Bank of Japan calls time on negative rates, but USD/JPY and Nikkei 225 both rally

The Bank of Japan has ended its negative interest rate policy after 8 years, raising rates above zero, though the market has taken the news in its stride.

An era and an experiment come to an end

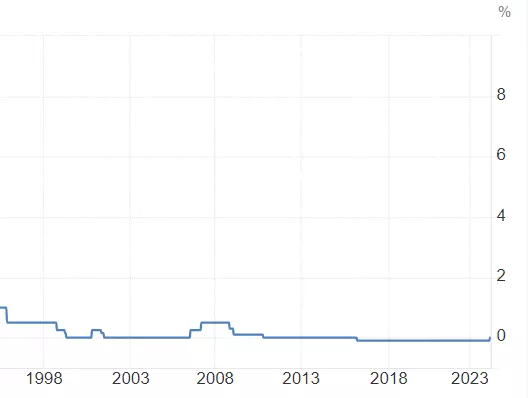

After maintaining a negative 0.1% policy rate since 2016, the Bank of Japan (BoJ) has lifted its key rate above zero for the first time since 2007. This marks the end of an era of unconventional monetary policy experimentation.

This marks the end of the era when central banks paid borrowers instead of charging interest. The BoJ's negative rate meant commercial banks were effectively being paid to borrow money instead of paying interest, which was an exceptional policy seen as a desperation move to revive growth and inflation after years of stagnation.

BoJ rate chart

Farewell to Yield curve Control

The BoJ is also abandoning yield curve control and halting purchases of ETFs. In addition to raising rates, the central bank is dismantling other signature policies like yield curve control which kept 10-year yields capped at 1%, as well as ending its stock buying program aimed at supporting equity prices.

It represents a major shift away from Japan's ultra-loose monetary policy. These moves by the BoJ signal a seismic shift from the extraordinary easing policies that defined its approach for decades as it battled persistent deflation and feeble growth after its 1990s asset bubble burst.

Japan introduced the term "quantitative easing" which other central banks adopted after 2008. Japan pioneered quantitative easing and bond buying, coining the term that later became part of the mainstream policy toolkit globally following the 2008 financial crisis.

An end to deflation?

The move signals Japan emerging from its long deflationary slump and asset bubble bursting. By reversing its unprecedentedly accommodative policies, Japan is signalling it has finally extricated itself from the economic malaise and deflationary spiral that plagued it since its late 1980s asset price bubble collapse.

However, the initial market reaction was muted, with yields and yen falling. Despite the historic policy pivot, markets did not react drastically, with 10-year bond yields declining and the yen depreciating against other major currencies in the initial aftermath.

The BoJ still has the world's lowest policy rates and says accommodation will continue for now. While marking a shift, the BoJ maintained it will preserve accommodative financial conditions for the time being, and its new positive policy rate remains the lowest among major central banks.

No rush to raise rates

Further rate hikes are expected to be gradual if inflation persists. The BoJ's communication suggests this first rate increase may be a "one and done" move for now, with further hikes likely to be slow and data-dependent, especially if inflationary pressures prove temporary.

Eliminating negative rates is a significant milestone, even if full impacts are not immediate. Though markets were unruffled initially, the BoJ’s exit from negative rates represents an epochal moment and potential return to more conventional policymaking after years of unprecedented stimulus experimentation globally.

Market reaction – a general shrug

What was supposed to be one of the key events of the week has passed with little notice by markets. The news had, essentially, already been ‘priced in’, i.e. market participants had already positioned themselves ahead of the meeting, and with no surprises in the decision the reaction was limited.

Nikkei 225 rallies

In the case of the Nikkei 225, the index had already bottomed out a week ago after a brief pullback from the record highs hit at the end of February and the beginning of March.

Indeed, the index had already been rallying into the meeting, and continued its gains. While the end of negative rates might boost the yen slightly, Japanese exporters will continue to benefit from currency weakness, helping earnings.

One of the strongest trends of recent months looks set to continue, with new record highs a definite possibility. It would need a break below short-term trendline support to put this view on pause.

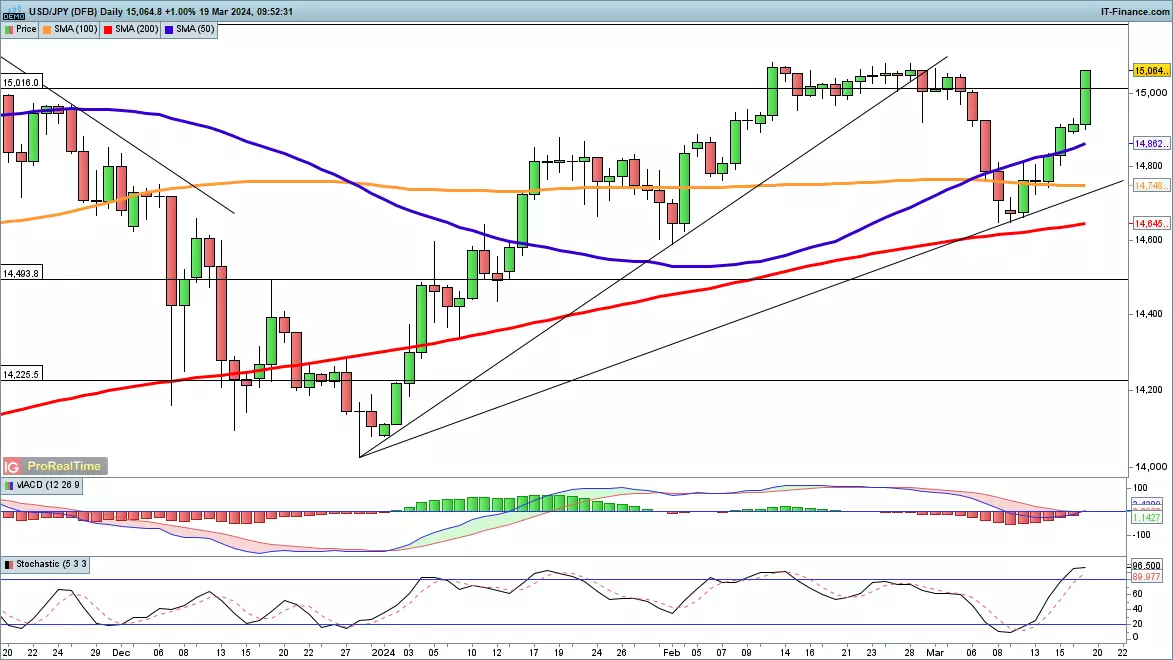

USD/JPY surges above Y150

USD/JPY had also gone through a brief pullback last week, as news reports indicated the moves that would be taken at the meeting.

Thus, the currency pair dropped swiftly from near-Y151 down towards the 200-day simple moving average (SMA) (red line on chart). This is the first time that it had neared the indicator since January.

It then proceeded to bounce, and the overnight rally has carried the price back to almost exactly where it was at the beginning of the month.

This leaves the uptrend firmly intact, and like the Nikkei 225, further gains above the February highs seem likely.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

See an opportunity to trade?

Go long or short on more than 17,000 markets with IG.

Trade CFDs on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Forex

- Shares

- Indices