Stock trading

Maximise your investment potential with zero fees. Trade stocks and ETFs across US, UK, German, and Irish markets without paying commission, FX charges, or custody fees. Experience the power of our award-winning platform1.

Invest for free

Buy and sell shares with no charges up to 100 trades per month

Stock screener

Explore the most sought after international shares easily with our intuitive screener

Dedicated support

We're here 24 hrs a day, 7 days a week, except for Saturday from 1am to 11am. (Dubai time)

Locally present and regulated

We have a local office in Dubai’s financial hub (DIFC) and we’re regulated by the Dubai Financial Services Authority (DFSA)

Out-of-hours US stock trading

Trade 700 US stocks 24/52 and 140+ US stocks out-of-hours

What can I trade?

US shares

Directly invest in thousands of US shares, such as Apple, Tesla, Facebook and more.

International shares

Choose from thousands of UK, Irish and German shares – from Vodafone and HSBC to Volkswagen and Siemens.

ETFs

Invest in a basket of shares or an entire index from just one position.

You can trade thousands of shares and ETFs from the following countries: US, UK, Ireland and Germany.

Find the complete list on our stock trading product list (PDF). If there is a specific share that you can’t find on our platform, please call us on 00971 (0)4 5592104 or email helpdesk.ae@ig.com to discuss your individual requirements.

What do I pay?

For the full list of fees and charge, please refer to our stock trading charges webpage

Trade your way

Find the right account for you; trade and invest forex, shares, indices, commodities and more

Up to 200x leverage*

- Up to 200x leverage to start trading with minimal upfront capital*

- Retail Clients benefit from negative balance protection meaning they can’t lose more than what was deposited into the account

- Speculate on price changes, without having to own the underlying asset.

*Up to 200x leverage applies to Professional IG Limited (UAE) accounts and all IG International Limited accounts.**

Investment

Prefer to own assets?

- Buy and sell over 10,000 popular shares and ETFs

- Profit from dividends, plus gain shareholder rights

- Pay $0 commission on all US shares up to 100 trades per month

Up to 200x leverage*

- Up to 200x leverage to start trading with minimal upfront capital*

- Retail Clients benefit from negative balance protection meaning they can’t lose more than what was deposited into the account

- Speculate on price changes, without having to own the underlying asset.

*Up to 200x leverage applies to Professional IG Limited (UAE) accounts and all IG International Limited accounts.**

Investment

- Buy and sell over 10,000 popular shares and ETFs

- Pay $0 commission on all US shares up to 50 trades per month

What is stock trading?

As a company’s market value goes up and down, so does the price of its shares. Stock trading means buying and taking ownership of a company’s shares, so you can sell them on to make a profit if their value rises.

How to buy and sell shares

The most common way to buy and sell shares is by using a stockbroker or stock trading service. To trade shares with IG you’ll need to open an account and decide whether you want to trade shares, or speculate on their price via CFDs.

ETF trading

Gain exposure to a group of assets – whether it’s shares, sectors or commodities – from just one position, with our range of exchange traded funds (ETFs).

Open an account now

-

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

-

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

-

Feel secure with a trusted provider

With more than 45 years of experience, we’re proud to offer a truly market-leading service

Trade anytime, anywhere

- Web-based platform

- Mobile trading app

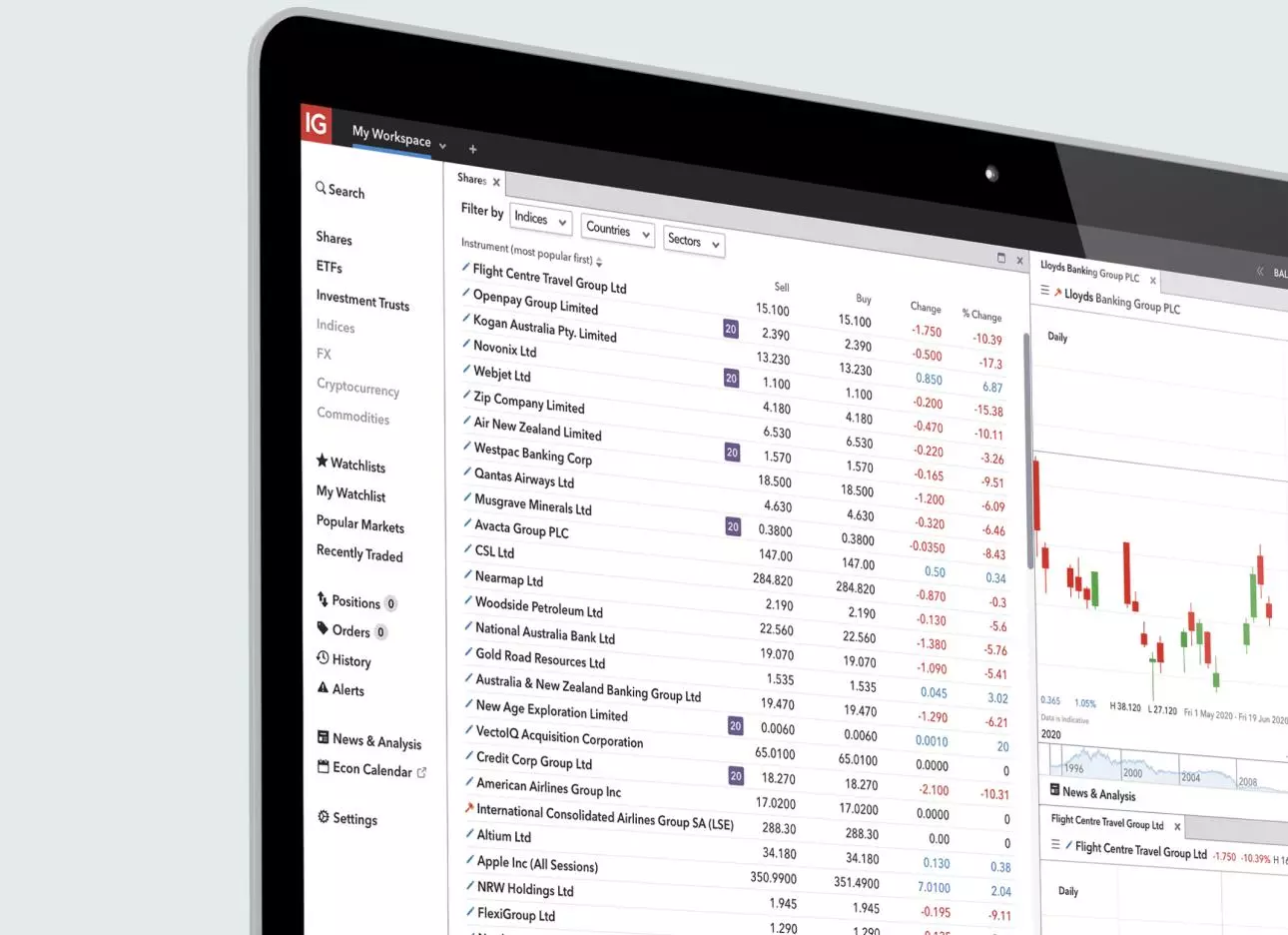

Our web-based platform

Take full control over your trading with our award-winning online platform.1

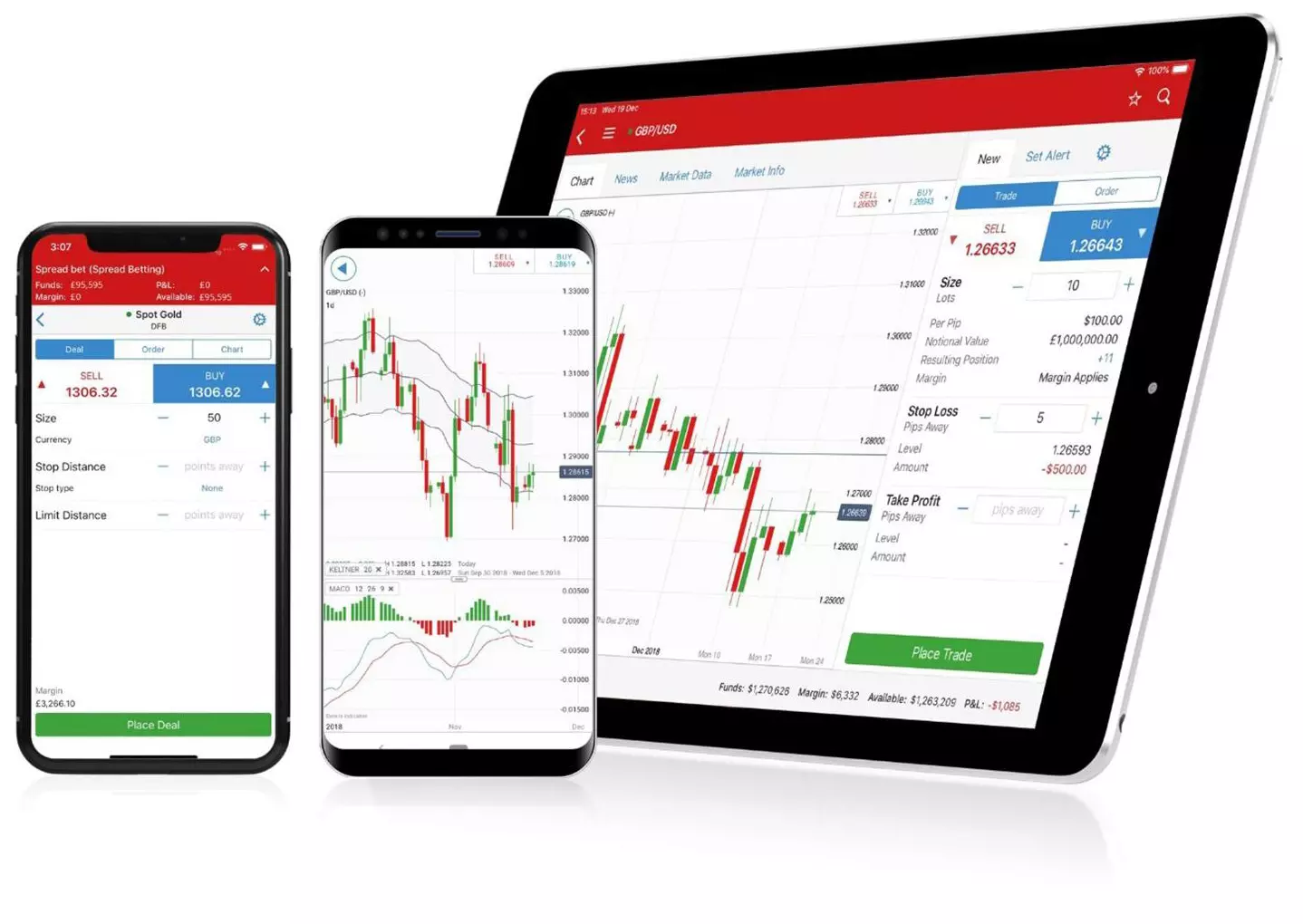

Mobile trading apps

Buy and sell shares on the go with our tablet and mobile platform.

Get the latest shares news

-

Alphabet earnings preview: will cloud and AI justify the $4 trillion valuation?

2026-02-03T05:16:22+0000

Open a stock trading account

It's free to open an account, and there's no obligation to fund or trade.

*Demo accounts are only available for CFD trading.

Open a stock trading account

It's free to open an account, and there's no obligation to fund or trade.

*Demo accounts are only available for spread betting and CFD trading.

Open a stock trading account

It's free to open an account, and there's no obligation to fund or trade.

Open a stock trading account

It's free to open an account, and there's no obligation to fund or trade.

FAQs

What’s the difference between buying shares and trading share CFDs?

There are two main differences between buying shares and trading contracts for difference on a share.

First, when you buy a share, you’ll be taking ownership of a portion of a company – this will give you certain benefits, such as voting rights and dividend payments. However, when you trade on shares with CFDs, you won’t ever take ownership of the underlying shares – you’re just speculating on the future market price. One implication of this is that you can take advantage of leverage when trading CFDs; meaning you'll only need to put up a fraction of the full value of the trade - the 'margin' - to gain full exposure. This means both profits and losses are magnified, and that losses can exceed deposits for Professional Clients.

Second, when you buy a share you will only profit when the underlying market price rises. When you trade CFDs, you can go both long and short – meaning you’ll have the opportunity to profit whether the market rises or falls.

Can I transfer existing stockholdings to IG?

Yes, simply open an IG stock trading account and complete the relevant form.

There are no charges for transferring shares, and we aim to complete your transfer as quickly as possible however, this is dependent on your transferring broker and largely beyond our control. You may be out of the market for a period while the transfer takes place.

How are dividends paid to my account?

Once we receive a dividend payment on any of the shares you own, we will credit your account. It will appear as additional cash and you can choose whether to either reinvest it or withdraw it.

How long does it take to withdraw funds once I have sold shares?

There’s a two or three-day settlement period once you’ve sold your shares until your funds are available to withdraw. In the meantime, the funds will appear as credit and can be used to trade.

Try these next

Discover how to buy and trade stocks with IG

Go long or short on thousands of global shares

with CFDs

Find all the important documents you need to start share trading with IG

Go long or short on thousands of global shares with CFDs

Find all the important documents you need to start share trading with IG

**IG International Limited is an IG entity based in 16 Burnaby Street, Hamilton HM11, Bermuda and regulated by the Bermuda Monetary Authority.

1: Winner of ‘Best Multi-Platform Provider’ at ADVFN International Finance Awards 2019. Winner of ‘Best Trading App’ at the Investors Chronicle,Financial Times Investment and at the Professional Trader Awards 2019.

2: 24 Hours Stocks will run from 4am Monday to 1am Saturday (GST). This corresponds to 1am Monday to 10pm Friday (UK time). These times are subject to change when daylight savings ends/starts in the UK.