Greggs' shares beat the market again

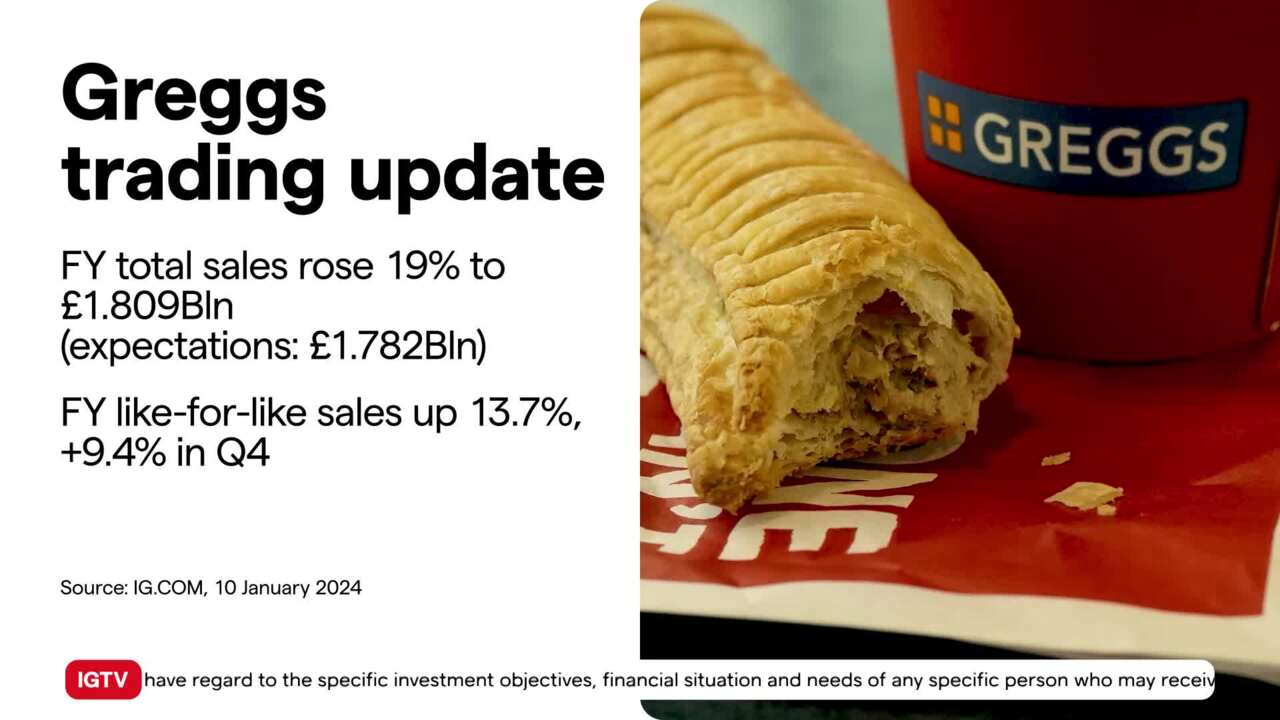

The stock of Greggs, the High Street bakery chain, is up after the business reported full-year total sales rose 19% to £1.8 billion (expectations had been for £1.7 billion).

FY like-for-like sales up 13.7% with an increase of 9.4% in Q4. It also reported a record 220 new shops opened in the year, with 33 closures and 42 relocations resulting in a net 145 new shop openings, and 2,473 shops trading as at 30 December 2023. It also reported good progress in development of supply chain capacity, supporting growth plans and, perhaps more importantly for us all, inflationary pressures reducing, enabling it to anticipate a full year outcome in line with our previous expectations.

(AI Video Summary)

Greggs share price rises following impressive sales increase

Shares of Greggs, a popular bakery chain, have experienced a rise in value recently due to strong business performance. In fact, the company reported sales of over £1.8 billion, which is a 19% increase compared to the previous year. This surpasses the market's expectation of £1.75 billion. Furthermore, their sales for a specific period (Q4 of last year) increased by an impressive 13.7%.

Reasons for success

One of the reasons for this success is Greggs improved ability to manage its supply chain and control inflationary pressures, which are positive signs for the company. Additionally, their net cash at the end of the year amounted to £195 million, slightly higher than the previous year's figure of £192 million. Greggs foresees that their overall performance for the year will align with expectations.

An interesting aspect of Greggs business strategy is their flexibility in opening and closing stores. In 2023 alone, they opened a record-breaking 220 new shops, while closing 33 and relocating 42. This allows them to adapt to different locations with high customer traffic.

The rise in Greggs share price today has been particularly impressive, with a 7% increase and the possibility of climbing up to 10%. These levels haven't been seen since August 1st of the previous year. This positive trading day can be attributed to the return of office work, especially in city centers. The fact that more people are going back to work has benefitted Gregg's and contributed to their share price increase. Currently, after 90 minutes of trading, Greggs shares are up by almost 7%.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices