Key events to watch in the week ahead: 22 - 28 April 2024

What are some of the key events to watch next week?

This week’s overview

Escalating tensions in the Middle East triggered a fresh round of risk-off moves in global markets this morning, as market participants price for the potential risks of disruptions in oil supplies or trade routes in the event of a wider regional conflict. Brent Crude prices were up 2.7% at the time of writing, while US futures point to a negative session.

Netflix’s results also took the spotlight, being the first of the megacap tech companies to report. Subscriber additions were higher than expected, but markets seem to find fault with its lower revenue guidance.

Into the new week, here are five things on our radar.

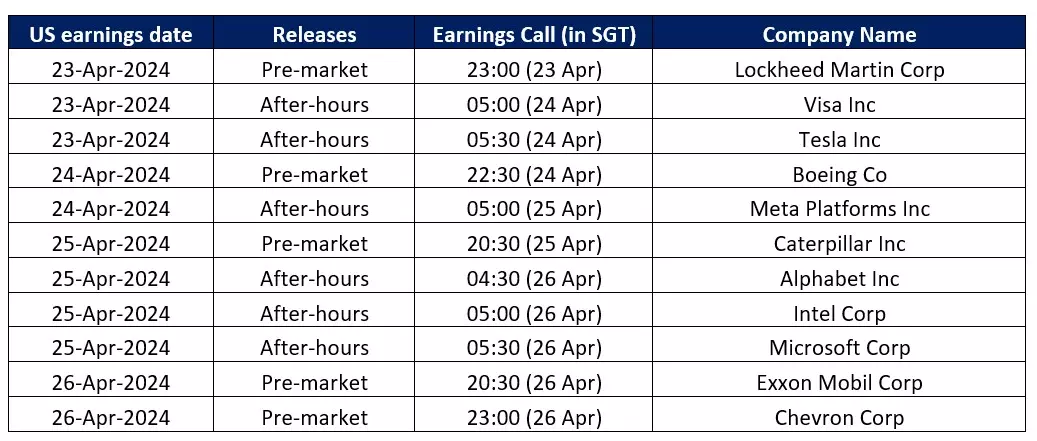

US earnings season: Visa, Tesla, Boeing, Meta Platforms, Alphabet, Intel, Microsoft

The earnings season will kick into higher gear next week. Several big tech earnings releases such as Tesla, Meta Platforms, Alphabet and Microsoft may set the tone for Wall Street, given its significant weightage in major US indices. Earnings from Visa, Boeing, Caterpillar and Intel will be in focus as well.

Thus far, 13% of S&P 500 companies have released their earnings, with 79% delivering an earnings beat, matching the outperformance seen in previous quarters. With market participants finding some unease in Netflix’s sales guidance this week, much will revolve around whether upcoming tech earnings can deliver.

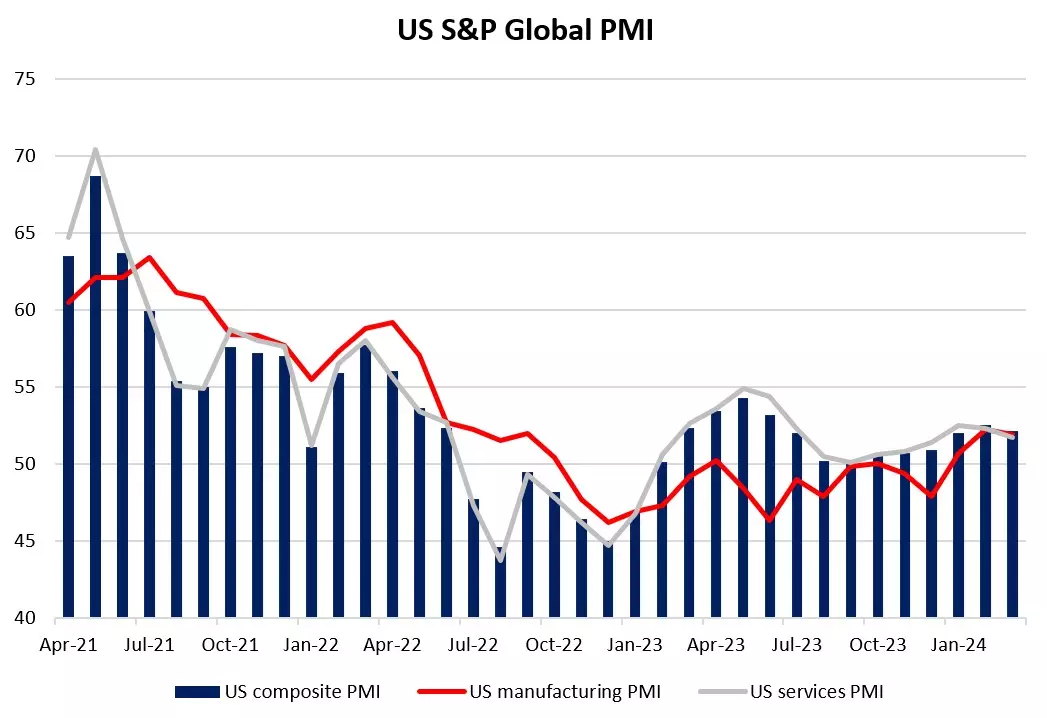

23 April 2024 (Tuesday, 9.45pm SGT): US S&P Global flash Purchasing Managers’ Index (PMI)

The recent run in stronger-than-expected US economic conditions has called for a delay in Federal Reserve (Fed)’s rate cuts, with markets now looking for a September move instead of the initial June timeline. The scale of rate cuts through 2024 has also been revised down to two 25 basis point (bp) cuts from the previous three.

Further resilience in US economic conditions may validate this timeline and reinforce the growing chorus among Fed members for more patience in policy easing. In March, US flash PMI numbers have indicated steady growth, with manufacturing PMI coming in at 51.9, while services activities eased slightly to 51.7 from previous 52.3. The lukewarm expansion in economic conditions is expected to continue, which should keep soft-landing hopes in place.

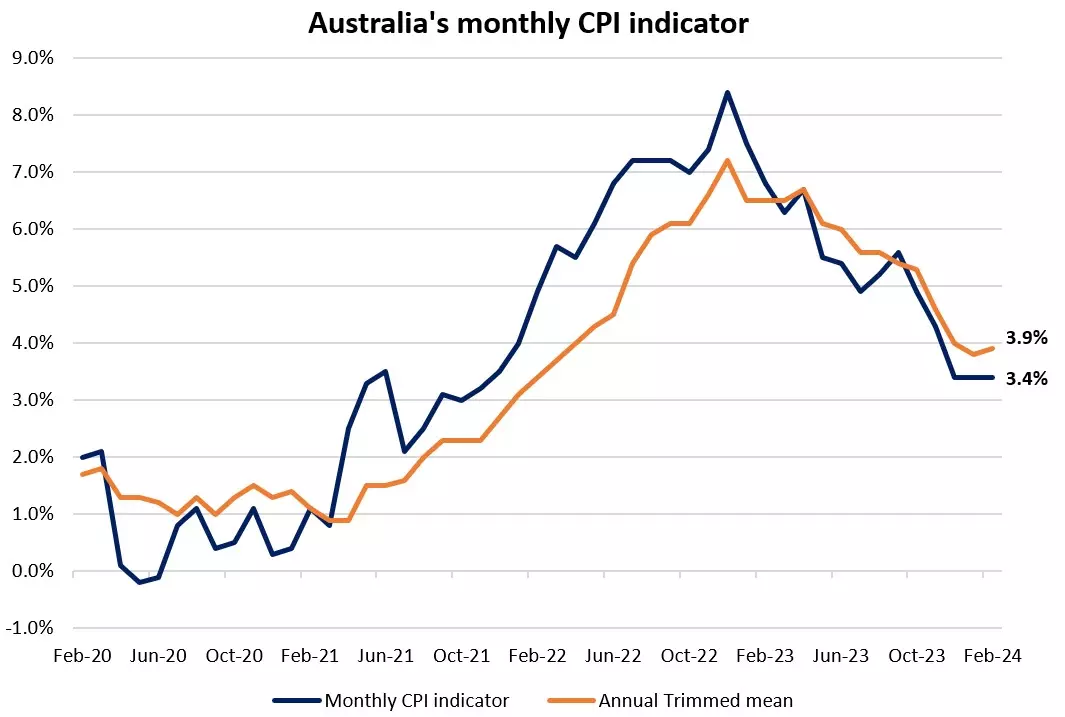

24 April 2024 (Wednesday, 9.30am SGT): Australia’s monthly consumer price index (CPI) indicator

In the December 2023 quarter (Q4), inflation rose by 0.6% for an annual rate of 4.1% YoY, below the 4.3% expected and well below the 5.4% print of the September quarter.

The Reserve Bank of Australia (RBA)'s preferred measure of inflation, trimmed mean inflation, rose by 0.8% quarter-on-quarter (QoQ), which saw the annual measure of trimmed mean ease to 4.2% YoY, a significant drop down from 5.2% in the September quarter and below the RBA's forecast of 4.5%.

The March 2024 quarter (Q1) is expected to show headline inflation increased by 0.9% over the quarter for an annual rate of 3.5%. The trimmed mean is expected to rise by 0.9% QoQ, allowing the annual trimmed mean to ease to 3.9% YoY.

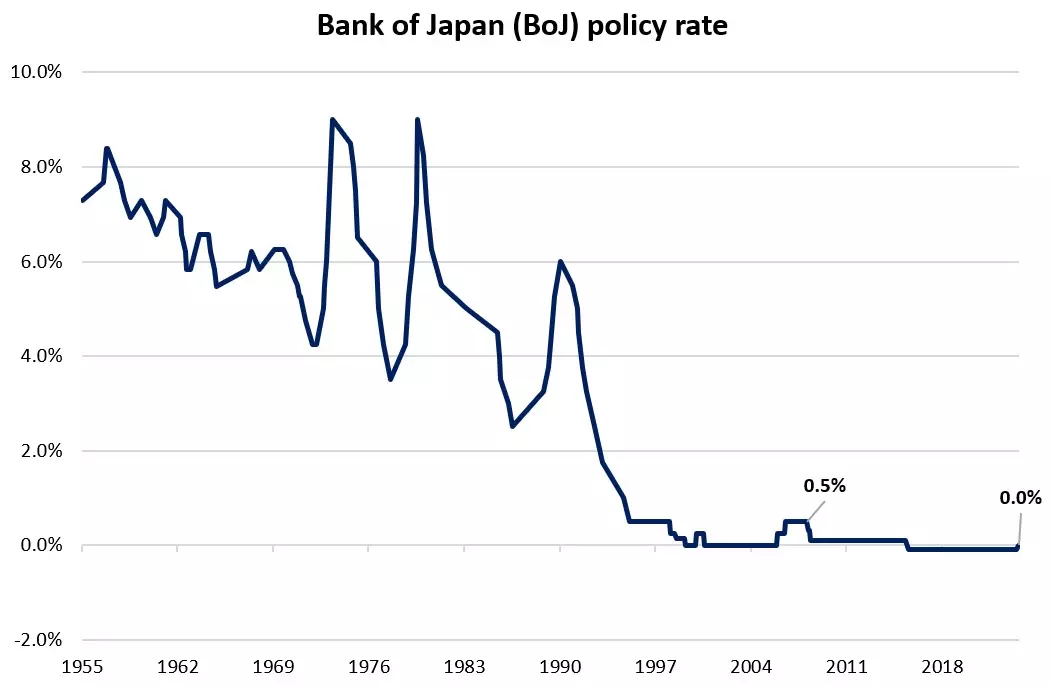

26 April 2024 (Friday, 12pm SGT): Bank of Japan (BoJ) interest rate decision

At the previous meeting, the BoJ raised its key short-term interest rate from -0.1% to a range of 0% - 0.1% for the first time in 17 years, riding on the hopes that a virtuous wage-price spiral could bring its ‘sustainable and stable 2% inflation’ target in sight. The central bank has also abandoned its yield curve control (YCC) policy.

At the upcoming meeting, the central bank is expected to keep policy settings on hold, having previously indicated patience in its future policy assessments. Rate expectations are priced for the BoJ to potentially hike rates further only in the July or September meeting.

Focus for the upcoming meeting will be on the BoJ’s quarterly outlook report, with eyes on how the weaker yen and surging oil prices in recent months will raise the bar on its inflation outlook, which will set expectations for the central bank’s next rate move.

26 April 2024 (Friday, 8.30pm SGT): US core Personal Consumption Expenditures (PCE) price index

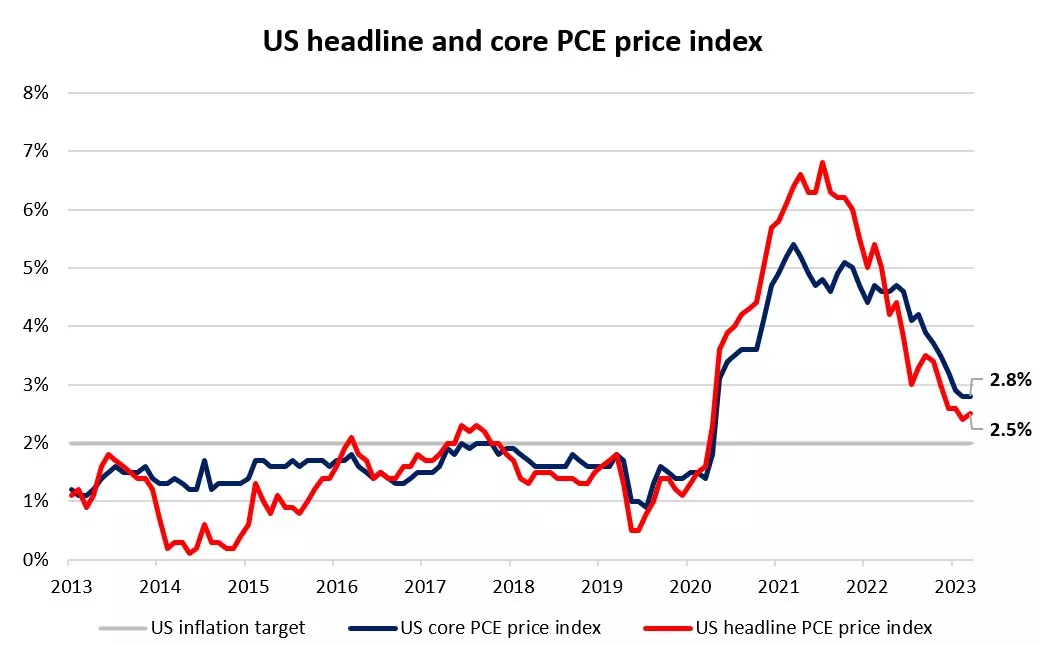

Both headline and core PCE price inflation have trended lower since September 2022. However, In February, headline inflation increased to 2.5% from 2.4%, while Core inflation remained stable at 2.8%.

This month (March), headline PCE is expected to increase by 0.3% month-on-month, which would raise the headline rate to 2.5%. The Core PCE price index is also expected to rise by 0.3% Month-on-Month, leaving the annual core rate of inflation at 2.8%.

After a third consecutive sizzling CPI report, the Fed Chair this week was forced to acknowledge that rates would need to stay higher for longer until greater confidence emerged that inflation is returning to target. After pricing in 170 bp of rate cuts at the start of the year, there is now just 42 bp of rate cuts priced for 2024 with a first rate expected in September.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.