How to invest in AI stocks & ETFs: your complete guide

The artificial intelligence revolution is creating unprecedented wealth. According to the UN Conference on Trade and Development, the global AI market is projected to explode from $189 billion in 2023 to a staggering $4.8 trillion by 2033, a 25-fold increase in a single decade.

What Are AI Stocks?

Artificial Intelligence (AI) stocks are shares in companies that develop, produce or apply AI technologies across various sectors, including:

- Semiconductor manufacturers

- Software development companies

- Cloud computing providers

- Quantum computing trailblazers

- Data analytics firms building machine learning

Since OpenAI’s ChatGPT launch in late 2022, AI has been catapulted from a niche technology into a dominant investment theme, reshaping valuations across global markets and driving innovation dozens of sectors, including automation, predictive analytics, robotics and natural language processing.

The three-tier AI investment structure

The AI economy operates through three distinct tiers, each offering unique opportunities and timing advantages:

Tier 1: Infrastructure companies (picks and shovels)

Infrastructure companies capture the first wave of AI spending by providing technology every AI application requires such as chips, cloud computing power and data centres. For example, Nvidia controls the majority of global AI chip sales through its superior hardware and CUDA software ecosystem.

This means that when companies want to invest in AI capabilities, they usually need to purchase Nvidia's products first. This creates powerful economic moats with massive profit margins and recurring revenue streams as AI adoption accelerates globally.

Tier 2: Platform companies (enterprise layer)

Platform companies package AI capabilities for business use, growing through network effects where early success attracts more customers.

For example, Palantir dominates government AI contracts and enterprise implementations, creating sticky, high-margin revenue streams. Once organisations commit to these platforms, switching costs become prohibitive, locking in long-term relationships.

Tier 3: Application companies (consumer-facing AI)

Application layer companies transform AI into products and services that end users directly experience. Tesla's autonomous driving technology and Microsoft's AI-enhanced Office suite are good examples — monetising AI by controlling customer relationships and charging premium prices for AI-powered experiences.

This tiered structure is all about timing. Infrastructure companies benefit first, platform companies gain momentum as enterprise adoption scales, and application companies capture long-term value as AI reaches mass consumer adoption.

Best AI stocks to watch in 2025

While there are hundreds of artificial intelligence stocks to consider, the reality is that AI development is expensive, so market share is dominated by a handful of US blue chips, including:

1. Nvidia (NASDAQ: NVDA)

Once primarily a gaming GPU manufacturer, Nvidia is now the backbone of global AI infrastructure. Its graphics processing units and CUDA ecosystem are indispensable for training and deploying advanced AI models, and this dominance means significant pricing power. However, the company remains vulnerable to supply chain issues, export controls and potential technological disruption.

2. Microsoft (NASDAQ: MSFT)

Microsoft dominates enterprise software and cloud computing through Windows, Office and Azure. Its multibillion-dollar partnership with OpenAI positions it as the leader in generative AI, with ChatGPT integrated throughout Azure, Office (via Copilot) and GitHub. However, this heavy reliance on OpenAI may represent a strategic concentration risk.

3. Apple (NASDAQ: AAPL)

Apple's ecosystem of consumer electronics, software and services centres on its flagship iPhone. The company invests heavily in device-based AI powering Siri, Face ID and image processing through custom chips that enhance privacy by minimizing cloud dependence. Despite these strengths, Apple perhaps lags its competitors in generative AI and large-scale cloud models.

4. Alphabet (NASDAQ: GOOG)

As Google's parent company, Alphabet is a global market leader in search, digital advertising and mobile operating systems. Its DeepMind and Google Brain divisions are pioneers in reinforcement learning and model efficiency, with AI deeply integrated into Google's core products and cloud services.

5. Meta Platforms (NASDAQ: META)

Operating Facebook, Instagram and WhatsApp, Meta deploys AI for recommendation systems, content moderation and advertising optimisation for billions of users. The company invests significantly in open-source models like LLaMA and next-gen infrastructure, though it faces ongoing ethical challenges regarding misinformation, user wellbeing and political manipulation.

Critical AI players beyond the US

While the American tech giants attract the most attention, several international companies play key roles in the AI supply chain:

- ASML Holdings (Netherlands) —the only company capable of producing extreme ultraviolet lithography machines, which are vital for manufacturing the most advanced semiconductors

- Taiwan Semiconductor Manufacturing Company (TSMC) — operates the world's most important chip foundry, producing cutting-edge semiconductors including 3nm chips, with 2nm production launching shortly

- SAP (Germany) — embeds AI capabilities throughout its enterprise software solutions, serving businesses across Europe and globally

- SoftBank (Japan) — invests heavily in AI companies through its Vision Fund, positioning itself across multiple AI sectors and stages of development

How to invest in AI stocks with us

- Learn more about artificial intelligence

- Download the IG Invest App or open a share dealing account online

- Search for your desired stock on our app or web platform

- Choose how many shares you’d like to buy

- Place your deal and monitor your investment

Investors look to grow their capital through share price returns and dividends - if paid.

But the value of investments can fall as well as rise, past performance is no indicator of future returns, and you could get back less than your original investment.

AI ETFs: Diversified exposure to the AI megatrend

For investors seeking broader exposure without picking individual stocks, AI-focused exchange-traded funds offer diversification benefits.

For example, the WisdomTree Artificial Intelligence UCITS ETF tracks the NASDAQ CTA Artificial Intelligence Index, providing exposure to robotics, big data and cloud computing companies.

You can also invest or trade in the AI Index , which is comprised of up of 25 leading US equities with revenue streams that are linked directly to the rapidly growing AI market.

Notable constituents include Nvidia, Taiwan Semiconductor, Palantir and Datadog:

Details correct as of 28th of July 2025

This index is calculated and managed by BITA GmbH.

Choose whether to trade or invest in artificial intelligence

| Trading | Investing | |

| Markets | Artificial intelligence shares and ETFs | Artificial intelligence shares and ETFs |

| Method | Trading derivatives like spread bets or CFDs | Investing with a share dealing account, ISA or IG Smart Portfolio |

| Time frame | Short to medium term | Medium to long term |

| Initial capital required | Deposit (margin) | Full value of investment |

| Returns | Profit from long and short positions | From capital appreciation and dividends |

| Cost of trading | Spreads when spread betting, commission when CFD trading. Margin requirements vary | Buy and sell shares and ETFs from zero commission for shares |

| Tax benefits | Spread bets are tax free, and both spread bets and CFDs are free from stamp duty3 | IG ISAs aren’t subject to capital gains tax (CGT) or income tax3 |

| Risk | Leverage can magnify both your profits and losses as they’ll be based on the full exposure of the trade, not just the margin required to open it. This means losses as well as profits could far outweigh your margin, so always ensure you’re trading within your means. | Limited to the initial outlay |

| Style | Day trading, swing trading, trend trading and position trading | Passive and active investing |

Pros and cons of AI stock investment

As with all investing themes, artificial intelligence comes with its own set of advantages and drawbacks:

Advantages of AI Stocks

- Growth potential — AI adoption is accelerating across virtually every industry, from healthcare and finance to manufacturing and entertainment. The market's projected growth to $4.8 trillion by 2033 represents exceptional expansion opportunities

- Capital Backing — major tech companies and venture capital firms continue to pour billions of dollars into AI development and deployment, providing significant financial support

- Margin improvements — AI-driven operational efficiencies may allow companies to significantly improve their profit margins through automation and optimisation

- Sector diversification — AI applications span multiple industries, providing diverse investment opportunities across various market segments

Disadvantages of AI Stocks

- Overvaluation risk — many AI stocks currently trade at sky-high valuations, pricing in excellent execution and continued market expansion. Historical precedent from the dot-com crash shows that even exceptional themes can crash

- Volatility — AI stocks frequently experience sharp price swings driven by sentiment shifts, earnings reports and technology announcements

- Regulatory uncertainty — government intervention may dramatically impact valuations by restricting development approaches, data usage practices or cross-border technology transfers. Evolving rules around ethics, privacy, and data protection could create unpredictable headwinds

Risk management strategies

Artificial intelligence is developing at a pace faster than previous technology cycles, creating both immense opportunity and significant risk. Breakthroughs in algorithms, chip design, or entirely new approaches to AI could quickly render today’s market leaders obsolete, particularly at the application layer where barriers to entry are relatively low.

At the same time, the industry requires enormous research and development spending with no guarantee of market success. A further source of vulnerability lies in the sector’s dependence on a surprisingly small group of companies spread across the world, meaning that supply chain disruptions or geopolitical tensions could impact many companies simultaneously.

Ethical concerns, ranging from algorithmic bias to job displacement and broader societal impacts, add another layer of uncertainty, as regulatory scrutiny and reputational risks continue to grow.

Given these dynamics, investing in the AI theme requires a disciplined approach. For example, diversification across geographies, company sizes, and AI market segments can help to reduce the risk of a single point of failure. Investors may also wish to limit AI exposure to around a percentage of their overall portfolio, while also implementing stop-losses on more speculative positions.

Just as early internet investors captured disproportionate gains before mass adoption drove valuations higher, the greatest opportunities in AI may be likely to occur over the next few years as the technology moves from hype to widespread commercial use.

Starting with the blue chips is a common risk mitigation strategy — because while past performance is not a guarantee of future returns, established players such as Microsoft and Alphabet can provide both exposure to AI and a measure of downside protection. These companies can anchor a portfolio while investors explore higher risk, higher-reward opportunities among emerging AI leaders.

Most importantly, success in AI investing requires adaptability, because today’s market leaders could become tomorrow’s legacy technologies.

Here are our best share dealing commission rates compared to those of our competitors:

| IG | Hargreaves Lansdown | AJ Bell | |

| Best commission rate on US shares | Free |

£5.95 | £4.95 |

| Standard commission rate on US shares | £10 | £11.95 | £9.95 |

| FX conversion fee | 0.5%** | 1% - 0.25% | 0.75% - 0.25% |

| Best commission rate on UK shares | £3 | £5.95 | £4.95 |

| Standard commission rate on UK shares | £8 | £11.95 | £9.95 |

| How to qualify for the best rate | - | 20+ or more trades in prior month | 10+ trades in prior month |

Other fees may apply. See our costs and fees.

**Increasing to 0.7% from 7 April 2025

Step-by-step guide to making an AI stocks or ETFs trade

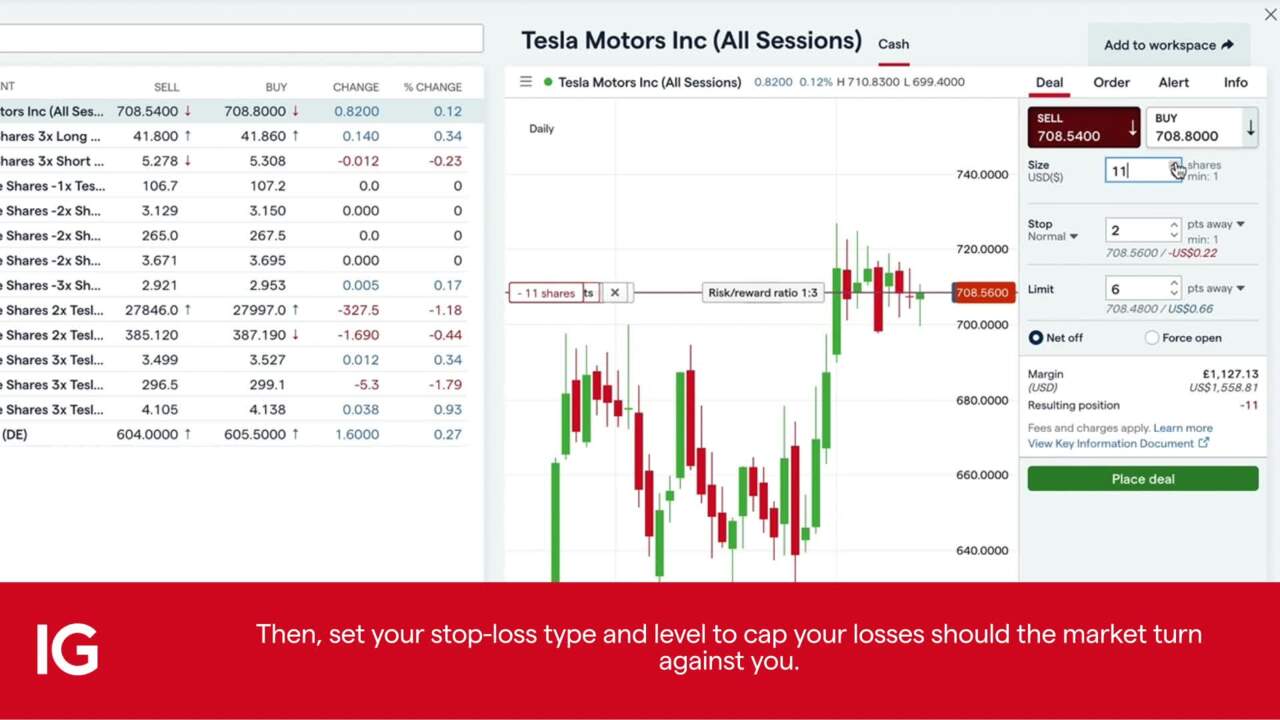

Here’s a screenshot of our trading platform, with some steps that take you through how to open a position for spread bets or CFDs.

- Search for and select your opportunity

- Choose ‘buy’ to go long or ‘sell’ to go short

- Put in your position size

- Set your stops or limits to help manage your risk

- Place your deal and monitor your position

Step-by-step guide to making an AI stocks or ETFs investment

Here’s a screenshot of our investment platform, with some steps that take you through how to open an investment position.

- Search for and select your opportunity

- Choose ‘buy’ to open your investment

- Put in your position size

- Set your order type

- Place your deal and monitor your position

Before you open a position on artificial intelligence stocks or ETFs, it’s important to take steps to manage your risk. For example, spread bets and CFDs are leveraged products, meaning that you should familiarise yourself with the impact of leverage on your trading.

We’ve also got free educational courses at IG Academy to help you get the most out of your time on the markets. If you’re not ready to trade with a live account, maybe you’ll want to try our demo – which gives you £10,000 in virtual funds to help build your confidence in a risk-free environment.

1 Based on revenue (published financial statements, 2023).

2

Other fees may apply

3

Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4

Best trading platform as awarded at the ADVFN International Financial Awards and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2020.