Futures trading

Make your longer-term positions more cost-effective by trading CFDs on futures. Speculate on exclusive 24/71 indices, popular global commodities and selection of bonds.

Transparent pricing

Know your costs for longer-term trades up front, with no overnight funding fees

Deep internal liquidity

Ensure best execution – even as contracts near expiry – thanks to liquidity from large internal flows

Round-the-clock dealing

Trade more 24/7 indices1 markets with IG than with any other provider

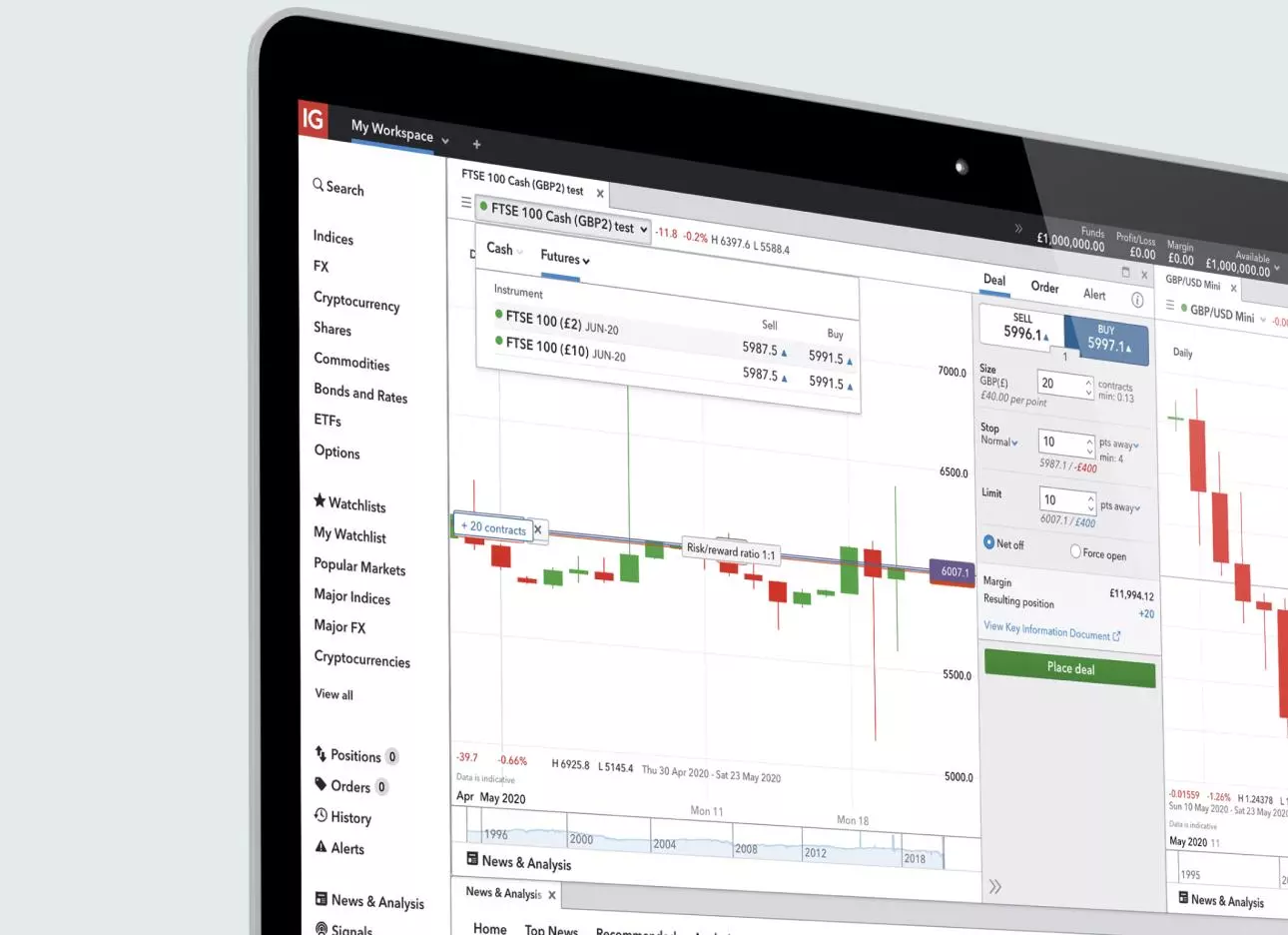

Award-winning technology2

Trade from our web-based, mobile app and third-party platforms

Huge selection of markets

Access index, commodity and bond futures from one account

Go long or short

Find opportunities whether markets are rising or falling

Discover our futures markets

- Index futures

- Commodity futures

- Bond futures

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Prices above are subject to our website terms and conditions. Prices are indicative only. All shares prices are delayed by at least 15 mins.

Find a futures market

Choose from over 80 indices or our huge range of commodity and bond futures.

Ways to trade futures with us

Trade futures in the UAE with CFDs. You’ll be speculating on the underlying market price, without entering the futures contract yourself.

Here are the key benefits of CFD trading:

| CFD trading | |

| Main features | Trade with leverage – open a position with a deposit, with losses and profits calculated on the full trade size |

| Accessible to | All clients |

| Traded in | Contracts |

| Commission | No commission on future CFDs and the charges are included in the spread. Other fees and charges may apply. |

| Platforms | Web platform, mobile trading app and MT4 |

| Learn more |

Note: CFD trading involves high risk. That’s because leverage can magnify both your profits and your losses as they’ll be based on the full exposure to the trade, not just the initial margin deposit required to open it. This means losses as well as profits could far outweigh your margin, so always ensure you’re trading within your means and take steps to manage your risk.

What are futures?

Futures are contracts that enable traders to lock in the current market price, without exchanging the asset until a predetermined future date.

When you trade with us, you’ll be taking a position on an underlying futures price using CFDs.

How do I trade futures?

- Understand how futures trading works

- Create an IG trading account

- Place your first trade

- Monitor and close your position

Benefits of futures trading

- Take your capital further with leverage

- Access a huge range of markets

- Capitalise on rising and falling prices

- Hedge existing exposure

- Get better execution with our deep internal liquidity

Costs and details

Our futures markets are designed to replicate the pricing and expiry dates of an underlying contract.

See our costs and details below.

- CFD futures

| Value of one contract (standard) |

Market hours(UK time*) | Dealing spread | Margin requirement (retail) |

|

| FTSE 100 Futures | £10 | 7am – 9pm | 4 | 5% |

| All other times | 8 | |||

| Wall Street Futures | $10 | 8am - 9pm | 6 | 5% |

| 9.15pm - 9.20pm | 16.2 | |||

| 10pm - 11pm | 16.2 | |||

| All other times | 10 | |||

| Oil – US Crude | $10 (cents/barrel) |

24 hours(except 10pm – 11pm) | 6 | 10% |

| Gold | $100 (100 troy oz) |

24 hours(except 10pm – 11pm) | 0.6 | 5% |

| Treasury Bond (Decimalised) |

$10 | 11.30pm – 10pm | 4 | 20% |

Want to take a smaller position? Trade our mini futures contracts for indices, commodities and bonds. They work in the same way as full-sized futures, with the same benefits.

*International times may vary.

Open a futures trading account in minutes

Demo accounts are only available for CFD trading.

Open a futures trading account in minutes

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With more than 50 years of experience, we’re proud to offer a truly market-leading service

*Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

Demo accounts are only available for CFD trading.

Open a futures trading account in minutes

Open a futures trading account in minutes

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With more than 50 years of experience, we’re proud to offer a truly market-leading service

*Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

Get the latest futures news

-

Binance Token (BNB) Struggles for Momentum as Market Pressure Meets Platform Expansion

2025-11-27T11:33:23+0000

Trade futures with a CFD trading account

It's free to open an account and there's no obligation to fund or trade.

*Demo accounts are only available for CFD trading.

Trade futures with a CFD trading account

It's free to open an account and there's no obligation to fund or trade.

*Demo accounts are only available for spread betting and CFD trading.

Trade futures with a CFD trading account

It's free to open an account and there's no obligation to fund or trade.

Trade futures with a CFD trading account

It's free to open an account and there's no obligation to fund or trade.

FAQs

How does IG ensure deep liquidity on futures markets?

Futures are a highly liquid market, but there are times when this isn’t the case. Our CFD futures markets, however, remain highly liquid at all times thanks to our large number of clients and our technology – ensuring best execution even on larger trades.

For our CFDs on commodity and bond futures, the last trading day may not be the same as the underlying exchange-traded contract. As these futures approach their expiry date, the market can become illiquid – because most traders will have already closed or rolled over their contract to avoid physical settlement. Spreads often widen as a consequence.

By having our contracts expire slightly earlier than in the underlying, we ensure you receive the best price that we can offer.

Try these next

Find opportunities across 17,000 markets.

Protect your capital with our in-platform tools.

Discover how to trade CFDs with us.

124/7 excludes the hours from 10pm Friday to 8am Saturday (UK time), and 20 minutes just before the weekday market opens on Sunday night. International times may vary.

2Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.