Tangible assets definition

What are tangible assets?

Tangible assets are the assets on a company's balance sheet that have a physical form. This includes machinery, office equipment and property, as well as materials that are used in production.

Current vs long-term tangible assets

Current tangible assets are those that can be turned into cash in the short term. These will appear in an earnings report as revenue. Company inventory is an example of a current asset.

Long-term tangible assets, also called fixed assets, are those that will not be turned into cash within one year. This means their value will depreciate, and so their cost is divided among the years of use. Machinery is an example of a long-term asset.

Different types of tangible assets will be handled differently in accounting, because it can be difficult to exchange them for cash. Fixed assets like property, for example, have less market liquidity and take longer to sell.

Start trading today

Learn how you can maximise your opportunities with leveraged trading.

Example of tangible assets

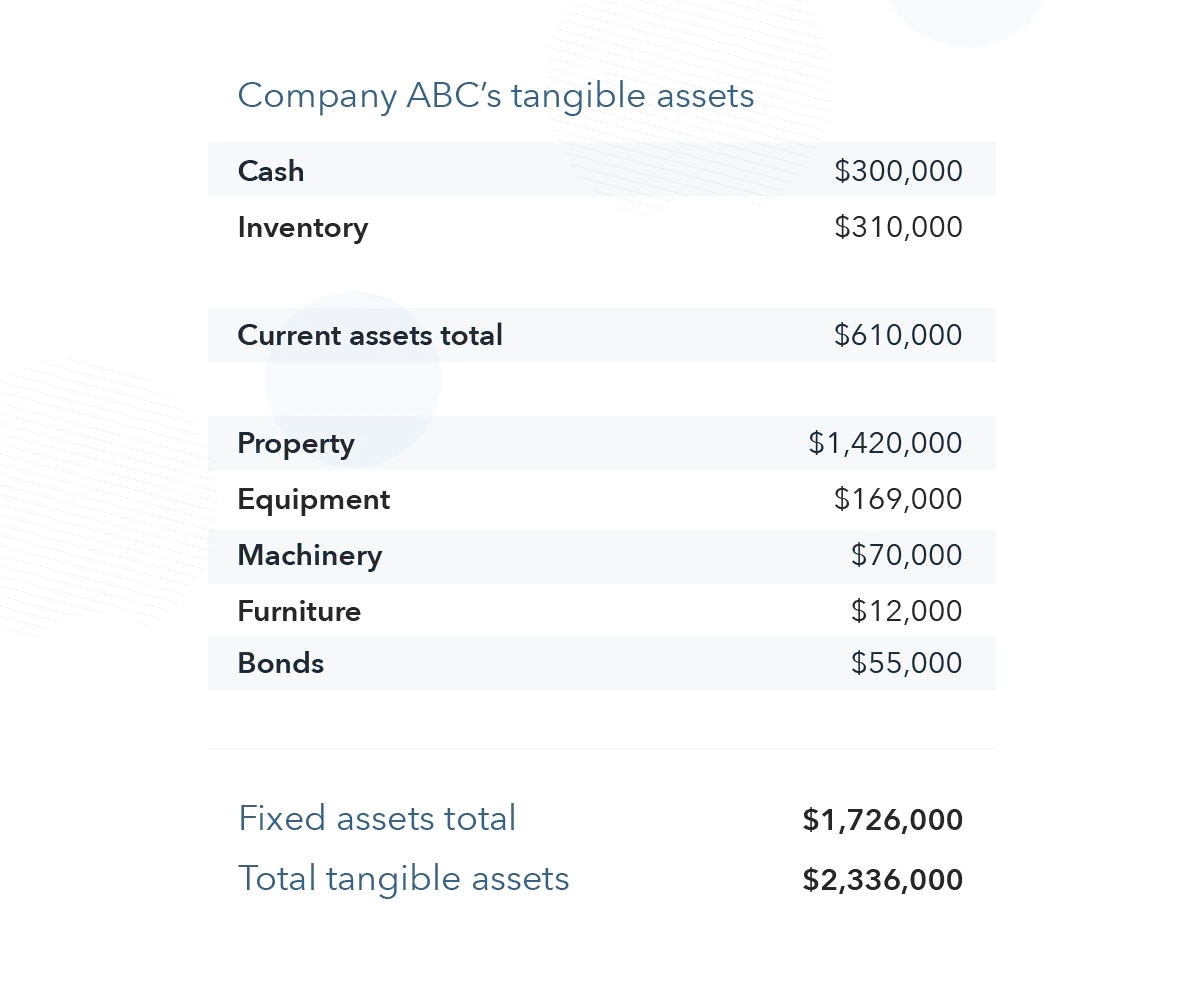

Examples of tangible assets include property, equipment, inventory and vehicles. They are physical and measurable assets of a business that can be converted to cash if needed and will appear on a balance sheet, like so:

This ratio is expressed as a percentage, which reflects how much of a company’s existing equity would be required to pay off its debt.

Tangible vs intangible assets

An asset can either be tangible or intangible. Tangible assets are physical assets, which can be seen. They can be short-term or long-term assets, such as cash or property. Tangible assets are used to assist the daily operations of a business and can be converted to cash if needed.

Intangible assets, on the other hand, cannot be seen – although they still carry value for the business. They include the brand name and intellectual property. Intangible assets cannot be converted into cash, but they do contribute to sales and revenue.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.