How to trade or invest in the Dow Jones

The Dow Jones Industrial Index, or simply the Dow, is one of the most well-known indices in the world, and home to some of the mightiest stocks in the US. Learn how to trade or invest in Wall Street with us.

If you’d like to trade or invest in the Dow Jones, follow these three steps, or discover our full guide below:

1. Decide if you want to trade or invest

There are several ways to gain exposure to Wall Street. The most popular include trading or investing in ETFs and individual shares or trading on the index’s value

2. Form a trading plan

If you’re planning on trading on the Wall Street index, you'll need to decide whether you're a short- or long-term trader – and how you're going to manage your risk

3. Open a live account with us

Open and fund an account with us – spread betting, CFD trading or share dealing. You can open one account, two or all three – just fill in our application form

How can you trade or invest in the Dow Jones index?

Trade the Wall Street index price

With us, you can trade price of the underlying index – the Dow Jones – directly and from a single position. You’ll do this by speculating on the Wall Street index’s price on our platform.

This is the most direct way to get exposure to the Dow Jones, it’s also more liquid than trading on individual stocks, or ETFs. Plus, you can trade it 24 hours a day, Monday to Friday.

When taking a position on the Wall Street index, you won’t own any company shares outright. Instead, you’ll trade on the index’s price movements using leverage derivatives like spread bets or CFDs.

With derivatives, you can go long (buy) or short (sell) on the asset price. You’ll put down an initial deposit (called margin) to open a larger position, with profits and losses calculated on the full position size, not your deposit. Note that this means your profits or losses could outweigh your deposit amount substantially.

Spread bets and CFDs are commission-free when you trade the Dow Jones index, as charges are included in the spread.

Trade or invest in Dow Jones-related ETFs

You can get broad exposure to the entire index by trading or investing in an ETF that tracks the price of the Dow. This means you won’t trade on the current price of the Dow Jones, but rather the ETF’s price, calculated on its net asset value (NAV).

Investing in Dow Jones-tracking ETFs is how many longer-term investors gain exposure to the entire index with just one transaction. You’ll do this with our share dealing platform. Here you’d buy upfront, based on the full value of the Dow Jones-based ETF, and hold until you want to sell.

All this for as little as £0 commission per ETF trade.1 Because an ETF will give you exposure to many Dow Jones-related stocks all at once, this can be a convenient, one-and-done way to track the index.

You could also trade Dow Jones-related ETFs on leverage with spread bets or CFDs, but bear in mind this offers lower liquidity and higher spreads than trading the Wall Street index directly (as in our above explanation). Leveraged trades mean you can go long or short on ETFs. However, again, total profits or losses can significantly outweigh your margin amount, as both are based on the total position size.

|

Trading the Wall Street index price directly |

Trading or investing in a Dow Jones-related ETF |

Trading or investing in Dow Jones-listed shares |

Account types |

Spread betting or CFD trading account |

Spread betting or CFD trading account to trade or a share dealing account to invest |

Spread betting or CFD trading account to trade or a share dealing account to invest |

Market hours |

You can trade our Wall Street market 24 hours a day Monday to Thursday and until 10pm Friday, and also our exclusive Weekend Wall Street market from 8am – 10.40pm on Saturdays and Sundays |

When the New York Stock Exchange is open – 2.30pm to 9pm, Monday to Friday (UK time). You can also trade our exclusive Weekend Wall Street, from 8am-10.40pm, Saturdays and Sundays (UK time) |

When the New York Stock Exchange is open – 2.30pm to 9pm, Monday to Friday (UK time). Also, invest or trade out of hours on top Dow Jones 30 stocks like Apple, Microsoft, Nike, Visa and more. See our after-hours times |

Timeframe |

Short to medium term |

Short to medium term for trading and long term for investing |

Short to medium term for trading and long term for investing |

Liquidity and execution |

0.0014 second execution speed and unique deep liquidity |

Higher liquidity offered by trading the index directly |

Higher liquidity offered by trading the index directly |

Costs |

Commission-free, spreads from just 2.4 points (for spread bets). Trading Wall Street on the spot (cash) incurs overnight fees, but index futures don’t incur these fees |

Commission-free for spread betting, with a commission charge of just 0.1% on each side of the trade for CFDs. Spreads from just 0.10% for spread bets. Cash (spot) ETF trades incur overnight fees. |

Invest in shares and ETFs from £0 commission per trade.1 With trading, get spreads from just £0.20 or 1 point for spread bets and CFDs, minimum £10 commission for share CFD trade. |

How to start trading or investing in the Dow Jones

If you’re ready to start trading or investing in the Dow Jones, follow these five steps:

Create your trading or investing account

You can open three different account types with us to take a position on the Wall Street index: spread betting or CFD trading accounts, or a share dealing account.

Spread betting and CFD trading |

Share dealing |

|---|---|

Speculate on the price of the index, shares and ETFs rising or falling |

Buy and sell underlying shares and ETFs |

Leverage your exposure – you’ll only pay a deposit to get exposure to the full position size |

Pay the full value of the shares or ETFs you buy upfront |

Leverage means both profit and loss will still be magnified to value of the full trade – so you could gain or lose money faster than you’d expect Trade tax-free with spread bets and offset losses with CFDs3 |

You may get back less than you put in because the value of shares and ETF can fall as well as rise Invest tax-free with a stocks and shares ISA3 |

Take shorter-term positions |

Focus on longer-term growth |

You can look to hedge your portfolio when trading |

Build a diversified portfolio |

Trade without owning the underlying asset |

Take ownership of the underlying asset |

No shareholder privileges |

Gain voting rights and dividends (if paid) |

Learn what moves the Wall Street index’s price

If you want to make a profit trading or investing in the Wall Street index, you’ll need to open and close positions at just the right time. For this, it’s essential to have a good understanding of what moves the index’s price.

Here are a few of the main factors that will drive the price up or down:

Strength of the dollar

The strength of the US dollar will have an effect on the price of the underlying (Dow Jones), and therefore the Wall Street index. A strong dollar often means that the index will rise in value, while a weaker dollar will generally mean it falls.

Value of Dow Jones-listed companies’ shares

As the underlying index is made up of companies on the New York Stock Exchange (NYSE) and the NASDAQ, the share prices of those companies will affect the index’s price in turn. As it is a price-weighted index, the performance of companies with a higher share price will have a greater effect over the value of the index compared to those with lower share prices, because they have a greater weighting in how the Dow is valued.

Earnings reports

Similarly to ordinary share prices, constituent companies’ earnings reports will affect the index. Strong earnings in large companies that are heavily weighted in the Dow Jones will often causing an increase in the Wall Street index’s price, and weak reports will usually mean a decrease.

Economic events

It’s not just the index’s companies themselves that affect the Wall Street index, macroeconomic factors can play a role, too. Any geopolitical factors that’ll affect the dollar’s price will likely affect Wall Street

News

While macroeconomic events themselves will play a factor, so too will news articles. Widely viewed news, both positive and negative, will affect the index’s price. In particular, news about central bank announcements, changes to fiscal policy in the States and reporting on big events like presidential elections will all move the value of the index.

Perfect your strategies

There are a few ways you can hone your Wall Street index trading strategy, to ensure the best possible chance of doing well when trading or investing in it. Here are some steps to follow:

- Choose your trading style: the first thing to determine is whether you’d suit a short-term, medium-term or long-term trading strategy. There are four main trading styles – scalping, day trading, swing trading and position trading

- Study charts and price action: poring over daily and weekly charts will help you learn the rhythms of the index and the market at large, which will help you get a feel for what the index might do going forward and be able to strategise accordingly

- Look for trading signals: by studying the Wall Street index price chart, you should be able to tell whether the current trend is bullish or bearish. You can confirm current trends with momentum indicators like the stochastic oscillator or relative strength index (RSI)

- Follow industry news: you shouldn’t only rely on technical analysis to craft your trading or investing strategy, you should also keep an eye on the news. As we’ve said, macroeconomic events and news articles can materially affect the Wall Street index’s price, so keeping an eye on the headlines is vital for your strategy

- Set trading alerts: of course, it’s unreasonable to expect yourself to watch the news or the market constantly. That’s why you can also use trading alerts with us, to get automatic prompts when the market’s doing something important to your strategy. Input your chosen alerts when opening a position and you’ll be notified once your alerts are triggered. You can receive trading alerts via email, SMS or push notification on our platform

Open your first Wall Street position

Let’s take a more detailed look at the various ways you can open a position using spread bets, CFDs or share dealing.

Spread betting on the Wall Street index

By spread betting on the Wall Street index, you can speculate on whether its price will rise or fall without owning any shares outright.

You’ll bet per point of the index’s movement, making a profit or loss based on whether your prediction is correct. So, excluding spread, if you go long and bet £10 per point that the Wall Street’s price will go up, you stand to gain £200 if the index price moves up by about 20 points (depending on the index’s price at that moment – in this example it’s £10 per point x 20 points) or lose £200 if the index price goes down 20 points instead.

Spread betting attracts zero commission charges. Instead, your cost of the trade is mostly encompassed in the spread.

Spread betting on Wall Street: cash indices

You can spread bet on the current price of the Wall Street index with the cash (spot) price.

This is how many choose to trade Wall Street with us, as it has tight spreads, no commission charges and mirrors the real-time index price more closely than futures pricing does.

Because spot trading incurs overnight funding charges if you leave a position open after 10pm (UK time), it’s best suited to short to medium-term trading strategies (you can read more on perfecting your trading strategy below.)

Our cash prices for the Wall Street index are based on our future’s price, with a fair value adjustment to get to a spot price as close to the real-time price of the index as possible. Spot trading (known as cash trading on our platform) is best done during the Dow Jones index’s normal market hours. The hours are based on the New York Stock Exchange’s regular hours, which are 2.30pm to 9pm, Monday to Friday (UK time).

However, good trading opportunities don’t always wait for 9am Monday – which is why we offer weekend Wall Street trading hours, too. This means you can trade Wall Street from 8am Saturday to 10.40pm Sunday. Bear in mind, though, that the index is priced on client sentiment, news and underlying market conditions like volatility during this time, not on the index price, as markets are closed.

To open a position:

- Go to the spread betting platform

- Navigate to the Wall Street index under ‘Indices’

- Select ‘Cash’ instead of ‘Futures’ to trade

- Decide whether you want to buy (go long) or sell (go short)

- Choose the size of your position per point

- Set yours stops and limits

- Click ‘place deal’ to open the position

Spread betting on Wall Street: index futures

While spread betting cash indices can work well for short-term traders, you can also trade on Wall Street via index futures.

The way that futures work is that you’ll agree to trade the Wall Street index at a specific price on a specific date in the future. This is often attractive for medium to longer-term trading strategies because you won’t incur any overnight fees. Plus, until the contract’s expiry date comes around, you can leave your position open as long as you want, albeit with wider spreads.

You’ll never have to pay any commission charges when spread betting on Wall Street futures, as we charge just our spread for index futures.

To open a Wall Street futures position:

- Go to the spread betting platform

- Select the Wall Street index under ‘Indices’

- Choose ‘Futures’ instead of ‘Cash’ to trade and select your preferred date range

- Decide whether you want to buy (go long) or sell (go short)

- Choose the size of your position per point

- Set yours stops and limits

- Click ‘place deal’ to open the position

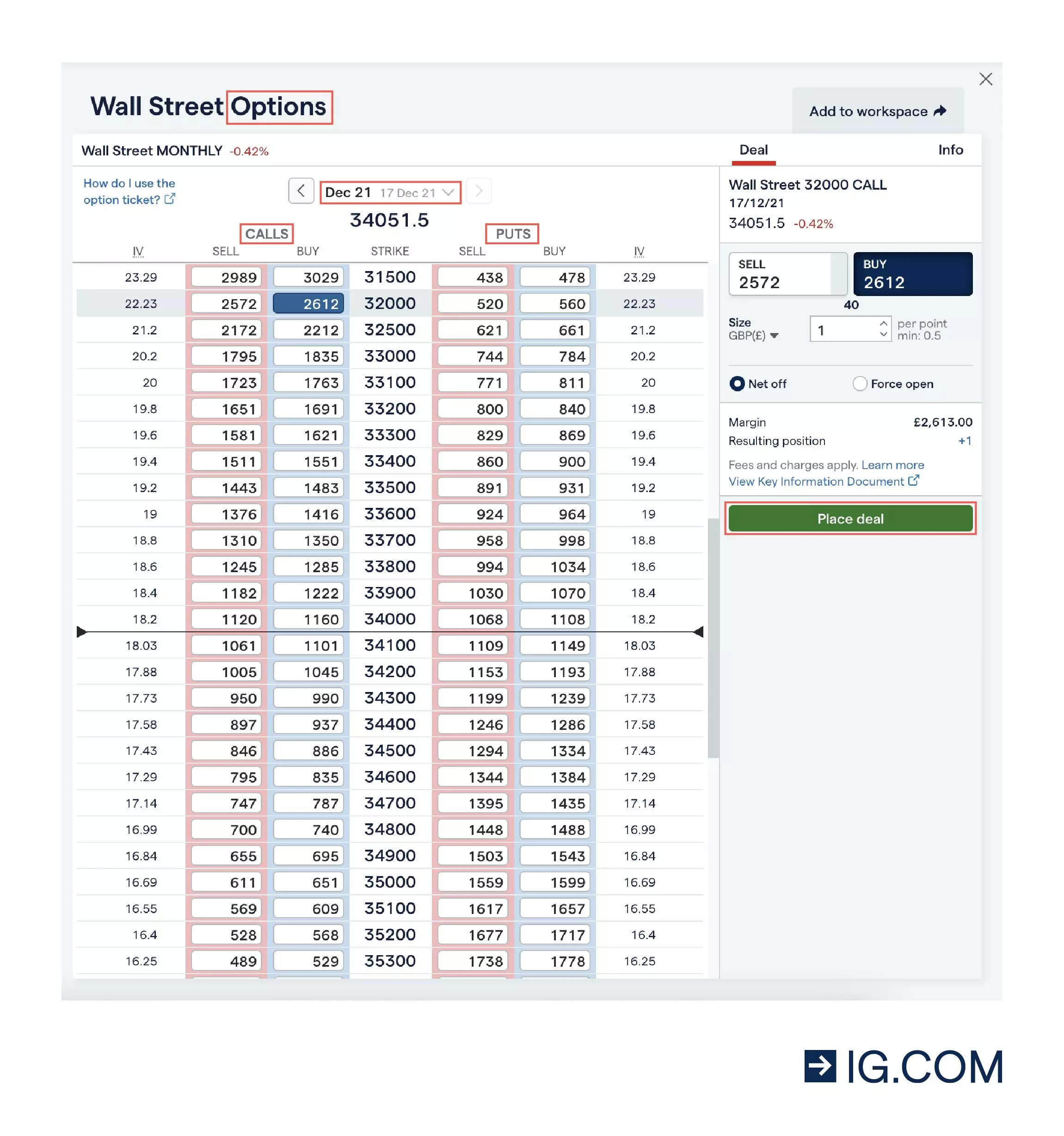

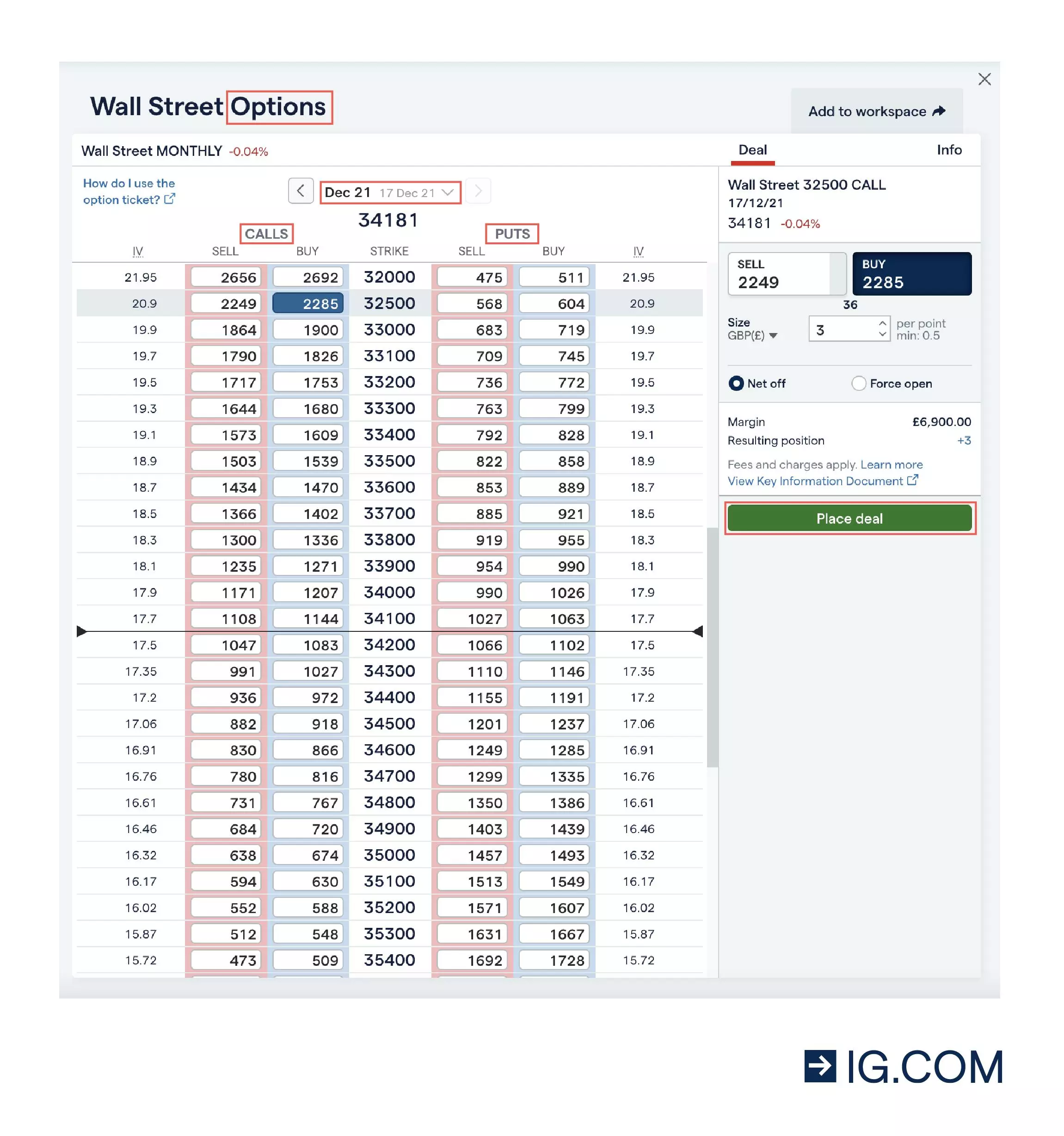

Spread betting on Wall Street: options

With us you can also trade the Wall Street index via options, which give you the right, but not the obligation, to buy or sell the options contract before a set expiry date in the future.

When you trade options by spread betting on our platform, you’ll be speculating on the Dow Jones’s price and if the index price will move beyond a certain point, before your expiry date is reached.

Bear in mind when spread betting options that, when buying options, you’ll only risk as much as the premium you pay when opening your trade. However, there is potentially unlimited risk when selling options, as there’s no limit to how much market prices can rise. For this reason, options trading is often only recommended for experienced traders.

To open an options position with spread betting:

- Go to the spread betting platform

- Click on Options’ instead of ‘Indices’

- Choose ‘Indices’ as your asset class and select ‘Wall Street’

- Decide on your preferred maturity date range – daily, weekly or monthly

- Select a call or put option, and whether you want to buy (go long) or sell (go short)

- Choose the size of your position

- Set yours stops and limits

- Click ‘place deal’ to open the position

Spread betting on Wall Street: ETFs

Want to gain broad exposure to the Wall Street index with a single trade? You can also spread bet on exchange traded funds (ETFs), instruments that track the performance of a range of Dow Jones-listed stocks or even the index itself.

With spread betting, you can get high liquidity and lower spreads than trading with CFDs, even from as little as 0.1%. There’s no commission charge, only the spread, plus overnight funding fees if you leave your position open after 10pm (UK time) on the day it’s created.

ETFs are available to trade with a cash (spot price) market. This means you cannot trade Dow Jones-related ETF futures.

To open a Dow Jones-tracking ETF position:

- Go to the spread betting platform

- Select ‘ETFs’ instead of ‘Indices’

- Click on an ETF, for example the iShares Dow Jones U.S. ETF

- Choose whether you want to trade ETFs on the spot (cash) or using forwards

- Decide whether to buy (go long) or sell (go short)

- Choose the size of your position per point

- Set yours stops and limits

- Click ‘place deal’ to open your position

Spread betting on Wall Street: shares

If you want to target a specific Dow Jones-listed stock with us, you can spread bet directly on all its constituent companies’ prices with us.

Because you’re trading on share prices, rather than owning those shares outright, you can speculate on whether the share price will rise or fall. Depending on whether your prediction is correct, this means you can make a profit (or loss) whether the market’s dropping or climbing.

As spread betting is leveraged, this also means you pay an upfront deposit a fraction of the cost you’d to buy the company shares if investing. Instead, you’ll pay your deposit (called margin) to open a larger position. Bear in mind, though, that profits and losses will be calculated based on your total position size, which could easily outweigh your margin amount.

Spread betting also means you don’t have to pay any commission charges, with spreads from just 2.4 points and additional overnight funding charges if you leave your position open longer than one day (and are trading on cash, not futures).

Of course, you can also invest in companies listed on the Dow, owning shares rather than speculating on the share price. Read on to find out how.

To open a shares position:

- Go to the spread betting platform

- Select ‘Shares’ instead of 'Indices' or 'ETFs'

- Click on your chosen stock, for example Apple

- Choose whether you want to trade with Cash or Forwards

- Decide whether to buy (go long) or sell (go short)

- Choose the size of your position per point

- Set yours stops and limits

- Click ‘place deal’ to open your position

Trading CFDs on the Wall Street Index

CFDs (contracts for difference) enable you to enter into a contract to speculate on the price of the Wall Street index, or the share price of Dow Jones-listed companies. The amount the index or share price rises or falls (so, the difference between the price when you open your position versus when you close it) determines your profit or loss.

Trading CFDs on Wall Street: cash indices

You can trade CFDs on the Wall Street index using the spot trading (known as cash in our platform), which is derived from future’s price with a fair value adjustment to get as close to the real-time cash price of the index as possible.

Trading Wall Street CFDs on the spot (cash) price means you don’t pay any commission charges, and spreads are lower than the futures price, although overnight funding fees apply (unlike with futures). This means cash or spot prices are often best suited to short-term trading strategies, which won’t require leaving a position open for longer than one day.

To open a Wall Street spot position:

- Go to the CFD trading platform

- Select the 'Wall Street index' under 'Indices'

- Choose 'Cash' instead of 'Futures' to trade and select your preferred date range

- Decide whether you want to buy (go long) or sell (go short)

- Choose your deal size in terms of number of contracts

- Set yours stops and limits

- Click ‘place deal’ to open your position

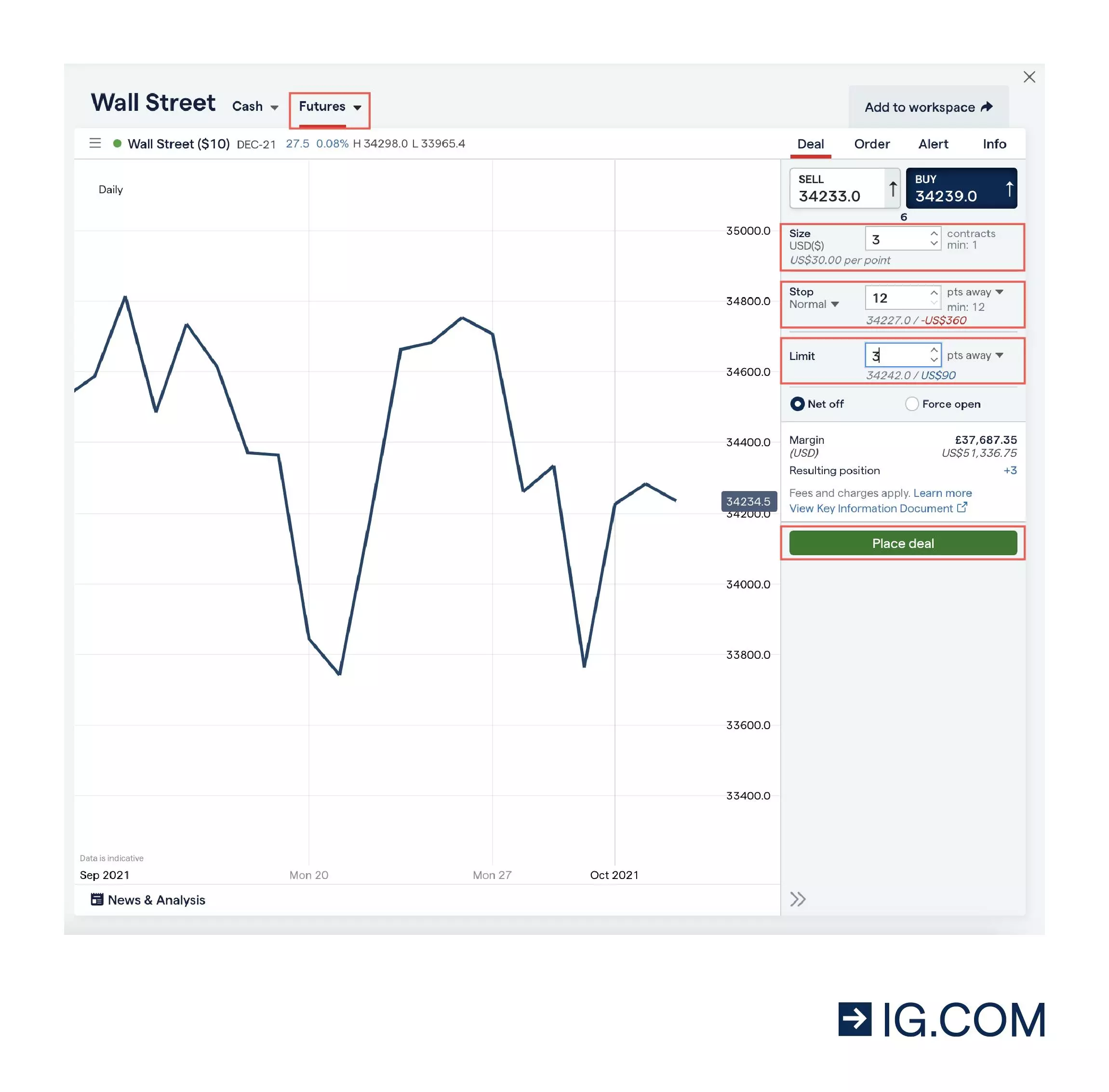

Trading CFDs on Wall Street: index futures

You can also trade Wall Street CFD futures with us, which don’t attract the same overnight funding charges that cash (spot) trading does.

Trading index futures via CFDs means you’re agreeing to trade the Wall Street index at a specific price on a specific date in the future.

This is commission-free, with slightly wider spreads than you’ll find on cash markets.

To open a Wall Street futures position:

- Go to the CFD trading platform

- Select the 'Wall Street index' under 'Indices'

- Choose 'Futures' instead of 'Cash' to trade and select your preferred date range

- Decide whether you want to buy (go long) or sell (go short)

- Choose your deal size in terms of number of contracts

- Set yours stops and limits

- Click ‘place deal’ to open your position

Trading CFDs on Wall Street: options

As we’ve said earlier, with options you have the right, but not the obligation, to exercise the contract on or before its expiry date. When you trade options via CFDs, you’ll pay an initial deposit (called premium) to open a larger position. You’ll then speculate on the option’s premium for a profit or loss – with both able to significantly outweigh your deposit amount as profits and losses are calculated on the full position size.

Buying options is limited risk as you’ll only risk as much as the premium you pay, but selling options is technically unlimited risk, as there’s no restriction to how much a market’s price can rise.

To open a CFD options position on the Wall Street index:

- Go to the spread betting platform

- Click on 'Options' instead of 'Indices'

- Choose ‘Indices’ as your asset class and select ‘Wall Street’

- Decide on your preferred maturity date range – daily, weekly or monthly

- Select a call or put option, and whether you want to buy (go long) or sell (go short)

- Choose the size of your position

- Set yours stops and limits

- Click ‘place deal’ to open the position

Trading CFDs on Wall Street: ETFs

If you’d like to trade CFDs but would like broad exposure to a variety of different Dow Jones constituent stocks all in one trade, then you could trade ETFs with us. Exchange traded funds (ETFs) are investment instruments that track the performance of a basket of Dow Jones-listed stocks.

ETFs attract low commissions – just 0.10% on each side of every CFD trade, with a minimum fee of £10 for online orders. Just remember, because you’ll be trading on the cash (spot) price, you’ll incur overnight fees if your position is left open longer than a day.

To open a Dow Jones-tracking ETF position:

- Go to the CFD platform

- Select ‘ETFs’ instead of 'Indices'

- Click on a Dow Jones-related ETF, for example the iShares Dow Jones Industrial Average UCITS ETF

- Choose whether you want to trade on the spot (cash) or using forwards

- Decide whether you want to buy (go long) or sell (go short)

- Choose your deal size in terms of number of contracts

- Set yours stops and limits

- Click ‘place deal’ to open your position

Trading CFDs on Wall Street: shares

If you’d like to trade certain Dow Jones-listed stocks instead, without owning assets outright, you could trade shares using CFDs.

CFD share trades are leveraged, meaning you’ll put down a small deposit (called margin) to open a larger position and speculate on a company’s share price, rather than buying the shares outright, paying the full share price upfront.

In this way, your initial CFD share trade margin costs a fraction of what it would to buy shares. Just remember that profits and losses are calculated based on the total position size, not your margin amount, and can outweigh your margin significantly.

When you choose CFD share trading, you can enjoy very low spreads. CFD trades on US shares also attract a minimum commission charge of $15 online. You’ll also be trading on the spot (cash) price with share CFDs, so remember that you’ll incur overnight funding charges if your position is left open for longer than a day.

To open a Dow Jones constituent shares position:

- Go to the CFD trading platform

- Select ‘Shares’ instead of ‘Indices’ or ‘ETFs’

- Click on your chosen company, for example Apple

- Decide whether you want to buy (go long) or sell (go short)

- Choose your deal size in terms of number of contracts

- Set yours stops and limits

- Click ‘place deal’ to open your position

Investing in Wall Street with share dealing

If you want to own actual shares of companies listed on the Dow Jones, like Apple or Microsoft, you can do that with us too, via our share dealing platform.

This means you’d buy a Dow Jones-listed company’s shares outright for the full share price. The difference between the company’s share price from when you bought the shares compared to when you sold them is the profit or loss that you’d make.

Because you’re buying shares outright and not trading on leverage, you’ll make a profit when the share price rises and a loss if it falls. However, because it’s not a leveraged trade, you don’t risk losing more than you paid to open the position.

Buying Dow Jones-related ETFs with share dealing

One of the things you can buy on our share dealing platform is Dow Jones-tracking ETFs. As we’ve mentioned previously, ETFs track the performance of a range of Dow Jones-related companies or track the Dow Jones index’s performance itself.

On our share dealing platform, you’re buying ETFs outright, rather than speculating on ETF prices as you would with trading. This means many investors have a ‘buy and hold’ approach to ETFs, most suitable to long-term trading strategies.

Even better, investing in US ETFs means you can pay no commission charges (£0 per trade) if you open three or more positions in the previous month,1 with a standard rate otherwise of £10.2 If you want to invest in a UK-listed ETF that tracks the Dow instead, you’ll pay £3 commission per trade if you open three or more positions in the prior month,1 with a standard rate of £8 per trade for less.

Buying Dow Jones-listed shares with share dealing

Of course, you can also buy Dow Jones constituents’ shares with us. This allows you to pick the right company for your particular strategy with a laser focus unlike the broad strokes of ETFs. If you’ve ever dreamed about actually owning Apple shares, or some other company of that stature, investing in Dow Jones-listed shares could be the right choice for you.

Just like with ETFs, investing in US shares means you can pay zero commission per trade if you open three or more positions in the month prior,1 with a standard rate otherwise of £10.2

Investing in a managed portfolio

If you’d rather hand over the reins of your investing to a professional, we also offer managed portfolios, called IG Smart Portfolios.

Here, you’ll get a bespoke bouquet of Dow Jones-listed stocks and funds chosen according to your unique investment goals and desires. A managed portfolio invests on your behalf, including into Dow Jones constituents if you wish, and takes care of the details so you don’t have to.

Often, many people assume that costs for something as exclusive as a managed portfolio must be sky-high. But with us, you’ll pay a fee of just 0.72% on your first £50,000 and a 0.22% fee after that.

FAQs

What are the ways you can trade or invest in the Dow Jones?

With us, you can trade and invest in the Wall Street index, which tracks the price of the Dow Jones. You can trade via spreads or CFDs, and can use both to trade on the index price directly, Dow-related ETFs, Dow Jones constituent shares and more. You can also trade the spot (cash) price or futures (or forwards).

If you’d prefer to invest, you can do so on shares or ETFs on our share dealing platform. Alternatively, you can open an actively managed portfolio so that we take care of the investing for you.

What are the stocks on the Dow Jones?

The Dow Jones index is comprised of 30 stocks, which are widely considered to be the biggest and best in their respective industries. These include Apple, Microsoft, Nike, Coca-Cola, Boeing, Disney, McDonald’s and Johnson & Johnson, among others.

How do companies join the Dow Jones?

The stocks on the Dow Jones index don’t change often and are hand-selected as titans of their industry. That’s because the caretaker of the Dow Jones index, the S&P Dow Jones Indices company, votes on the stocks to include on the Dow Jones via committee. This means companies cannot apply to join the Dow Jones but are independently chosen by members of the S&P Dow Jones Indices.

How is the Dow Jones’ price calculated?

The Dow Jones Industrial Average index (or the ‘Dow Jones’ or ‘Dow’ for short) is a collection of the largest blue-chip stocks on the NYSE and the NASDAQ. It’s a price-weighted index. This means that the stocks’ share prices affecting the weighting of the index in descending order. So, more expensive shares like Apple will determine the Dow Jones’ price more than smaller stocks with lower share prices.

To determine the Dow Jones’ price, the index’s companies’ share prices are added together and divided by a specially calculated divisor number (as a more mathematically accurate substitute for dividing the share prices by the number of stocks there are in the Dow Jones – which is 30). These companies’ shares will have different weightings each depending on how high their share price is. This means that sudden changes in share price of a heavily weighted stock on the Dow Jones, for example on the day earnings reports are released, can significantly affect the Dow Jones’ price. This, in turn, will affect our Wall Street index price.

What are the Dow Jones’ trading hours?

The Dow Jones index is open during New York Stock Exchange hours, from 9.30am to 4pm Eastern Standard Time. This translates to 2.30pm to 9pm UK time. Bear in mind, though, that this will change in winter due to daylight savings.

Luckily, with us you can trade the Wall Street index 24 hours a day, Monday to Friday. You can also trade our exclusive Weekend Wall Street, from 8am to 10.40pm, Saturdays and Sundays (UK time).

1 Please note published rates are valid up to £25,000 notional value.

2 See our full list of share dealing charges and fees.