The value of the pound since Brexit

Brexit has been one of the key factors influencing sterling over the past few years. Discover the main events that have affected the value of the pound since the Brexit referendum.

December 2020 to January 2021

Brexit takes a backseat to Covid-19 vaccine news

December’s headlines were dominated by the successful clinical trials of the Pfizer-BioNTech coronavirus vaccine. Brexit slumped down many people’s radars, and attention turned instead to how quickly people in the UK and across Europe would be able to return to normal.

That said, as the 31 December 2020 deadline neared, EUR lost ground against GBP – falling 1.88% in the EUR/GBP pair from 14 December to 31 December 2020 as it became more likely that a deal would be reached. But overall for the entire month of December, the EUR/GBP pair gained 0.34%.

October to November 2020

Euro bears lock in gains as EUR weakens against GBP

October was a relatively good month for euro bears, with the EUR/GBP pair losing 1.17% of its value from 1 to 31 October 2020 as GBP strengthened against EUR. The fall for the euro came on the back of rising coronavirus infections across Europe.

France and Germany implemented new lockdowns toward the end of October 2020, and there were regional lockdowns in Spain, which worsened the likelihood of an already fragile economic recovery.

August to September 2020

Pound weakens against the euro and dollar

The pound weakened against the euro from 18 August to 23 September, with the GBP/EUR pair losing 1.65% of its value as EUR gained ground over GBP. In the same period, the GBP/USD pair saw a drop of 3.11% – indicating that USD was strengthening against GBP.

One possible reason could be anxiety surrounding the supposed breakdown in Brexit negotiations. Another could be investors flocking to EUR and USD as potential safe havens during the coronavirus pandemic amid fears of a second wave.

February to April 2020

Coronavirus sparks panic in GBP crosses

The pound weakened against the dollar from 25 February to 1 April, represented by a 4.12% decline in value for the GBP/USD pair. The effects of coronavirus on the markets were particularly damaging during this period, so it might’ve been expected that investors poured their money into the dollar as a safe haven.

Interestingly, the pound also weakened against the euro during the same time frame – with the GBP/EUR pair falling 4.69%. This is an indication that investor confidence in GBP was much lower than it was for EUR as the initial onset of the coronavirus began to sting the markets.

December 2019

Pound surges after Conservative election win

Sterling had remained relatively flat during the election campaign which dominated much of November 2019. Overall, polls predicted that the Conservatives would win the December 2019 election, but Labour did experience some significant gains in the closing days of the campaign – prompting increased nervousness in the markets.

However, on the day of the election, exit polls revealed that the Conservatives were expected to win a majority, which prompted the pound to surge.

Sterling gained 1.61% against the euro to break through 1.20 – reaching a high of 1.20822 before closing at 1.20476. Against the dollar, the pound gained 2.07%, rising from an open of 1.32001 to a high of 1.35156, before closing at 1.34735.

October 2019

Pound gains after a deal is agreed with EU

In the first 10 days of October, sterling lost 1.31% of its value against the euro, and 0.42% of its value against the dollar. This was after statements from European leaders, which showed they were unconvinced by Boris Johnson’s withdrawal agreement and his proposed plan to eliminate the so-called Irish backstop.

However, on 10 October rumours emerged that the prime minister had held a successful meeting with his Irish counterpart – Leo Varadkar – after which it was declared that the two believed that a deal was possible by 31 October. Sterling strengthened on the news, rising from an open of €1.11 euros to the pound, to a close of €1.29.

Sterling gained a further 1.19% against the euro and 1.23% against the dollar on 15 October after it emerged that a deal between the UK and the EU was imminent. However, following the agreement of a deal between British and European negotiators on 17 October, the pound closed 0.03% down against the euro – before remaining relatively flat for the rest of October, despite the news of an early UK general election.

September 2019

Pound spikes after reaching lowest point since 2016

Fears of no deal intensified towards the end of August 2019, which saw sterling reach its lowest point against the dollar since a flash crash in 2016 – trading at lows of $1.19585. However, following a move from MPs on 4 September which effectively blocked a no-deal Brexit, the pound spiked to break through $1.2340.

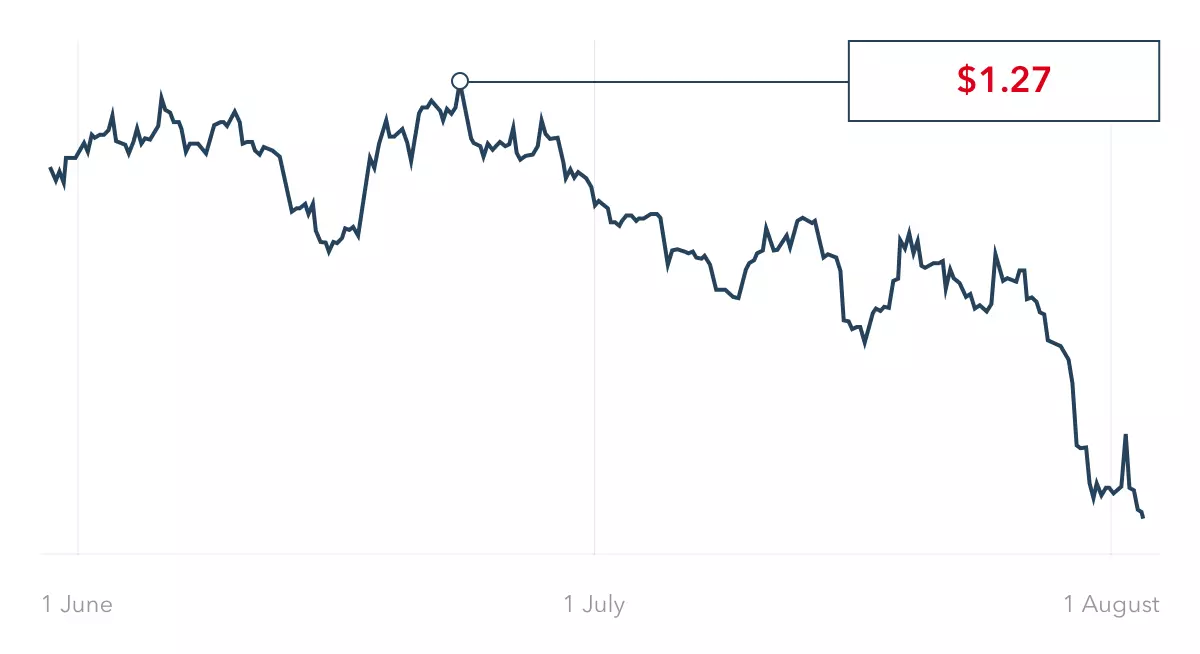

June and July 2019

Commitment to no deal sees pound weaken

Sterling experienced some of its biggest declines in over a year in June and July 2019, starting at $1.26 and ending at $1.22, with a high throughout this two-month period of $1.27. The fall came on the back of Theresa May’s resignation as prime minister on 7 June, and Boris Johnson’s succession on 24 July 2019 following his victory in a Conservative leadership contest.

The slump in the latter part of July to $1.22 dollars to the pound was a result of Boris Johnson’s commitment to a no-deal Brexit, should the 31 October deadline arrive without a withdrawal deal in place with the EU.

The same can be said for the GBP/EUR pair throughout this period, which traded between €1.13 and €1.09 to the pound from 1 June to 31 July 2019. Similar to the pairing with the dollar, the pound’s partnership with the euro was tested by Theresa May’s resignation and the announcement that Boris Johnson would succeed her as prime minister.

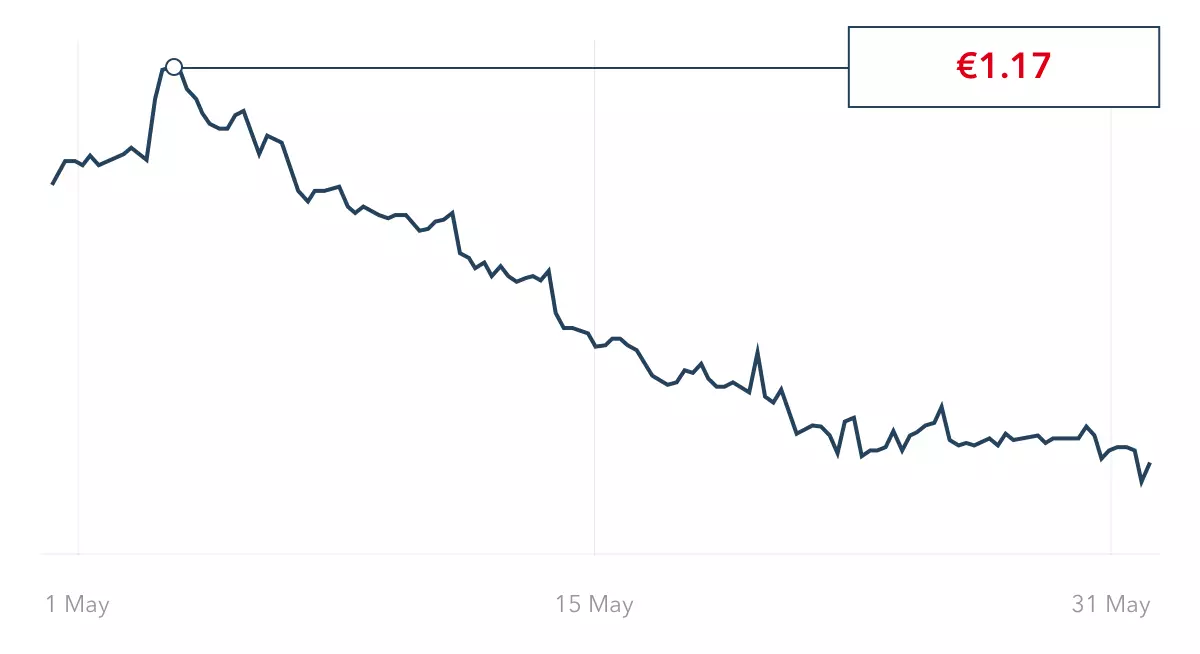

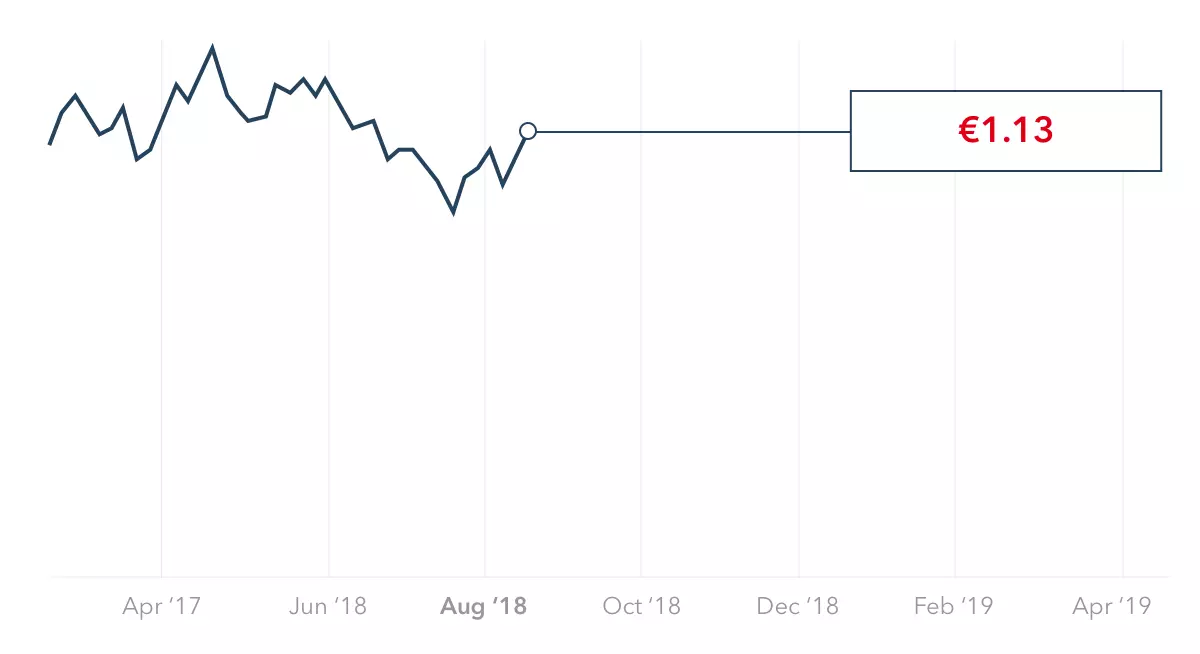

May 2019

Pound falls against backdrop of prime minister’s resignation and political impasse

May 2019 saw a steady decline in the value of the pound against the euro. Starting off at €1.17 euros to the pound, the month ended with the currency pair trading at €1.13.

The price chart below shows that this drop was steady and gradual, but entirely consistent throughout the month. The pound’s weakening was caused by parliamentary deadlock early in the month, the announcement of Theresa May’s resignation on 24 May – following the repeated defeat of her deal in the Commons – as well as the Brexit Party’s dominance in the EU elections.

The pound experienced similar slumps against the dollar against this news, trading from the upper end of $1.31 at the start of May, down to just above $1.26 towards the start of June.

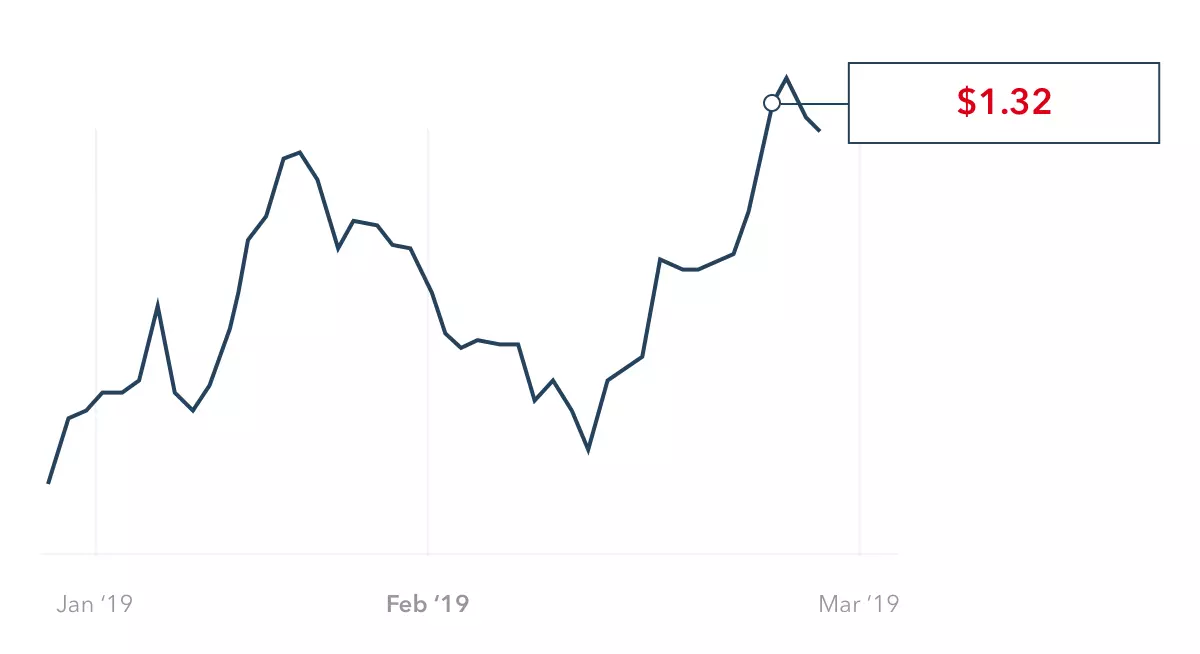

February 2019

Brexit vote delay causes pound to rise

Just 33 days before the agreed Brexit deadline, Prime Minister Theresa May announced that the Parliamentary vote on her revised deal would be postponed. On 26 February 2019, May announced that if no deal was agreed and a hard Brexit was taken off the table, then there might be an extension of the Brexit timetable.

The news caused the pound to rise, reaching €1.16 – its highest level against the euro (GBP/EUR) since May 2017. Against the dollar (GBP/USD) sterling reached $1.32 in intraday trading before beginning to fall again.

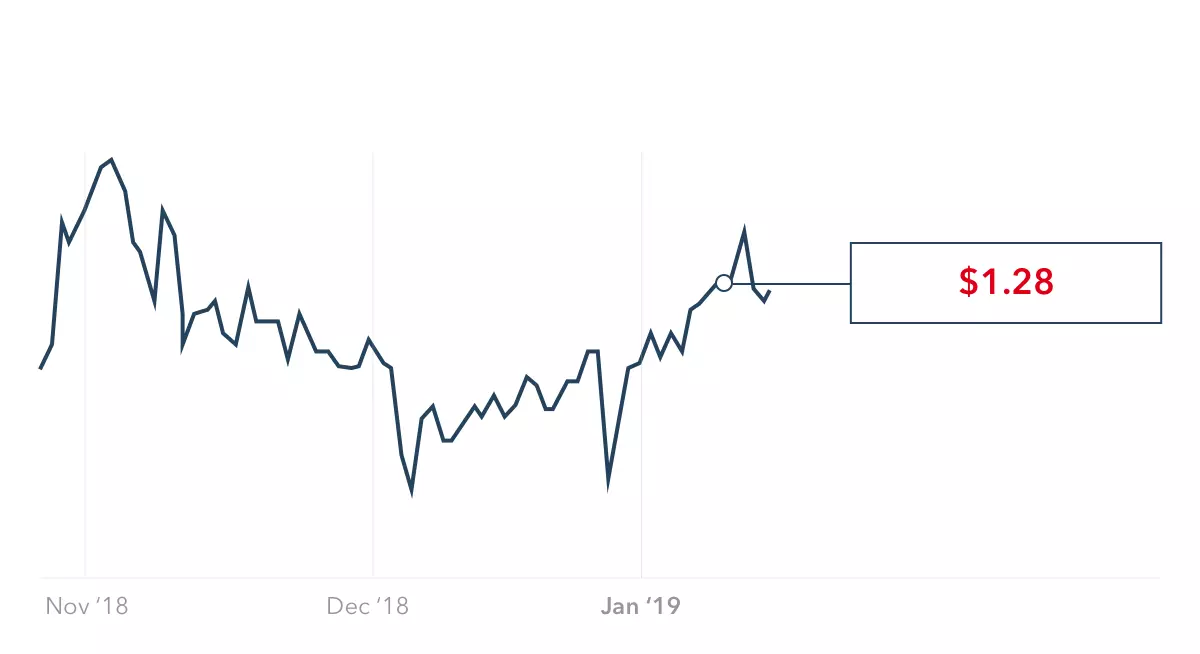

November 2018

Brexit deal uncertainty hits the pound

The pound started to rally in early November as it looked likely that May had agreed a draft deal with Brussels.Then, on Wednesday 14 November, May announced that she had secured cabinet approval for the draft Brexit agreement. Sterling leapt 1.4% against the dollar to trade at $1.30 and reached a near-seven month high against the euro, trading at €1.15.

But, as the announcement settled in, the pound began to fluctuate on the back of minister resignations led by Brexit Secretary Dominc Raab, and internal disagreements. On 15 November, the pound fell 1.7% against the dollar to $1.27 and 1.9% against the euro to €1.12.

On 10 December, the pound took another hit after the Common’s vote on May’s Brexit deal was delayed. After May’s trip to Brussels to salvage the deal failed, the pound fell again by 0.5% against the dollar to $1.25.

The ‘meaningful vote’ was rescheduled for 15 January 2019. The value of the pound increased in the build up to the vote, reaching a multi-week high of $1.28 the day before. The government’s Brexit deal was rejected by a majority of MPs, and although sterling shed 1% of its value initially, it did continue to rise shortly after the defeat.

July and August 2018

Fears of a no-deal Brexit pound Britain’s currency

The price of the pound climbed in early July 2018 as news broke that David Davis would be resigning from his position as Brexit secretary. His decision came after he voiced criticisms of the Chequers plan – the proposal that outlines the government’s preferred Brexit outcome.

Despite rising uncertainty in May’s government, this was seen as increasing the chances of a soft Brexit. By midday on 9 July, sterling had risen 0.56% against the dollar to $1.33 and increased against the euro too, up to €1.13.

But, just one day later, the news that Foreign Secretary Boris Johnson would also be resigning pushed the pound back into its downfall. During the afternoon of 9 July, it fell back to $1.32 and €1.12.

In the month that followed, the pressure on sterling continued. The British currency was down against all other major currencies amid fears that Britain would be leaving the EU with no deal. Sterling fell below $1.29 for the first time in 12 months on 8 August after comments from Bank of England Governor Mark Carney and International Trade Secretary Liam Fox spread uncertainties over Brexit negotiations.

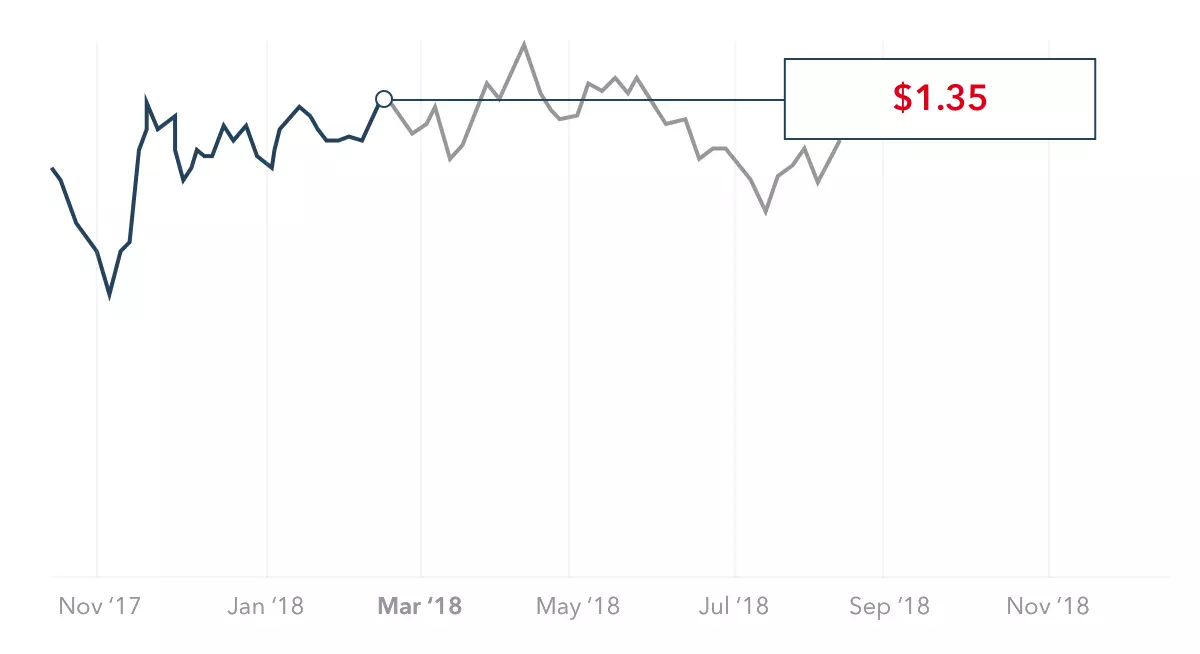

March 2018

Pound rallies as a Brexit transition deal is announced

In January 2018, the pound regained lost ground and was even trading above $1.40 for the first time since Brexit.

Sterling remained above $1.37 in the weeks that followed, spurred on by the anticipation of a Brexit transition deal, expectations of another Bank of England rate hike and a weak dollar, caused by Donald Trump’s tariff threats against trade partners.

On 19 March, the EU and UK announced there would be a 21-month transition period, which sent sterling soaring. The pound gained as much as 1.1% against the dollar, reaching a three-week high of $1.40. Sterling also climbed 0.8% against the euro, trading above €1.15 for the first time since the snap election.

Sterling continued to gain on the back of the agreement, trading at post-Brexit highs of $1.43 on 16 April.

But suddenly, Britain’s currency fell off, declining nearly 3.5% to $1.39 against the dollar in ten days. The trigger for the sell-off was suggestions that the Bank of England would not be raising interest rates, despite the fact the UK economy had only grown 0.1% in the first quarter of 2018.

Cable reached a four-month low, trading at $1.35, on 3 May after pro-Brexit ministers announced they would be demanding a clean break from the EU customs union – a direct challenge to May’s tendency toward compromise.

Despite a plunge to $1.32 towards the end of May, sterling remained trading close to $1.34 in the month that followed and returned to normal volatility levels.

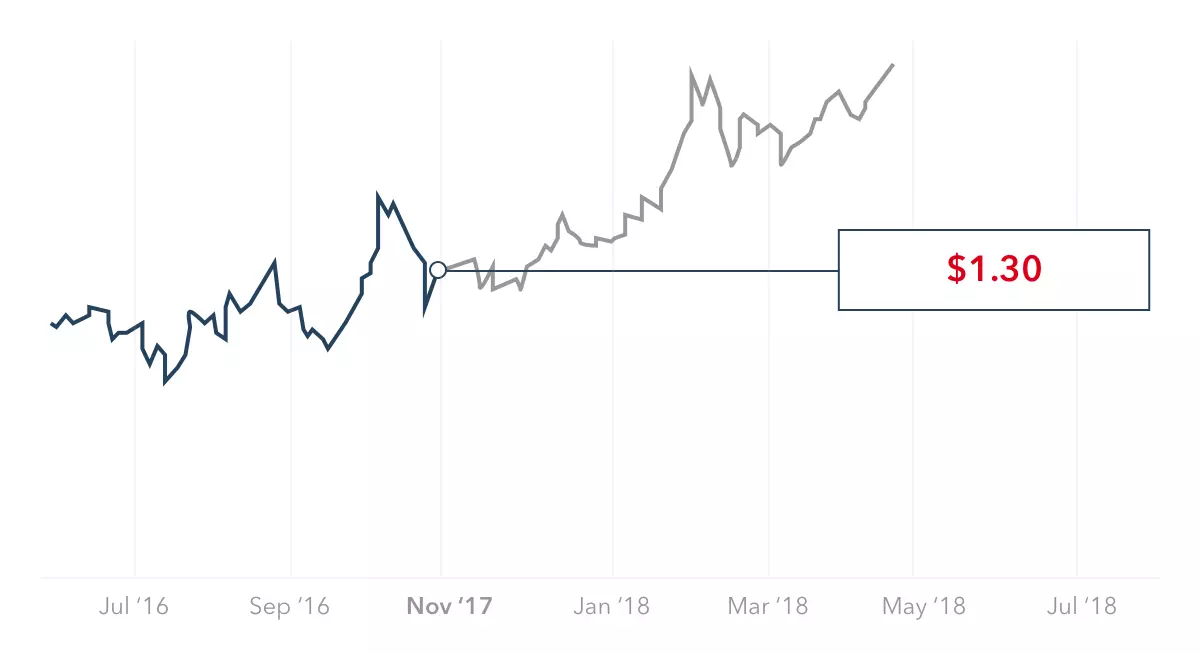

December 2017

Phase one of Brexit agreements causes market uncertainty

Soon after the interest rate hike, the pound rallied as news that the UK and EU were making progress on Brexit negotiations spread – cable reached $1.35, its best level in weeks.

On 8 December, it was announced that phase one of Brexit negotiations had been agreed upon. Reactions were mixed: while many believed it was a good first step in talks, others feared that the hard part of Brexit was still to come.

Though initially sterling jumped – reaching its highest level against the euro in six months, up 0.3% to €1.14 – it soon fell back as the euphoria of an agreement died down. The reality of the remaining uncertainty played out across GBP/USD and GBP/EUR, pushing it down to $1.33 and €1.13.

November 2017

Pound stumbles as BoE hikes interest rates after Brexit

As political instability continued to negatively impact the UK economy, speculation arose as to what Brexit’s effect on interest rates would be. The weaker pound had driven up the cost of living and increased the price of imported food, fuel and other goods. Inflation had hit 3% in September, which was the highest level since 2012.

This led to the Bank of England raising interest rates, on 2 November, for the first time in ten years. Though it did not come as a surprise, the pound plunged from $1.32 to $1.30 as traders were concerned over the gloomy forecast of growth, and the uncertain timeframe of future rate hikes.

The pound also fell against the euro, from €1.13 to €1.11.

June 2017

Sterling rallies in support of a UK snap election

In April 2017, May surprised markets by calling for a snap election. Cable finally broke out of the $1.20 to $1.27 range it had been stuck in since October, as the announcement caused sterling to jump 2.7% to $1.28. The rally came out of belief that a larger Conservative majority would make Brexit negotiations smoother.

But, on 8 June, sterling fell back 2% as the results of the election confirmed a hung parliament. Cable fell from $1.29 to a low of $1.26, while the pound hit a seven-month low against the euro, falling to €1.12.

The election intended to consolidate May’s political powers ahead of Brexit talks had instead weakened her position. The lost seats forced the Conservatives to form a coalition with the Democratic Unionist Party (DUP).

In the months that followed, both sterling and the PM were in trouble as pressure mounted for May to quit her post. This worried currency traders, who feared unstable leadership in a crucial time of Brexit negotiations.

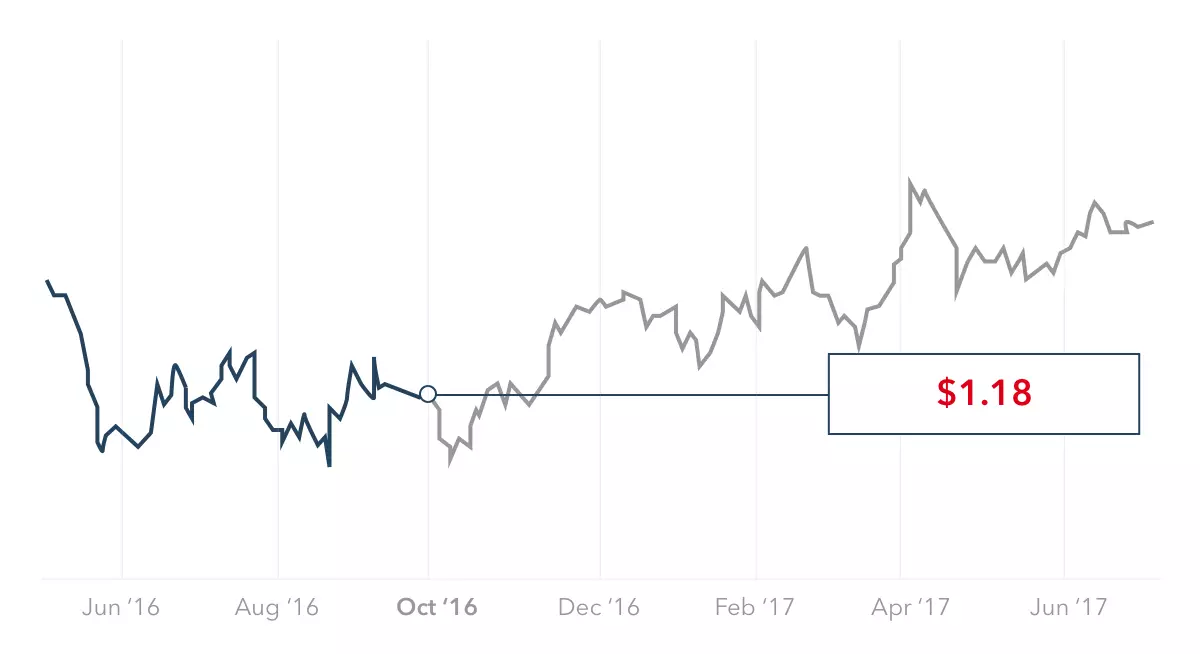

October 2016

Threat of Article 50 sinks the pound’s value

Market panic was exacerbated by the news that David Cameron would be stepping down as Prime Minister. In the following weeks the pound saw volatility as a leadership contest within the Conservative Party ensued, resulting in Theresa May taking the helm on 13 July 2016.

Despite May’s ‘Brexit means Brexit’ rhetoric, the potential for political stability helped sterling make its way to $1.34 – its highest price against the dollar since the referendum.

But in October, the pound fell again as May announced that the UK would trigger its exit from the EU in March of the following year. Sterling sunk to €1.11, a three-year low against the euro, and fell against the dollar to $1.23 – reaching intra-day lows of $1.18 for the first time in 30 years.

In January 2017, the pound fell to $1.21 as Brexit uncertainty continued to spread, and traded below $1.20 for the second time since the referendum.

Soon after, sterling clawed its way back to relative stability, despite Article 50 being triggered on 29 March 2017. The pound gained against the euro, and saw only minor declines against the dollar.

June 2016

Brexit referendum shocks forex markets

On 23 June 2016, the UK voted to leave the EU. This decision took markets by surprise. Due to last-minute polling which suggested that ‘remain’ had the edge, sterling initially rallied – with the pound to euro rate before Brexit rising to €1.32, while also reaching highs of $1.50 against the US dollar.

But as the Brexit result reverberated around the world, the pound experienced its largest intra-day collapse in 30 years. Sterling fell harder against the dollar than it did against the euro – reaching lows of $1.32 and €1.20 respectively – as the eurozone was already facing internal struggles over an Italian referendum and French elections.

Get Brexit-ready with IG

Discover trading opportunities around Brexit – and download our free checklist – to learn how to profit from upcoming volatility and hedge against downside risk.

You might be interested in…

Learn to trade the reaction to Brexit across 90 currency pairs

Go long or short on over 15,000+ markets