Written by Anzél Killian, Senior Financial Writer. Reviewed by Axel Rudolph, Senior Market Analyst

What is spread betting?

Spread betting is a popular derivative product you can use to speculate on financial markets – such as forex, indices, commodities or shares – without taking ownership of the underlying asset. Instead, you’d be placing a bet on whether you think the price will rise or fall.

We invented financial spread betting in 1974, and today we enable you to trade over 15,000+ markets, whether they are rising or falling in price. This gives you a much wider range of opportunities than traditional buy-and-hold investing.

Spread betting is leveraged, meaning you’ll use a small deposit (called margin) to open a larger position. Just remember that this means both losses and profits could outweigh your initial deposit as both are calculated on the full position size. As you won’t be taking ownership of the asset, spread betting is also tax-free.*

How does spread betting work?

Spread betting works by tracking the value of an asset, so that you can take a position on the underlying market price – without taking ownership of the asset. There are a few key concepts about spread betting you need to know, including:

What do ‘long’ and ‘short’ mean in spread betting?

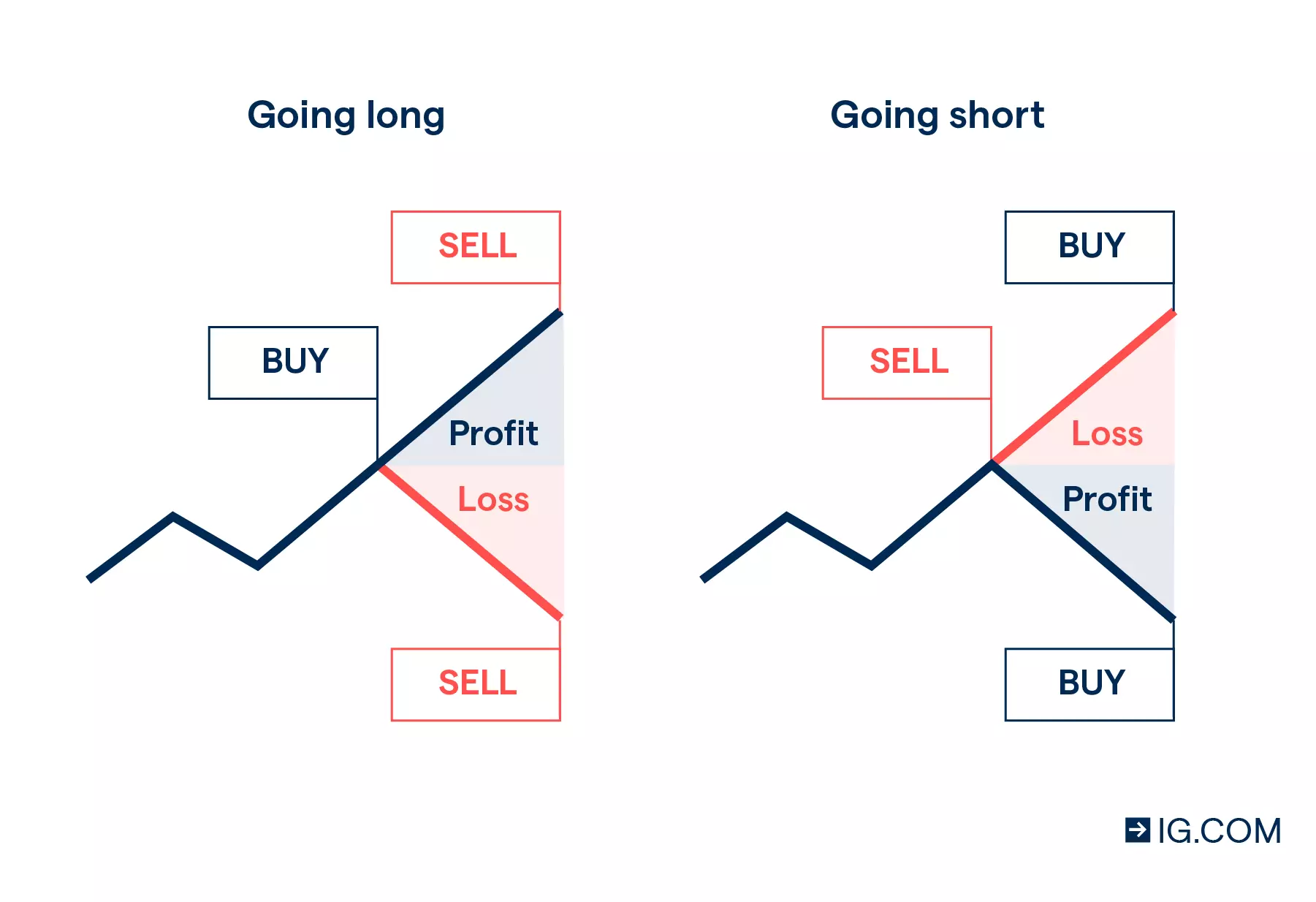

Going long is the term used to describe placing a bet that the market price will increase over a certain timeframe. Going short or ‘shorting’ a market is the reverse – placing a bet that the market will decline.

So spread betting enables you to speculate on both rising and falling markets. You would buy the market to go long, or sell the market to go short.

Let’s say you thought the price of gold was going to decline. You could open a spread bet to ‘sell’ the underlying market. The loss or gain to your position would depend on the extent to which your prediction was correct. If the market did decline, your spread bet would profit. But if the price of gold increased instead, your position would make a loss.

What is leverage in spread betting?

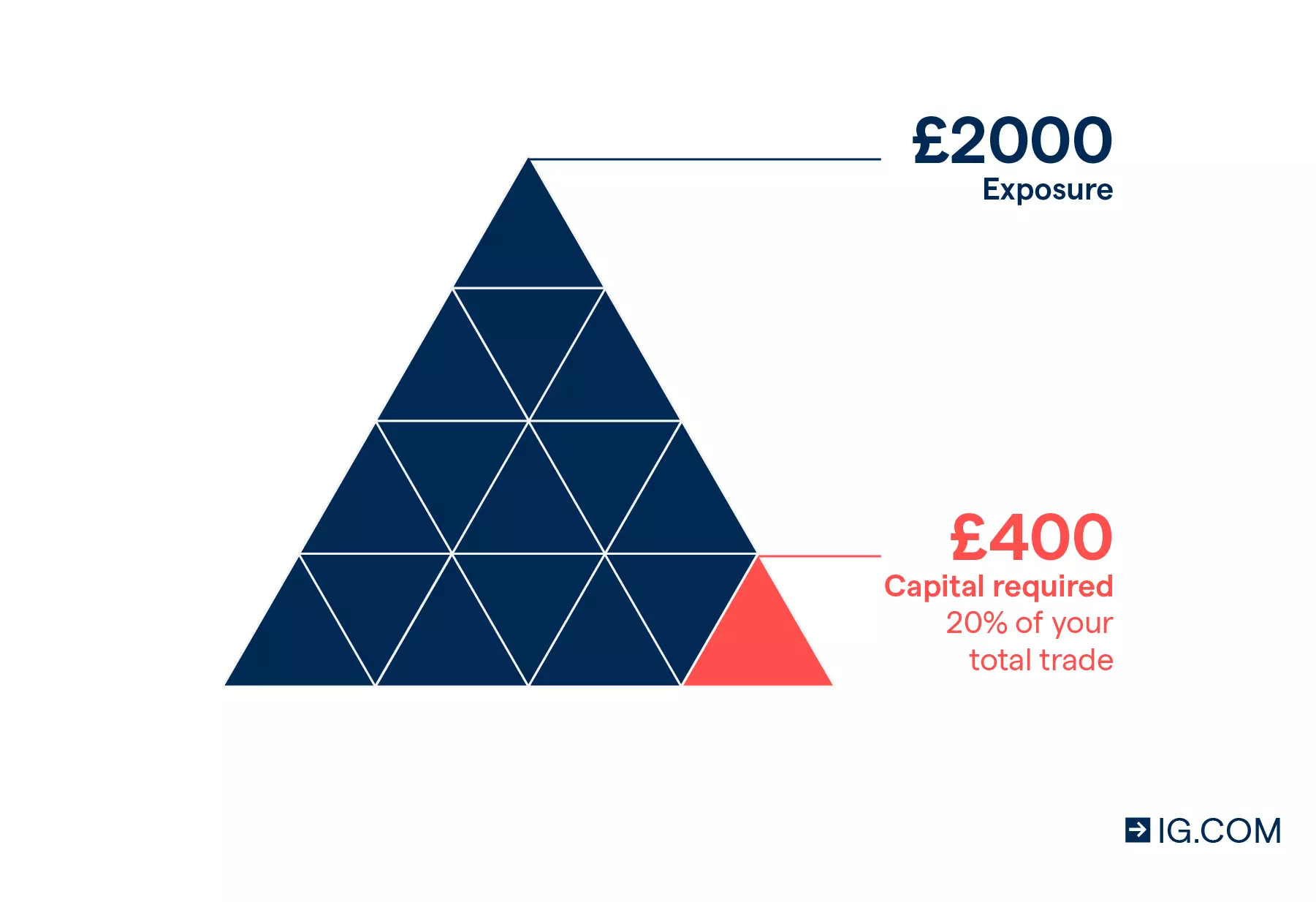

Leverage enables you to gain full market exposure for a fraction of the underlying market cost.

Say you wanted to open a position on Facebook shares. As an investor that would mean paying the full cost of the shares upfront. But by spread betting on Facebook shares instead, you might only have to put down a deposit worth 20% of the cost.

Discover the benefits of spread betting

It’s important to note that leverage magnifies both profits and losses as these are calculated based on the full value of the position, not just the initial deposit. To manage your exposure, you should create a suitable risk management strategy and to consider how much capital you can afford to put at risk.

What is margin in spread betting?

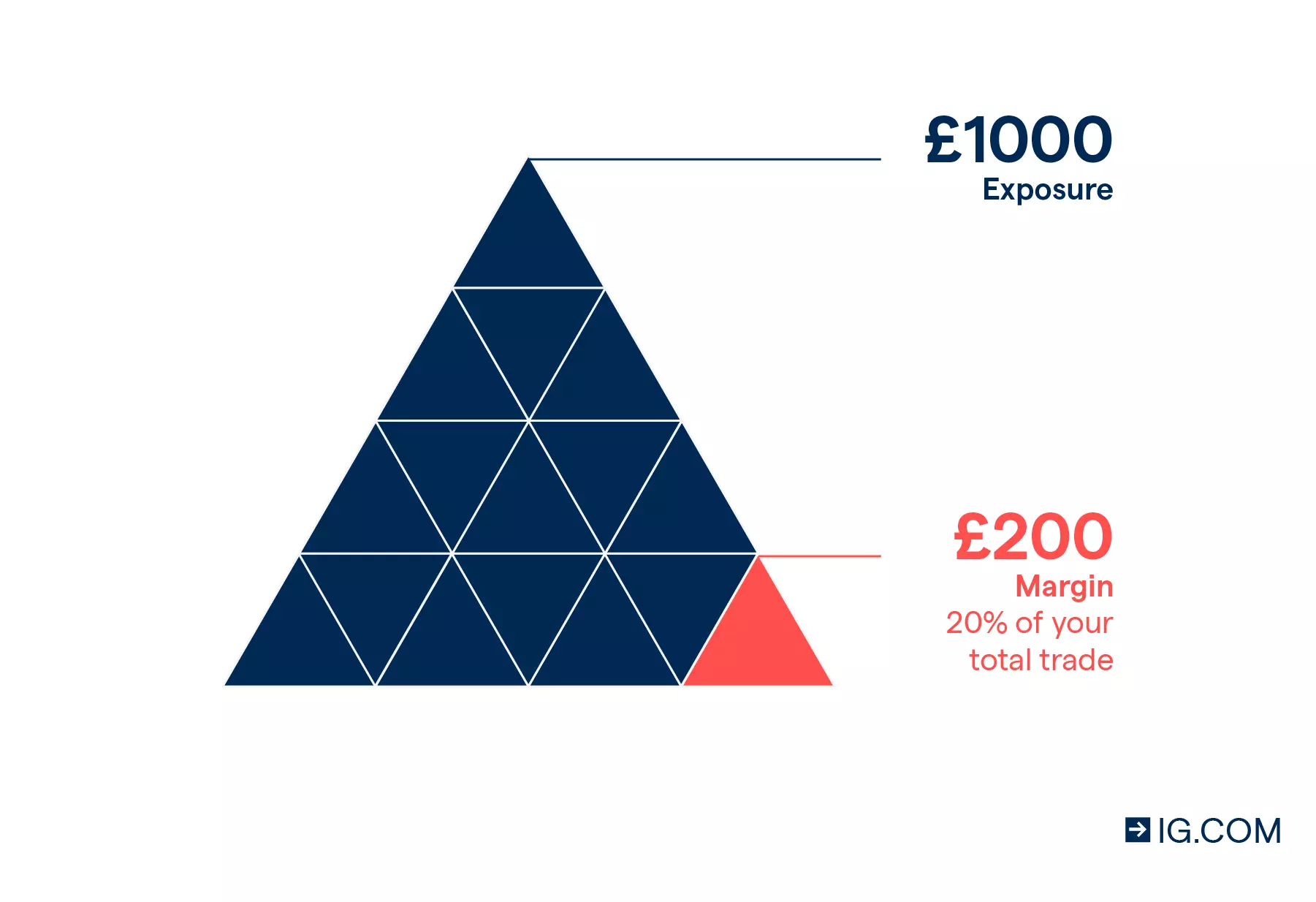

When you spread bet, you put down a small initial deposit – known as the margin – to open a position. This is why leveraged trading is sometimes referred to as ‘trading on margin’.

There are two types of margin to consider when spread betting:

- Deposit margin. This is the initial funding required to open the position, which is usually presented as a percentage of your total trade.

- Maintenance margin. This refers to the additional funds that might be required if your open position starts to incur losses that are not covered by the initial deposit. You’ll get a notification – known as a margin call – asking you to top up the funds or risk having your position closed

Your margin rate when spread betting depends on the market you trade. For example, when you spread bet on shares your margin might be 20% of the trade size. Whereas, if you spread bet on forex, it might be just 3.33% of the trade size. See our margin rates.

Main features of spread betting

Spread betting has three main features: the spread, bet size and bet duration. The spread is the charge you’ll pay for a position, the bet size is the amount of money you want to put up per point of market movement, and the bet duration is how long your position will remain open before it expires.

Learn more about:

What is the spread?

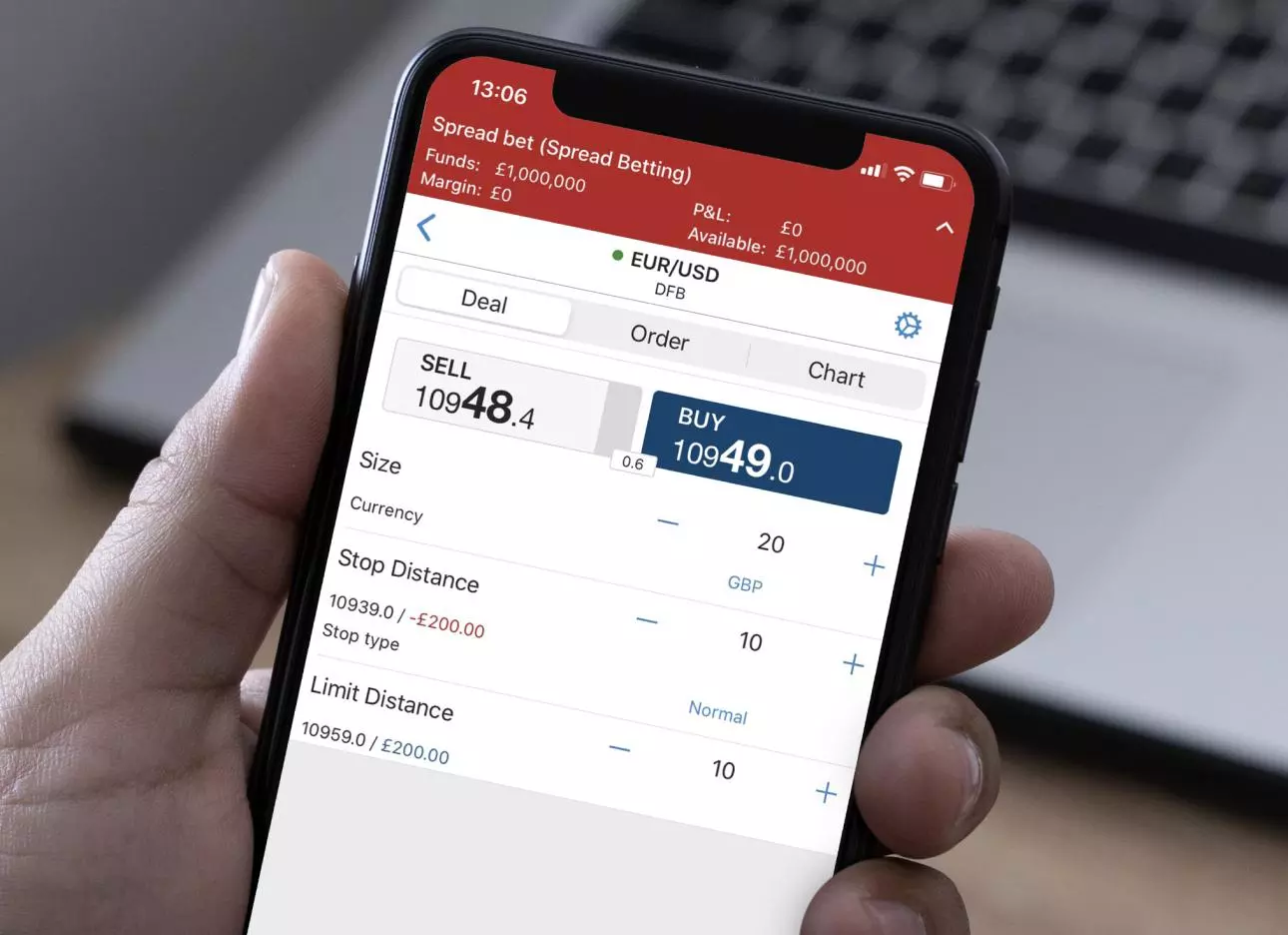

The spread is the difference between the buy and sell prices, which are wrapped around the underlying market price. They’re also known as the offer and bid. The costs of any given trade are factored into these two prices, so you’ll always buy slightly higher than the market price and sell slightly below it.

For example, if the FTSE 100 is trading at 5885.5 and has a one-point spread, it would have an offer price of 5886 and a bid price of 5885.

What is the bet size?

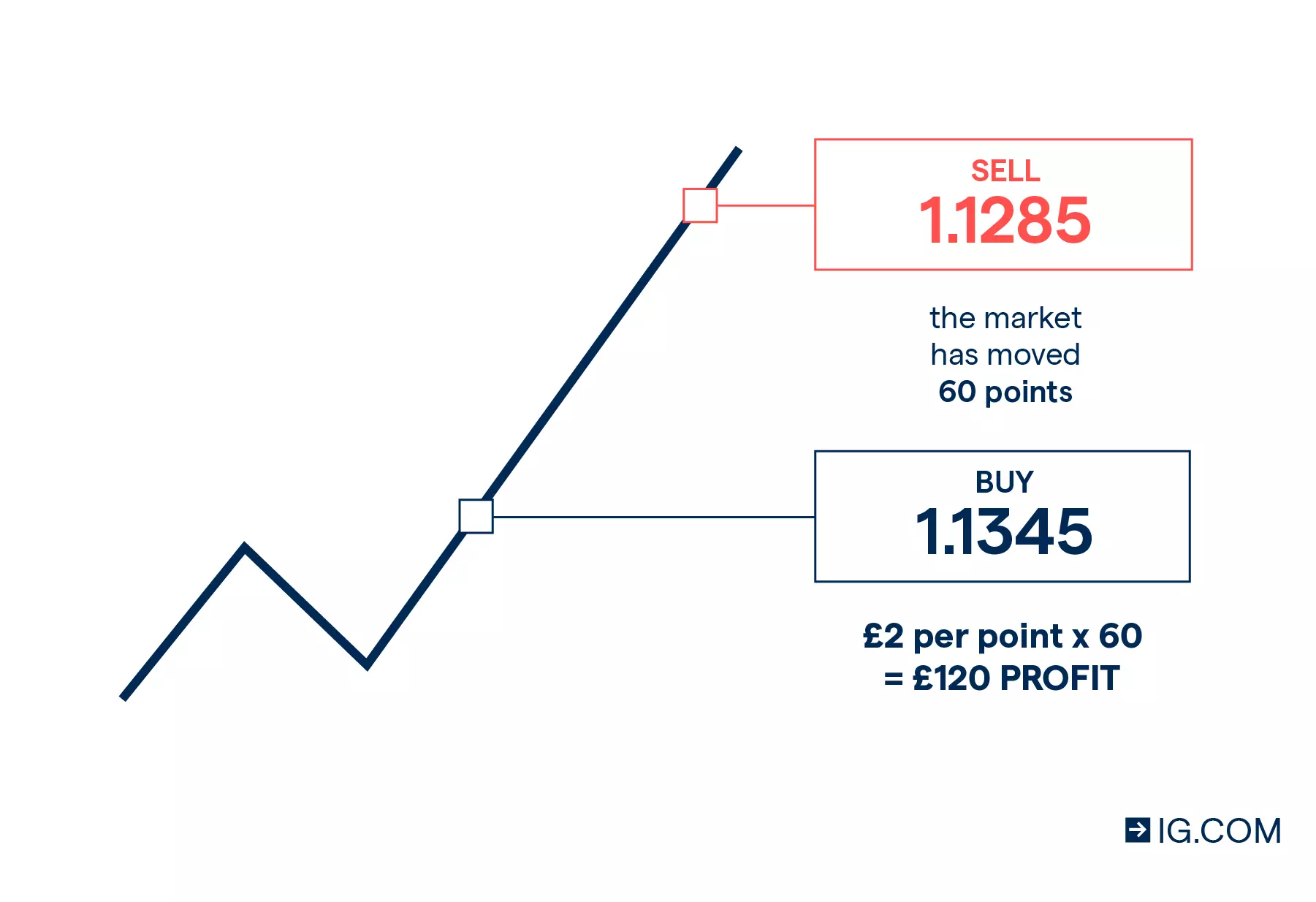

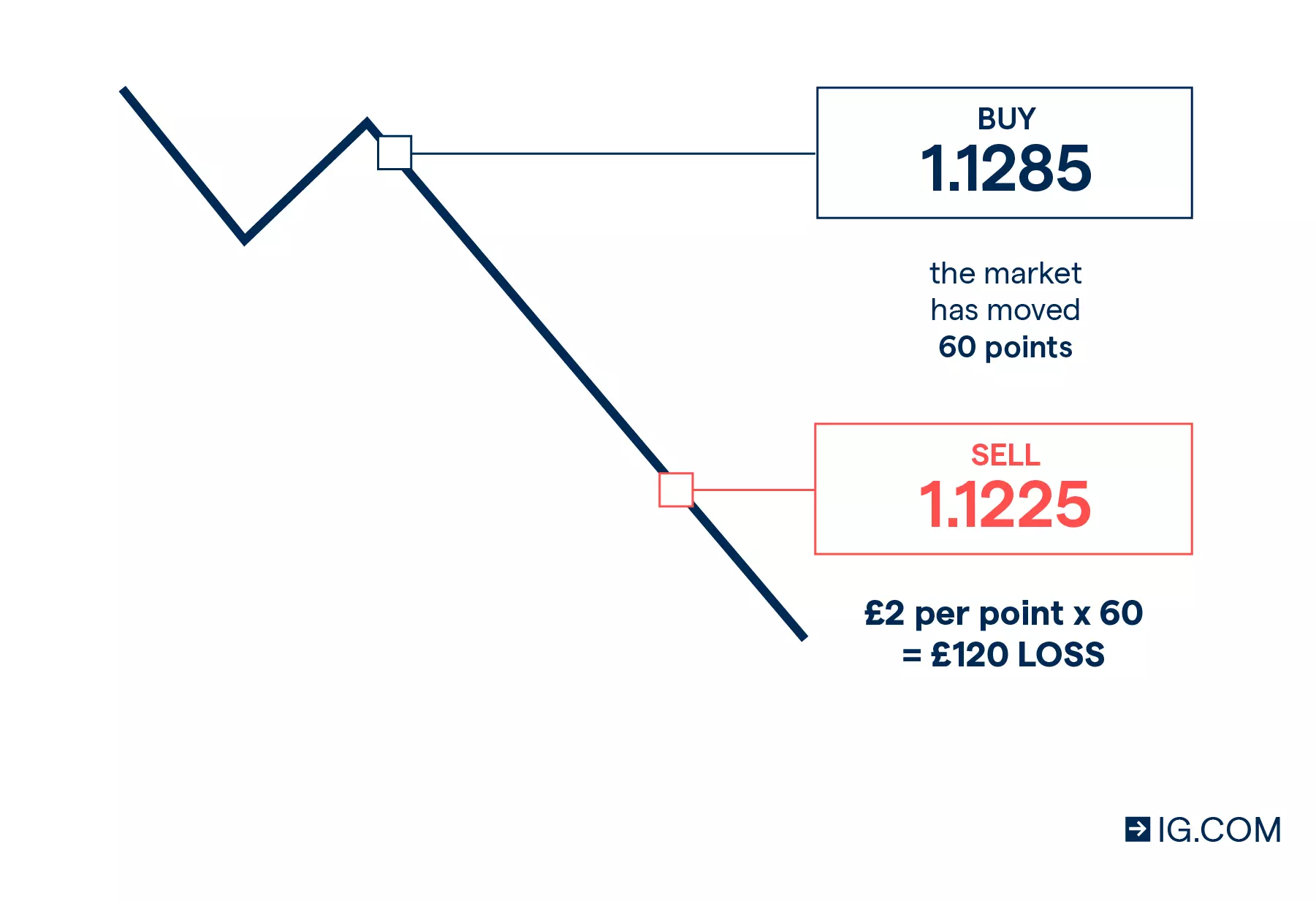

The bet size is the amount you want to bet per unit of movement of the underlying market. You can choose your bet size, as long as it meets the minimum we accept for that market. Your profit or loss is calculated as the difference between the opening price and the closing price of the market, multiplied by the value of your bet.

We measure the price movements of the underlying market in points. Depending on the liquidity and volatility of your chosen market, a point of movement can represent a pound, a penny, or even a one hundredth of a penny. You can find out what a point means for your chosen market on the deal ticket.

If you open a £2 per point bet on the FTSE 100 and it moves 60 points in your favour, your profit would be £120 (£2 x 60). If it moved 60 points against you, your loss would be £120.

What is the bet duration?

The bet duration is the length of time before your position expires. All spread bets have a fixed timescale that can range from a day to several months away. You’re free to close them at any point before the designated expiry time, assuming the spread bet is open for trading.

Our spread bet durations include:

- Daily funded bets. These bets run for as long as you choose to keep them open, with a default expiry in the distant future. They offer our tightest spreads but are subject to overnight funding – so are generally used for short-term positions

- Quarterly bets. These are futures bets that expire at the end of a quarterly period – although they can be rolled into the next quarter if you let us know in advance. They have wider spreads, but lower funding costs that are built into the price, making them suitable for longer-term speculation

Ready to start spread betting? Open an account

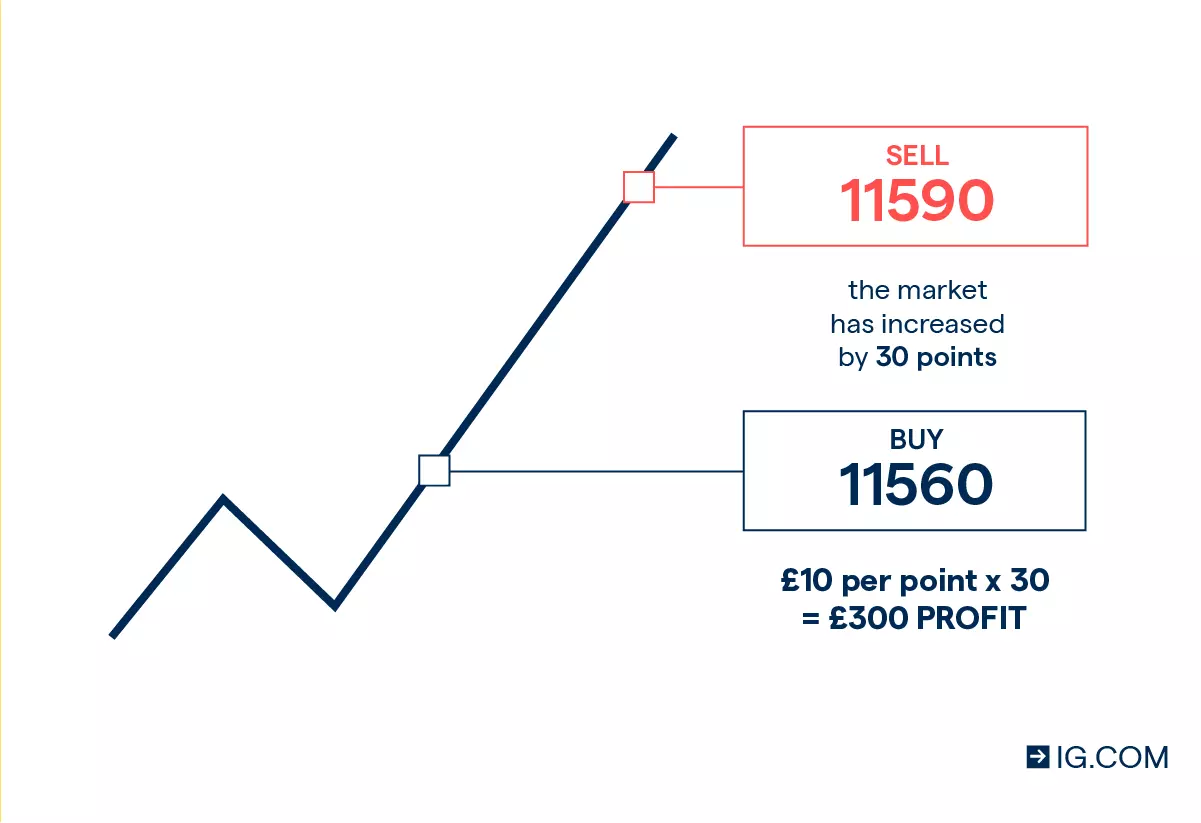

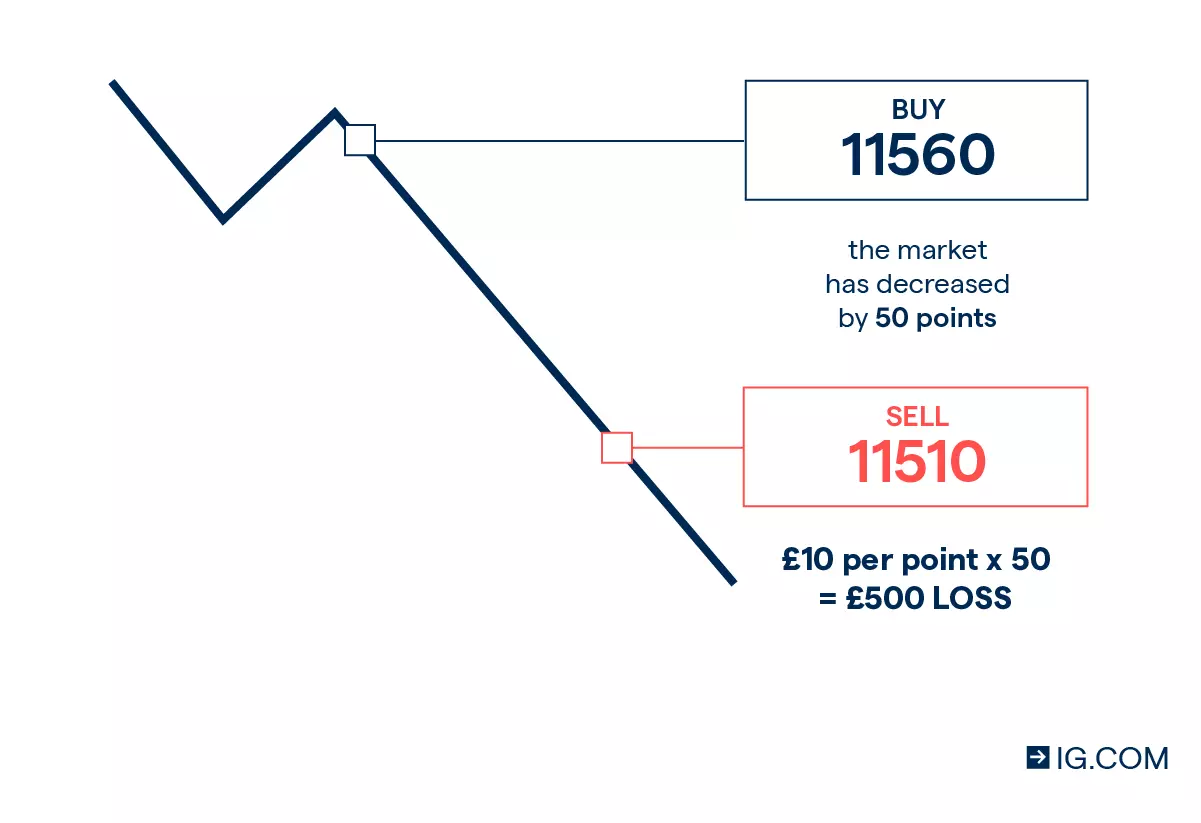

Example: Apple spread bet

Say Apple is trading with a sell price of 11550 ($115.50) and a buy price of 11560 ($115.60). You anticipate that Apple shares are going to rise in the next few days, so decide to go long on (buy) Apple shares for £10 per point of movement at 11560.

If Apple shares did rise in price, you might decide to close your trade when the sell price hits 11590. As the market has increased by 30 points (11590 – 11560), you’d be coming out with a profit of £300 (30 x £10), excluding any additional costs.

If the market had fallen in value instead – down to a sell price of 11,510 – you would have ended up with a loss. As the market had moved by 50 points (11,560 – 11,510), you would have made a loss of £500 (50 x £10). Again, not including any additional charges.

Find out more about how to spread bet and see more examples, or use our spread betting calculator to see how margin, profit and loss work.

FAQs

Yes, if your prediction of whether the market will rise or fall is correct, you’ll profit and if it’s incorrect, you’ll lose.

Learn about how to start spread betting

It is important to remember that all forms of trading carry risk. So, although spread betting provides opportunities for profit, you should never risk more than you can afford to lose.

When you hedge using a spread bet, you open a position that will offset negative price movement in an existing position. This could be trading the same asset in the opposite direction, or on an asset that moves in a different direction to your existing trade.

For example, if you were worried that inflation might impact the value of your share portfolio, you might decide to take a long position on gold – an asset that typically has an inverse correlation with the dollar and can protect portfolios from inflation. If your shareholdings did decline, the profits from your spread bet on gold could offset any losses. But if your shareholdings rose in value instead, this profit could offset any potential loss to your gold spread bet.

Spread bets are not taxed.* Traditionally, when you buy and sell shares you have to pay stamp duty and capital gains tax on any profits that you make, but spread bets are tax-free. And because you don’t take ownership of the underlying asset, you won’t have to pay stamp duty either.

Spread betting is a bet on the future direction of a market, while a CFD is an agreement to exchange the difference in the price of an asset from when the contract is opened to when it is closed. There are a range of similarities and differences between these two derivative products.

Leverage is an inherent part of spread betting, so you can’t open a position without it. Before you start trading on leverage, it’s a good idea to build up your knowledge on the subject and create a risk management strategy.

Discover more about risk management, including what leverage is and how it impacts your trades

Dividend payments have no impact on your spread betting position. If you hold a spread bet open on an equity or index when a dividend payment takes place, we’ll make an adjustment to your position. This means that capital will either be credited or debited to your account if a dividend is paid, depending on whether you have incurred additional running loss/profit.

Develop your spread betting knowledge with IG

Find out more about spread betting and test yourself with IG Academy’s range of online courses.

Try these next

Discover the differences between spread betting and CFD trading

Learn about risk management tools including stops and limits

Browser-based desktop trading and native apps for all devices

* Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.