US rate cut expectations keep receding

According to Fed Chairman Jerome Powell yesterday, recent data show a lack of further progress on inflation. His reaction was that it would be appropriate to give the policy further time to work.

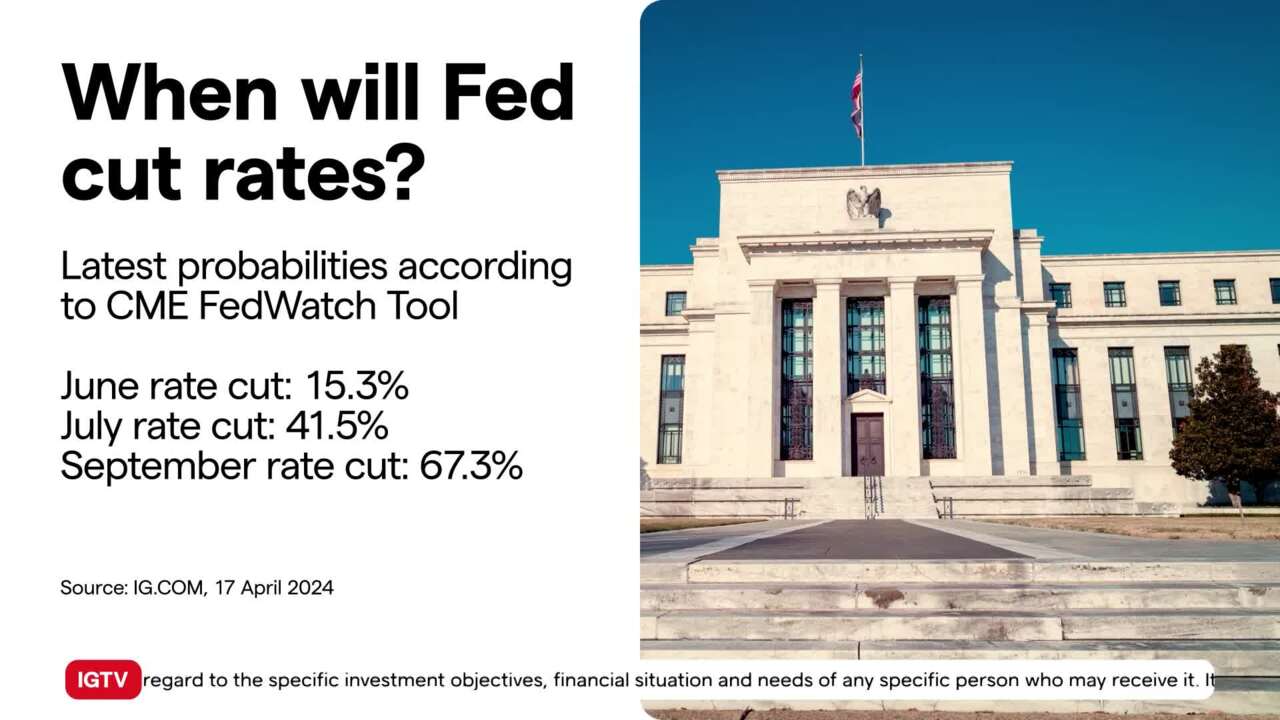

As IGTV’s Jeremy Naylor explains, the market reaction was instant with US two-year treasury yields rising past 5% to their highest since November last year. The CME Fed watch tool, before Powell’s statement yesterday, saw a 22.7% chance for a 25 basis point cut in June. That reading is now down to 15.3%. Expectations of a July cut also diminished by about 7 percentage points to 41.5%. The event forecast for a September cut is also down from 72% yesterday to the most recent reading of 67.3%.

(AI Video Summary)

Federal Reserve

Federal Reserve Chairman Jerome Powell's recent remarks indicated a persistent inflation issue, leading to a reconsideration of the pace of interest rate cuts. Initially, cuts were anticipated as early as May, but expectations have now shifted, with reduced probabilities for cuts in June, July, and September as per the CME FedWatch tool. Market reaction included a surge in US 2-year yields and the strengthening of the dollar to notable highs against the euro, sterling, and yen. Powell's stance suggests a more cautious approach to monetary policy, possibly limiting rate cuts to once this year based on forthcoming economic data.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices