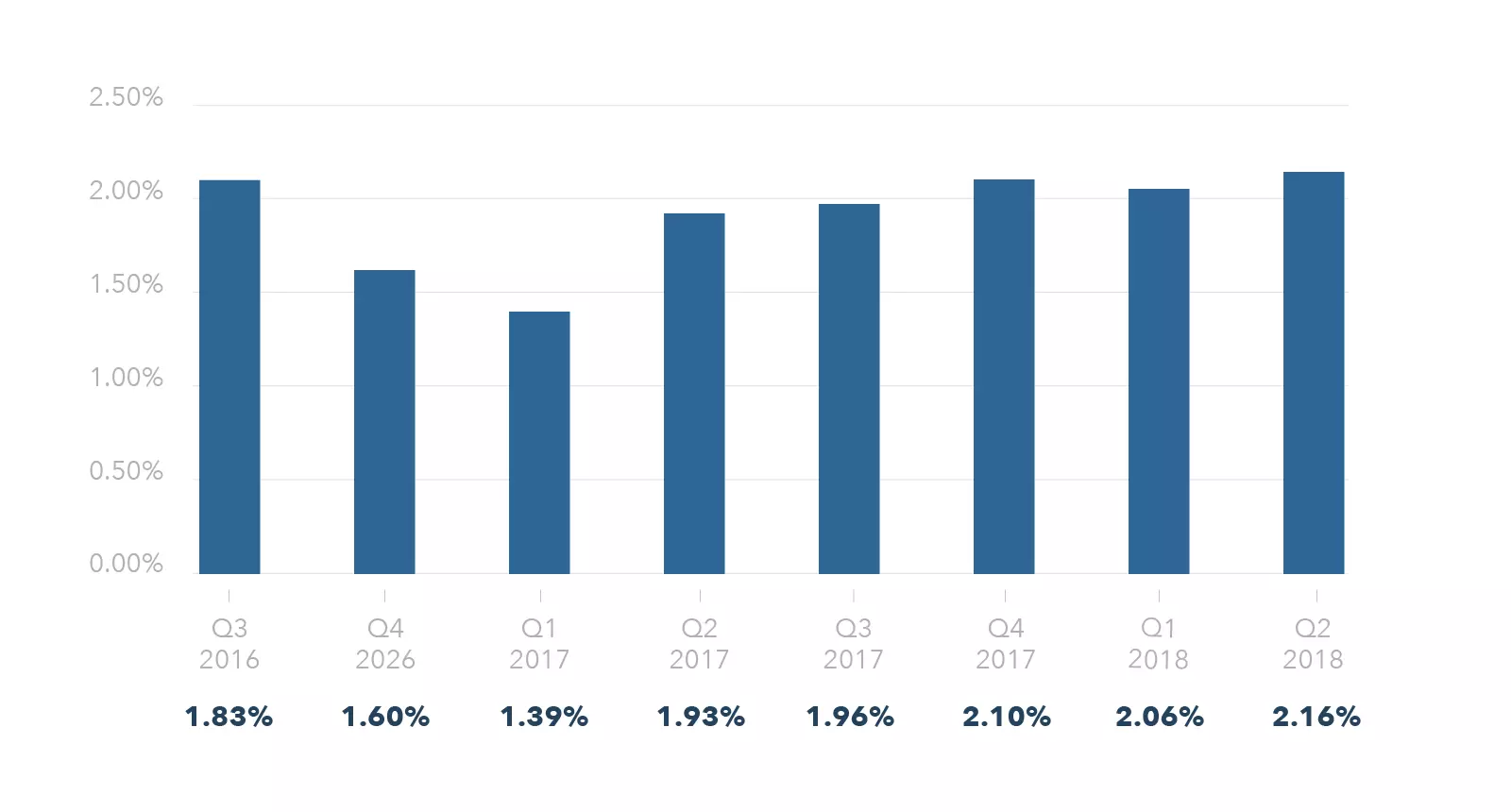

With IG, however, your order would either be filled at your original price or rejected if the change in price was outside our tolerance level. If this is the case, then the order won’t go through, leaving you to decide if you want to resubmit your order at the new price. The below chart shows IG’s rejection rates from 2016 to 2018 for trades that had experienced slippage outside of our tolerance level.

Find out more about how to trade stocks

When to watch out for slippage

Slippage tends to be prevalent around or during major news events. Announcements from banks about monetary policy and interest rates, or a company earnings report and changes in senior directors, can all cause heightened volatility which can increase your chances of experiencing slippage.

Some of these events, such as a company announcement about a change in CEO for instance, are not always foreseeable. Other events, such as major meetings of the Federal Reserve (Fed) or Bank of England (BoE), are scheduled – although it is not always clear what will be announced.

How to avoid slippage

There are several ways to minimise the effects of slippage on your trading:

Trade markets with low volatility and high liquidity

Trading in markets with low volatility and high liquidity can limit your exposure to slippage. This is because low volatility means that the price is less inclined to change quickly, and high liquidity means that there are a lot of active market participants to accommodate the other side of your trades.

Equally, you can mitigate your exposure to slippage by limiting your trading to the hours that experience the most activity because this is when liquidity is highest. Therefore, there is greater chance of your trade being executed quickly and at your requested price.

For instance, stock markets experience the largest trading volume while the major US exchanges like the NASDAQ and the New York Stock Exchange are open. The same can be said with forex where, although it is a 24-hour market, the largest volume of trades takes place when the London Stock Exchange is open for business.

Conversely, slippage is more likely to occur if you hold positions when the markets are closed – for example, through the night or over the weekend. This is because when a market reopens its price could change rapidly in light of news events or announcements that have taken place while it was closed.

Apply guaranteed stops and limit orders to your positions

Unlike other types of stop, guaranteed stops are not subject to slippage and will therefore always close your trade at the exact level you specify. For this reason, they are the best way to manage the risk of a market moving against you. However, it should be remembered that unlike other stops, guaranteed stops will incur a premium if they are triggered.

Limits on the other hand can help to mitigate the risks of slippage when you are entering a trade, or want to take profit from a winning trade. With IG, if a limit order is triggered it will only be filled at your pre-specified price or one that is more favourable for you, as explained in the next section.

Find out how your provider treats slippage

If the price moves against you when opening or closing a position, some providers will still execute the order. With IG, that won’t happen because our order management system will never fill your order at a worse level than the one you requested, but it may be rejected.

This is because we set a tolerance level either side of your requested price. If the market stays within this range by the time we receive your order, it will be executed at the requested level. If, however, the price moves outside this range, we will do one of two things:

- If the market moves to a better price, we will ensure that you receive that price. For example, if the price slips to a more favourable level before we can close a trade for you, you would receive the additional profit

- If the price moves beyond our tolerance level against you, we will reject the order and ask you to resubmit it at the current level

Slippage summed up

- Slippage is an unavoidable part of trading. It occurs when the price at which an order was executed is above or below the price at which it was quoted

- Slippage occurs when a market moves suddenly during the few seconds between when an order was placed, and when it was executed by a broker or on an exchange

- You can minimise your exposure to slippage by trading during a market’s most active hours and by going for highly liquid markets, preferably those with low volatility

- Slippage can be positive as well as negative, enabling you to get a better price than you previously expected

- Use guaranteed stops and limits on your trades to help mitigate the effects of slippage

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Discover how to trade the markets

Explore the range of markets you can trade – and learn how they work – with IG Academy's free ’introducing the financial markets’ course.