Our commitment to best execution

Putting your interests first

A transparent policy

An automated process

At IG we’d like to see you trading successfully and regularly with us – it’s a fundamental part of our business model – so we do our utmost to act in your favour at every stage of the dealing process.

As the world’s No.1 spread betting and CFD provider,1 we believe it’s our responsibility to lead industry standards in best execution – giving your trades every possible chance to play out as you intended. That’s why we continuously invest in faster and more intelligent execution technology.

Pricing

We aim to offer you the best price and the tightest spread

Our clients tell us that price is the most important factor in terms of best execution. So we source our underlying prices from multiple venues, and these are reviewed regularly. Plus, we’ll always try to add liquidity venues that improve the integrity of our price and reduce the transactional charges to our clients.

As the world’s largest and oldest spread betting and CFD provider,1 we can offer greater liquidity at the best possible price.

How we give you the best price

Markets can move in milliseconds, meaning the price you click to trade on may have changed by the time your order reaches us. Our order management system will never fill you at a level worse than the one you requested – however, occasionally insufficient liquidity may result in your order being rejected instead. In Apr – Jun 2024 only 0.20% of orders placed with IG Group were rejected due to size (liquidity).

Watch the videos below to learn more about speed of execution, price improvement and sourcing better prices.

- Speed of execution

- Price improvement

- Sourcing better prices

Symmetrical tolerance

You’ll always get your desired price (or better) on limit and at-quote orders

A symmetrical tolerance level is set a certain distance either side of your requested price – if the market stays within this range by the time we receive your order, your order will be executed at the level you requested.

If the price moves outside this range, we will do one of two things:

- If the market moves to a better level for you, our price-improvement technology will ensure you receive it

- If the price moves beyond our tolerance in the opposite direction, we'll reject the order and ask you to resubmit at the current level

We make these checks to ensure the price your order is filled at is consistent with the current price that is available to our clients.

If you submit a market order it will be filled in the size and price available when we receive it.

To give an example, in Apr – Jun 2024 over 263,000 of IG Group's at-quote orders received a price improvement. This was equivalent to a total benefit of £3.5 million to clients.

Deep liquidity and advanced dealing options

We take steps to help you get your full size

Liquidity – the ease with which an asset can be bought and sold quickly, and at stable prices – affects your ability to get the deal you want.

At IG, our size and the huge volume of trades we handle every day enable us to offer deep and consistent liquidity, giving you more control over your trades. Particularly if you deal in larger sizes, you’re more likely to be filled at your desired price with IG.

Maximum automatic size

To prevent your order from being rejected, we set a maximum size we automatically accept. This avoids delay to your execution – potentially adversely affecting the outcome – which would result from order rejection.

Our maximum automatic sizes are shown below (data correct as of June 2023):

- Most popular currencies

- Most popular indices

| Markets | Maximum automatic size (GBP notional)4 | £/point (spread bets) | No. of lots (CFDs) |

| GBP/USD | 6,285,000 | 500 | 63 |

| EUR/USD | 5,300,000 | 500 | 63 |

| USD/CAD | 5,400,000 | 400 | 68 |

| USD/JPY | 7,380,000 | 500 | 93 |

| AUD/USD | 5,100,000 | 800 | 101 |

| Markets | Maximum automatic size (GBP notional)4 | £/point (spread bets) | No. of lots (CFDs) |

| FTSE 100 | 3,700,000 | 500 | 50 |

| DAX | 6,300,000 | 400 | 47 |

| US 500 | 15,760,000 | 3500 | 18 |

| Wall St | 6,940,000 | 200 | 25 |

| Australia 200 | 3,650,000 | 500 | 36 |

Advanced dealing options

To help you take control of your execution and increase the probability that your order will be accepted, we offer two special dealing options:

- Points through current – a way to reduce the likelihood of price rejection by specifying your tolerance for price movement, particularly useful when trading in large sizes

- Partial fills – a tool to prevent rejection on grounds of size, ensuring your order will be filled in the largest size possible if we can’t fill it in full

Slippage

We pass on positive slippage, and offer guaranteed stops to help you avoid negative slippage

Slippage occurs when your order is executed at a price that differs from the one you requested. Caused by insufficient liquidity at your desired price level, it can work either against you or in your favour:

- Slippage on stops has a negative impact for you, as you’ll be filled at a worse price

- Slippage on limits has a positive effect for you, as you’ll be filled at a better price

This means you’ll get the best deal from a provider that offers lower slippage on stops but higher slippage on limits.

IG achieves this by adjusting our execution logic to ensure you’re more likely to experience positive than negative slippage. To see that in action, take a look at our slippage performance for the last quarter in the table below.

- Summary

- Most popular currencies

- Most popular indices

| Markets | Stops – zero slippage | Stops – negative slippage | Limits – positive slippage | Limits – zero slippage |

| Currencies | 89% | 11% | 55% | 45% |

| Indices | 72% | 28% | 74% | 26% |

| Markets | Stops - Zero slippage | Stops - Negative slippage | Limits - Positive slippage | Limits - Zero slippage | Average negative slippage (in pips) | Average positive slippage (in pips) |

| EUR/USD | 93% | 7% | 49% | 51% | 0.053 | 0.086 |

| GBP/USD | 88% | 12% | 57% | 43% | 0.062 | 0.083 |

| USD/CAD | 93% | 7% | 53% | 47% | 0.005 | 0.009 |

| USD/JPY | 87% | 13% | 59% | 41% | 0.097 | 0.107 |

| AUD/USD | 96% | 4% | 43% | 57% | 0.090 | 0.083 |

| Markets | Stops - Zero slippage | Stops - Negative slippage | Limits - Positive slippage | Limits - Zero slippage | Average negative slippage (in pips) | Average positive slippage (in pips) |

| FTSE 100 | 95% | 5% | 50% | 50% | 0.013 | 0.048 |

| Germany 40 | 92% | 8% | 89% | 11% | 0.128 | 0.248 |

| US 500 | 76% | 24% | 93% | 7% | 0.140 | 0.116 |

| Wall Street | 67% | 33% | 89% | 11% | 0.184 | 0.166 |

| Australia 200 | 82% | 18% | 51% | 49% | 0.034 | 0.035 |

Keep in mind that you can completely avoid the risk of negative slippage on stop orders to close by using guaranteed stops. These are free to place – you’ll only pay a small charge if they’re triggered. Find out more.

Order fill

98.97% of orders filled. 5 Rejections are due to underlying market dynamics plus erroneous/excessive orders.

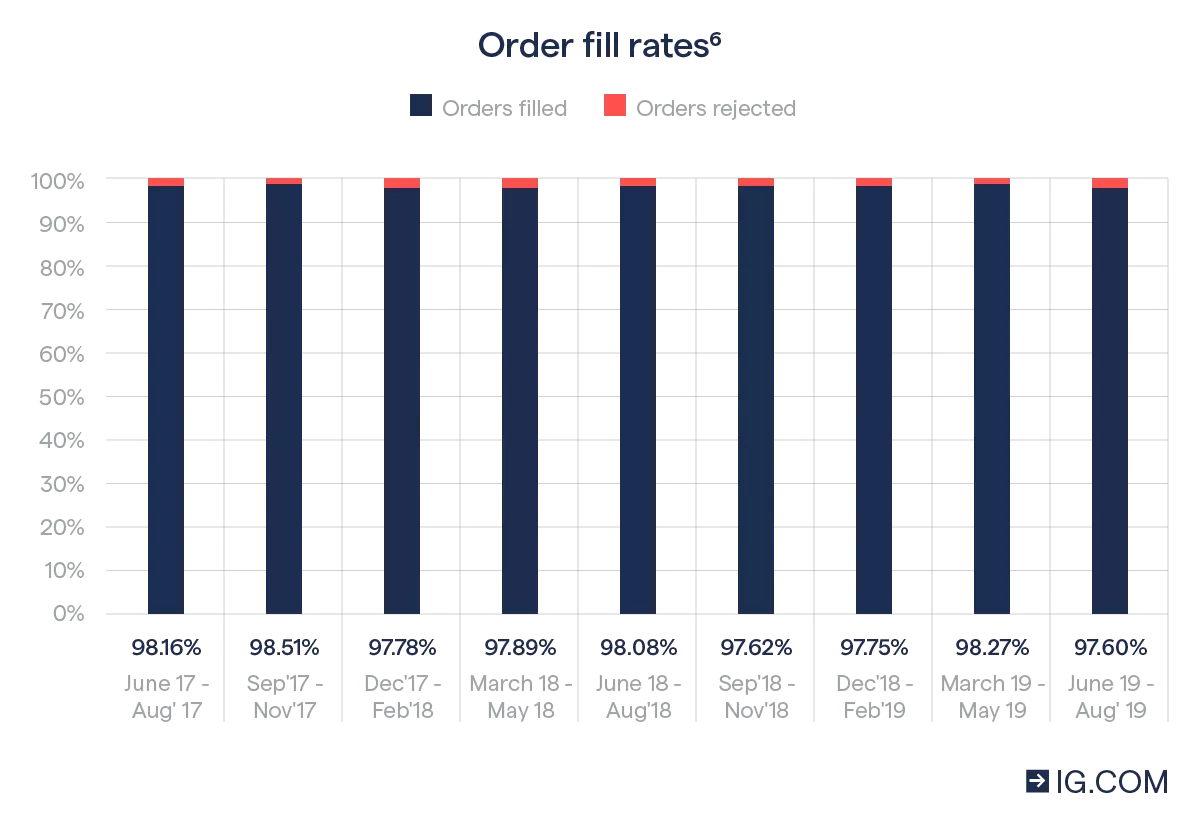

As it’s in your interests to get the best order fill you can, we make it our business to deliver that. We constantly monitor client rejection rates to ensure your likelihood of execution is as high as possible. Below are our order fill rates for all spread bet and CFD asset classes, per quarter, over the past two years. Rejections are caused by underlying market dynamics, or relate to orders placed in error, as well as orders that exceed acceptable parameters.

Why do clients’ orders get rejected?

The main reasons why clients get rejected are price changes in the underlying market and issues with liquidity.

We created our advanced dealing options to give you back control over these factors.

No manual intervention

We never intervene to handle active at-quote orders7 manually – and this means you get a faster execution speed, plus it’s more likely we’ll be able to execute your order at the price you specify.

The only occasions when you may experience manual intervention at IG are on stops and limits, or on trades placed by phone.

.png/jcr:content/renditions/original-size.webp)

31.5 million trades filled for Apr – Jun 24

£2.3 trillion in notional flow per quarter8

100% of successfully filled orders executed at requested price or better

98.97% of orders successfully filled (not rejected) in

Apr – Jun 249

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 15,000+ global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Order execution policy

When we execute orders on your behalf, our order execution policy ensures that we will consistently take all the steps needed to achieve the best possible result.

This policy outlines the factors we consider and the steps we take when handling and executing your orders. You can see a summary of that policy below, along with a list of the execution venues, exchanges, liquidity providers or brokers we may rely on to execute or price your orders.

Summary order execution policy

(PDF, 728KB)

Execution venues

(PDF, 98KB)

PDFs require Adobe Reader, which is available free from Adobe.

For more information on best execution, please refer to our regulatory disclosures updated on a regular basis under MIFID II reporting obligations.

Pricing for specific products and markets

How are out-of-hours markets priced?

We offer two-way quotes on a variety of markets outside of their traditional trading hours. This enables us to offer continuous, fair trading opportunities, even when the underlying market is shut. However, in these circumstances we cannot draw on the current market price as a reference, so will instead create our own prices to reflect our view of a market’s prospects.

For example, we might price an out-of-hours index by taking into account the performance of other indices around the world that are open. We might also account for our overall clients’ trading activity on the out-of-hours market, or factor in news stories that break outside of the trading session. Since our out-of-hours prices are market-made, automatically priced off moves in correlated markets, you’ll find that our spreads are generally wider than during normal trading hours. This is all done with our clients' best interest in mind.

Weekend markets are an extension to our out-of-hours market offering, with our quotations reflecting our view of the prospects for each market. This includes analysing specific market or geographic news flow which may affect markets that we are pricing. Furthermore, business done by other clients may affect our quotations. There may be nothing against which to measure our quotations at these times, and the market-making element will again necessitate wider spreads than during normal market trading hours. Weekend markets can be used by clients to hedge their existing positions in the markets we offer, though price movements in these markets over the weekend will not affect the status of existing positions. This ensures that clients who do not wish to utilise the weekend offering cannot be adversely affected by it (for example, by having stop losses triggered).

Remember, out-of-hours prices may be very different to those available when the market opens next, so trading on them could lead to a profit or loss that would not have otherwise been incurred if you’d waited

How do we price digital 100s?

Digital 100s enable you to trade on whether statements about the future behaviour of a market will be true or false. For example: ‘EUR/USD to be above 11446.1 at 4pm’ or ‘Silver to be below $14.00 per ounce at the close of trading’.

Please note that, from 2 July 2018, regulatory interventions mean that certain products are unavailable to retail traders.

Each digital 100 is priced between 0 and 100. The closer the price is to 100, the more likely it is the statement in question will be true. The closer it is to zero, the more likely it is it will be false.

Our digital 100 prices are based on the behaviour of an underlying market, but set by our dealing desk according to four factors:

- Time to expiry

- The underlying market’s current value

- Our expectation of future volatility

- Client business

If the statement you trade on does indeed end up being true, the digital 100 would close with the price settling at 100. If on the other hand the statement turns out to be false, the digital 100 price would settle at 0.

How does IG’s pricing for CFD options work?

An option’s price – meaning the premium that the holder pays the writer to buy the option – will change depending on several different factors. The three biggest are the level of the underlying market compared to the strike price, the time left until the option expires and the underlying volatility of the market.

All of these factors work on the same principle: the more likely it is that an option will move above its strike price (for calls) or below it (for puts), the higher its premium will be.

Try these next

We're clear about our charges, so you always know what fees you will incur.

We break down our algorithmic offering, so you can remove human error from your trading and backtest your theories.

See how we've been changing the face of trading for 45 years.

1 Based on revenue (published financial statements, 2023)

2 Based on IG Group's OTC data for Jun – Aug 2023

3 Based on IG Group's OTC data for Jun – Aug 2023

4 This is the minimum liquidity a client should usually be able to receive per trade during main market hours. A client may be able to receive more depending on broker exposure

5 Based on IG Group's OTC data for Apr – Jun 2024

6 Rejection rates are for orders rejected by IG. Rejections due to client error, for example placing an order on the wrong side of the market, are excluded

7 An 'active' order, submitted through our platforms, is where you give us an instruction to execute an order immediately. As opposed to 'passive' orders where you give us an instruction to execute an order later, subject to the price moving to a specific level

8

Includes all OTC trades with IG Group

9 Based on IG Group's OTC data for Apr - Jun 2024. Excludes rejections due to underlying market dynamics, erroneous orders and orders exceeding acceptable parameters.