European indices: The ECB meeting and economic data influencing European indices

European indices face uncertainty as economic data disappoints and the ECB's upcoming meeting takes center stage. Explore the factors impacting these markets and what to watch for.

European economic woes deepen as soft data hits equity markets

Last week, we witnessed a continuation of disappointing economic data in Europe, which had a unanimous downward impact on European equity indices.

The list of soft data included the following:

- HCOB Composite Purchasing Managers' Index (PMI) for August fell to 44.6 from 48.5 previously

- German Factory Orders for July plunged by 11.7% compared to the 7.6% prior

- Eurozone Retail Sales in July decreased by -0.2% from the previous 0.2%

- Eurozone GDP Growth Rate Year-on-Year (YoY) dropped to 0.5% from the previous 1.1%.

At the heart of this slowdown in economic activity are higher interest rates, a disappointing boost in China's reopening, and soaring energy prices, all of which are dampening growth prospects.

ECB meeting looms and uncertainty prevails

Despite these challenges, inflation remains persistent. Adding to the uncertainty leading up to this week's European Central Bank (ECB) meeting, there is a division among members and markets regarding the ECB's likely actions.

Presently, the rates market is pricing in a 35% chance of a rate hike on Thursday night. In contrast, economists, who may be giving more weight to core inflation at 5.3% (significantly above the target), are evenly divided.

For the record, we believe the ECB will probably look beyond the uncertain outlook and raise the deposit rate by 25-basis points to 4%. They are likely wary that the longer inflation remains above the target, the more firmly it may become entrenched in expectations.

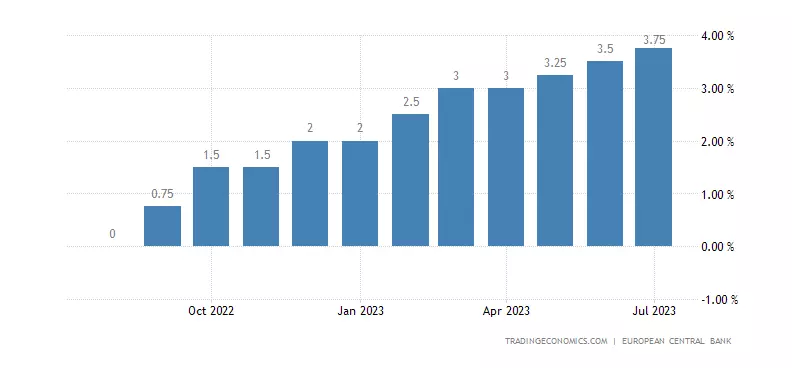

ECB interest rate meeting

Thursday, September 14 at 10:15 pm AEST

At its last meeting in July, the ECB raised its key deposit rate by 25 basis points to 3.75%. It noted: "Inflation continues to decline but is still expected to remain too high for an extended period."

Regarding forward guidance, the ECB mentioned that future interest rate decisions would be based on incoming data.

"The Governing Council will continue to follow a data-dependent approach to determine the appropriate level and duration of restrictions. Specifically, its interest rate decisions will be based on its assessment of the inflation outlook considering economic and financial data, underlying inflation dynamics, and the strength of monetary policy transmission."

Since the ECB meeting in July, growth data has continued to soften. However, inflation remains above target. As pointed out by ECB Council member Klass Knot this week, markets may be misreading the possibility of an interest rate hike next week. Given that inflation remains high and the risk of it becoming entrenched, we believe the ECB will likely raise rates this week by 25 basis points to 4% and maintain a data-dependent approach.

Eurozone deposit facility rate chart

DAX technical analysis

In last week's update, we noted that the DAX likely completed Wave B of a three-wave correction at the late August 16,070 high. While it remained below the 16,070/120 resistance area, we expected to see a retest of recent lows and support around 15,500ish. This view played out well as the DAX traded to a low of 15,585 at the end of last week.

This week, all eyes are again on the critically important support level at 15,500. If the DAX were to break below this level on a closing basis, it could pave the way for a more significant pullback towards the March 2023 low, around the 14,700/600 area. Conversely, if the DAX can maintain its position above 15,500, it might signal a rebound towards the 16,070/120 area.

DAX daily chart

FTSE technical analysis

In our recent update on the FTSE, we highlighted the risk of the FTSE moving lower to retest downside support at 7,200. Despite some encouraging initial signs that we were on the right track, dovish comments from Bank of England (BoE) Governor Andrew Bailey provided a lifeline as the FTSE rebounded by the end of last week.

Nevertheless, we continue to emphasise that if the FTSE were to witness a sustained break of support at 7,200, there is potential for it to extend its decline towards 7,000 before revisiting the 2022 lows in the 6,800/6,700 range. However, until such a scenario unfolds, it's advisable to anticipate further range trading.

FTSE daily chart

- TradingView: the figures stated are as of September 12, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.