Fed opens door for more hikes with “no hesitation”, what’s the impact?

The interest rate guessing game is not over. In a speech on Thursday, US Federal Reserve Chair Jerome Powell said the Fed will not hesitate to tight monetary policy further. What would the impact on the USD, S&P 500, and gold?

The interest rate guessing game is not over.

In a speech on Thursday at "Monetary Policy Challenges in a Global Economy" panel, hosted by the IMF, US Federal Reserve Chair Jerome Powell poured cold water on the surging notion of a peaked rate, emphasizing that the US central bank will continue to move carefully but stated, “If it becomes appropriate to tighten policy further, we will not hesitate to do so.”

Powell also confessed, “We know that ongoing progress towards our 2 percent goal is not assured. We are not confident that we have achieved such a stance.”

In other words, the US central bank would rather keep its door open in case the upside surprise of inflation returns, given that “Inflation has given us a few head fakes,” in Powell’s words.

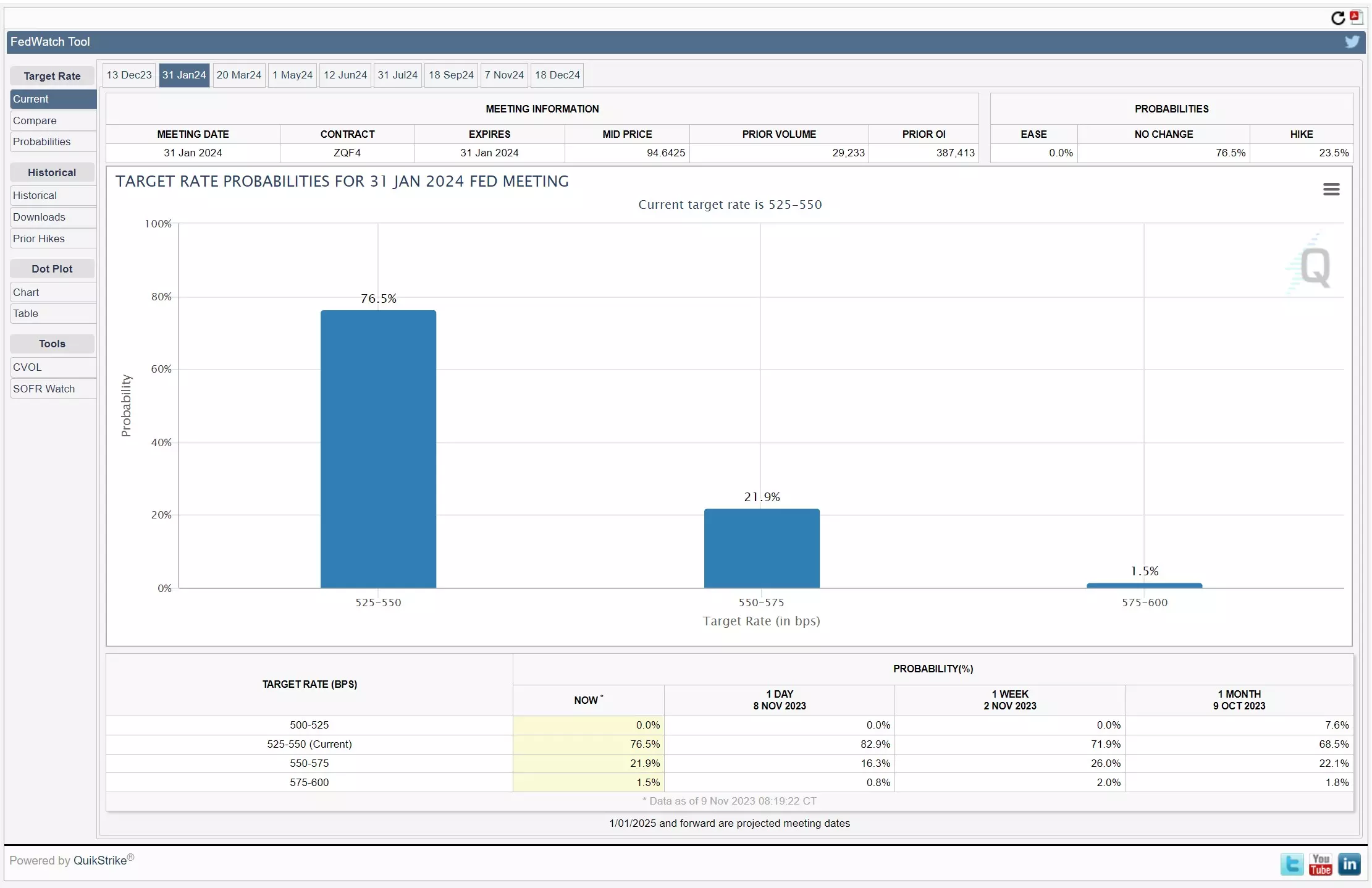

Following these remarks, the market quickly moved to price in a higher chance for another hike before January 2024 and also postponed the timeline of the Fed’s first rate cut to the second half of 2024.

USD technical analysis

The USD's fall from its October high seems to have found support around the February peak of 105. This week’s recovery, ignited by a series of speech by key Fed members, has assisted the greenback in establishing another ascending trendline, indicating the continued strength of the US dollar.

The next major upside target is the current convergence point of the 20 and 50-day moving averages (105.6-105.7). A breakthrough from this level would propel the price to retest the previous July-November trendline. Solid support is spotted around 105, with the possibility of a further pullback to the newly formed trendline.

S&P500 technical analysis

After the best week in two years, S&P 500 has gained nearly 5% in November. However, the selloff on Thursday appears to have taken the wind out of the recent uptrend.

The August low, approaching 4340, seems to be the next zone of support. Any further retreat below this level will bring the 50-day and 200-day moving averages into view. On the other hand, imminent pressure is expected from the October peak at 4387.

Gold prices technical analysis

After failing to challenge the $2,000 threshold, the price of the yellow metal has dropped nearly 3% this week. However, a short-term bounce from the 200-day moving average appears to be in progress. Nevertheless, with the resurgence of the US dollar, the bounce may soon encounter new pressure from the 20-day moving average, currently situated around $1,977.

This information has been prepared by IG, a trading name of IG Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

CFDs are a leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your initial deposit, so please ensure that you fully understand the risks involved.

Discover how to trade the markets

Learn how indices work – and discover the wide range of markets you can trade on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on FTSE 100 and Germany 40

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.