Central banks preview: busy week with rate decisions from Fed, BoE, BoJ

This week will see the US Federal Reserve, the Bank of England and the Bank of Japan all announce their latest decisions on interest rates. On Wednesday, the Fed is widely expected to keep rates steady.

Some of the recent macroeconomic indicators plead for a resurgence in economic activity, therefore raising the risk of renewed price pressures. If this Wednesday's decision is a given, the November meeting could be a close call, and the FOMC economic projections will be of particular interest. Meanwhile, the Bank of England is likely to raise interest rates once again on Thursday.

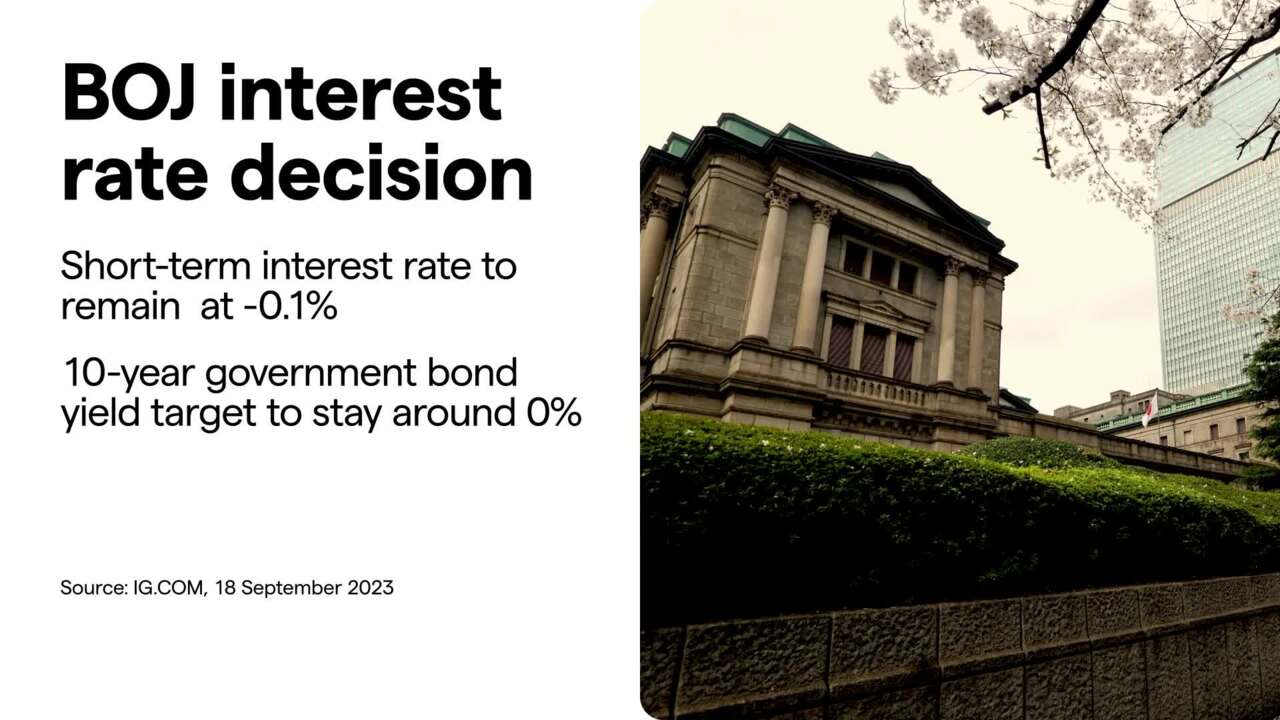

All but one of 65 economists polled by Reuters in recent days predict Andrew Bailey will raise rates by 25 basis points to 5.5%. In Asia, the highlight of the week will be the BoJ meeting on Friday with the key short-term interest rate expected to remain unchanged at -0.1%. IGTV’s Angela Barnes has more.

The European Central Bank

This week is an important time for central banks as they make decisions about interest rates. The European Central Bank (ECB) has decided to increase its rates for the tenth time, even though there are concerns of a recession in the eurozone. ECB President Christine Lagarde said that a strong majority supported this decision.

The Federal Reserve

On Wednesday, the US Federal Reserve will also make a decision on rates, and it is expected that rates will stay the same. The question is whether the Fed will continue to raise rates in the future, as recent reports suggest that the economy is getting stronger and prices could go up.

The Bank of England

Based on a Reuters poll, it is likely that the Bank of England will raise interest rates on Thursday. Most experts think that there will be a 25 basis point increase to 5.5 percent. The latest data, like lower-than-expected industrial production and monthly GDP, may suggest that this could be the end of the tightening cycle.

But inflation is still high compared to other major economies, and recent average hourly earnings show that it might stay that way. The Bank of Japan's meeting on Friday will be an important event in Asia. Even though there has been talk about a rate hike, it is not expected to happen. It is likely that the short-term interest rates will stay the same at 0.1 percent.

The People's Bank of China

The People's Bank of China (PBOC) is also expected to update the market on Wednesday. It is predicted that the one-year and five-year loan prime rates will stay the same. Before the Bank of England makes its monetary policy decision, the British pound has fallen to its lowest level in three months. If the bank surprises the market with something other than a 25 basis point increase, it could cause more volatility for the pound.

GPB/USD

Looking at the GBP/USD price chart, it hit a low of 1.2379 on Friday and ended the week near that level. It is currently stable but has the potential for a change after closing below the 200-day simple moving average.

EUR/GBP

In the EUR/GBP chart, it has been trading within a range for four months. If it breaks away from this range, there could be a good trading opportunity.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market.

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.