Trading vs investing: your guide to the key differences

If you want to get involved in the financial marketplace, you’ll either trade or invest. But, what’s the difference? Trading and investing each have unique features, advantages and disadvantages. We’ll unpack them in this guide.

What’s the difference between trading and investing?

Investing is the ownership of financial assets and is usually a long-term affair with limited risk. Trading is speculating on financial markets without the ownership of those assets, often with a higher risk than investing and done with a more short-term frame of mind.

Investing

- When investing with us (also known as share dealing), you’re taking direct ownership of shares, ETFs and investment trusts

- Ownership entitles you to voting rights and dividend payments if the company grants them

- You need to commit the full value of your position upfront

- You buy and sell these assets on-exchange through a broker like us

- You can only ‘go long’ when share dealing

- We offer 14,900 leading stocks, ETFs and funds

Trading

- When trading, you’ll be using derivatives like spread bets and CFDs to speculate on an asset’s price movements

- You never take ownership of the underlying asset itself

- You only put down a margin deposit to open your position. This is known as leverage*

- You trade over-the-counter directly with us

- Because you’re speculating on price movements using derivatives, you can ‘go long’ and ‘short’

- We offer 15,000+ markets including shares, ETFs, indices, forex, commodities and more

You can use the same application form to open a live account for both share dealing and trading. Alternatively, you can practise trading with spread bets and CFDs by opening a demo account credited with £10,000 in virtual funds.

* Leverage is higher risk form of trading, which you can read more about below. Please bear in mind that while leverage can help to bring down your initial outlay, it will also act to amplify both your profits and your losses – so it’s vital to understand this feature of trading thoroughly before opening a position.

What is investing?

Investing is the act of buying a financial asset, owning it outright, with the aim of making a profit from that purchase further down the line. This is the most intuitive way beginners usually think of accessing financial markets.

For example, you have analysed the market and decide to purchase Apple shares in the hopes that the company’s share price will appreciate in future. When investing with a platform like ours, you’ll buy and own that actual financial asset – for instance shares or ETFs.

Because you’re buying these, you’ll have to commit the full value of your position upfront. So, in the case of shares, the current share price for that stock multiplied by the number of shares you want to own.

This can be a significant amount of money to commit upfront. However, that amount also represents the full extent of your risk. With investing, you can only ever lose what you paid for shares in a ‘bad investment’, whereas with trading you can lose (or gain) far more than your initial capital outlay. This often makes investing a longer-term prospect and a less risky one than trading.

Just remember that your capital is still at risk, as the value of shares, ETFs and other investment vehicles can fall as well as rise, which could mean getting back less than you originally put in.

Also, just like buying any other asset, you can only profit if that stock or ETF does well in the financial markets and you sell it for more than you paid for it. Because the price of your investment asset needs to appreciate in value to make a profit, you’re restricted to ‘going long’. When ‘going long’, you believe that the price of an asset will rise over a certain timeframe, so you buy it with the intention of selling it later to earn a profit – ‘buy low, sell high’.

Once you’ve bought shares in a company, you’re also entitled to any dividends they pay out. Just bear in mind that companies are not obligated to do so and usually only pay out generous dividends when they’re especially profitable. Plus, you’ll have shareholder voting rights if you invest in stocks.

You can use our share dealing platform to invest in a wide selection of over 14,900 leading stocks and funds – we offer over 11,000 stocks and 2900 ETFs in the UK alone.

Investing can be intimidating, with a lot financial knowledge required to make sound investment decisions. If you’d prefer an expertly managed portfolio, consider our Smart Portfolios. We’ll invest in a balanced portfolio of ETFs on your behalf, and we have some of the lowest fees on the market. Investment trusts are also a good choice if you’d like an actively managed alternative to passively managed ETFs.

Just remember that, with all investing, past performance is not a guarantee of future results. Every investment decision should be based on a thorough analysis of market conditions and the prospective investment itself.

What is trading?

The main feature of trading, is that you’re taking a position on the price of an asset - without owning that asset itself, as you would with investing. Rather, you are only predicting how it performs on the financial market, with the aim of making a profit (if your prediction is correct).

To use our earlier example, instead of buying Apple shares, you’d trade on the Apple share price. This means you’d use a financial product, such as spread bets or CFDs, to stake a certain amount of money on a prediction, rather than purchasing shares outright.

Because you have no ownership when trading, you can go either ‘long’ or ‘short’ with your trades. Going long means you’re speculating that the market price for that asset will rise, while going short means you believe that asset will fall in value. You can make a profit or a loss by going long or short when trading. This is different to investing, in which you can only profit if that asset appreciates in value.

When trading with us, you’ll use products called financial derivatives. The two types that we offer are spread bets and CFDs (contracts for difference). We are the top spread betting and CFD trading platform in the UK,1 with award-winning technology and over 45 years’ experience.2

Another main difference between trading and investing is that spread bets and CFDs are leveraged, while investing in shares is non-leveraged. ‘Leveraged’ means you’re trading by putting down an initial deposit amount to open a larger position. In essence, you are borrowing that amount from the provider to make a bigger trade.

So, if you decide to open a position worth £1000 by trading with either spread bets or CFDs, you’ll pay a deposit – called margin – worth a small percentage of this to open a £1000 position.

Leveraged trading can mean that you’re able to make a smaller amount of capital go further, but it’s also higher risk. This is because, with leverage, your profits and losses are calculated based on the position’s full value, not the amount you paid on margin to open that position. This means your losses or profits could substantially outweigh what you paid upfront – unlike in investing, where your losses are capped at your initial outlay.

Both spread bets and CFDs are leveraged, and both give you access to 15,000 markets to trade on.

These include, but are not limited to:

Trading vs investing overview

|

Trading |

Investing |

What are the account types? |

||

What markets can you access? |

15,000+ markets |

11,000+ company stocks |

Will you own the asset? |

No |

Yes |

Do you get shareholder privileges and dividends? |

No shareholder privileges, but positions are adjusted to offset changes from dividends. |

With shares and ETFs, you’ll receive dividends if they’re paid. Owning shares may also grant you voting rights in company decisions. |

Can you go short? |

Yes, you can go short to speculate on prices falling or long to speculate on prices rising. |

Not as standard. To short stocks with traditional short-selling, you’d need to borrow shares, likely from a broker, sell those shares and then buy them back later. However, we don’t offer this. |

Is the position leveraged? |

Yes |

No |

What’s the deposit required to open a position? |

Initial outlay for leveraged trades varies depending on the market and the total position size. |

You’ll pay the full value of the position upfront |

What’s the timeframe? |

Intra-day, short and medium term |

Medium to long term |

Risks |

Trades are leveraged, meaning you can lose substantially more than your initial outlay. |

No investment is guaranteed. You may get back less than invested. |

Risk management |

Choose an automatic stop-loss level to try to limit potential losses. |

Market orders to close |

Market hours |

24-hour trading on forex and major stock indices. We also offer weekend trading on selected markets. However, all spot positions left open after 10pm (UK time) incur additional overnight funding charges. |

Access our exclusive 24-hour trading on over 70 US shares. Otherwise, deal when the underlying exchange or market is open. |

Platforms |

Web-based platform, mobile app, MT4 (for selected CFD trades), ProRealTime for advanced, professional traders. |

Web-based platform, mobile app, L2 Dealer for advanced traders. |

Tax |

No capital gains tax or stamp duty on spread bets.4 |

You’ll pay stamp duty on each deal and capital gains tax on your profits.4 |

Costs |

The main charge when trading is in the spread, apart from share and ETFs CFDs where it’s commission. |

Share dealing incurs zero commission on shares.5 |

Ready to trade or invest?

The 3 main ways to invest

Shares, ETFs and Smart Portfolios

| Shares | ETFs | Managed Smart Portfolios | |

| What it is | Choosing specific companies to invest in by buying stocks | A broad exposure financial instrument that tracks a whole group of stocks or even an industry or sector passively | Leaving the decision-making to the experts by buying a portfolios of ETFs that’s curated for you by our in-house portfolio managers |

| Why you’d choose it | To buy a stake in companies you believe will rise in value, and capitalise on the possible increase in share price by later selling your shares for a profit. Also, to receive any dividends payable and exercise shareholder rights in company decisions. | To diversify investment into an industry or sector you believe in, to possibly make a profit from the positive growth of that whole group of stocks or industry | To access the expertise of professionals and take the weight of decision-making off you, while still gaining exposure to a diverse portfolio of different ETFs picked to align with your goals and interests |

| What we offer | More than 16,000 international and top UK shares | More than 2900 international ETFs | A tailor-made portfolio of stocks and ETFs that fit with your financial aims, preferences and risk profile |

| Find out more | Find out more | Find out more |

The 2 main ways to trade

Spread betting

Spread bets are a way to speculate on the price fluctuations of a market per point of movement, by going long or short. If your prediction is correct, you’ll make a profit – if not, you’ll make a loss. Both profit and loss are calculated by multiplying your bet size by the amount of price points that market has moved up or down.

CFD trading

CFD stands for ‘contract for difference’, because you’re entering into an agreement to exchange the difference in an asset’s price between the time of your opening a position to the time of closing it.

With CFDs, you can go long or short depending on whether you think the market price will rise or fall. If your prediction is correct, the difference in price between your opening of the trade and your closing it is given to you in the form of profit. If your prediction is incorrect, you forfeit that difference instead as a loss

Trading vs investing: an example

To illustrate how spread betting and CFD trading compares to investing via our share dealing account, we’ve put together a brief example based on a position of 5000 Lloyds Banking Group shares.

You'll note that the main charges for spread betting is the spread, wrapped into the buy and sell prices. Whereas for CFD trading and share dealing it's a commission charge when you buy and sell.

| Spread betting | CFD trading | Share dealing | |

Lloyds share price |

50p |

50p |

50p |

Our buy price |

50.05p |

50p |

50p |

You decide to |

Buy (go long), |

Buy (go long on) |

Buy 5000 shares |

Margin amount |

20% |

20% |

No margin, |

Initial outlay (in GBP) |

£500.50 |

£500.00 |

£2500.00 |

Stamp duty |

None4 |

None4 |

1.257 (£2,500.00 |

Commission |

None |

£10.00 |

None |

Share price |

51p |

51p |

51p |

Our sell price |

50.949p |

51p |

51p |

Difference from |

0.899 |

1 |

1 |

Your gross profit |

£44.95 |

£50.00 |

£50.00 |

Value of full position |

£2,550.00 |

£2,550.00 |

£2,550.00 |

Cost to close |

£1.02 |

£10.006 |

£3.005 |

Your net profit or loss* |

£44.95 |

£30.00 |

£42.75 |

Profit or loss as a percentage |

9% |

6% |

2% |

Capital gains tax (CGT) |

None4 |

Subject to CGT, |

Subject to CGT4,7 |

Remember, this example may not be applicable to everyone trading in the UK, as tax is based on individual circumstances and your position may require unique analysis. The table is for illustrative purposes only.

How to take a position when investing

You’ll follow slightly different steps depending on whether you’re buying shares and ETFs yourself or investing in a Smart Portfolio.

To buy stocks and ETFs yourself, you’ll:

- Create a share dealing account or log in

- Choose the asset you want to invest in

- Determine the size of your investment and order type

- Open your investment position and monitor it over the long term

If you want to go with a Smart Portfolio instead, you’ll start the process by taking an assessment to gauge your risk appetite and other factors. Based on your results, we’ll recommend a portfolio. Once you’ve made your selection and deposited the necessary funds, our managers will invest on your behalf.

How to take a position when trading

- Decide whether you want to trade with spread bets or CFDs – this will determine which type of account you open

- Create a live account for either spread betting or CFD trading, or log in

- Find an opportunity and select your first trade

- Select ‘buy’ to go long, or ‘sell’ to go short

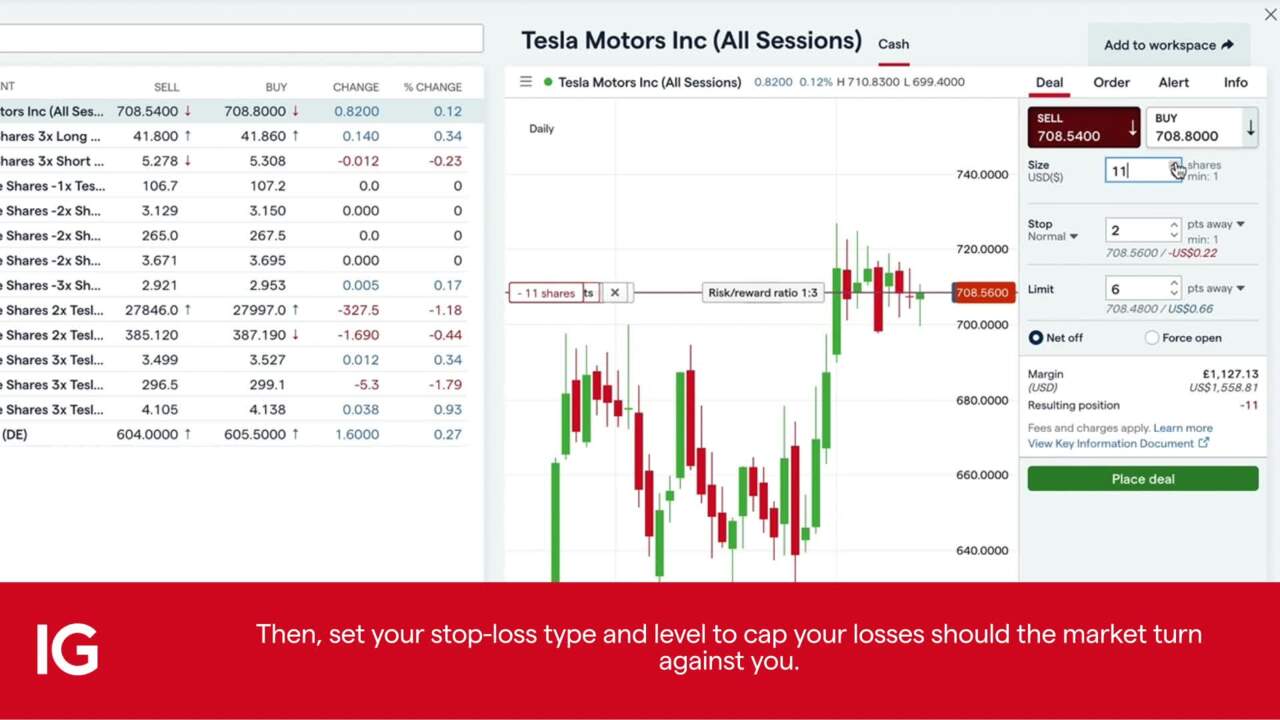

- Choose your position size and take steps to manage your risk

- Open and monitor your trade

Essential investing concepts

The start of a solid foundation when investing is knowledge of the key concepts. Here are a few you need to know:

What’s a stock exchange?

A stock exchange is a centralised financial marketplace where assets such as shares and bonds change hands and are bought and sold for money. Just as you’d go to a marketplace to buy and sell goods like food or clothing, financial assets like shares and ETFs have marketplaces, too. Each country has its own stock exchange with various companies’ shares listed on them.

What are dividends?

Dividends are payments given to shareholders by the company they’ve bought shares in, which usually come out of company profits. Companies that do well financially are more likely to give dividends, or larger dividend payments, than ones that are struggling.

It’s important to note that companies are not required to pay dividends, but may choose to. Some companies pay dividends regularly and predictably, for example each quarter, while others give ‘special’ dividends more sporadically and only if certain profit margins are met. Shareholders should think of dividends as ‘bonuses’ rather than the primary source of their investment income.

Companies announce their dividends ahead of time. When a stock is ‘cum dividend’, it’s due to be paid out soon, on the specified ‘payment date’. Close to this time, that stock is ‘ex dividend’, meaning that payouts are imminent and, if you were to become a shareholder at this point in time, you’d only be eligible for the next dividend and onward.

However, no company or ETF is an island – and wider market conditions and sentiment will often affect the share price or ETF’s price, too. These factors include macroeconomic events (for instance, the Covid-19 pandemic affected almost every company and ETF globally), major geopolitical events in the country that company or ETF is domiciled in, news and fiscal decisions on interest rates and the like.

If the company or ETF in question is linked to a certain industry, for instance mining, the supply and demand for resources from that industry will also materially affect the share price or ETF value.

Essential trading concepts

The start of good investing is solid knowledge base of its basic concepts. Here are a few you need to know:

What’s short and long trading?

Long trading and short trading are the terms for the two main directions a market can move in.

You’ll go long (or ‘buy’, also known as being bullish) if you think what you’re trading on will appreciate in price.

Going short or ‘shorting’ a market (also known as ‘selling’ or being bearish) is the reverse – taking a position with the belief that the asset price will decline.

You’ll make a profit or loss depending on whether your prediction is correct. In other words, you’ll make money going long if market prices rise and lose money if they fall. You’ll make money shorting that market if its price depreciates and make a loss if it instead rises.

Remember, going short is an inherently risky strategy when trading, as your potential for loss is theoretically unlimited. This is because there’s no limit to how much an asset’s price can fall. So, ensure you always take steps to manage your risk.

What’s leverage?

Leverage is a feature of many types of trading, which determines the way you open a position and how much you pay.

Unlike investing, where you’ll pay the full value of the trade upfront to buy that asset, leverage means you’ll pay a small portion of the position’s worth upfront to take a position on the asset.

So, with a leveraged trade, you’ll decide you want to open a position worth a certain amount and then put down an initial deposit to open that trade. This amount is a fraction of the position size and you are essentially ‘borrowing’ the rest from the provider you’re using to trade. When you close your trade for either a profit or loss, both are calculated on the full position size, not your deposit amount. Profits are payable to you, losses are the amount you forfeit.

What's margin?

Margin is the initial deposit amount required to open a leveraged trade. You can find more information on margin in the ‘What’s leverage’ section.

FAQs

Which is right for me: trading or investing?

Whether you’re more of a trader or more of an investor is determined by a number of factors. This could include your financial goals, the timeframes for those goals, your risk appetite, the capital you have available and your knowledge of the financial marketplace.

Generally (although not always), investing is best suited to those who have a long-term view and can wait months or even years to achieve their financial goals. It’s also often used by those with a lower appetite for risk and with enough capital to pay full position sizes upfront.

Trading, on the other hand, is usually shorter-term than investing, with less upfront capital required. However, it does require more of a time commitment and willingness to watch markets regularly. Trading is often higher risk than investing and so is best suited to those with a greater appetite for taking risks.

Not sure whether you’re a trader or investor? Don’t worry – you can open both a trading account and an investment account with us, so you don’t need to choose.

How can I open a trading account?

Once you’re ready, you can open a live trading account with us by filling in our application form. We’ll ask you a few questions about your trading experience and verify your identity (this takes place almost instantly in most cases). Then, you can fund your account and start trading.

How can I open an investment account?

To start investing with us, you’ll need to create a share dealing account. There’s no obligation to fund or invest with us once you’ve opened it. Fill in the form, send us the required documentation listed on our website, and we’ll create a share dealing profile for you. As soon as you fund your investment account, you’re ready to start share dealing.

Can I have more than one account?

Yes. With us, you can open a spread betting account, a CFD trading account and a share dealing account. You can create one, two or all three of these simultaneously – just be aware that you will need to fund each one separately.

What is a demo account?

We offer free a practice account, called a demo, to help you gain experience and confidence before opening a live account, to maximise your chances of successful trading.

Opening a demo account with us is free and gives you access to a demo version of our live platform to familiarise yourself with it, plus £10,000 in virtual funds to practise trading with on the demo.

Where can I learn more about trading?

With us, you get free access to educational resources to learn more about trading and investing. This includes IG Academy, where you can undertake courses in your own time at various skill levels, from the most basic concepts to advanced knowledge.

Apart from this, we also have ‘Analyse and Learn’ content for you to keep learning about trading, including ‘Strategy and Planning’ articles and ‘News and Trade Ideas’ for more current events to keep abreast of in the trading world.

Try these next

Learn online trading skills and tips with this guide

Explore how to trade or invest in shares online

Discover thousands of markets for you to trade on

1 Based on revenue (published financial statements, 2023)

2 Awarded ‘best finance app’ and ‘best multi-platform provider’ at the ADVFN International Financial Awards 2024.

3 Negative balance protection applies to trading-related debt only and is not available to professional traders.

4 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

5 Please note published rates are valid up to £25,000 notional value. See our full list of share dealing charges and fees.

6 With share CFDs, we charge a small commission when you open the position, and again when you close it. The charge is 0.10% per share, with a minimum charge of £10.