What is the CAPE ratio and how do you calculate it?

The CAPE ratio is a popular way of assessing how long-term business cycles impact a company’s valuation. Discover the difference between the CAPE ratio and P/E ratio, and how to calculate the CAPE ratio for stocks and indices.

What is the CAPE ratio?

The CAPE ratio is a comparison of a stock or index price to its total earnings, which is used to tell whether its’s over or undervalued. It’s an extension of the traditional price-to-earnings ratio (P/E) that monitors a ten-year period to account for variations in profitability due to economic cycles.

The CAPE ratio – which stands for cyclically-adjusted price-to-earnings – is also known as the Shiller P/E. It was named after professor Robert Shiller who first developed the method, alongside his colleague John Young Campbell. The two suggested ten-year earnings were strongly correlated with returns for the next 20 years.

The ratio is used to measure a company’s profitability under different economic influences. Profit peaks and troughs are extremely common as consumer spending habits change significantly in periods of economic boom or bust. Taking these swings into account can help show whether a company will perform in the long run and is worth investing in.

Learn more about investing with us

CAPE ratio vs P/E ratio: what are the differences?

The P/E ratio is the price of a stock, divided by its earnings in a single year. While the market price of a stock tells us how much investors are willing to pay to own the stock, the P/E ratio reveals whether or not the share price is an accurate representation of the company’s earnings potential.

If the P/E ratio figure is high when compared to other companies in the industry or an index – typically above 11 – then the stock is overvalued. And if the P/E ratio is low – below ten – then it is undervalued.

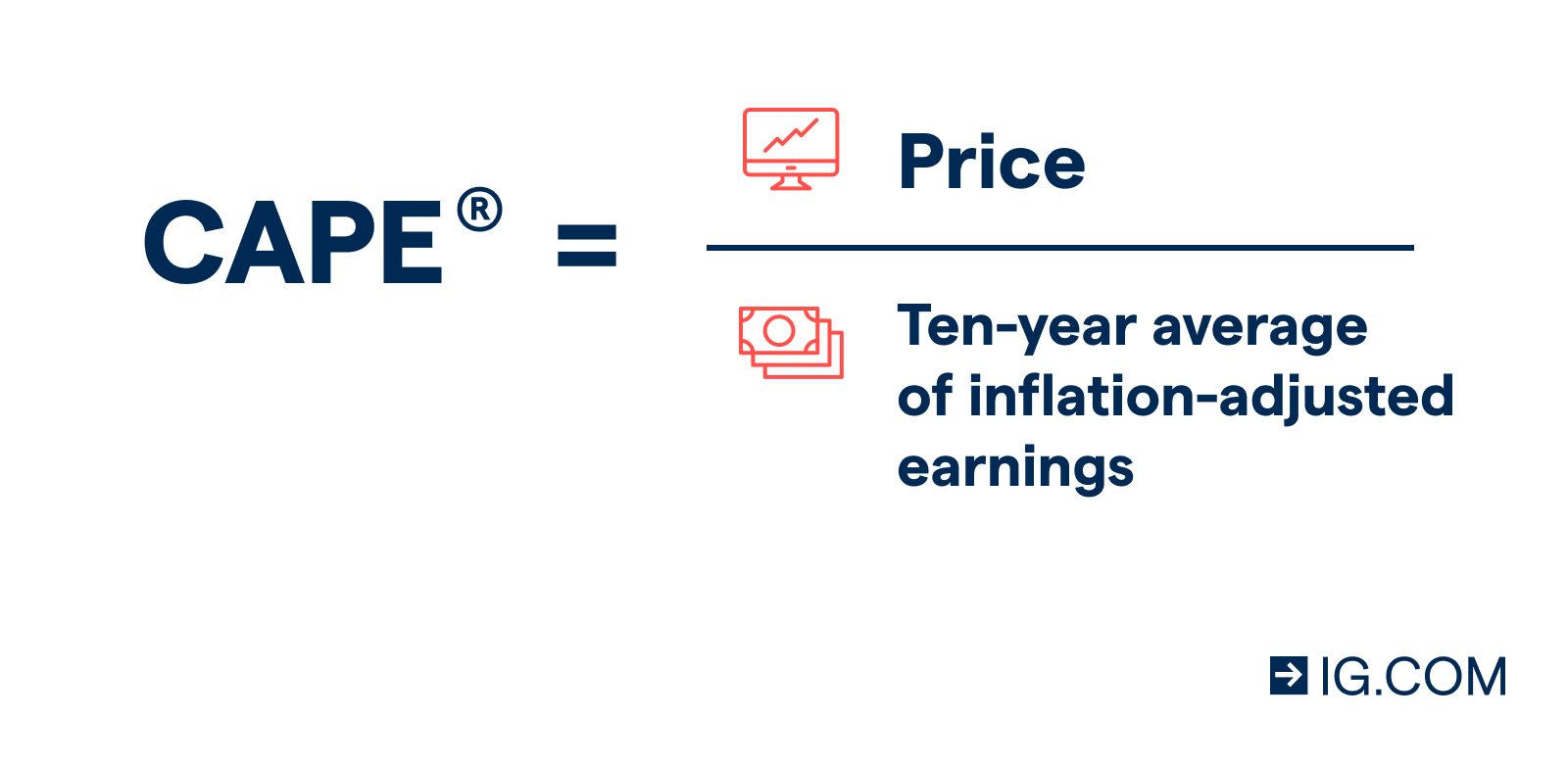

However, critics of the P/E ratio argued that using just one year of profits couldn’t give an accurate representation of profits. So, the CAPE ratio was created, which uses a ten-year average of inflation-adjusted earnings. This means it can take into account longer-term business cycles and smooth out short-term market movements and volatility.

How to calculate the CAPE ratio

The CAPE ratio is calculated by dividing a company’s stock price by the average of the company’s earnings over a ten-year period and adjusting it for inflation.

How to calculate the CAPE ratio

The CAPE ratio is calculated by dividing a company’s stock price by the average of the company’s earnings over a ten-year period and adjusting it for inflation.

In the same way as the P/E ratio, a stock with a high CAPE ratio is considered overvalued, and a stock with a low CAPE ratio would said to be undervalued.

The CAPE ratio and forecasting

The CAPE ratio is used to forecast the likely earnings of a company or index over the next 20 years. The theory is that the lower the value of the ratio, the higher the return from equities over the next two decades as the stocks come into line with their true value. And the higher the value of the ratio, the less likely equities are to achieve oversized returns, as their stock prices are inflated already.

Critics of the CAPE ratio point out that it’s not very useful for forecasting market valuations, as it is inherently a lagging indicator – meaning it looks a historical patterns rather than current or forward-looking trends.

Learn more about leading and lagging indicators

It’s also worth noting that, accounting practices have changed since the CAPE ratio was created – making historical comparisons difficult as earnings are no longer calculated in the same way. This means the metric isn’t always going to be 100% accurate.

How to use the CAPE ratio in your trading

To use the CAPE ratio in your trading, you’d divide your chosen company’s latest share price by its average earnings over the previous ten years. If it is a low CAPE ratio, you could consider buying the stock in the expectation that it will rise in value over the longer term. And if it is a high CAPE ratio, you would need to consider the company’s fundamentals before you opened a position, as there is the possibility the stock price could fall if market participants are unwilling to support its inflated price.

Learn about stock market rallies

The CAPE ratio is better suited to long-term valuations of the stock market than the P/E ratio, which makes it more useful for investors who are looking at a timeframe of years – rather than traders who might only hold a position on a stock or index for minutes or days.

The CAPE ratio can still be useful for traders as part of fundamental analysis as it provides an indication of whether market sentiment will be bullish or bearish. When you use the CAPE ratio, it’s important to remember that it’s based on historical data, which is no guarantee of future performance.

Want to start trading or investing? Open an account with us and be ready to deal on live markets in minutes.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

Explore the markets with our free course

Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course.