The complete guide to trading strategies

A trading strategy is different from a trading style. There are four high-level trading strategies that every trader should know. Discover the main trading strategies in this article.

What is a trading strategy?

A trading strategy is a plan that employs analysis to identify specific market conditions and price levels. While fundamental analysis can be used to predict price movements, most strategies focus on specific technical indicators.

What is the difference between trading strategy and trading style?

Although there is a lot of confusion between ‘style’ and ‘strategy’, there are some important differences that every trader should know. While a trading style is an overarching plan for how often you’ll trade, and how long you’ll keep positions open for, a strategy is a very specific methodology for defining at which price points you’ll enter and exit trades.

A trading style is your preferences while trading the market or instrument, such as how frequently and how long or short-term to trade. A trading style can change based on how the market behaves but this is dependent on whether you want to adapt or withdraw your trade until the conditions are favourable.

Best trading strategies

We’ve looked at some of the most popular top-level strategies, which include:

Trend trading

A trend trading strategy relies on using technical analysis to identify the direction of market momentum. This is usually considered a medium-term strategy, best suited to the trading styles of position traders or swing traders, as each position will remain open for as long as the trend continues.

The price of an asset can trend up or down. If you were going to take a long position, you’d do so when you believe the market is going to reach higher highs. If you were going to take a short position, you’d do so if you thought the market would reach lower lows.

Derivative and leveraged products – such as CFDs – are popular choices for trend-following strategies, because they enable traders to go both long and short. Here, you would put up a small initial deposit (called margin) to open a larger position. Note that leveraged trading is high risk and you could lose more than your initial deposit amount, because your total profit or loss is based on the total position size. Make sure you have adequate risk management steps in place.

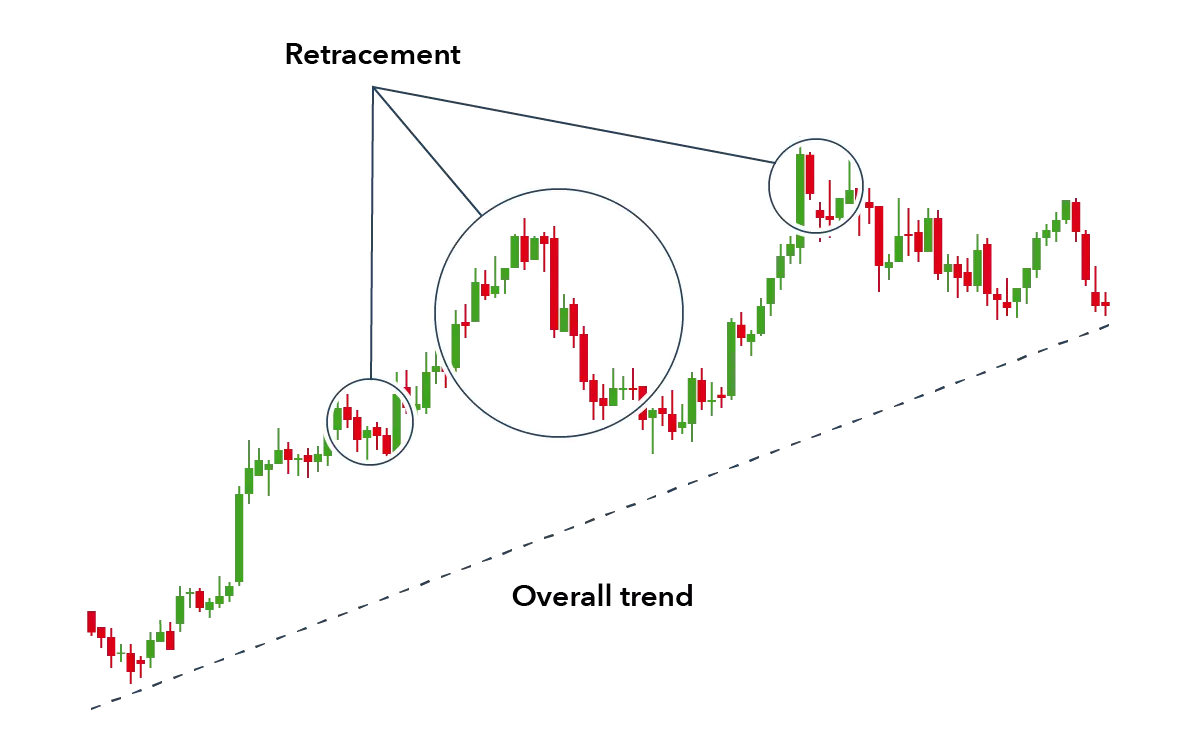

Trend traders will use indicators throughout the trend to identify potential retracements, which are temporary moves against the prevailing trend. Trend traders will often take little notice of retracements, but it’s important to confirm it’s a temporary move rather than a complete reversal – which is often a signal to close a trade.

Some of the most popular technical analysis tools included in trend-following strategies include moving averages, the relative strength index (RSI) and the average directional index (ADX).

Range trading

Range trading is a strategy that seeks to take advantage of consolidating markets – the term to describe a market price that remains within lines of support and resistance. Range trading is popular among very short-term traders (known as scalpers), as it focusses on short-term profit taking, however it can be seen across all timeframes and styles.

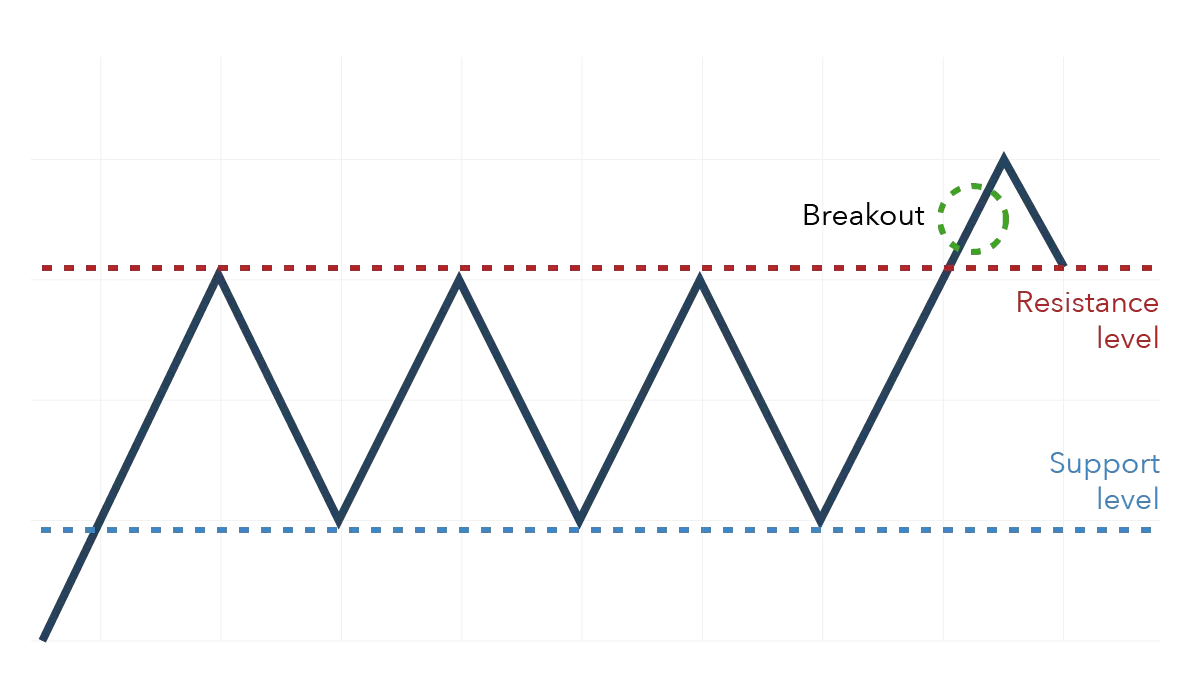

While trend traders focus on the overall trend, range traders will focus on the short-term oscillations in price. They will open long positions when the price is moving between two clear levels and is not breaking above or below either.

This is a popular forex trading strategy, as many traders work off the idea that the very liquid currencies market remains in a tight trading range, with significant volatility in between these levels. This means that short-term traders can seek to take advantage of these fluctuations between known support and resistance levels.

.png/jcr:content/renditions/original-size.webp)

There are a range of other indicators that range traders will use, such as the stochastic oscillator or RSI, which identify overbought and oversold signals. Range traders will also use tools, such as the Bollinger band or fractals indicators, to identify when the market price might break from this range – indicating it is time to close the position.

Breakout trading

Breakout trading is the strategy of entering a given trend as early as possible, ready for the price to ‘break out’ of its range. Breakout trading is commonly used by day traders and swing traders, as it takes advantage of short to medium-term market movements.

Traders who use this strategy will look for price points that indicate the start of a period of volatility or a change in market sentiment – by entering the market at the correct level, these breakout traders can ride the movement from start to finish. It is common to place a limit-entry order around the levels of support or resistance, so that any breakout executes a trade automatically.

Most breakout trading strategies are based on volume levels, as the theory assumes that when volume levels start to increase, there will soon be a breakout from a support or resistance level. As such, popular indicators include the money flow index (MFI), on-balance volume and the volume-weighted moving average.

Reversal trading

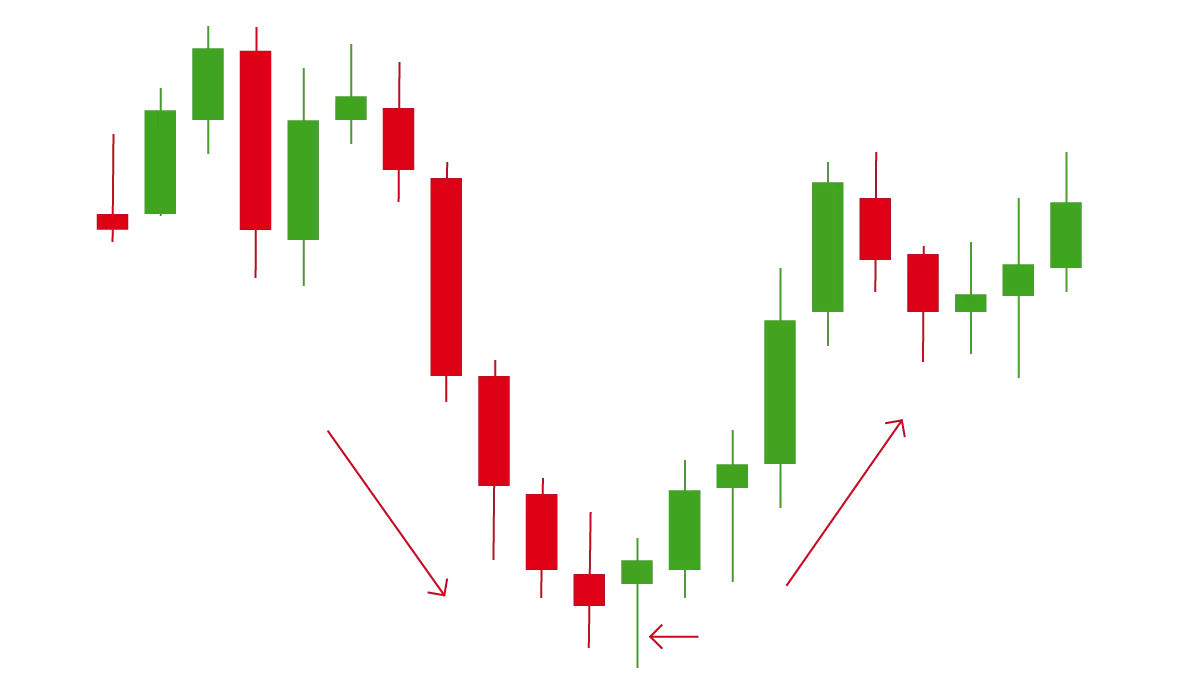

The reversal trading strategy is based on identifying when a current trend is going to change direction. Once the reversal has happened, the strategy will take on a lot of the characteristics of a trend trading strategy – as it can last for varying amounts of time.

A reversal can occur in both directions, as it is simply a turning point in market sentiment. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will soon turn into an uptrend. While a ‘bearish reversal’ indicates that the market is at the top of an uptrend and will likely become a downtrend.

When trading reversals, it is important to make sure that the market is not simply retracing. The Fibonacci retracement is a common tool, used to confirm whether the market surpasses known retracement levels. It is worth noting that some consider Fibonacci retracements to be a self-fulfilling prophecy, as many orders will congregate around these levels and push the price in the desired direction.

It is important to combine technical indicators with other forms of analysis, whether this is other technical tools or fundamental analysis.

Gap trading

A gap occurs when where no trading activity has taken place. This happens when an asset’s price moves sharply high or low with nothing in between, implying the market has opened at a different price to its previous close.

If you’re a gap trader, you are likely a day trader that watches these price gaps from a previous day and seek opportunities between this and the opening range of trading for the next day. An opening range that rises above the previous day’s close is a ‘gap’ that usually signifies going long, while an opening range that is below the previous day’s close signifies an opportunity to go short.

Pairs trading

Pairs trading is finding the correlated pair of instruments where the valuation relationship has gone out of whack, buying under-priced instruments and the selling the overpriced ones. The aim is to make a profit irrespective of market conditions such as downtrends, uptrends and so on.

Arbitrage

Arbitrage is a transaction or a series of transactions in which you generate profit without taking any risk. An example of this would be spotting an opportunity in two equivalent assets where one is priced higher than the other and taking advantage of buying the lower priced one while it is still undervalued. There are few arbitrage opportunities because many traders may also be on the lookout and so they are often found quickly. In this case, the arbitrage edge disappears quickly as more traders flood the market to try and trade the opportunity.

Momentum

Momentum trading strategy is based on price trends and the direction they're taking. This happens where there is heavy price movement (or momentum) and traders are selling and buying assets for a period of time. Once there is a price change, the momentum changes in a different direction.

Ready to start building a trading strategy? Open an account with us to trade on live markets or practise trading first with a demo account.

Learn more about styles, strategies and trading plans with our IG Academy range of online courses

What’s the best trading strategy for you?

There’s no one-size-fits-all approach when it comes to trading, and no one person’s strategy will be exactly the same. The strategy that’s going to work best for you will depend on your appetite for risk, your trading style, your level of motivation and more.

Always do as much research as you can before entering the live markets and get your demo account to hone your skills.

What to know before you put your trading strategy in action

Putting your strategy in action can take time, dedication and practise. You can start with a demo account, where you can put your strategy to the test in a risk-free environment. You’ll even get S$200,000 in virtual funds to practise with when you sign up.

You can also use the demo account as an opportunity to explore the markets and get into the daily habits of a trader. Once you’re ready to take on the live markets, you’ll have access to a range of different platforms. You can choose between our cutting-edge web platform, our award-winning mobile app1, or specialised platforms such as MT4, L2 Dealer and ProRealtime. You’ll also have access to free trading alerts, which are automatic and customisable notifications you’ll get when your trading specifications are triggered. Plus, trading signals that give actionable buy and sell suggestions.

Discover the basics of getting started with online trading

Footnotes

1 Awarded the Best Online Trading Platform by Influential Brands in 2021.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

Explore the markets with our free course

Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course.