Australian economy braces for potential slowdown: A glimpse at the upcoming Q1 2023 GDP release

Australia's six-quarter economic growth may slow in Q1 2023, prompting speculation of RBA rate hike pause. Markets watch RBA guidance, household spending, net exports, and AUD/USD trends.

On Wednesday at 11:30 am, the Australian Q1 2023 GDP is poised for a decline.

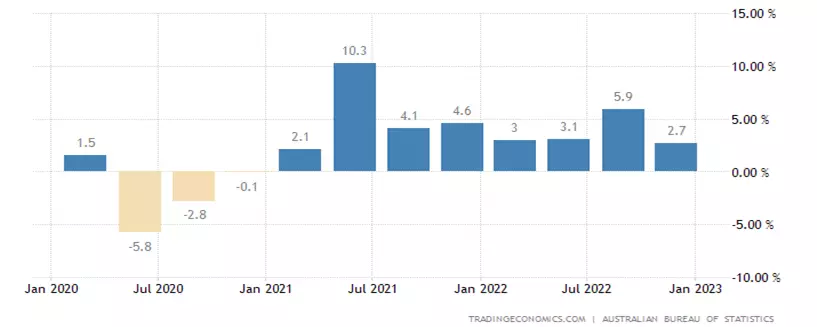

In the December quarter (Q4) of 2022, Australia's economic growth rose by 0.5% QoQ or 2.7% YoY, slowing down from 5.9% YoY in the September quarter (Q3). Net trade (due to increased exports and fall in imports) and consumption primarily drove the GDP growth in the December quarter.

Expectations for Q1 2023

For Q1 2023, GDP is expected to rise by 0.3% QoQ or 2.5% YoY. Although this would mark a sixth consecutive quarter of economic expansion, it would also denote the slowest pace since the 2% fall in the September quarter of 2021. The expectations range significantly, from -0.2% to +0.5%.

As articulated in the Statement of Monetary Policy in May, the RBA anticipates slower growth as it endeavours to control inflation and balance the labour market via higher interest rates.

A dive into the details

Household spending, driven by robust services consumption including hotels, cafes, restaurants, and transport services, is projected to contribute positively to the growth.

The household saving ratio, which dropped from 7.1% to 4.5% in Q4, is forecasted to decline further as household spending exceeds growth in disposable income, thereby prompting consumers to utilise their savings to offset the cost of living and mortgage pressures.

Net exports, which surged by 1.1% in Q4, are anticipated to detract -0.5% percentage points from growth in Q1 2023 due to softer commodity prices and weaker volumes.

In Q4, Australia's Terms of Trade rose 0.6% as growth in export prices outpaced import prices. Since then, Australia’s Terms of Trade have turned lower, which suggests a flat outcome is likely in Q1.

GDP growth rate YoY

Impact on markets

The release of Q1 2023 GDP just a day after the RBA's June Board meeting means that markets are likely to prioritise understanding the implications of the RBA's forward-looking guidance rather than a retrospective GDP print.

That said, a GDP of 0.5% QoQ or higher would amplify expectations of further RBA rate hikes, supporting the AUD/USD while posing risks to the ASX 200. Conversely, a GDP of 0.1% QoQ or less would fuel speculation that the RBA has concluded its rate hiking cycle and is ready for an extended pause.

Forecast for the AUD/USD

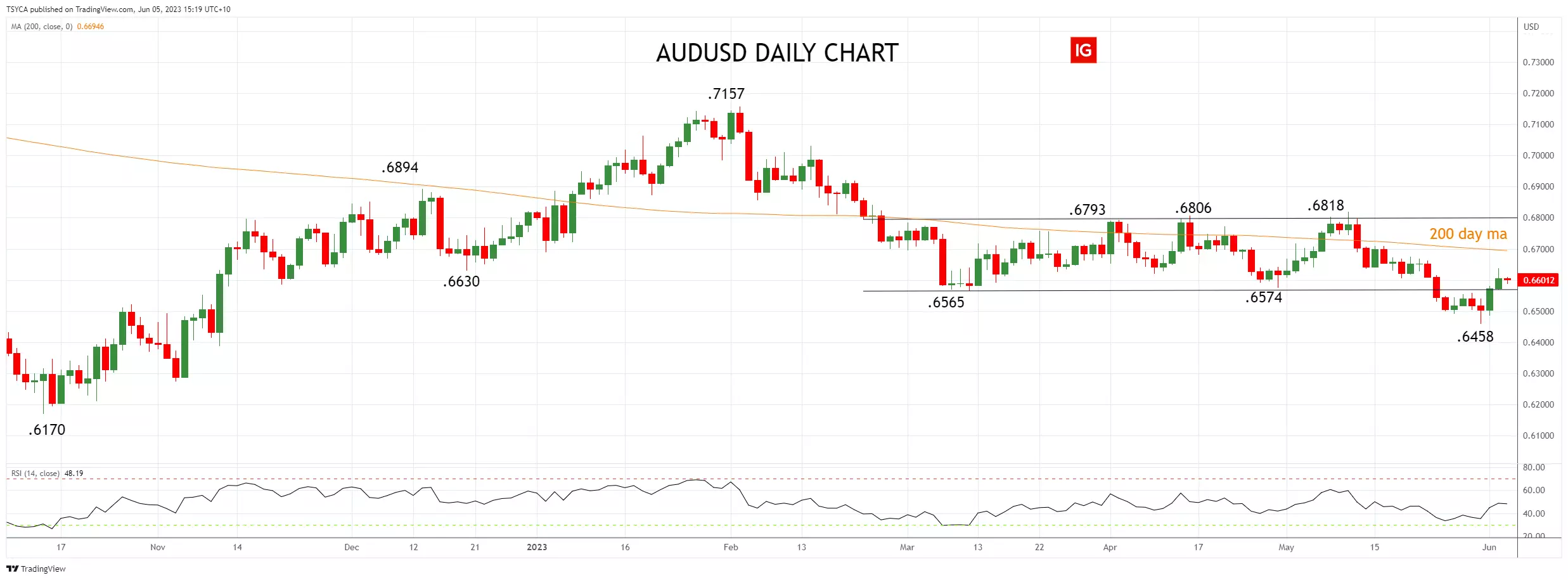

The AUD/USD concluded last week higher at .6607 (1.34%), bolstered by stronger commodity prices and upside surprises in the monthly CPI indicator and wage increase at the Fair Work Commissions Review. This suggests the RBA may implement another rate hike, if not in June, then possibly in July.

In technical terms, the AUD/USD's close back above .6565 (range lows) currently mitigates the downside risks that followed the sell-off in late May. On the upside, resistance from the 200-day moving average is seen at .6700c, ahead of a solid resistance barrier from range highs at .6800/20c.

On the downside, a break of support at .6565 and then of the May 31st .6458 low would put the support at .6350 on the market's radar.

AUD/USD daily chart

- TradingView: the figures stated are as of June 5, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Live prices on most popular markets

- Forex

- Shares

- Indices