Automated trading can help you increase the efficiency of your trades – by enabling faster execution of your strategies. Learn more about our automated trading platforms’ features and how they can add value to your strategy.

What is automated trading?

Automated trading is a method of participating in financial markets by using a program that executes trades based on predetermined entry and exit conditions. As the trader, you’ll combine thorough technical analysis with setting parameters for your positions, such as orders to open, trailing stops and guaranteed stops. Your trades are then automatically managed from start to finish, meaning you could spend less time monitoring your positions.

Auto trading means you can carry out many trades in a small amount of time, with the added benefit of taking the emotion out of your trading decisions. That’s because all the rules of the trade are already built into the parameters you set. With some algorithms, you can even use your pre-determined strategies to follow trends and trade accordingly.

How does automated trading work?

With automated trading, you’ll be speculating on the rise or fall of the underlying market price using either spread bets or CFD trades.

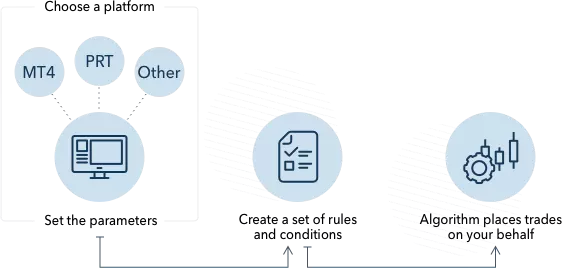

First, you’ll choose a platform and set the parameters of your trading strategy. You’ll then use your trading experience to create a set of rules and conditions (called parameters), and then your custom algorithm will apply the criteria to place trades on your behalf.

These factors are normally based on the timing of the trade, the price at which it should be opened and closed and the quantity. For example: ‘buy 100 Apple shares when its 50-day moving average goes above the 200-day average’.

The automated trading strategy that’s been set will constantly monitor financial market prices, and trades will automatically be executed if predetermined parameters are met. The aim is to execute trades faster and more efficiently and to take advantage of specific, technical market events.

Remember that these trades will be leveraged, because they are made using spread bets and CFDs that happen to be automated. This means you’ll put down a small deposit (called margin) to get exposure to a larger position. Both profits and losses are calculated based on the position’s full size rather than your smaller margin amount, which means you run the risk of losses outweighing your initial deposit.

What are the pros and cons of automated trading?

With automated trading, you can:

- Fit your strategy around your schedule – execute trades automatically, day or night

- Reduce the impact of emotional and gut reactions with planned strategies

- Identify new opportunities and analyse trends with a wide range of indicators

- Execute multiple real-time trades simultaneously without any of the work of manual execution

Just remember, you’ll be affected by human error if the parameters set by you don’t accurately predict how the market will move and by how much. Plus, you run the risk of compounded losses due to the higher number of simultaneous trades and the speed at which automated trades are executed.

What platforms can you use for automated trading?

The platform you’ll use for automated trading will depend on your trading preferences. We have several automated trading options available to our clients.

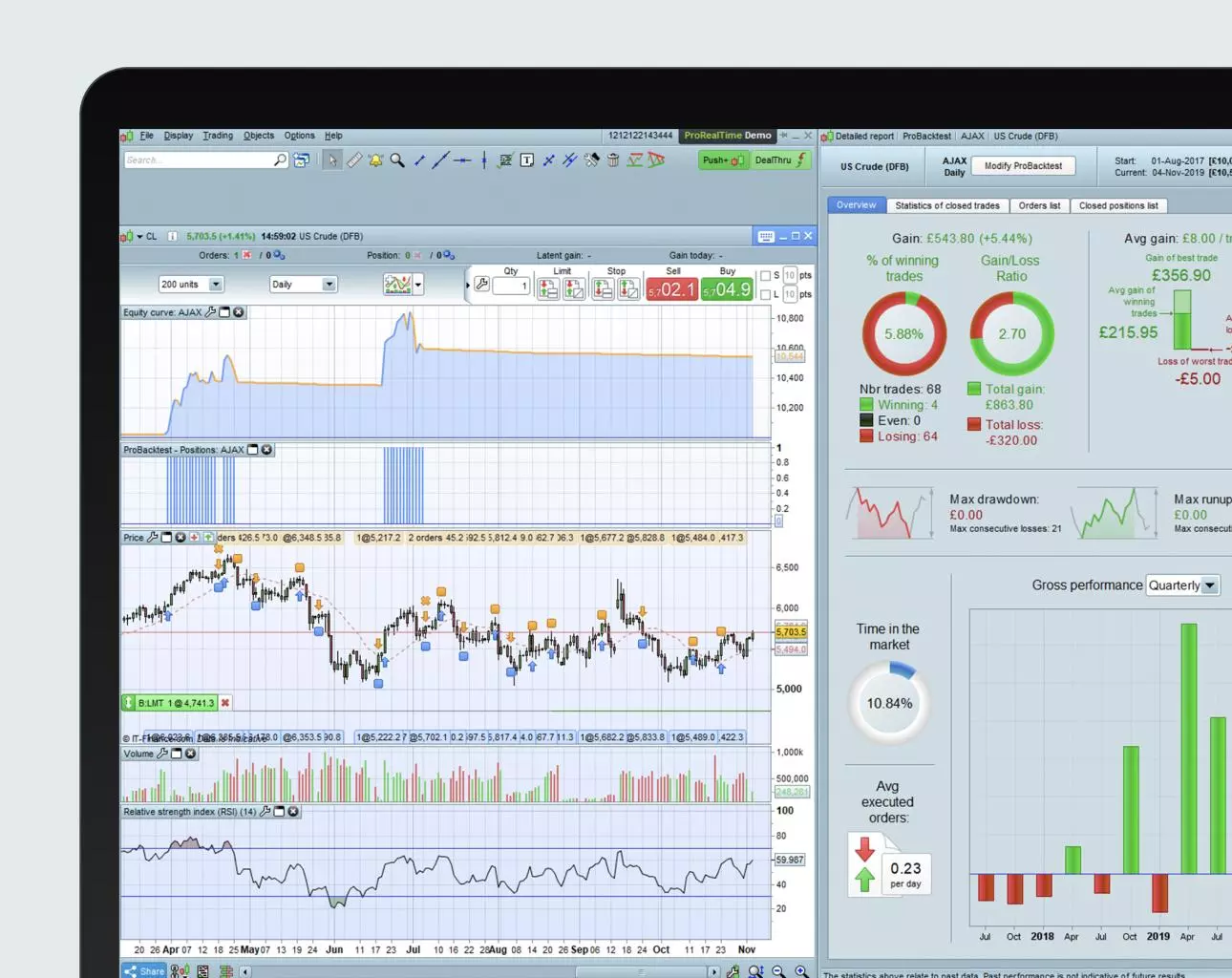

ProRealTime

Automate your trading with assisted creation tools, enabling you to build simple or advanced strategies without the need for coding. With ProRealTime, you get access to an advanced yet easy-to-use, backtesting suite to test your system. Our platform has over 100 indicators and has been optimised to suit both new and experienced traders. Get it for free when you trade at least four times a month.

MetaTrader4

Customise your trading experience by building your own expert trading algorithms, creating indicators and placing a range of orders. Plus, import Expert Advisors (EAs) to help you find opportunities according to your predefined parameters. EAs can either notify you of an opportunity or open a position automatically.

APIs

Build your own platform and create advanced trading solutions from scratch. This platform lets you code your algorithms from the ground up. Orders are filled using our market-leading technology, ensuring you get the best execution. You can view real-time and historical market prices, analyse market instruments and trader sentiment information, maintain watchlists and more.

How to get started with automated trading

Open an account with us

ProRealTime, MetaTrader4 and APIs are all accessible with either our spread betting or CFD accounts. To open a live account with us, just follow these three steps:

- Fill in a form, we’ll ask a few question about your trading knowledge to ensure you get the best experience

- Get verification, we can usually verify your identity immediately

- Fund your account and start trading, you need to fund your account to begin trading. You can make a deposit, plus withdraw your money, whenever you like

Pick your platform

Then, it’s time to choose the platform that’s right for you. Decide whether you want to use ProRealTime, MetaTrader4 (MT4) or APIs.

Depending on which one you choose, you’ll go through a few quick steps to get up and running:

- If you’re going with ProRealTime, you’ll activate ProRealTime from My IG after opening your live account, then launch the platform

- If you’ve decided on MT4, you’ll either create an MT4 demo account or follow our step-by-step process of how to download MetaTrader4 in our platform

- Want to use APIs to trade? Then you’ll either do so through ProRealTime or build your own API platform

Set up your trading strategy

Once you’ve opened your live account and decided on platform, it’s time to put your trading strategy in place. This can be done in a number of ways, but here are a few useful starting steps:

Find the right trading style and timeframe for you

There are different ways to trade, based on the timeframe you’d like to keep your positions open for. These include day trading, swing trading, scalping and position trading. Deciding which one works best for you is an important part of developing your strategy

Study the market

To set in place good parameters for your automated trades, you’ll need to have a firm understanding of how to read the market. Studying charts and price action to see the history of the market you’ve chosen to trade means a deeper understanding of patterns and trends

Learn all about analysis

Analysis is key to researching your chosen market, which helps you to better predict what it’ll do next. Traders needs both technical analysis and fundamental analysis to make sense of what the market’s doing

Keep up to date with the news

Big macroeconomic events, such as earnings seasons, elections or changes in federal policy, can and often do signal changes in the market. Keeping an eye on the headlines will ensure these kinds of events and the changes in market sentiment they cause don’t take you and your automated trades by surprise

FAQs

Is automated trading right for me?

Automated trading might be right for you if you’re looking for a technique that helps you to trade according to predefined parameters. This can be especially helpful when trying to avoid emotional trading. Automated trading is a good solution for someone who wants a low maintenance trading strategy that relies on advanced technology.

Remember that these trades will be leveraged, because they are made using spread bets and CFDs that happen to be automated. This means you’ll put down a small deposit (called margin) to get exposure to a larger position. Both profits and losses are calculated based on the position’s full size rather than your smaller margin amount, which means you run the risk of losses outweighing your initial deposit.

What automated trading systems could I use?

We offer a variety of automated trading systems for you to use, including ProRealTime, MetaTrader4 and APIs.

Try these next

Deal with automated strategies powered by cutting-edge technology

Get integrated access to our leading web-based charting package

Access trading solutions designed for your organisation's needs