How to trade or invest in water

Discover how to trade or invest in water with us, the UK’s No.1 trading provider.1

Ready to starting trading or investing in water? Follow these steps:

1. Choose whether to trade or invest

Learn about the differences between spread bets, CFDs, and share dealing.

2. Identify a stock or ETF through your own analysis

Carry out your own technical and fundamental analysis to identify a stock or ETF that you’d like to take a position on.

3. Open an account and place your trade or investment

Open a trading account to speculate with spread bets and CFDs, or open a share dealing account to take direct ownership.

If you’d like to learn more before you start trading or investing in water, here’s our full guide:

5 steps to trading or investing in water

Learn about the water industry

The water industry is concerned with the supply of water to both residential and industrial properties. This includes the supply of drinking water, waste water, sewage works and water distribution systems. In many respects, water is part of the utilities industry – and access to water is regarded as a basic human right.

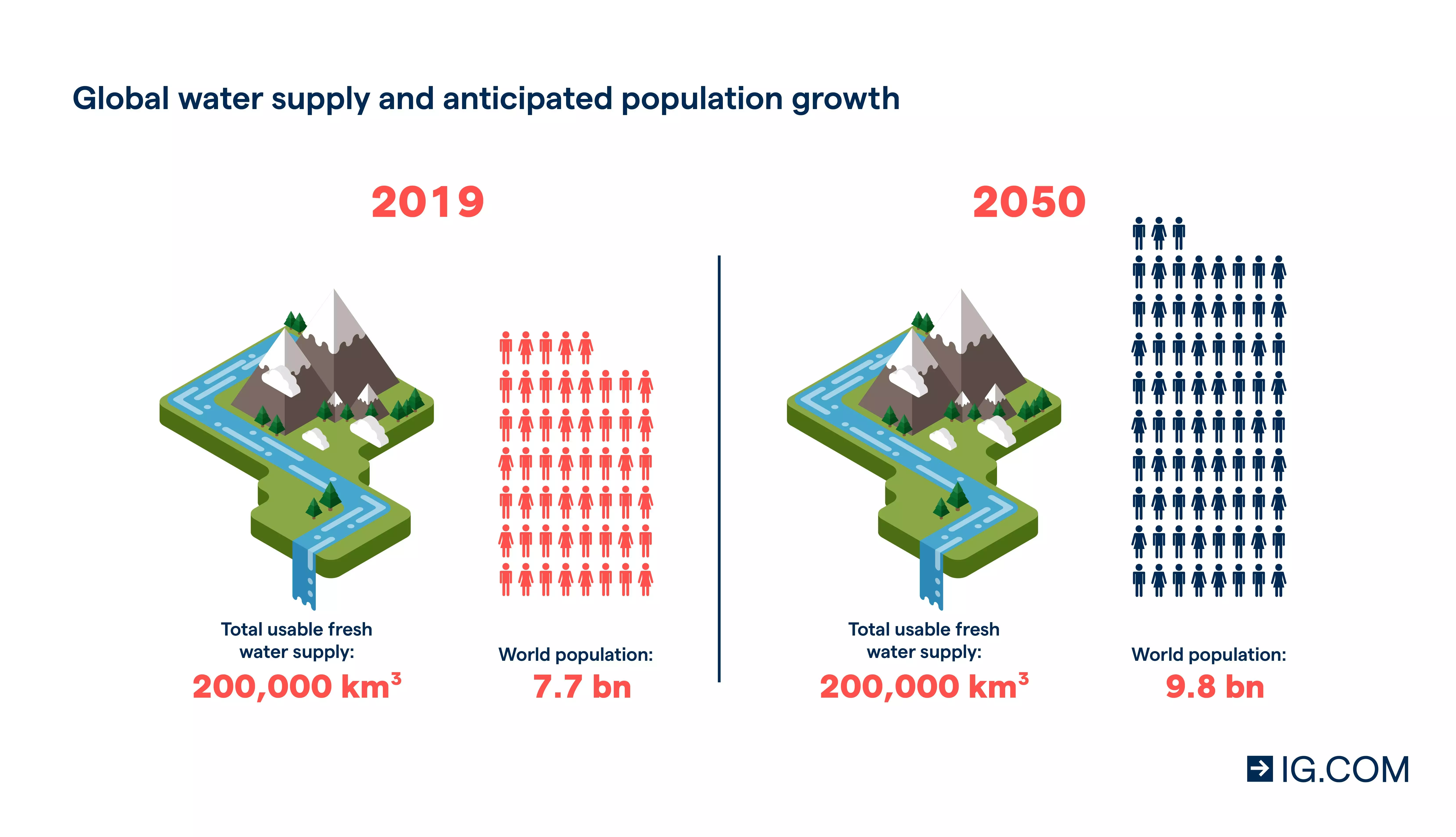

That said, water is currently facing a different set of challenges to the rest of the utilities industry. That’s because it’s in high demand due to the inherent nature of human life, but there are growing concerns about a supposedly increasing scarcity of clean, readily usable water. This is especially true with a growing global population, and the water industry will face ever-increasing pressure in the coming years to ensure that peoples’ daily water needs are met.

Discover why people trade or invest in water

Water trading and investing is how people are looking to capitalise on the increasing uncertainty surrounding the water industry and the future of water security. The idea behind trading or investing in water is that access to a commodity that’s so essential for life on Earth might become harder to obtain in the coming years.

Let’s put this into perspective with an example. China is set to have a 25% annual water deficit by 2030. This is one supposed reason for the country’s occupation of the Tibetan plateau – the glacial meltwater from which feeds the Yellow and Yangtze rivers in China, as well as the Brahmaputra and Indus in India. Control of the plateau secures a greater certainty of a steady water supply.

Water is one of several thematic opportunities that’ve gained popularity in recent years – and people are interested to see exactly what this industry has in store. Other thematic investing opportunities include 5G, electric vehicles and artificial intelligence.

- Stocks

- ETFs

| Trading | Investing |

| Speculate on stock prices rising or falling with spread bets or CFDs. | Buy the stocks outright and benefit from any upward movement in their price. |

| Trading | Investing |

| Speculate on ETF prices rising or falling with spread bets or CFDs. | Buy shares in an ETF outright and benefit from any upward movement in the ETF’s price. |

- Water stocks live market prices

- Water ETFs live market prices

.jpg/jcr:content/renditions/original-size.webp)

Choose whether to trade or invest in water

| Trading | Investing | |

| Markets | Water shares and ETFs | Water shares and ETFs |

| Method | Trading derivatives like spread bets or CFDs | Investing with a share dealing account, ISA or IG Smart Portfolio |

| Time frame | Short to medium term | Medium to long term |

| Initial capital required | Deposit (margin) | Full value of investment |

| Returns | Profit from long and short positions | From capital appreciation and dividends |

| Cost of trading | Spreads when spread betting, commission when CFD trading. Margin requirements vary | Buy and sell shares and ETFs from zero commission for UK2 |

| Tax benefits | Spread bets are tax free, and both spread bets and CFDs are free from stamp duty3 | IG ISAs aren’t subject to capital gains tax (CGT) or income tax3 |

| Risk | Leverage can magnify both your profits and losses as they’ll be based on the full exposure of the trade, not just the margin required to open it. This means losses as well as profits could far outweigh your margin, so always ensure you’re trading within your means. | Limited to the initial outlay |

| Style | Day trading, swing trading, trend trading and position trading | Passive and active investing |

Trading vs investing in water

Trading and investing are similar terms that are sometimes used interchangeably – but there are some important differences between them.

‘Trading’ means that you’re speculating on the price of something rising (going long) or falling (going short) using derivatives like spread bets or CFDs. These are leveraged products, which means they enable you to get full market exposure for an initial deposit – known as margin. But, it’s worth mentioning that leverage can increase both your profits and your losses.

‘Investing’ means that you’re taking direct ownership of water company shares or shares in water ETFs to benefit from prices rising. Leverage isn’t available for investments, so you’ll need to commit the full cost of the position upfront. But, this also caps your maximum risk at this initial outlay.

Here’s how our share dealing rates match up to our competitors:

| IG | Hargreaves Lansdown | AJ Bell | |

| Best commission rate on US shares | Free |

£5.95 | £4.95 |

| Standard commission rate on US shares | £10 | £11.95 | £9.95 |

| FX conversion fee | 0.5%** | 1% - 0.25% | 0.75% - 0.25% |

| Best commission rate on UK shares | £3 | £5.95 | £4.95 |

| Standard commission rate on UK shares | £8 | £11.95 | £9.95 |

| How to qualify for the best rate | - | 20+ or more trades in prior month | 10+ trades in prior month |

Other fees may apply. See our costs and fees.

**Increasing to 0.7% from 7 April 2025

Identify an opportunity through your own analysis

Competent analysis can be the difference between making a profit or incurring a loss. It’s important that you do both fundamental and technical analysis before you open a position on a water stock or ETF.

- Technical analysis looks at chart patterns, technical indicators and historical price action

- Fundamental analysis is based on the fundamentals of a company, including its net revenue and profit and loss statement

Interested in analysis? Find out more at IG Academy

Pick your platform and place your water trade or investment

Our award-winning trading platform is available on desktop or our mobile app.4 You’ll get in-platform news and analysis from our team of experts, as well as Reuters newsfeeds, plus you’ll receive access to a range of technical indicators to help in your chart analysis.

Step-by-step guide to making a water stocks or ETFs trade

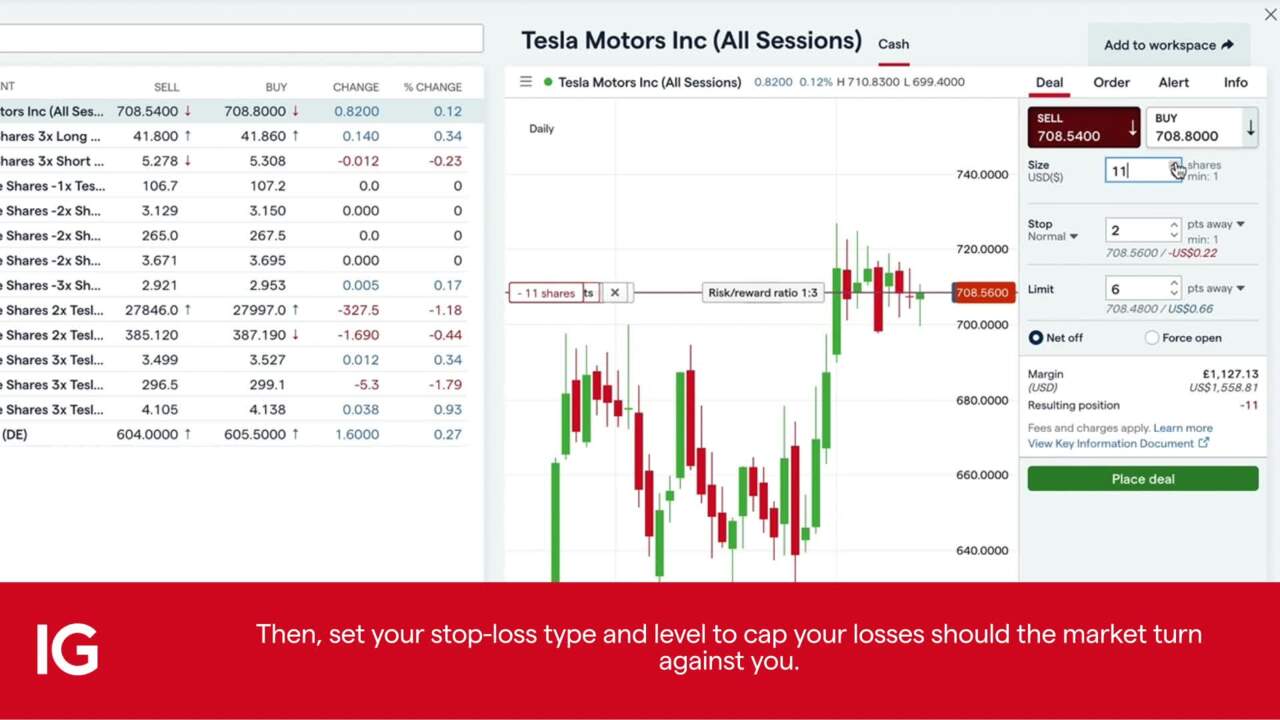

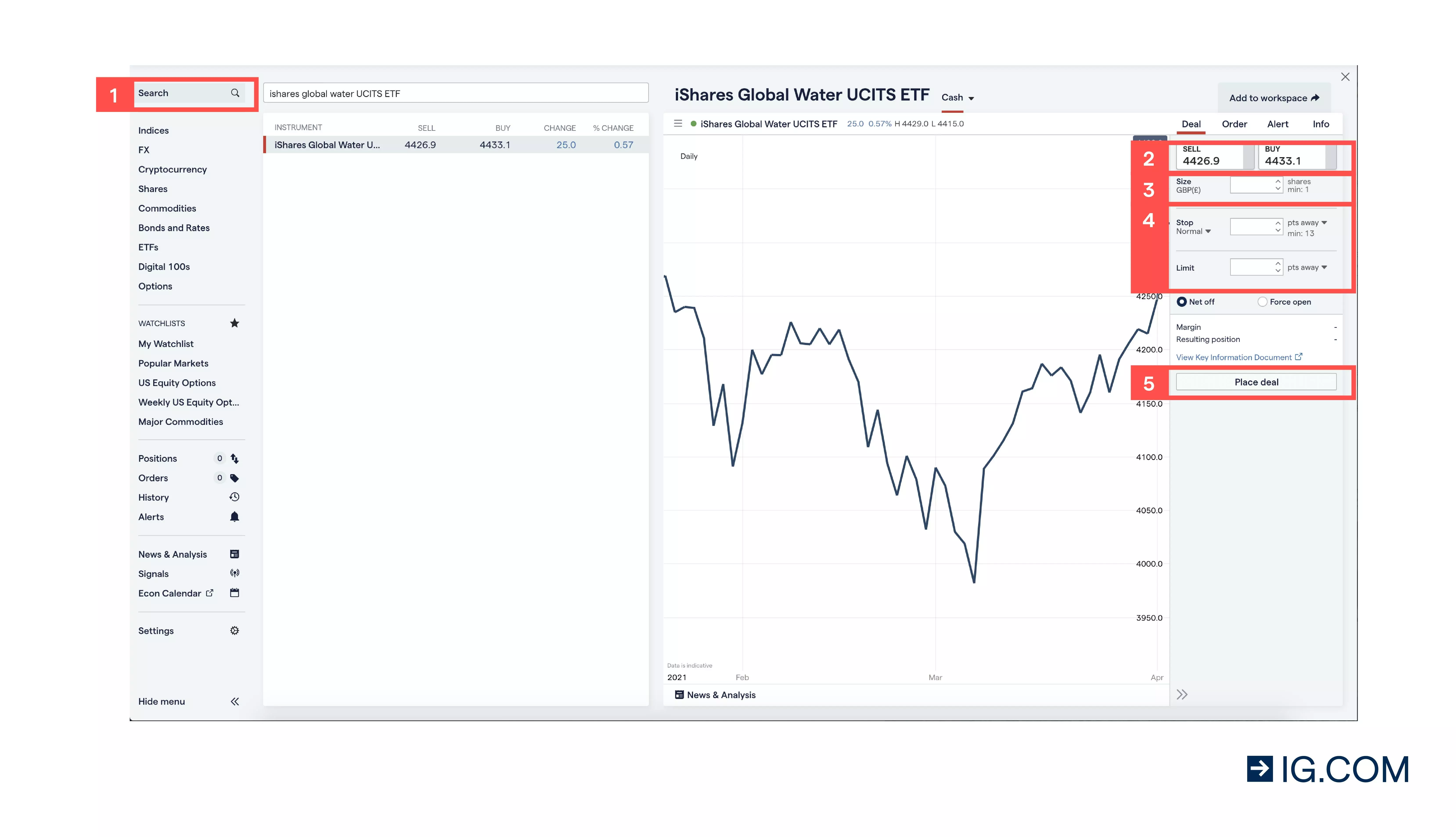

Here’s a screenshot of our trading platform and five steps to show you how to open a water position using spread bets or CFDs.

- Search for and select your opportunity

- Choose ‘buy’ to go long or ‘sell’ to go short

- Put in your position size

- Set your stops or limits to help manage your risk

- Place your deal and monitor your position

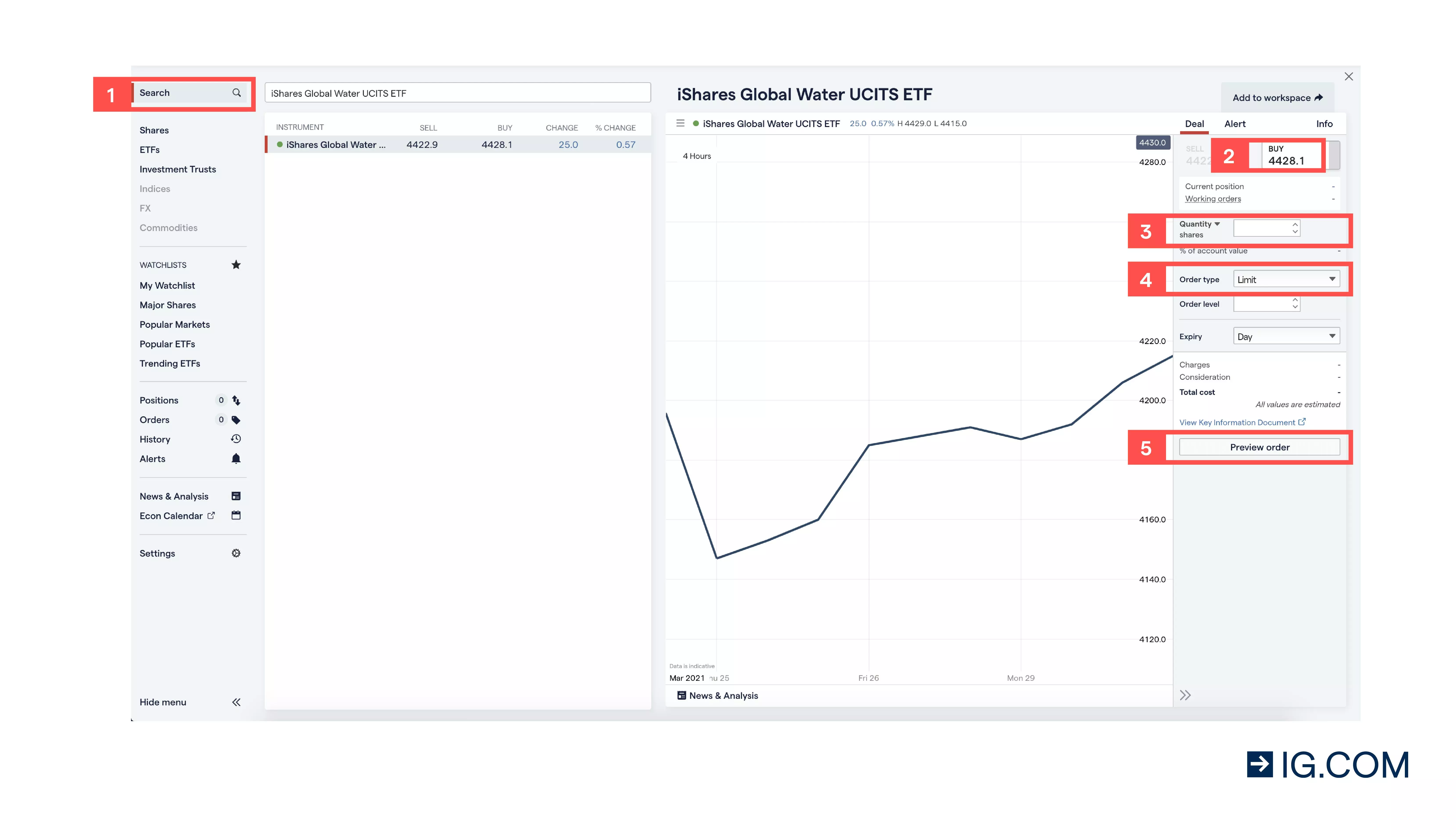

Step-by-step guide to making a water stocks or ETFs investment

Here’s a screenshot of our investment platform, with some steps that take you through how to open a water investment in stocks or ETFs.

- Search for and select your opportunity

- Choose ‘buy’ to open your investment

- Put in your position size

- Set your order type

- Place your deal and monitor your position

If you’re not ready to take a position on the live markets yet, we’ve also got free educational courses at IG Academy to help you get the most out of your time on the markets. If you’re not ready to trade with a live account, maybe you’ll want to try our demo – which gives you £10,000 in virtual funds to help build your confidence in a risk-free environment.

1 Based on revenue (published financial statements, 2023).

2

Other fees may apply

3

Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4

Best trading platform as awarded at the ADVFN International Financial Awards and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2020.