Why use DMA with IG?

More liquidity

Trade on underlying market prices sourced from a range of global liquidity venues, including primary exchanges, multilateral trading facilities (MTFs), market makers and banks.

Market depth

Deal at the price you want, with full view of the best bid and offer price available – plus further prices on either side of the order book.

Order control

Take greater control of trade execution with advanced order types – including pegged, fill or kill, execute and eliminate, good for auction, percentage of volume and more.

After-hours trading

Take full advantage of corporate earnings announcements by trading in the pre- and post-market on 75 key US shares.

What DMA markets can I trade?

DMA shares

Trade shares with no dealer intervention, full market depth and access to dark liquidity pools, using either share CFDs or our share dealing service.

DMA forex

Trade currencies at the market price – and get liquidity from major providers – with Forex Direct, our DMA forex service. To trade DMA forex, you’ll need to qualify for an IG professional account.

What DMA markets can I trade?

Mobile apps

Get DMA on the move with apps specifically developed for iOS and Android smartphones and tablets.

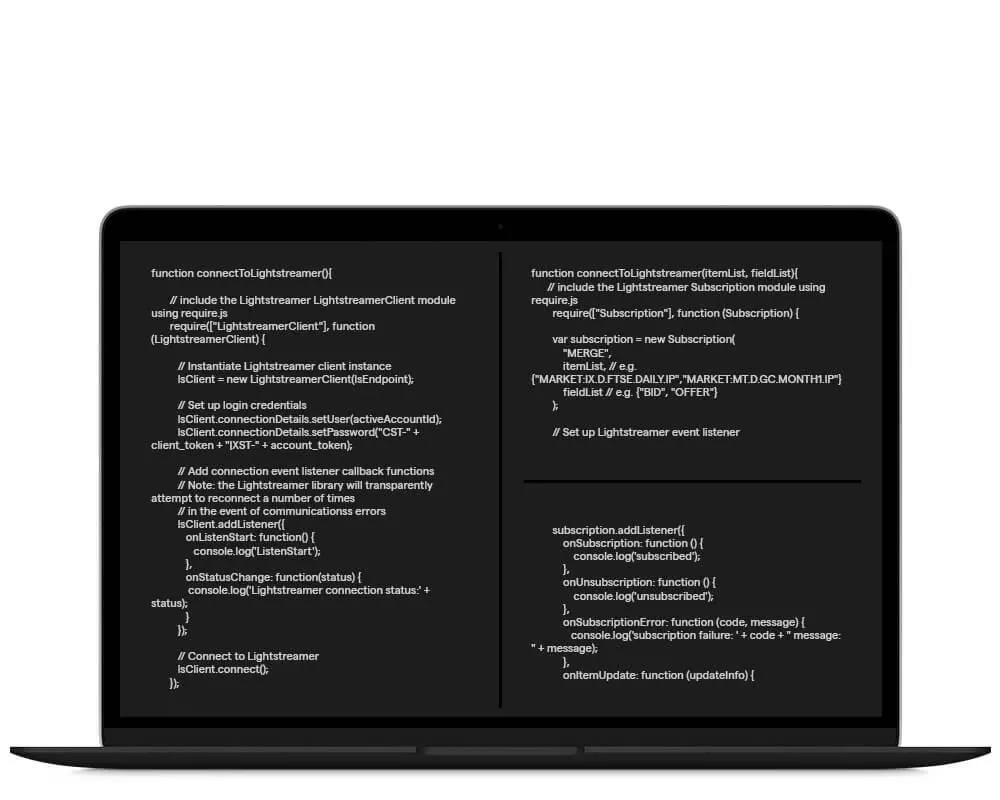

API

Build your own DMA platform and automate your trading with our sophisticated FIX API.

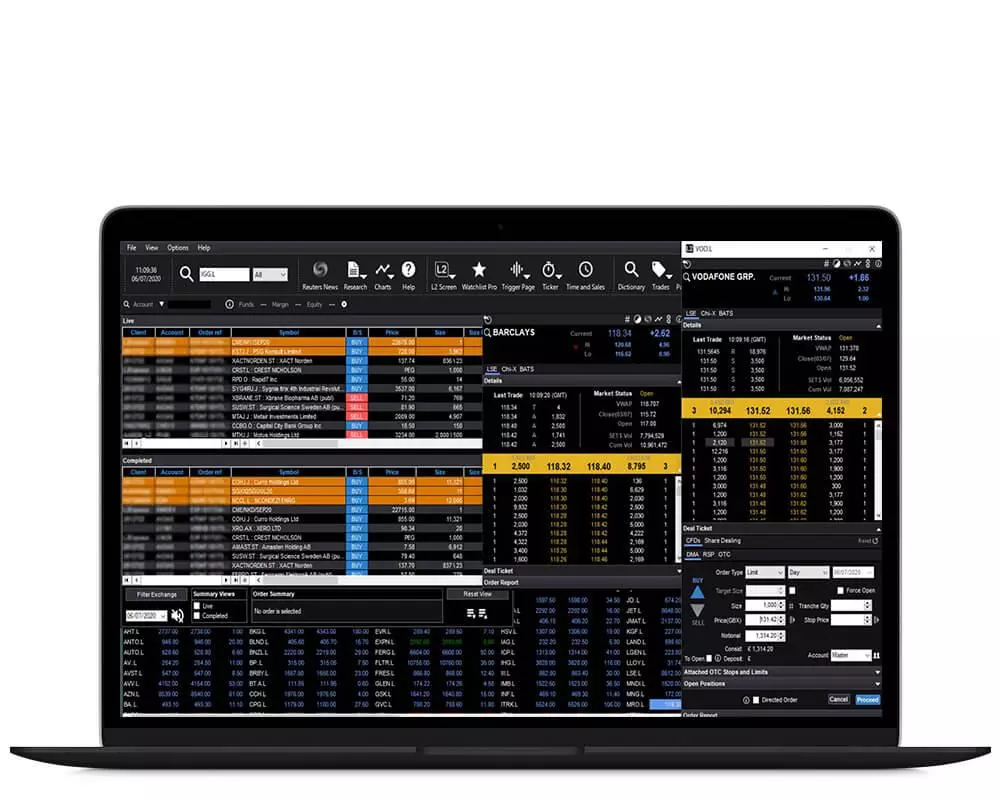

L2 Dealer

Trade with professional tools on a customisable interface with L2 Dealer – our advanced DMA platform.

How much does DMA cost?

DMA prices are not necessarily better than OTC, as our pricing technology is engineered to find the best available prices for both. However, direct access to the markets can give you greater visibility and flexibility as a trader.1

Commission charges

Our only charges are a small commission – the same as an over-the-counter (OTC) trade.

Exchange fees

Depending on the exchange you want to view or trade on, you may be liable to pay data fees.

Other fees

You may have to pay transaction costs, such as stock borrowing fees.

Start trading DMA in minutes

Start trading DMA in minutes

Open an account by completing our simple online form

Fund your account with a minimum of £1000

Choose your trading platform and place your first trade

What is DMA trading?

Direct market access (DMA) is a way of placing trades directly in the underlying market – whether that’s on the order books of an exchange or multilateral trading facility (MTF), or with another liquidity provider. DMA can give traders more flexibility and transparency, but it’s usually recommended for advanced traders only due to its complexity.

Try these next

Automate your strategies with algorithmic trading platforms like ProRealTime and MetaTrader4.

Your growth is our business. Access prime brokerage solutions designed for your organisation's needs.

We're clear about our charges, so you always know what fees you will incur.

Why use DMA with IG?

More liquidity

Trade on underlying market prices sourced from a range of global liquidity venues, including primary exchanges, multilateral trading facilities (MTFs), market makers and banks.

Market depth

Deal at the price you want, with full view of the best bid and offer price available – plus further prices on either side of the order book.

Order control

Take greater control of trade execution with advanced order types – including pegged, fill or kill, execute and eliminate, good for auction, percentage of volume and more.

After-hours trading

Take full advantage of corporate earnings announcements by trading in the pre- and post-market on 75 key US shares.

What DMA markets can I trade?

DMA shares

Trade shares with no dealer intervention, full market depth and access to dark liquidity pools, using share CFDs.

DMA forex

Trade currencies at the market price – and get liquidity from major providers – with Forex Direct, our DMA forex service.

Our DMA trading platforms

Mobile apps

Get DMA on the move with apps specifically developed for iOS smartphones and tablets.

API

Build your own DMA platform and automate your trading with our sophisticated FIX API.

L2 Dealer

Trade with professional tools on a customisable interface with L2 Dealer – our advanced DMA platform.

How much does DMA cost?

DMA prices are not necessarily better than OTC, as our pricing technology is engineered to find the best available prices for both. However, direct access to the markets can give you greater visibility and flexibility as a trader.1

Commission charges

Our only charges are a small commission – the same as an over-the-counter (OTC) trade.

Exchange fees

Depending on the exchange you want to view or trade on, you may be liable to pay data fees.

Other fees

You may have to pay transaction costs, such as stock borrowing fees.

Spreads

Your key payment for trading forex is the spread – the difference between the buy and the sell price – our charge for executing your trade. We work to keep our spreads among the lowest in the business.

| Spot FX | DMA av. spread |

| EUR/USD | 0.165 |

| AUD/USD | 0.295 |

| USD/JPY | 0.242 |

| EUR/GBP | 0.540 |

| GBP/USD | 0.589 |

| EUR/JPY | 0.678 |

| USD/CHF | 0.399 |

Open a DMA trading account in minutes

Open a DMAtrading account in minutes

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

Start trading DMA in minutes

Start trading DMA in minutes

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

What is DMA trading?

Direct market access (DMA) is a way of placing trades directly in the underlying market – whether that’s on the order books of an exchange or multilateral trading facility (MTF), or with another liquidity provider. DMA can give traders more flexibility and transparency, but it’s usually recommended for advanced traders only due to its complexity.

Try these next

Automate your strategies with algorithmic trading platforms like ProRealTime and MetaTrader4.

Create and refine your own trading algorithms, or use off-the-shelf solutions.

We're clear about our charges, so you always know what fees you will incur.

1 When you place your order we take a parallel position in the underlying market, so we can’t change or reverse your order once it’s been executed.