Is now a good time to buy gold?

With coronavirus continuing to cause volatility in the markets, many investors are wondering whether now is a good time to buy gold. Here, we take a look at the best time to buy gold, and highlight some ways to take a position.

Gold as a safe-haven investment

Gold has a reputation as a safe-haven investment, which means that people will tend to move their money into gold during times of economic uncertainty.

Often, this is because when markets are behaving unpredictably or trends are going against the ‘norm’, gold performs better than other assets, like stocks or currency pairs. Typically, when indices fall in value, gold rises – but this is not a certainty, which is important to keep in mind.

Gold has also been used as a hedge against rising inflation in the past. This is because it tends to act as a more consistent instrument to store value in rather than currencies or stocks, which can lose value with rising inflation.

Is now the time to buy gold?

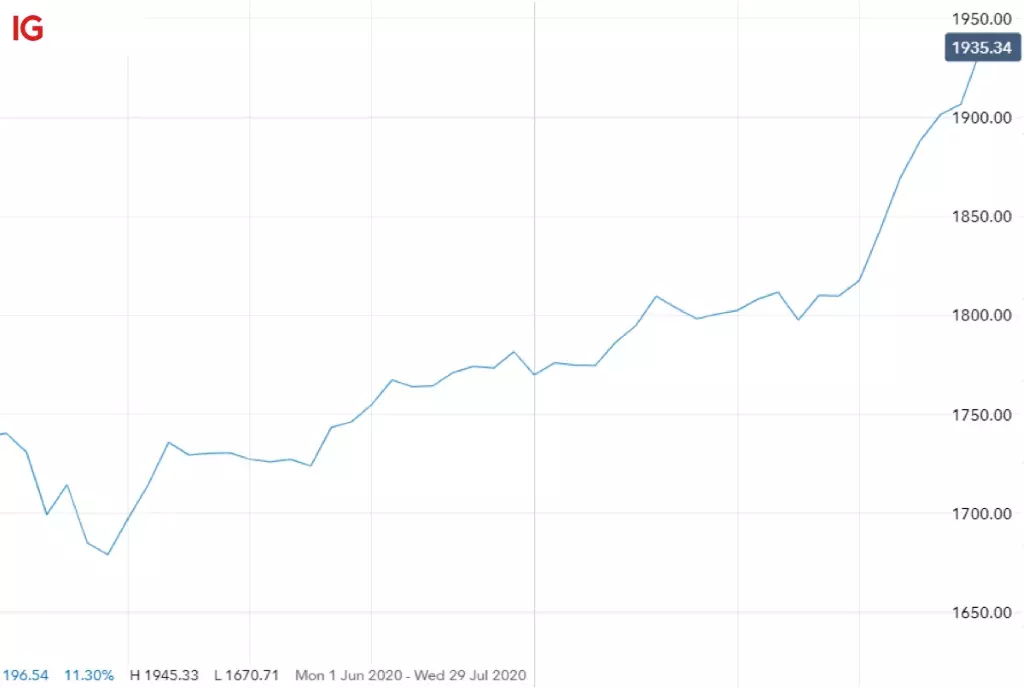

Gold has risen in value during the coronavirus pandemic, gaining 16.44% from 1 January to 1 July as a result of the widespread market uncertainty and increased volatility. Future movements for the remainder of 2020 will depend on how the coronavirus response develops, and whether life is able to return to normal.

If stocks and indices recover close to pre-virus levels, then gold could experience a flattening or decline in value. But, this is also dependent on other market factors such as levels of inflation and stimulus measures taken by central banks to ease the damage caused by the virus.

Below, you can see a screenshot from our trading platform highlighting gold’s price movements from 1 January to 1 June 2020.

.jpg/jcr:content/renditions/original-size.webp)

Following the first half (H1) of 2020, gold hit a record high in July as investors grew increasingly nervous around the impact of coronavirus on the markets – reaching its highest price since September 2011. With central banks introducing more measures to reduce the economic impact of the pandemic, it remains to be seen how gold will react in the second half of 2020.

When is the best time to buy gold?

The best time to buy gold is generally when markets are uncertain and you need or want to diversify your portfolio. If you think that stocks are going to decline, perhaps because of an economic slowdown – like the one brought about by the coronavirus pandemic – then gold could be a good buy during the initial phases of the market slump.

Many traders will take intraday positions on day, opening and closing all their gold positions within one market session. To do this, you’ll need to know the daily gold trading hours.

How to buy or invest in gold

You can buy or invest in gold in a number of ways. Popular methods to get direct exposure to the value of gold include investing in gold stocks, investing in gold exchange traded funds (ETFs) and buying gold futures. Let’s talk through each of these in turn.

Firstly, investing in gold stocks. This means that you’ll be taking direct ownership of shares in companies that are involved in the gold business. Popular companies to invest in are those who mine, process and refine gold into bullion bars.

Secondly, investing in gold ETFs. This means that you’ll own shares in an exchange traded fund – for example, one designed to mirror the underlying market price of gold as closely as possible. Gold ETFs can also track the market price of a collection of gold stocks, or they could track the industry as a whole. What an ETF won’t do is give you ownership of gold bars or shares in companies that are directly involved in the gold trade.

Thirdly, buying gold futures. These are contracts between a buyer and a seller to exchange gold for a set price at a fixed future date. The buyer has the obligation to buy the gold, and the seller has the obligation to sell it. Futures will give you direct ownership over gold bars if you are taking on the obligation to buy, meaning that you’ll have to have the storage capacity to take delivery.

If investing in gold with these methods doesn’t sound like it’s for you, you can always speculate on the price of gold company shares, gold ETFs or gold futures with financial derivatives like CFDs. As derivatives, these products won’t give you ownership of the underlying assets, but they will enable you to speculate on their value.

To trade on gold’s price movements, you’ll need to create a trading account.

Since they don’t give you ownership, CFDs can be used to go long to speculate on the price of gold assets rising, as well as short to speculate on the price of gold assets falling. As a result, they are favoured by traders who are seeking to profit from price movements in both bullish and bearish markets.

Gold as a diversification strategy

Gold is a good asset to use as part of a diversification strategy. Often, investors will seek to have holdings in a variety of different asset classes to protect themselves against declines in one sector.

Stocks, bonds, property and gold are all representative of different sectors. Having a diversified portfolio means that an investor will be better protected against a decline in one of these sectors – rather than having all their eggs in one basket.

For example, gold will often outperform stocks or bonds during times of economic uncertainty. In this case, gold can help to offset the losses that these assets might incur when markets are down, and stock or bond prices fall.

Gold outlook

- Gold’s reputation as a safe-haven asset has no doubt contributed – at least partially – to its price increase during the first six months of 2020

- What remains to be seen, is how the next six months of 2020 will play out

- Gold’s price increase could continue if markets remain uncertain, or if another wave of economic downturns hits countries around the globe

- If market volatility continues, then gold might appreciate in value more than it already has as investors look to it as a store of value during uncertain times

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

Predict on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.1

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

1In the case of all DFBs, there is a fixed expiry at some point in the future.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this commodities strategy article, and try it out risk-free in your demo account.

Ready to trade commodities?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Deal on our wide range of major and niche commodities

- Protect your capital with risk management tools

- Enjoy some of the best spreads on the market – Spot Gold from 0.3 points

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.