European indices: UK CPI inflation and BoE interest rate decision

Discover the anticipated movements in UK CPI inflation and the Bank of England's upcoming interest rate decision. Will inflationary pressures persist, or is the central bank nearing the end of its rate hiking cycle?

What to expect from UK CPI inflation?

Date: Wednesday, 20 September at 4pm AEST

Headline inflation in the UK, which peaked at 11.1% in October 2022, is expected to rise by 0.7% month-on-month (MoM) in August (from 0.4% prior), leading the annual rate of headline inflation higher to 7% year-on-year (YoY) from 6.8% in July. This would represent the first increase in the annual inflation rate since February, primarily due to higher energy prices.

Core inflation is expected to rise by 0.4% MoM in August, which would see the annual core inflation rate fall to 6.8% YoY from 6.9% YoY in July. Within core inflation, troublesome services inflation is expected to edge lower to 7.3% YoY from 7.4%, above the Bank of England's (BoE's) 7.1% forecast.

BoE interest rate meeting

Date: Thursday, 21 September at 9pm AEST

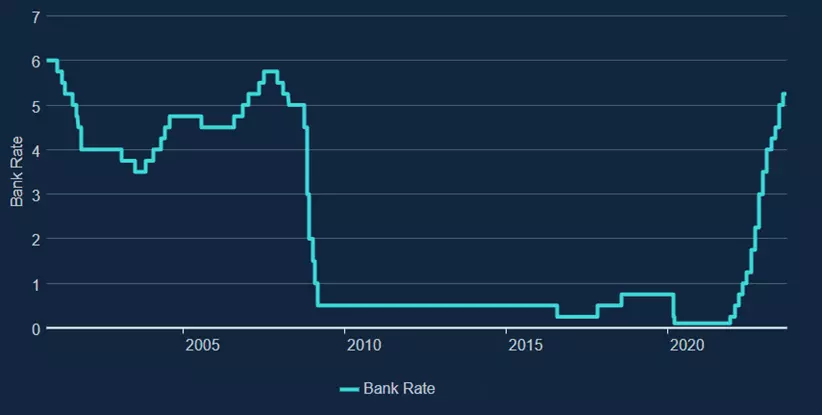

The BoE is widely expected to hike rates by 25bp to 5.5%. Despite headline inflation moderating to 6.8% in July, it remains more than three-fold above the central bank's 2% target.

However, the BoE's objective of taming inflation must also be juggled with weaker underlying growth momentum (July's gross domestic product contracted more than forecast), and the BoE will need to tread carefully to avoid a recession.

To that effect, if Wednesday night's inflation report is inline and is followed by a cooler services purchasing managers' index (PMI) data on Friday, this week's BoE rate hike may mark the end of the BoE's tightening cycle. This aligns with recent comments from BoE Governor Andrew Bailey, who noted the BoE is "much nearer" to ending its rate hiking cycle.

BoE official bank rate chart

DAX technical analysis

The view remains that the correction in the S&P 500, which started from the late August 16615 high, has further to go. At this point, it appears to have completed the first two waves of the correction and is missing a final leg lower (Wave C of a three-wave ABC pullback) to retest and break the mid-August low of 15,500ish, with the potential to test wave equality at 15,000.

Should the pullback play out as expected and signs of basing emerge, we expect to see the uptrend resume, which would see the DAX test and break the July 16,615 high.

DAX daily chart

FTSE technical analysis

In recent weeks, the FTSE rebounded from the critically important 7,200 level, initially supported by BoE Governor Andrew Bailey's dovish comments in late August and then by last week's dovish ECB meeting.

While downside risks have eased for now, the FTSE needs to remain above the 200-day moving average at 7,634 and then see a sustained break above the downtrend resistance at 7,690 from the bull market 8,047 high to indicate the uptrend has resumed. Until then, there is a good chance of further rotation within the 7,750/7,200 range.

If the FTSE were to see a sustained break of support at 7,200, there is scope for it to extend its decline towards 7,000 before a retest of the 2022 lows 6,800/6,700 area.

FTSE daily chart

- TradingView: the figures stated are as of 19 September 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.