Will FedEx be on the move around Q2 earnings?

Shipping company FedEx will report its fiscal second quarter later today, after the US markets close. In the past two quarters, shipping demand has been down.

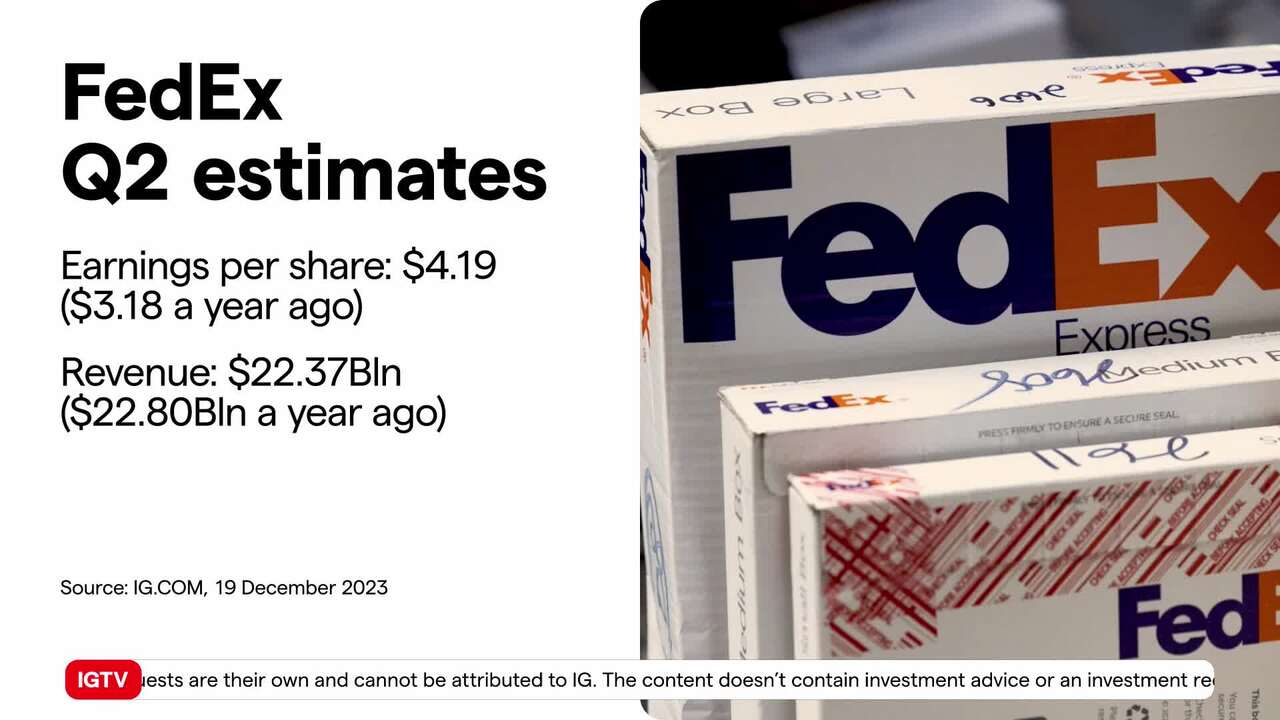

In the lead-up to the holiday period, shippers have been offering discounts to customers, in a period when they usually raise prices. On the other hand, FedEx managed to benefit from events that affected some companies in the sector. In recent months it picked up business from bankrupt delivery company Yellow. It also gained some from as negotiations between rival UPS and Teamsters took a long time. Analysts anticipate earnings of $4.19 per share, down from the $4.55 of the previous quarter, but about one dollar higher than a year ago. Revenues are forecast to reach $22.37Bln, nearly half a billion dollars lower than a year ago. Given the current environment, investors will want to know how much volumes have been hit, and by how much margins have shrunk.

(AI Video Transcript)

FedEx

FedEx the popular shipping company in the US, is going to announce its financial performance for the second quarter today after the stock market closes. The shipping industry has faced some tough times recently, especially leading up to the holiday season when there was less demand than usual. As a result, shipping companies have been offering discounts to attract customers instead of increasing prices. But FedEx has been able to take advantage of some events that affected its competitors.

One event that helped FedEx was the bankruptcy of Yellow, another delivery company. FedEx was able to gain new business from Yellow's customers. Another event was the lengthy negotiations between rival company UPS and the Teamsters union. During this time, FedEx was able to secure more business while its competitor was distracted. Despite these positive developments, analysts predict that FedEx's earnings for this quarter will be around $4.19 per share, which is lower than the previous quarter but still higher than this time last year. Revenue is also expected to be lower, around $22.37 billion, which is almost half a billion dollars less than last year.

The stock price of FedEx

Despite these predictions, the stock price of FedEx has been rising steadily, reaching its highest level since July 2021 during yesterday's trading session. This indicates that investors are confident in the shipping industry and are putting their money into companies like FedEx. Investors are especially interested in seeing how FedEx's performance will affect the volumes of packages being shipped and the profit margins. In summary, the second-quarter results of FedEx will give us a better understanding of the challenges facing the shipping industry recently. Despite gaining new business from its competitors, FedEx is still expecting lower earnings and revenue. Investors will be closely watching the report to see how much of an impact this has had on the number of packages being shipped and the company's profit margins.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices