Meta shares climb then fall after better than forecast Q3

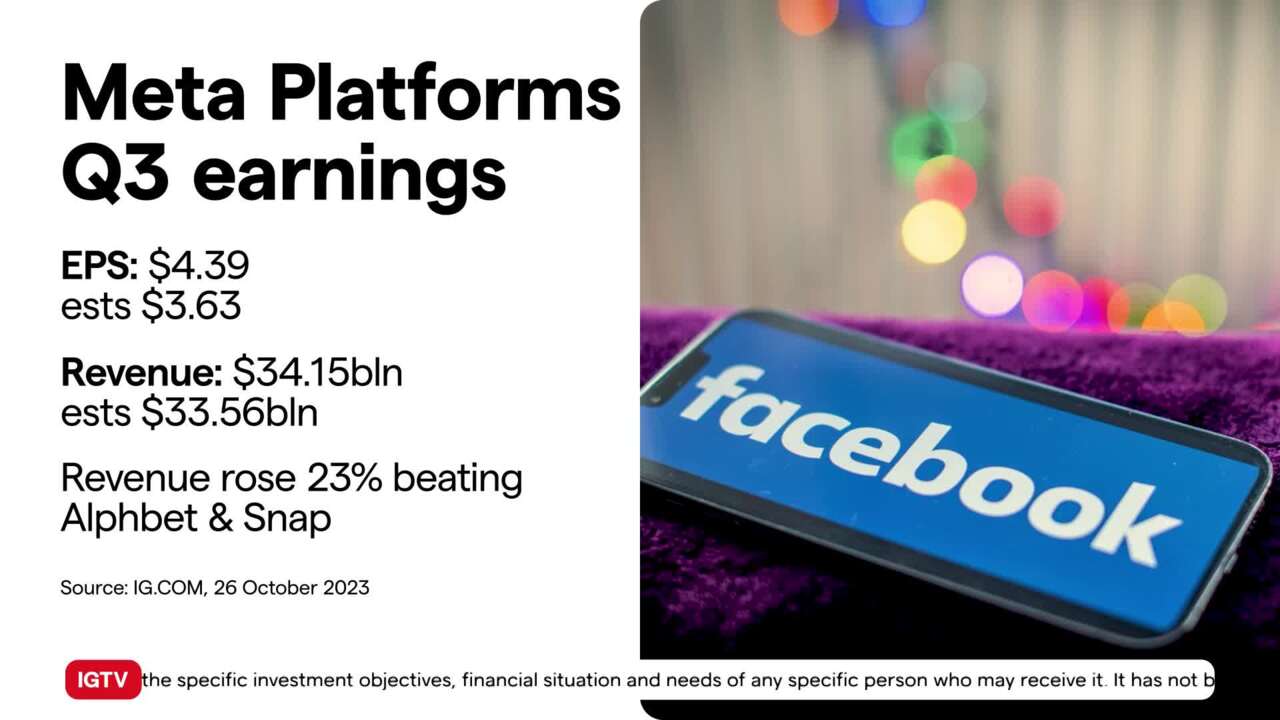

Facebook owner Meta Platforms reported better-than-expected results for the third quarter. Earnings per share came in at $4.39 versus estimates of $3.63 while revenue was $34.15 billion against $33.56 billion expected.

Revenue increased 23%, the fastest rate of growth since 2021. This represents an outperformance versus competitors. Google parent Alphabet said ad revenue increased about 9.5%, while smaller rival Snap reported revenue growth of 5%. The stock initially rose in extended trading after the report, but then reversed course and fell more than 6.7% on concerns about potential ad softness tied to the Middle East conflict.

(AI Video Transcript)

Meta's revenue growth

Meta had a fantastic third quarter, with their revenue growing by a remarkable 23%, which is the fastest growth they've seen since 2021. They also did really well with their earnings per share, exceeding expectations. Other big companies like Google's parent company Alphabet and Snap also saw increases in their ad revenue, with Alphabet reporting a 9.5% increase and Snap reporting a 5% growth.

Meta's stock

But even with all this great news, Meta's stock initially went up in extended trading, but then it changed course and fell more than 3%. The company's CFO, Susan Lee, expressed some concerns about potential ad softness connected to the Middle East conflict, which was similar to what Snap had mentioned before. Despite these cautionary comments and the stock's decline, Meta's stock is still up about 150% this year, making it the second-best performer in the S&P 500. The only company doing better is chip maker NVIDIA.

The Middle East conflict

So, considering the cautionary comments and the stock's fall in extended trading, experts expect that Meta will experience a loss when trading resumes on Wall Street. This doesn't mean that Meta is doing poorly overall, as they have had an exceptional year, but it's important to keep in mind the potential impact of the Middle East conflict on their ad revenue.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize your opportunity

Deal on the world’s stock indices today.

- Trade on rising or falling markets

- Get one-point spreads on the FTSE 100

- Unrivalled 24-hour pricing

See opportunity on an index?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on an index?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from one point on the FTSE 100

- Trade more 24-hour indices than any other provider

- Analyse and deal seamlessly on smart, fast charts

See opportunity on an index?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.