Market update: German Ifo highlights ongoing economic weakness; ECB rate pushback

German manufacturing sentiment fell further in November, and ECB’s Vasle pushes back on rate cut bets.

Sentiment in German business has ‘clouded over’ according to the latest Ifo report with companies ‘less satisfied with their current business’, and ‘more skeptical about the first half of 2024.’

In manufacturing, the Business Climate Index fell noticeably. Companies assessed their current business situation as significantly worse. Their expectations also grew more pessimistic. Energy-intensive industries are having a particularly tough time. Order books continue to shrink overall.

Service sector improves, trade setback, construction declines

In the service sector, the business climate improved slightly. Service providers were more satisfied with their current business. They also reported less skepticism in their outlook for the coming six months. In restaurants and catering, the business situation improved, but expectations took a nosedive.

In trade, the business climate suffered a setback. Companies assessed their current situation as markedly worse. Their expectations also darkened. For retailers, holiday trade is disappointing this year. In construction, the Business Climate Index fell to its lowest level since September 2005. Companies assessed their current situation as worse. Moreover, roughly one in two companies are expecting business to deteriorate further in the months ahead.

Economic calendar

ECB's Bostjan Vasle rejects rate cut expectations

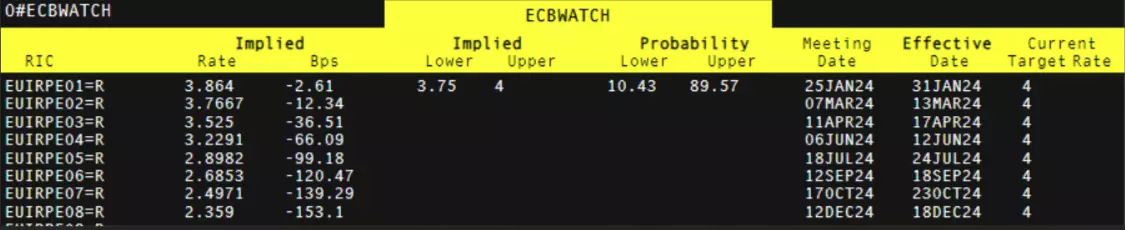

ECB policymaker Bostjan Vasle today continued the central bank’s pushback against current interest rate expectations, saying that market forecast for rate cuts are premature and ‘inconsistent with the stance appropriate to return inflation to target.’ Current market pricing shows the first 25bp rate cut fully priced in at the April meeting with a total of 150 basis points of cuts seen through 2024.

EUR/USD technical analysis

EUR/USD is trading in a tight 40 pip range so far today in quiet market conditions. On Tuesday we have the final Euro Area inflation reading – forecast at 3.6% vs 4.2% prior -while on Friday we have the Fed’s preferred inflation report, core PCE, released at 13:30 UK. Both releases have the ability to move EUR/USD in either direction. Initial support for the pair starts with the 23.6% Fibonacci retracement at 1.08645 followed by a prior level of horizontal support at 1.0787. Resistance at last Wednesday’s 1.1017 high followed by 1.1076.

EUR/USD daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Explore the markets with our free course

Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this index strategy article, and try it out risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Get fixed spreads from 1 point on FTSE 100 and Germany 40

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider – 26 in total

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.