Compounding explained

Recommended:

Financial independence foundations

- How to save money

- What is the 70:20:10 rule?

- What is a pension fund?

- How to increase your earnings

- Preserving vs growing wealth – what is the difference?

- Saving vs investing

- What are assets?

- The right asset type for wealth building

- Taxes, CPI and other money eroders

- Protect what you have: risk management

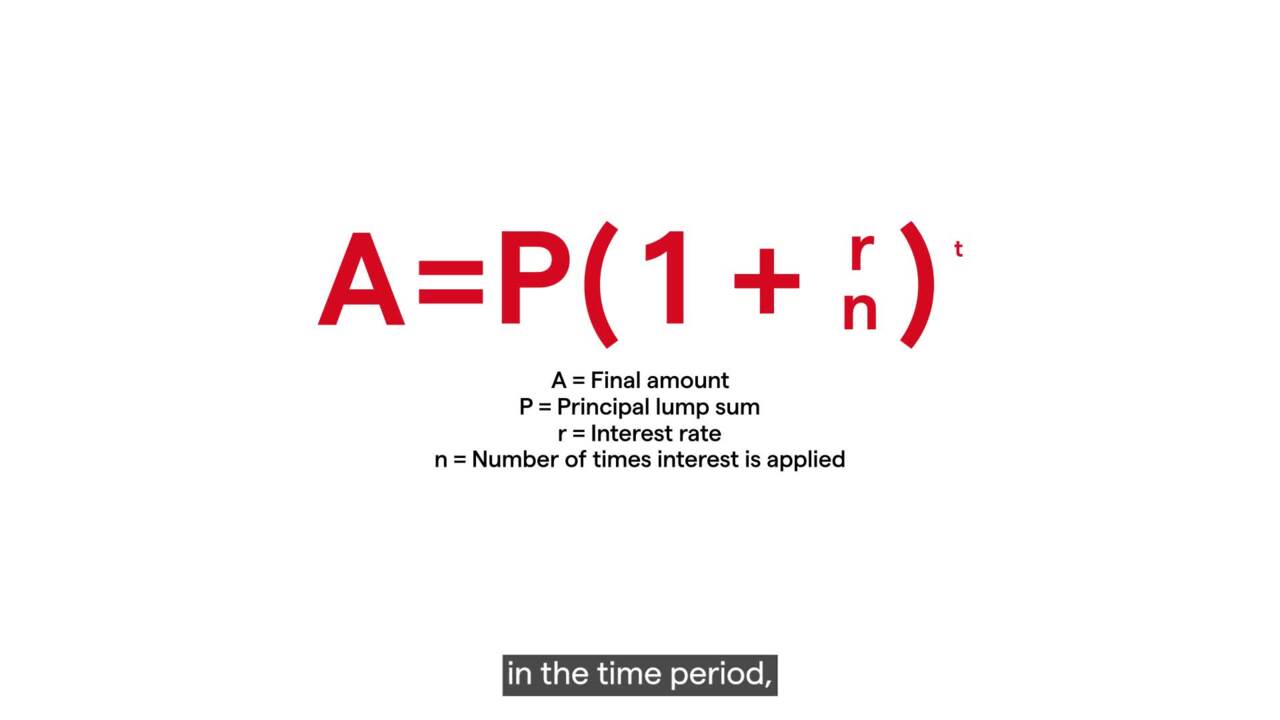

Compounding is a miracle of mathematics whereby you can make ‘free’ money on your money simply by doing nothing. Think of it as your money having babies. It is one of the most effective ways to build wealth and boost your savings and investments. Compounding’s best friend is time: the longer you do it the more money you will make.

Both saving and investing follow the same principle – you choose a home for your money, and you hope to earn interest or some other form of income on your money at the end of each year.

Compound interest on savings

When you save your money in a bank account, you will be offered an annual return on your money. If you put £1,000 into a savings account paying 1% in annual interest, you will earn £10 in interest.

You can withdraw that £10 and spend it, keeping your end of year savings total at £1,000. Or you can leave it in your savings account for another year, boosting your savings total to £1,010.

At the end of the following year, you will receive another 1% in interest, but this time your interest equals 1% of £1,010, rather than 1% of £1,000. That means that by the end of year two, you will earn £10.10 in interest, bringing your savings account total to £1,020.10.

If you continue to save your interest payments, continue to earn 1% per year on your savings, and add no other money to your £1,000 savings pot, the effects of compound interest will allow you to keep on growing your money year after year.

By year 10, your initial £1,000 investment will be worth more than £1,100, earning you more than £100 in interest alone.

By year 20, your £1,000 will be worth more than £1,220; and by year 30 it will have grown to almost £1,350. That’s £350 of free money from a one-off £1,000 savings payment made 30 years ago.

The longer you can keep reinvesting your interest, the more your money will grow. This makes compounding particularly beneficial for younger people at the start of their savings and investing journey; and for pension savers who don’t plan on touching their money until they are retirement aged.

Compound interest on investments

Earning compound interest on your investments is very similar, but the results may be quite different. When you invest your money, you are taking on a little more risk than you would incur in the average savings account. Investors usually accept this risk in the hope of getting a much better return which will offset any losses and deliver better growth opportunities than a typical savings account.

But while savings accounts come with fixed rates, there are no guarantees in investing. Even a low-risk investment portfolio will have some exposure to equities, which will add some volatility. This means that your investment portfolio could return 10% one year, and 5% the next. It could even lose value by the end of the year.

For example, the FTSE All-Share returned 18.3% in 2021, but lost 9.8% in 2020. In the 10 years between 2012 and 2021, there were two years where the stock market lost money; two years where it earned no more than 1.2% per year; and six years where it saw double-digit growth. This is a volatile record, especially when compared with the consistency of bank-based savings accounts. But if you are happy to leave your money in place and reinvest any interest, compound interest can work wonders.

If you had placed £1,000 into a FTSE All-Share-tracking ETF at the start of 2012, by the end of year 10 you would have £1,782.33 in your investment portfolio. This is despite several years of low or negative returns. Remember, your investments only make or lose money when you sell them. If at the end of your 10-year investment period you didn’t sell any of your shares, your portfolio could lose all that value again if the market turns against you. Your returns are only theoretical until you sell your shares in the market. Also remember that selling shares at a profit can incur a tax bill, so your real return on a share investment would only be clear once you’ve paid your taxes.

If you are invested in dividend-paying stocks, which pay a premium annually or quarterly, you can earn even more money from your investments and the effect of compound interest.

Compounding

Compound interest is one of the most accessible tools for new investors, and it requires absolutely no skill. Simply choose a place to keep your money, then make sure you are reinvesting any interest and not making any withdrawals. The longer you can keep your money saved or invested, the more money you will be able to earn on your initial investment.

You also might be interested in

Financial markets participation

When starting your journey as a financial market participant, there are basics you need to learn. Explore how to actively build your wealth and preserve it.

Ethics in the financial markets

It’s important to understand the role of ethics in financial markets. Explore how to get started with investments that align with your values and passion.